The boom and bust cycle that affected the peripheral economies of the euro area between approximately 1999 and 2013 is one of the most dramatic, but also most interesting, experiences in the recent economic history of developed countries. It started relatively innocently in selected countries of the single currency area. Over time, however, imbalances grew so large that they almost toppled the single currency.

The aforementioned episode has been extensively described in the literature (e.g. In't Veld et al. 2012, Diaz Sanchez and Varoudakis 2014, Sinn and Valentinyi 2013). In the first years after the creation of the euro area, its peripheral countries (Greece, Ireland, Portugal, and Spain) experienced a significant reduction in the costs of financing and received sizeable capital inflows from abroad. This resulted in an uptick in the rates of growth of these economies, but also in an increasing volume of housing loans, which in turn translated into rapid increases in housing prices. At the same time, the periphery’s current account and net foreign asset position systematically deteriorated.

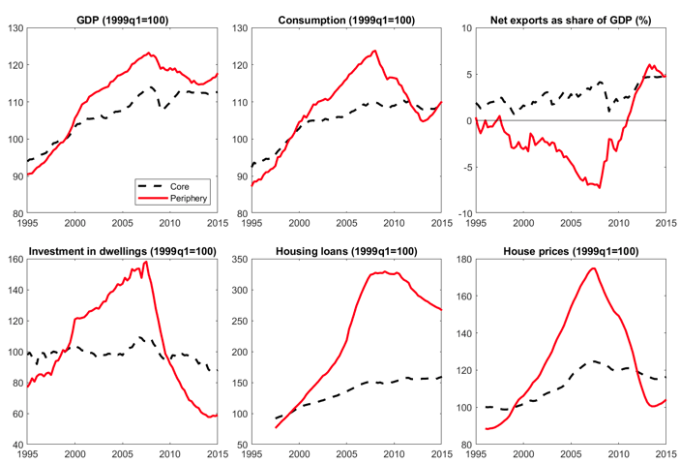

The Global Crisis in 2008 triggered a rapid correction of these imbalances. Foreign capital, which previously flowed into the peripheral euro area countries, swiftly started to retreat towards the ‘safe havens’ in the core. This capital outflow was accompanied by a severe drop in housing prices, as well as a credit crunch. As a consequence, as we show in Figure 1, the recessionary forces were much stronger in periphery than in the core countries which resulted in a deeper and more protracted decline in GDP and consumption, among other things. Fiscal problems followed suit and brought the euro to the verge of collapse in 2012.

Figure 1 Stylised facts on imbalances in the euro area

As is well known, common monetary policy is not able to stabilise all union countries if they face asymmetric shocks. Recently, however, there has been a renewed interest in the effects of pursuing macroprudential policies, which are usually aimed at stabilising the financial sector itself. These policies may use a wide set of tools, such as capital requirements for banks, or the regulation of the maximum value of loan-to-value ratio, which dictates how big a mortgage can be granted to the household relative to the value of purchased housing. Such policies, if applied on a country or regional level, could possibly respond to asymmetric developments in the financial or housing sectors of a monetary union (e.g. Quint and Rabanal 2014, Rubio 2014).

In Bielecki et al. (2019), we analyse whether the recent boom-bust cycle could have been mitigated if, from the onset of the monetary union, its member states had pursued independent macroprudential policies, in the form of regulating the maximum loan-to-value ratio. To that end, we construct a structural two-region dynamic stochastic general equilibrium (DSGE) model of the euro area, with each region representing the aggregates of core and periphery countries. In both regions the households can in principle take on debt up until they are constrained by the maximum loan-to-value ratio. As banks finance mortgages with both domestic and foreign deposits, this generates international flows of capital.

The model parameters are estimated using seventeen macroeconomic variables for the core and periphery of the euro area over the period from 1995 to 2015. We use the estimated statistical properties of the model to obtain the parameters of monetary and macroprudential policies that maximise social welfare. In the next step, we generate counterfactual scenarios under the assumption that these optimal policies were applied in the analysed countries starting in the first quarter of 1999. Monetary policy is assumed to be common for the core and periphery while macroprudential policy is allowed to react to region-specific developments, i.e. to set different loan-to-value ratios in the core and periphery.

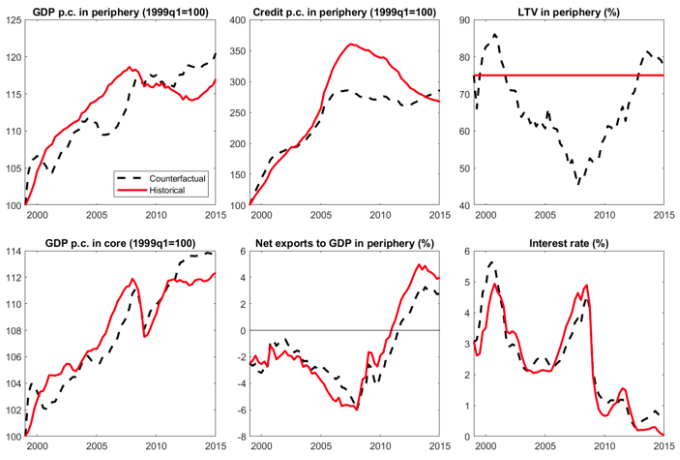

Figure 2 displays the behaviour of selected macroeconomic variables in the peripheral countries, comparing the actual outcomes to their counterfactuals. Optimal macroprudential policy would have implied a significant tightening of the loan-to-value ratio in the periphery from 2001 to 2008, effectively stabilising credit as of 2005. As a result, the external imbalances and housing boom would have been mitigated, and the recession associated with the Global Crisis would have been shallower. The euro area would have also avoided hitting the effective lower bound on nominal interest rates.

Figure 2 Historical and counterfactual paths under optimal monetary and macroprudential policies

A side effect of an aggressive macroprudential policy manifests itself in short and shallow recessions associated with ‘popping’ credit bubbles, such as around 2005. Despite that, the welfare gains from following the optimal macroprudential policy would have been ubiquitously positive. We find that the groups that would have benefitted most from implementing the optimal policies are the borrowers in both the core and peripheral countries. While they would have been more constrained in taking on debt during booms, they would have faced milder problems associated with mortgage repayment in the midst of a recession.

Our additional experiments show that the introduction of the optimal macroprudential policies would indeed have been associated with noticeable welfare gains. In contrast, the benefits of pursuing the optimal monetary policy would have been quite small, as the historically implemented monetary policy was close to optimal. While optimised monetary policy actions could have slightly reduced the volatility of GDP in both regions, they could not have prevented the build-up of imbalances on the housing markets and in international capital flows.

All in all, our study demonstrates that macroprudential policy can be an effective tool in mitigating internal and external imbalances in a monetary union. If these policies are implemented at a national rather than area-wide level, they will give scope for reacting adequately to the situation in each individual economy, where common monetary policy is ineffective. It should be noted, however, that pursuing an optimal macroprudential policy may require a large variation in the policy instrument, such as the loan-to-value ratio. As such decisions may not be popular, particularly in the boom phase, the regulator should be safeguarded with an appropriate degree of institutional independence and credibility.

References

Bielecki M, M Brzoza‐Brzezina, M Kolasa, and K Makarski (2019), "Could the boom‐bust in the eurozone periphery have been prevented?" Journal of Common Market Studies 57(2): 336-352.

Diaz Sanchez, J L and A Varoudakis (2014), "Tracking the causes of Eurozone external imbalances: New evidence", VoxEU.org, 6 February.

In’t Veld, J, A Pagano, R Raciborski, M Ratto and W Roeger (2012), "Imbalances and rebalancing scenarios in an estimated structural model for Spain", European Economy - Economic Papers 458, Directorate General Economic and Monetary Affairs (DG ECFIN), European Commission.

Quint, D and P Rabanal (2014) "Monetary and macroprudential policy in an estimated DSGE model of the euro area", International Journal of Central Banking 10(2): 169-236.

Rubio, M (2014) "Macroprudential policy implementation in a heterogeneous monetary union", Discussion Papers 2014/03, University of Nottingham, Centre for Finance, Credit and Macroeconomics (CFCM).

Sinn, H and A Valentinyi (2013), "European imbalances", VoxEU.org, 9 March.