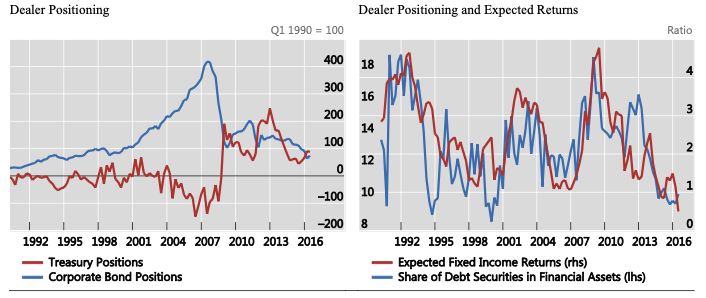

Banks’ balance sheet leverage has been shrinking, and dealers’ corporate bond holdings have fallen and stagnated (Figure 1). These factors raise potential concerns that dealers have reduced their market making commitment with potentially adverse effects on market liquidity (e.g. CGFS 2014, CGFS 2016).

Figure 1 Bank balance sheet leverage

Source: Adrian et al. (2018).

In a recent paper (Adrian et al. 2018) we find that post-crisis regulatory reform may explain some of this, but most these trends preceded any constraining effect of regulation. And there is only limited evidence of widespread bond market liquidity deterioration. Traditional market liquidity metrics in the markets where dealers are the most important market-makers tend to indicate robust market liquidity.

Reduced dealer corporate bond holdings probably have more to do with lower expected returns (Figure 2). We find that there is a tight correlation (55%) between expected fixed-income returns and dealer fixed-income positioning, with periods of sharp changes in asset valuations typically accompanied by sharp adjustments in positions.

Figure 2 US dealer positioning and expected returns

Source: Adrian et al. (2018).

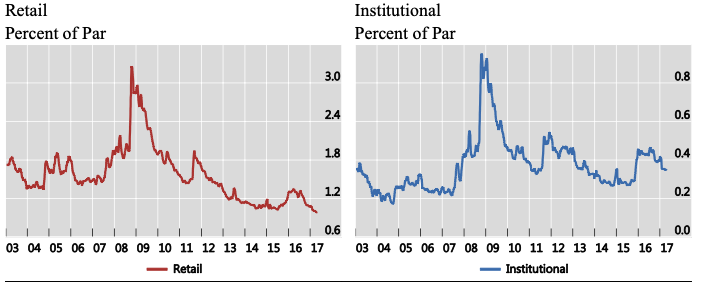

More stringent regulations may have reduced institutions' ability to provide liquidity, but there is only limited evidence that this has led to a widespread deterioration of bond market liquidity since the Global Crisis (Adrian et al. 2017). Figure 3 shows that corporate bond liquidity has deteriorated for institutional-sized trades, but not for small ones. This could be partially because dealers may have shifted toward an agency model, in which they match offsetting orders to avoid holding bonds on their balance sheets. Traditionally, dealers acted as principals, buying bonds from their customers when they wanted to sell, and holding them on their balance sheet until offsetting trades were found later, thus bearing the risk that prices might fall in the interim.

Figure 3 Corporate bond market liquidity measured by price impact

Source: Adrian et al. (2018).

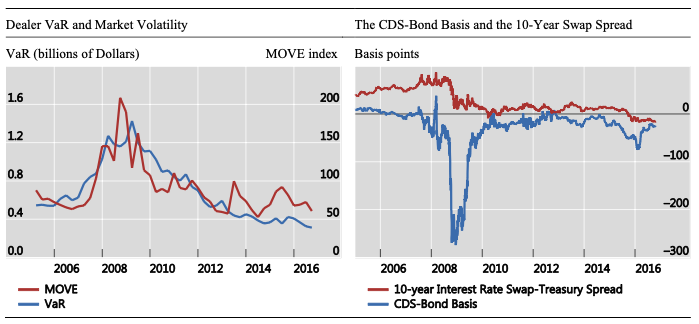

Other likely causes of shrinking leverage and dealer position taking include conservative risk management and expensive funding. The left panel of Figure 4 shows that the balance-sheet capacity of eight large US dealers, measured by firm-wide value-at-risk, has declined dramatically since the crisis, in hand with the decline in market volatility, as proxied by the Merrill Lynch Option Volatility Estimate (MOVE) index.

The decline in balance sheet capacity is often linked to a deterioration of funding cost indicators, two of which are shown in the right panel of Figure 4. One is the spread between the 10-year interest rate swap and the 10-year Treasury yield. The swap spread has typically been positive, but such spreads were negative at times in 2010, and also turned negative in late 2015 (where they remained through mid-2016). Such negative swap spreads are often cited as evidence of regulatory balance-sheet constraints on banks.

Another measure of market dislocation is the credit default swap (CDS)-bond basis, the difference between the market CDS spread and the theoretical CDS spread implied by the yield on the underlying bond. The right panel of Figure 4 shows the basis for a portfolio of investment-grade bonds. Before the crisis it was close to zero, as one might expect. However, since the crisis, the average basis has been negative, probably reflecting the fact that dealers lack the balance sheet capacity needed to buy the bonds (and to buy CDS protection) to arbitrage the spread.

Figure 4 US dealer value-at-risk and funding costs

Source: Adrian et al. (2018).

We find that, in general, regulatory reform has made the financial system markedly safer, while evidence of adverse unintended consequences is limited to date and needs to be weighed against the broader benefits of regulatory reform. The reforms have increased the quantity and quality of bank regulatory capital, and new liquidity requirements enhance bank liquidity profiles and improve their ability to withstand liquidity financial and economic stress. This should reduce the probability of widespread market liquidity crises and make market-making more robust (Fender and Lewrick 2015).

Of course, international standard setters are now increasingly focused on evaluating the costs and benefits of the new regulatory regime, and we expect a more granular quantification in coming years.

References

Adrian, T, M Fleming, O Shachar, and E Vogt (2017), "Market Liquidity after the Financial Crisis", Federal Reserve Bank of New York staff report 796.

Adrian, T, J Kiff, and H S Shin (2018), "Liquidity, Leverage, and Regulation 10 Years After the Global Financial Crisis", Annual Review of Financial Economics 10: 1-24 (also CEPR Discussion Paper 13350).

Anderson, M, and R M Stulz (2017), "Is Post-Crisis Bond Liquidity Lower?" NBER working paper 23317.

Committee on the Global Financial System (CGFS) (2014), “Market-Making and Proprietary Trading: Industry Trends, Drivers and Policy Implications”, Committee on the Global Financial System 52.

Committee on the Global Financial System (CGFS) (2016) “Fixed Income Market Liquidity,” Committee on the Global Financial System 55.

Fender, I and U Lewrick (2015), "Shifting tides - market liquidity and market-making in fixed income instruments", BIS Quarterly Review, March.