President Xi’s opening address to the 19th Party Congress (October 2017) set forth a development path for the next century. We focus on two points in his address: solidifying the anticorruption reforms of the 18th Congress into a zero-tolerance policy (pp. 7 and 22) and developing high-quality effective market institutions. Pairing these objectives makes good economic sense because they are profoundly intertwined.

Corruption as a middle-income trap

These twin policies resonate with economic research revealing a mutually reinforcing feedback loop between corruption and stalled development. Corrupt officials misappropriating government money defund public goods and services, including those that might deter corruption. Bribing corrupt officials for regulatory favours or subsidies diverts corporate spending away from investing in productivity and corporate attention away from market signals. This stalls growth, and stalled growth locks in corruption (Krueger 1974, Fisman and Svensson 2007, Ayyagari et al. 2014).

Unfortunately, corruption is an enticing ‘second best’ optimal policy for key actors in an economy with an interventionist government. Bribes grease squeaky bureaucratic wheels to help businesses get things done where officials, not markets, allocate key resources. Bribes supplement officials’ incomes where stunted economic activity keeps government revenues low (Fisman 2001, Wei 2001, McMillan and Woodruff 2002, Li et al. 2008, Calomiris et al. 2010, Agarwal et al. 2015, Zeume 2016).

But once entered, this second-best thinking can entrap a whole economy in a low-level pit (e.g. Murphy et al. 1993, Morck et al. 2005). Powerful officials rationally focus on maximising bribe income (even erecting artificial regulatory barriers they can take bribes for removing), rather than institution building. Profit-maximising firms rationally invest in bribing officials because bribes, not enhancing productivity or responding to market signals, have higher returns. This explains clear empirical findings (e.g. Mauro 1995) linking worse corruption to slower growth.

China’s leaders have presided over phenomenal growth that has raised China well into the ranks of middle income economies. But state-owned enterprises (SOEs) remain dominant in most sectors, non-SOEs are subject to extensive official intervention, and the Party holds officials directly responsible for overseeing tangible growth. Successful anti-corruption reforms must thus overcome both officials’ undiminished economic powers and their fears that ending bribes would interrupt growth by freezing bureaucratic gears.

China’s anticorruption policy

Paradoxically, while China’s unwillingness to diminish officials’ control over the economy undoubtedly feeds corruption, the Party’s unwillingness to cede control over the state may help China escape this trap. The Party’s legitimacy depends on delivering broad-based economic growth without forsaking its socialist legacy. Inequality due to corruption is especially toxic to this legitimacy. Thus, the Central Commission for Discipline Inspection (CCDI) argued for fighting corruption because “public trust in the Party and government has fallen to a critical level” (Xinhua, 20 November 2012).

The 18th Party Congress (14-18 November 2012) made Xi Jinping Party General Secretary and Chairman of the Central Military Commission. His acceptance speech denounced “corruption and bribe-taking by party members”.1

Sixteen days later, on 4 December, the anticorruption drive began. Thenceforth, cadres could neither dispense nor accept favours, including lavish entertainment or travel, traditionally used to build ‘connections’. This came surprisingly early. Traditionally, major policies are announced a year or so into a new leader’s term. The Party also clearly meant business. On 5 December, Sichuan’s Deputy Party Secretary Li Chuncheng was “investigated” and cadres were asked to write “self-reflection and self-criticism”. On 7 December, Professor Wang Yukai, a prominent member of the State Council-directed Chinese Academy of Governance, explained “[t]he Politburo took the lead to change work style, it will play a critical role in fighting corruption at the root”.

An event study of China’s anticorruption policy

This is a great opportunity to study the expected effect of anti-corruption reforms. While discerning the actual effects takes time, event studies can identify investor expectations about those real effects. Lin et al. (2016) do this, and follow-up studies (e.g. Ding et al. 2017) find concordant results.

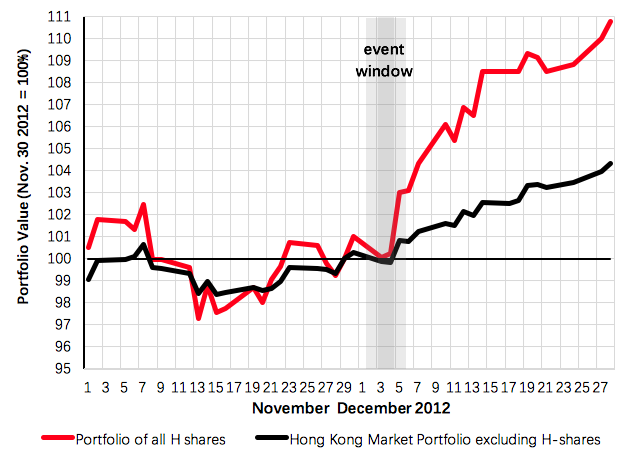

Lin et al. (2016) find mainland stocks trading in Hong Kong rising sharply relative to other Hong Kong stocks (Figure 1) and mainland-traded shares rising about 3% on news of the reform. To the extent that listed firms represent the economy, investors expected reduced corruption to increase firm values on average.

Figure 1 Hong Kong listed mainland (H) shares versus other Hong Kong shares

Notes: Cumulative total returns around the 4 December 2012 advent of the anticorruption reform, both indexes normalised to 100% at the beginning of the five-day event window surrounding the event date.

SOEs versus non-SOEs in more versus less liberalised provinces

Close to half of China’s listed firms are SOEs, and the anticorruption Policy affected SOEs and non-SOEs differently. SOEs’ top managers are Party cadres directly subject to the Policy. The Policy thus suppresses SOE spending on wining and dining their top insiders and officials from whom their top insiders sought personal favours. Shareholders, expecting SOEs to eliminate this (from their viewpoint) wasteful spending, and perhaps related self-dealings, would price SOE shares higher on news of the new Policy.

Non-SOE top managers need not be Party cadres, so their firms’ spending on such things could be unaffected. However, unlike SOEs, which are internal cogs in the Party command and control system, non-SOEs must sometimes court official favour to get things done. The new Policy affects non-SOEs by barring officials, also all Party cadres, from accepting such bribes. The new Policy would bar officials from accepting wining, dining, and other such private benefits from non-SOEs.

How this affects non-SOEs’ share prices depends on the extent of prior market liberalisation, which different Chinese provinces had implemented to very different extents. In less liberalised provinces, officials still allocate key resources, so bribing them is critical to get anything done. Deprived of the ability to pay bribes, their non-SOEs might be caught in frozen bureaucratic gears (e.g. Wei 2001). Expecting this, shareholders would price non-SOEs in less liberalised provinces lower on news of the anticorruption Policy.

In more liberalised provinces, where market forces allocate resources, officials still solicit bribes, but as fees for passing artificial ‘toll booths’ they erect in non-SOEs paths. The new Policy was designed to suppress this behaviour, freeing non-SOEs of these tollbooth fees. Expecting this, shareholders would price non-SOEs in more liberalised provinces higher on news of the anticorruption Policy.

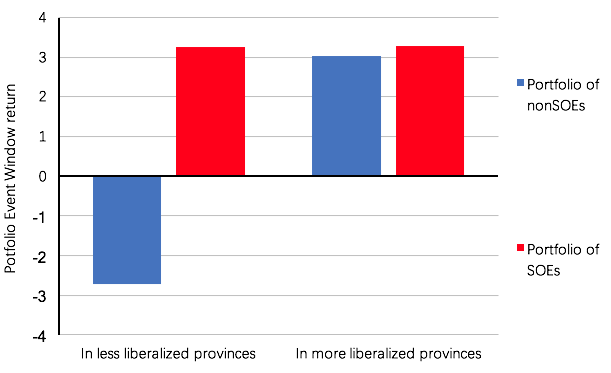

Figure 2, based on findings in Lin et al. (2017), shows exactly this pattern across portfolios of mainland traded shares. SOE shares gain on news of the reform. Non-SOEs in economically liberalised provinces also gain, but non-SOEs in less reformed provinces drop sharply.

Figure 2 Gains and losses depend on prior market reforms

Notes: Returns of portfolios of non-SOEs and SOEs located in the least and most liberalised tertiles of China's provinces in the three-day windows surrounding the 4 December 2012 news of China's anticorruption reforms.

Lin et al. also discern some more nuanced differences across firms and industries. Chinese firms disclose ‘entertainment and travel costs’ (ETC) (Cai et al. 2011), which they posit might proxy spending on perks for insiders and bribes for officials. Regressions show higher past ETC decreasing the gains of SOEs in more reformed provinces, but increasing the gains of non-SOEs in those provinces. Investors expect curtailed corruption to advantage non-SOEs previously more encumbered by official ‘toll booths’. Their regressions also show more non-SOEs with higher productivity, more external financing needs, and greater growth potential gaining more on news of the Policy if located in more liberalised provinces. Investors expect curtailed corruption to advantage more market ready and capital market-dependent non-SOEs where markets are more up and running. SOE share price reactions show no analogous pattern.

Subsequent work reinforces these conclusions. Li et al. (2017) find evidence of a shift in credit allocation towards non-SOEs and away from SOEs as the anticorruption reforms took hold. Event studies of subsequent news of follow-on provincial anticorruption policies show non-SOEs, but not SOEs, gaining more (e.g. Ding et al. 2017). These findings are readily interpretable as reinforcing Lin et al.’s findings – investors’ initial expectations about the impact of reforms on SOEs remained unchanged, but the provincial buy-ins led investors to further boost the valuations on non-SOEs in more liberalised provinces.

Future events may unfold in unexpected ways. China’s anticorruption reforms might ultimately stall or falter amid factional infighting. These results stand nonetheless. If investors did not expect the reforms prior to 4 December 2012 and believed the reforms were real at the time, these changes in share prices summarize the market’s expectations about the impact of reducing corruption.

Market reforms prep for reducing corruption

Reducing corruption creates more value where market reforms are already more fully implemented. If officials, rather than markets, allocate resources, bribes can be essential to grease bureaucratic gears to get anything done. Thus, non-SOEs stocks actually decline in China’s least liberalised provinces – e.g. Tibet and Tsinghai – on news of reduced expected corruption. These very real costs of reducing corruption can stymie reforms, and may explain why anticorruption reforms often have little traction in low-income countries where markets also work poorly.

China has shown the world something interesting: prior market reforms clear away the defensible part of opposition to anticorruption reforms. Once market forces are functioning, bribe-soliciting officials become a nuisance rather than tools for getting things done. Eliminating pests is more popular than taking tools away.

These patterns in Chinese stock price reactions to news of a genuinely unexpected and seemingly real anticorruption reform suggest the existence of a feedback loop that reform-minded leaders might activate. Market reforms clear the way for anticorruption reforms, and create an advantage for more productive market-ready private sector firms. These are the sorts of firms that are more likely to invest shareholders’ money in productivity-enhancing growth opportunities and less willing to pay bribes. As these firms grow stronger and more important, their self-interest in further market liberalisation and anticorruption reforms would lead them to support political leaders advocating further such reforms. A self-reinforcing upward spiral towards increased wealth and better institutions ensues.

A virtuous cycle ensues – persistent anticorruption efforts encourage market-oriented behaviour, which makes anticorruption reforms more effective, which further encourages market oriented behaviour. President Xi is right to state that anticorruption reforms are the path to developing high-quality market institutions.

References

Agarwal, S, W Qian, A Seru, and J Zhang (2015), “Disguised corruption: Evidence from consumer credit in China”, Paper presented at Asia Bureau of Finance and Economics Research.

Allen, F, J Qian and M Qian (2005), “Law, finance, and economic growth in China”, Journal of Financial Economics 77, 57-116

Ayyagari, M, A Demirguc-Kunt and V Maksimovic (2014), “Bribe Payments and Innovation in Developing countries: Are Innovating Firms Disproportionately Affected?”, Journal for Financial and Quantitative Analysis 49(01), 51-75.

Cai, H, H Fang and L C Xu (2011), “Eat, drink, firms and government: An investigation of corruption from entertainment and travel costs of Chinese firms”, Journal of Law and Economics 54, 55-78

Calomiris, C W, R Fisman and Y Wang (2010), “Profiting from government stakes in a command economy: Evidence from Chinese asset sales”, Journal of Financial Economics 96, 399-412.

Carpenter, J N, F Lu and R Whitelaw (2014), “The real value of China's stock market”, available at SSRN

Ding, H, S Li and K Shi, (2017), “Equilibrium Consequences of Corruption on Firms: Evidence from China's Anti-Corruption”, working paper.

Fan, G, X Wang and H Zhu (2011), NERI index of marketization of China’s provinces: 2011 report (in Chinese), Economic Science Press, Beijing

Fisman, R (2001), “Estimating the value of political connections”, American Economic Review, 1095-1102

Fisman, R and E Miguel (2007), “Corruption, norms, and legal enforcement: Evidence from diplomatic parking tickets”, Journal of Political Economy 115, 1020-1048

Fisman, R and J Svensson (2007), “Are corruption and taxation really harmful to growth? Firm level evidence”, Journal of Development Economics 83, 63-75

Krueger, A O (1974), “The political economy of the rent-seeking society”, The American Economic Review 64, 291-303

Ke, B, N Liu and S Tang, (2016), “The effect of anti-corruption Campaign on Shareholder Value in a Weak Institutional Environment: Evidence from China,” working paper presented in Asia Bureau of Finance and Economic Research, May 2016.

Li, B, Z Wang and H Zhou, (2017), “Political Uncertainty, State Ownership, and Credit Reallocation: Evidence from the Chinese Anti-corruption Campaign,” Working Paper, PBC School of Finance, Tsinghua University

Mauro, P (1995), “Corruption and growth”, The Quarterly Journal of Economics, 681-712

McMillan, J and C Woodruff (2002), “The central role of entrepreneurs in transition economies”, Journal of Economic Perspectives 16, 153-170

Morck, R and M Nakamura (1999), “Banks and corporate control in Japan”, Journal of Finance 54, 319-339

Morck, R, D Wolfenzon, and B Yeung (2005), “Corporate Governance, Economic Entrenchment and Growth,” Journal of Economic Literature, Vol. XLIII, 655–720.

Murphy, K M, A Shleifer and R W Vishny (1992), “The Transition to a Market Economy: Pitfalls of Partial Reform”, Quarterly Journal of Economics 107, 889-906.

Murphy, K M, A Shleifer and R W Vishny (1993), “Why is rent-seeking so costly to growth?”, American Economic Review 83, 409-414

Rajan, R G and L Zingales (1998), “Financial dependence and growth”, American Economic Review 88, 559-587

Schwert, G W (1981), “Using financial data to measure effects of regulation”, Journal of Law and Economics 24, 121-158

Shleifer, A and R Vishny (1993), “Corruption”, Quarterly Journal of Economics 108, 599-617

Thompson, J E (1988), “More methods that make little difference in event studies”, Journal of Business Finance and Accounting, 15, 77–86

Wedeman, A (2012), Double paradox: Rapid growth and rising corruption in China. Cornell University Press.

Wei, S-J (2001), Corruption in economic transition and development: grease or sand? United Nations Economic Commission for Europe, Geneva.

Yuen, S (2014), “Disciplining the Party. Xi Jinping’s anti-corruption campaign and its limits”, China Perspectives, 41-47.

Zeume, S (2016), “Bribes and firm value”, Ross School of Business Working Paper No. 1273

Endnotes

[1] Full text available on the BBC website at http://www.bbc.co.uk/news/world-asia-china-20338586.