These are exceptional times in fixed-income markets: US treasuries (of ten-year maturity) currently yield less than 2% per year, the German bunds (same maturity) yield just above 1%, and Japanese government bonds (same maturity) yield less than 0.5%. These low yields on safe assets coincide with unusually low credit spreads. In other words, both safe and risky assets currently provide very low promised returns. For investors who aim to meet return benchmarks or value targets (this includes most institutional investors), this can be an exceedingly challenging situation. They can be tempted to ‘reach for yield’ by taking on additional credit risk and illiquidity to raise portfolio yields.

Concerns about reaching for yield are old. Jones (1968) observed that life insurers tended to maximise yields within investment categories in 1968 and Cox (1967) raised the issue for banks.

However, for a 30-year period from the 1970s until around ten years ago, high yields in fixed-income markets made it relatively easy for institutions to get high yields. Now everything has changed, and reaching may be back with a vengeance. In the early 2000s, following the burst of the internet bubble, the US Federal Reserve set historically low interest rates. Credit spreads soon dropped as well. But even as the worldwide economy recovered, the Fed maintained low interest rates.

In 2005 a chief economist of the IMF, Raghuram Rajan, spoke about the potential buildup of risk in the global financial system as the incentive to reach for yield intensified. The financial crisis in 2008-09 temporarily raised risk premia and credit spreads, providing plenty of opportunities for investors looking for yield. But that turned out to be a brief interlude. Post-crisis, corporate bond markets have rebounded, and the safer sovereigns issue debt at new historical lows. Federal Reserve Governor Janet Yellen (2011) articulated concerns about monetary policy-driven reaching for yield when rates are low and stable. And last month newly appointed Federal Reserve Governor Jeremy Stein (2013) articulated concerns about reaching both in insurance companies and banks.

The evidence: US insurance investment and corporate bonds

In recent work with Victoria Ivashina (Becker and Ivashina 2013), we attempt to estimate the amount of reaching for yield in a systematic manner. Assessing the extent of reaching behaviour among financial institutions is inherently challenging. There is no rule against taking more risk when yields are low. It is only a concern if it leads to more risk taking by portfolio managers than their investors, clients and regulators desire. In order to bring systematic evidence to bear on this important topic, we studied the US insurance industry through the swings in credit-market conditions over the last decade.

Insurance companies’ risk taking is closely related to their capital requirements. To determine the credit-risk component of capital requirements for US insurers, corporate bonds are sorted into six categories based on their credit ratings. For corporate bonds rated from AAA down to A-, insurance companies only need $0.30 of equity capital for every $100 of face value invested. However, such bonds can have vastly different credit risk, liquidity and duration. An insurance company (or its investment manager) can therefore change the risk exposure and the yield in the bond portfolio without affecting capital requirements at all.

With over 90% of all securities holdings by insurance companies being in fixed income, the treatment of fixed income is the key driver of capital compliance. Corporate bonds are the largest piece of insurance portfolios, making the insurance industry critical to the bond market. Insurers, and specifically life insurers, are the largest single group of bond investors, far ahead of mutual funds, pension funds, hedge funds, banks and retail investors. Within corporate bonds, insurers show a marked preference for safer grades: they buy more than twice as much as mutual funds and pension funds together of newly issued investment-grade bonds, but less than half as much of high yield.

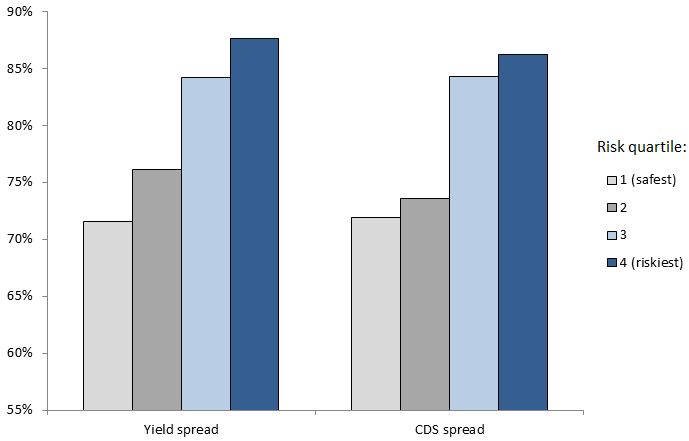

Figure 1 summarises insurance firms’ pre-crisis investment behaviour within highly rated bonds benchmarked against mutual funds and pension funds. There is notable reaching for yield. Insurance companies hold just 72% of all bonds in the lowest yield-spread quartile, but 88% in the highest yield-spread quartile. In other words, insurance portfolios systematically tilt toward risky securities within the investment-grade spectrum. As one would expect, these bonds are riskier, and insurance firms’ bond holdings have higher systematic risk than those of many other investors (this is not to say that mutual and pension funds do not reach for yield, but if so, reaching behaviour for these institutions is either weaker, or driven by different risk metrics and, therefore, manifested differently).

Figure 1. Insurance companies prefer high risk (% insurance holdings of all institutions, corporate bonds at issue, 2004Q1-2007Q2, AAA through A)

Clearly, insurance companies, sometimes reach for yield while maintaining low capital requirements. A key questions is whether such reaching for yield may contribute to cyclicality in credit markets, as suggested by Rajan, Yellen and Stein. Indeed, we find:

- That reaching behaviour disappeared completely in the financial crisis;

- That is returned as soon as credit markets (and insurance companies’ capital positions) recovered.

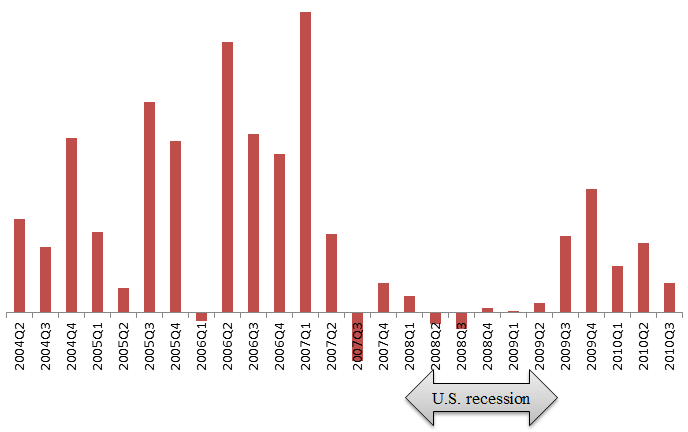

Figure 2 shows the quarter-by-quarter pattern from 2004 to 2010.

Figure 2. Relative reaching for yield by US insurance companies, over time

Note: A zero value indicates that insurance companies invest in a way that is similar to mutual funds and pension funds, whereas positive values indicate that they buy more of riskier bonds (within investment grade).

The outlook

At a high level, our findings show how the institutional arrangements and regulation of banks, insurance and asset management industry may influence credit cycles. Specifically, reaching for yield has implications for the credit supply. When investors reach for yield, issuers that happen to belong to favoured ‘buckets’ (high-risk firms with A ratings on senior debt, for example) become able to borrow at better terms than they should, given their risk and liquidity. In line with this, our research documents that times of pronounced reaching for yield by insurance firms coincide with unusually high issuance activity by riskier firms.

Like regulators, investors who delegate portfolio decisions need to rely on noisy, sometimes biased measures (think credit ratings). Throughout the financial system, institutions and money managers are rewarded for beating risk benchmarks that are approximate at best. In all likelihood, this means that reaching for yield is hardwired into financial intermediation. The reaching for yield we document for insurance firms and corporate bonds may also occur in banks which reach for yield in their lending to households and businesses.

However, illiquid and complex securities are particularly prone to this issue. Weak incentives and regulation that reduces visibility or discourages assessment of risk by outside claimholders can also exacerbate this problem (and we provide some evidence for this in our research). Additionally, the extent of reaching for yield is related to market conditions, and the Federal Reserve governors are right to worry in the current environment of extremely low yields.

References

Becker, Bo, and Victoria Ivashina (2013), “Reaching For Yield in the Bond Market”, NBER working paper No 18,909.

Cox, A (1967), “Regulation of Interest on Deposits: An Historical Review,” Journal of Finance 22(2), 274-296.

Jones, Lawrence D (1968), Investment policies of life insurance companies, Harvard University, Boston.

Rajan, Raghuram (2010), Fault Lines, Princeton University Press.

Stein, Jeremy (2013), “Overheating in Credit Markets: Origins, Measurement, and Policy Responses” at the "Restoring Household Financial Stability after the Great Recession: Why Household Balance Sheets Matter" research symposium sponsored by the Federal Reserve Bank of St. Louis, St. Louis, Missouri.

Yellen, J (2011), “Remarks at the International Conference: Real and Financial Linkage and Monetary Policy, Bank of Japan”.