The process of collecting, aggregating, and analysing data for the purpose of successful operation is nothing new for companies. However, the amount and variety of data that companies use has increased dramatically in recent years. Crucially, an increasing use of data as an (unmeasured) input in production could render key economic statistics, such as output and productivity, seriously flawed (OECD 2020).

Covid-19 is accelerating the digital transformation of our private and professional lives (Coyle and Nguyen 2020), pushing digital business models into even the last corners of the economy. This also means that more and more data are being produced and used to create new products and services. The role of the value of data has been widely discussed both from a data governance perspective (Savona 2020, Aaronson 2020) and from the data ownership and privacy regulation angle (Bergemann et al. 2020, Jones and Tonetti 2020). These are important and pressing issues that contribute to a better understanding of the economic value of data and to the development of future-proof economic statistics.

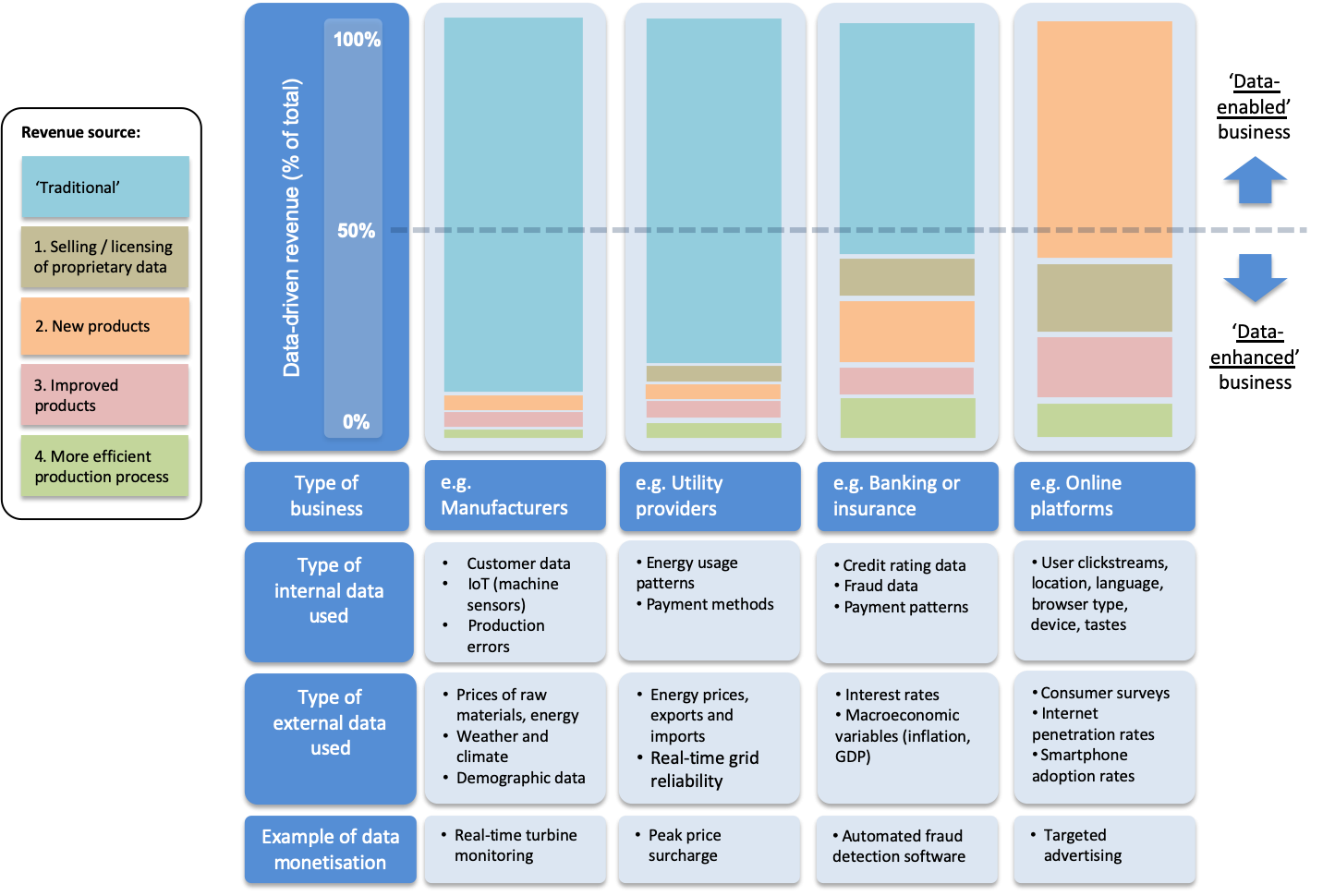

In a recent paper (Nguyen and Paczos 2020), we engage with some of these issues in more detail. We develop a framework based on how businesses monetise data, and propose a taxonomy of data types and characteristics associated with the economic value of data. Drawing on real-world examples, we discuss strategies used by businesses to monetise data, and distinguish four main types:

1. Selling or licensing of data

2. Selling entirely new data-related products

3. Using data to improve or enhance existing products

4. Using data to improve overall productive capacities and efficiency

Based on this framework, we develop the concept that businesses can be data-enabled or data-enhanced. Broadly speaking, data-enabled businesses have developed revenue generation strategies fully reliant on data. They would not exist without access to large amounts of data and advanced data analytics (see also Li et al. 2019 on measuring the value of data for online platforms). On the other hand, data-enhanced businesses exploit data to better coordinate pre-existing business operations, facilitate decision-making, and introduce improved goods and services. However, data and data analytics do not alter or determine their core business models.

We put those strategies together in a framework of data monetisation strategies across different business models (see Figure 1) which can be used to assess the degree to which businesses are relying on data to generate revenue.

Figure 1 Framework: data monetisation across business models and sectors

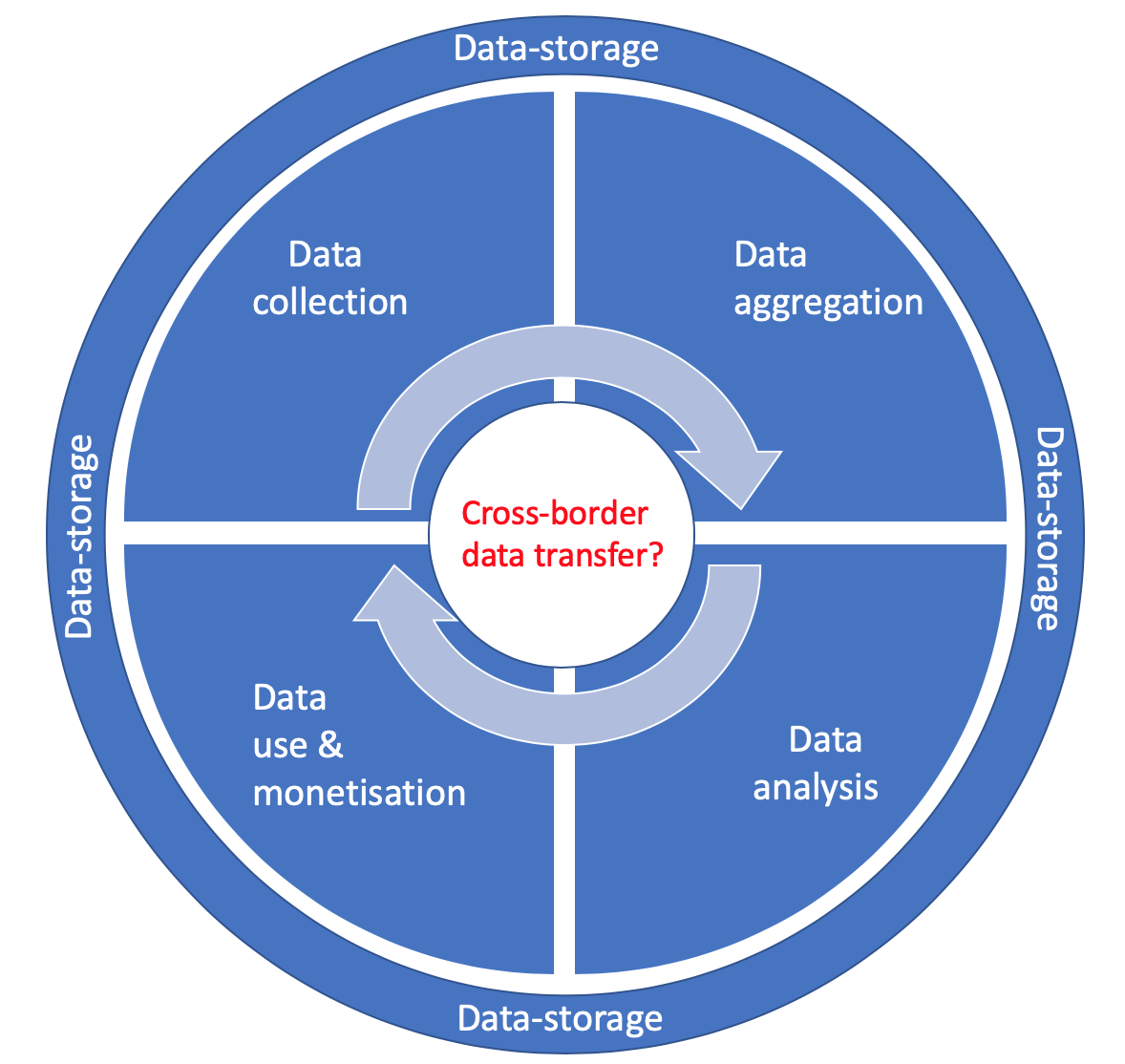

To examine further the ways that data can be used in the value-generation process, we elaborate on the concept of a ‘data value chain’ composed of four stages: data collection, aggregation, analysis, and monetisation. Considering that digitalisation enables the physical detachment of the different stages, we derive that moving between stages necessarily involves data flows. While these flows often take place within data centres and single countries, they can in principle also span multiple countries and jurisdictions.

As a result, cross-border data flows are directly linked to the creation of economic value (Tomiura et al. 2019), especially since the costs for replicating stages in many countries are often prohibitively high. Finally, since data monetisation itself can be used to collect further data, we propose that the ‘chain’ would be better termed a ‘cycle’ (see Figure 2).

We continue with a review of existing data taxonomies that can be useful when thinking about the economic (or business) value of data. This is useful because one needs to simultaneously consider the different types of data that exist (e.g. personal, non-personal) as well as the specific characteristics that make data valuable (or some data more valuable than others).

We conclude that there are several ways in which data can be structured into different types. One could emphasise data usage or access rights, the subject or the source of data, the way in which data are generated (e.g. machine- versus user-generated), or the funding source (in terms of who pays for data collection). In terms of characteristics, data are generally more valuable if they are linkable, accessible, disaggregated, timely, trustworthy, representative, and scarce/excludable.

While we discuss these types and characteristics in more detail in our paper, we are aware that this not an exhaustive list, and that there are countless others we could specify. Our aim here is to capture the most important dimensions (which could change in the future) and minimise overlap.

Figure 2 The data value cycle

In the final section of the paper, we turn to economic measurement and the feasibility of different approaches. For example, a cost-based method has been demonstrated to work in Canada (Statistics Canada 2019); other approaches based on market prices or actual data-driven revenues are more experimental and less developed.

We propose a conceptual framework aimed at progressing the much-needed debate on measurement challenges posed by the increasing use of data and dataflows in modern economies. However, much more research and discussion are needed in the coming years, as data become one of the most important (and valuable) economic resources on the planet. We need to ask: ‘Do we see data everywhere but in company balance sheets?’

References

Bergemann, D, A Bonatti and T Gan (2020), “The Economics of Social Data”, Cowles Foundation for Research in Economics Discussion Paper.

Aaronson, S A (2019), “Data Is a Development Issue”, CIGI Paper No. 223.

Coyle, D and D Nguyen (2020), “Valuing goods online and offline: the impact of Covid-19”, Covid Economics 33: 110-124.

OECD (2020), A roadmap toward a common framework for measuring the Digital Economy, OECD Report for the G20 Digital Economy Task Force, OECD Publishing, Paris.

Jones, C I and C Tonetti (2020), “Nonrivalry and the Economics of Data”, American Economic Review, 110(9): 2819-58.

Li, W C Y, M Nirei and K Yamana (2019), “Value of Data: There’s No Such Thing as a Free Lunch in the Digital Economy”, RIETI discussion paper 19-E-022.

Nguyen, D and M Paczos (2020), “Measuring the economic value of data and cross-border data flows: A business perspective”, OECD Digital Economy Papers No. 297, OECD Publishing, Paris.

Tomiura, E, B Ito and B Kang (2020), “Characteristics of firms transmitting data across borders: Evidence from Japanese firm-level data”, Discussion Paper No.20-E-048, Research Institute of Economy, Trade, and Industry, Tokyo.

Savona, M (2019a), “The Value of Data: Towards a Framework to Redistribute It”, SPRU Working Paper 2019-21.

Statistics Canada (2019), “The value of data in Canada: Experimental estimates”, 10 July.