How do we estimate the impact of a credit crunch during a crisis? Comparing the value of production before and after the crisis may be misleading. A firm might have produced less because it could not obtain credit, but it might also have produced less because the demand for its products dropped or was expected to do so in the near future. This means that we have to disentangle the effects on production of the reduction in credit supply from the effects that are due to a decline in credit demand.

One way of separating the two channels is to compare firms that are sensitive to a reduction in credit supply with similar firms that are insensitive. Suppose we have two groups of firms. Both groups face the same demand for their products, but the firms in one group have their own funds to finance production, while the others depend on external finance. Comparing the decrease in the value-added during the crisis between both groups gives the effect of the credit crunch. The difficulty lies in finding such ‘control’ and ‘treatment’ groups.

Our approach, which originates with Rajan and Zingales (1998)1, consists of ranking narrowly defined industries by their dependence on external finance and then comparing the changes in value-added across those industries. If the credit supply is perfectly elastic, as is supposedly the case in financially developed countries that are not under any financial stress, then how much each industry depends on external finance can readily be computed from the actual credit usage. Assuming that the variation in dependence on external finance is mainly driven by technology and is thus comparable within narrowly defined industries across time and countries, this pre-computed measure can also be applied to less financially developed countries, or to financially developed countries that are experiencing a financial stress. We use the dependence on external finance as computed by Raddatz (2006) – who uses the US data on listed companies during the 1980s – and apply his measure to the recent crisis to help us to disentangle credit-supply and credit-demand effects.

A leveraged crisis

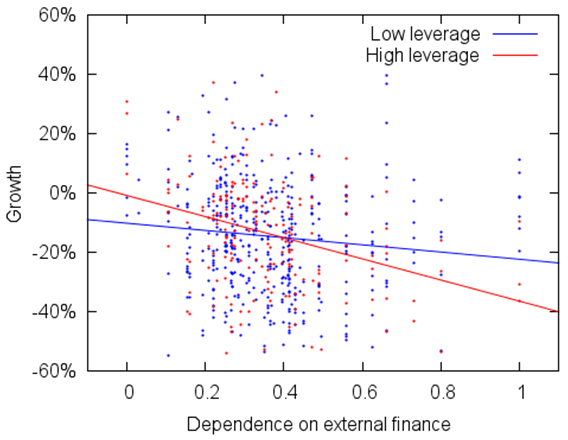

We apply the described approach to measure the impact of the 2008-09 credit crunch on manufacturing industries in the OECD economies (Bijlsma, Dubovik and Straathof 2013). Figure 1 provides a simplified presentation of our main results.2 The figure plots the growth rates in manufacturing in 2009 against dependence of external finance for two groups of countries, countries with highly leveraged banks and countries with low leveraged banks. The first thing to note is that the graph shows that for both groups of countries more financially dependent industries were indeed hit harder by the crisis.

Figure 1. Growth of value added in manufacturing in 2009

In addition, Figure 1 also provides an indication of the role of the financial structure. Credit is provided by both banks and bond markets. If there was a credit crunch, then it should have differed across countries with respect to the differences in those funding channels. Figure 1 shows that the negative impact of the crisis on financially dependent industries was itself aggravated when the banking sector in the country was more leveraged.

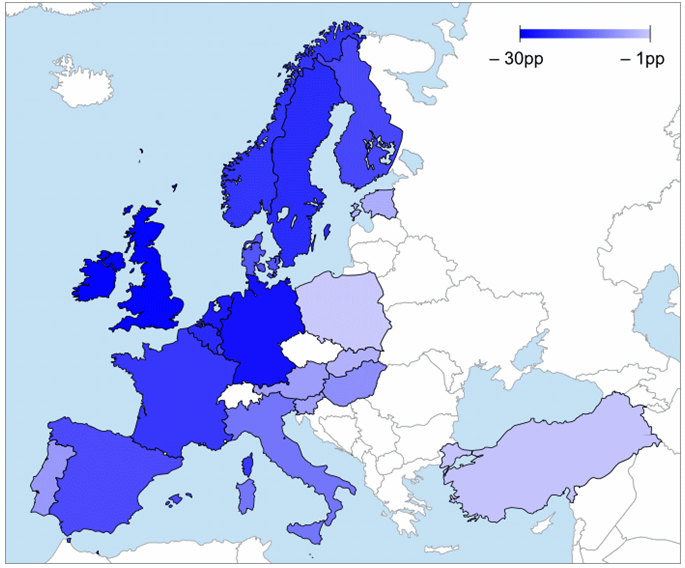

While we can not estimate the actual size of the credit crunch per country, we can compute the credit crunch as implied by the two factors that we found to be significant, namely, the leverage of banks and the portion of financially dependent industries. Figure 3 gives the results. Germany, for example, has the third most leveraged banking system (after Luxembourg and Ireland) and hosts a lot of financially dependent industries. Based on these observations, we estimate the credit crunch in manufacturing in Germany at 27 percentage points in 2009. Indeed, OECD numbers show that manufacturing in Germany did in fact drop by 22 percentage points in 2009, more so than in Spain, Italy, France, or the UK. Poland's banks are least leveraged among European countries, and the country hosts relatively few financially dependent industries. We estimate the credit crunch in Poland at no more than two percentage points in 2009.

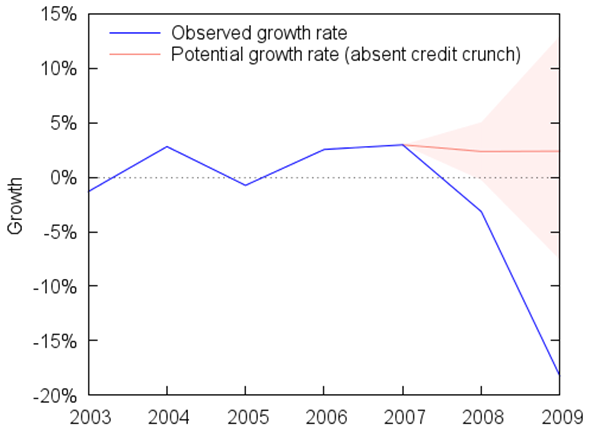

Figure 2. Growth absent credit crunch

What growth in manufacturing would there have been in the absence of a credit crunch? This counterfactual can be computed assuming that, absent the credit crunch, financially dependent industries in countries with highly leveraged banks would have performed just as well (or just as poorly) as financially independent industries in countries with moderately leveraged banks. We find that, if not for the credit crunch, the growth would have stayed at a roughly 2.4% in the OECD economies (Figure 2). Consequently, according to our results almost the entire drop in manufacturing growth is due to the stress of the financial system.

Figure 3. Credit crunch in Europe in 2009

Policy implications

Financial crises are generally associated with long-lasting negative consequences for the economy (see, e.g., Reinhart and Rogoff 2009). Our research suggests that reduced credit supply was the central factor depressing economic growth in the direct aftermath of the 2007-2008 financial crisis. In Europe, the financial crisis was followed by a partly self-fulfilling debt crisis. This crisis is still ongoing and, most likely, still affecting banks’ balance sheets. Complementary to measures addressing the self-fulfilling nature of the Eurozone crisis, such as the ECB’s Outright Monetary Transactions, restoring credit to the real sector is a crucial ingredient in solving the Eurozone’s debt crisis.

Two responses can alleviate the credit-supply problem. The first and preferred response focuses on restructuring and recapitalising banks. While this approach has been relatively successful in the US, in Europe governments have failed in recapitalising banks quickly. Europe’s policymakers should consider a new round of fierce stress testing and recapitalisation. The IMF recently suggested that the European Stability Mechanism can be an important instrument to recapitalise banks.

A second possibility may be to lower banks’ costs of providing loans. Two options are available:

- Provide cheap funding.

- Guarantee loans.

The Netherlands, for example, has subsidised lending by banks via state guarantees on those banks’ loans that are extended to small and medium-sized firms. In 2011, firms received 909 million euro of loans with state-financed guarantees, and 486 million in 2012 (the total flow of loans in 2011 and 2012 was 10.2 billion and 11.5 billion euros respectively, according to ECB figures). There are design issues with such guarantee schemes, e.g. how to prevent crowding out of purely private lending, but these can be overcome in practice.

The UK has a similar National Loan Guarantee Scheme, with £2.5bn in cheaper loans offered to over 16,000 thousand businesses. In addition, however, the Bank of England also provides cheap funding to banks under the provision that the banks invest the money in the real sector, the so-called ‘funding-for-lending scheme’. It allows banks and building societies to borrow for up to four years. In return, the banks have to provide collateral, such as business or mortgage loans. The amount they can borrow increases with the amount they lend to the real economy. Further, the banks that increase their lending pay a lower fee in comparison with the banks that reduce their lending.

Last but not least, our research shows that higher leverage of the banking sector was an important factor increasing the impact of the crisis on the real economy. This calls for renewed attention to the optimal level of banks’ leverage that finds the right balance between stability and banks’ role as providers of maturity transformation.

References

Bijlsma, M, Dubovik, A, and Straathof, B (2013), "How Large was the Credit Crunch in the OECD?", CPB Discussion Paper, 232.

Braun, M, and Larrain, B (2005), "Finance and the Business Cycle: International, Inter-Industry Evidence", The Journal of Finance, 60(3), 1097–1128.

Dell'Ariccia, G, Detragiache, E, and Rajan, R (2008), "The real effect of banking crises", Journal of Financial Intermediation, 17 (1), 89–112.

Kroszner, R, Laeven, L, and Klingebiel, D (2007), "Banking crises, financial dependence, and growth", Journal of Financial Economics, 84(1), 187–228.

Raddatz, C (2006), "Liquidity needs and vulnerability to financial underdevelopment", Journal of Financial Economics, 80, 677–722.

Rajan, R, and Zingales, L (1998), "Financial Dependence and Growth", The American Economic Review, 88(3), 559–586.

Reinhart, C, and Rogoff, K (2009), This Time is Different, Princeton University Press.

1 And which has been followed by, among others, Braun and Larrain (2005), Raddatz (2006), Kroszner et al. (2007), and Dell'Ariccia et al. (2008).

2 The complete analysis is more involved and is presented in the paper.