The fiscal rules in the Eurozone are designed to constrain fiscal policy so that sufficient buffers exist for countries to weather shocks. However, incentives to obey the rules have been low, due to weak enforcement. This means a reccurrence of sovereign debt crises still cannot be excluded from the realm of possibilities. As a result, it is advisable to prepare for such unfortunate situations in advance.

The European Stability Mechanism (ESM) was created to provide assistance in liquidity crises. By providing ‘loans against reforms’, it fills funding gaps when market access is lost, while also overseeing reforms. However, the repayment of public debt that becomes due during the programme currently weighs heavily on the ESM’s limited financing envelope. In the recent programmes for Greece or Portugal, more than 60% of financing needs were caused by maturing long-term debt securities. The prospects of ESM bailouts can also induce moral hazard – investors expect to be repaid in full even if they lend to a government that runs crisis-prone deficits.

A restructuring mechanism would incentivise creditors to pay more attention to crisis risks, and to demand appropriate risk premiums on government bonds. In turn, this could discipline governments and their budget policies. This rationale is similar to the recently introduced bail-in rules for the banking sector.

In case of a crisis, the mechanism would reduce uncertainty by setting out clear processes and rules. It would reduce deadweight losses vis-à-vis the current system, in which the restructuring of privately held sovereign debt is carried out ad hoc, as happened in Cyprus and Greece.

A mechanism to regulate sovereign debt restructuring would also spread the adjustment burden more evenly between creditors and taxpayers. The crisis funds retained by not repaying creditors immediately could be reallocated to finance macroeconomic adjustment programmes with longer durations, leaving more time for reforms and reducing procyclical fiscal austerity.

How the mechanism works

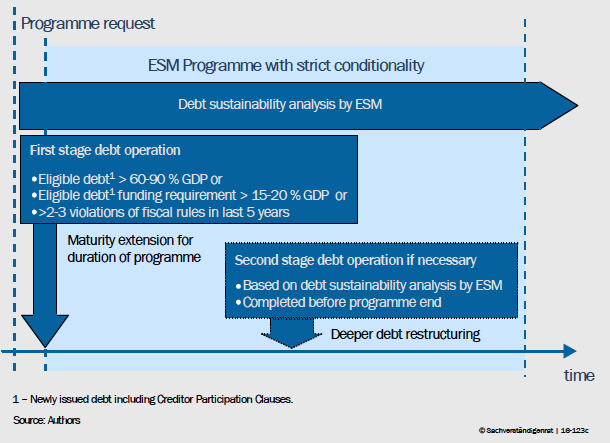

We have developed a mechanism that draws on previous proposals for the Eurozone (see Andritzky et al. 2016 for a survey). Figure 1 provides an overview. Like many others, we propose that the mechanism should only be applied as part of an ESM programme. This would help to deter governments from free-riding on debt relief and encourage them to put their fiscal policies on a sustainable footing. Like other proposals, ours proposes debt restructurings are implemented through Collective Action Clauses in debt contracts. We envision a version of these called ‘Creditor Participation Clauses’ (CPCs). They are based on a single limb vote, ensuring aggregation across all debt containing CPCs.

Figure 1 Newly issued debt, including Creditor Participation Clauses

At the start of a crisis, it is hard to distinguish between a mere funding crisis and a full-blown solvency crisis. While the latter requires a reduction of the debt burden, the former can usually be overcome through maturity extensions and interim funding, such as that provided by the ESM. In our proposal, a two-stage mechanism would avoid having to make this fateful decision at the onset of a crisis, when uncertainty is high and the line between funding and solvency crises are blurred. Our proposal puts these two possible debt operations in sequence, as the liquidity need is eminent at the start of the crisis while the question of solvency cannot be reliably assessed until later.

As is already the case today, access to ESM credit facilities would require an assessment of public debt sustainability (ESM Treaty Article 13 1.b). Since it is in the ESM’s own interest to ensure repayment, the preparation of a debt sustainability analysis and the decision to invoke the restructuring mechanism would rest with the ESM. The ESM would trigger a restructuring in two stages:

- In stage one, we propose a fast and simple decision to trigger a maturity extension, avoiding delays and lingering uncertainty. According to our proposal, a maturity extension would be required if debt featuring CPCs exceeds 60-90% of GDP, or its refinancing volume exceeds 15-20 % of GDP. In addition, two to three or more violations of fiscal rules in the preceeding five years would trigger a maturity extension.

- In stage two, the ESM would decide whether to demand negotiations for a deeper restructuring in the course of the programme, using a more comprehensive set of considerations. It would also determine what extent of debt relief these negotiations would need to achieve. While there would be no need for a set timeline for the second stage, any deeper restructuring would necessarily have to take place while the standstill was still in effect.

While thresholds for debt stock and financing requirements are common, we favour including compliance with fiscal rules as an additional evaluation criterion for first-stage restructuring. A country’s track record under existing fiscal rules is an indication of its economic and political capacity to deliver fiscal adjustment. Including past compliance could also ex ante incentivise governments to adhere to fiscal rules. To reduce threshold effects, we propose a range that provides some (limited) discretion to policymakers, guided by technical analysis of the ESM. Using simple and hard-to-manipulate criteria should nevertheless prevent judgements from being distorted too heavily by political considerations.

How the mechanism could be introduced

A key advantage of our proposal over others is the ease with which it could be introduced. As opposed to more heavy-handed approaches, our mechanism builds on the existing ESM Treaty, which demands that private sector involvement be considered (Preamble 12, ESM Treaty). All that would need to be amended are ESM guidelines that make ESM lending conditional on our new, two-stage mechanism.

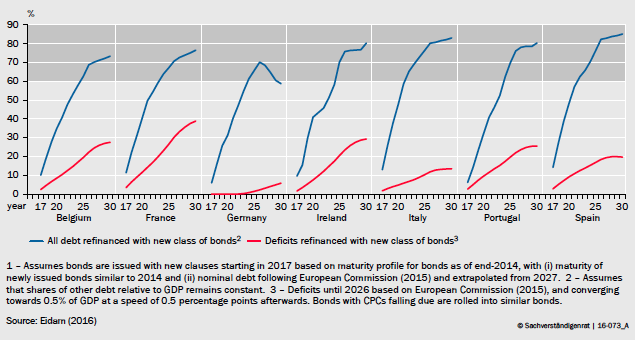

Also, the mechanism would become effective over time, as countries slowly replace existing debt with a new class of debt including CPCs. Figure 2 shows two simulations about how the eligible debt in relation to GDP – one of the mechanism’s triggers – would develop during the phase-in.

- If, starting in 2017, all existing bonds and new deficits were rolled over into new bonds with CPCs starting in 2017, many countries would reach the lower threshold – a debt ratio of 60-90% - after 5 or more years. For example, this would be the case for Italy between 2021 and 2032, depending on assumptions. Italy’s public debt could in those years decline to 121% and 100% of GDP, respectively.

- If only new deficits were financed exclusively with new bonds with CPCs, no member state would reach the critical thresholds at any foreseeable point in time. Indeed, governments might voluntarily issue more debt with CPCs to signal their commitment to sustainable debt levels.

Figure 2 Penetration of debt stock with bonds including Creditor Participate Clauses (CPCs) issued from 2017

It would be easy to devise a transition that resulted in a phase-in speed somewhere between those two simulations. Providing generous phase-in periods would allow countries to reduce excess debt and mitigate concerns about rekindling the Eurozone Crisis. At the same time, the phase-in would provide a hard-to-reverse commitment to the mechanism’s introduction. However, it would still have to be ensured that debt other than CPC-equipped contracts could be restructured as well.

The genie is out of the bottle already

The genie of sovereign debt restructuring in the Eurozone is already out of the bottle and cannot be put back. Debt restructuring in Greece and Cyprus have demonstrated that private creditors of Eurozone governments should not feel immune to contributing their part.

With the adoption of the IMF’s new lending framework last year, creditor participation has officially become an element of IMF programmes (IMF 2015). Since ESM programmes should be prepared in liaison with the IMF, the reach of the IMF’s new bail-in rules already extends into the Eurozone. As a result, it is best to develop a rule-based mechanism for the Eurozone now, rather than in the midst of the next crisis. Any country deemed ‘too big to be saved’ would have to restructure its debt regardless of whether a mechanism such as ours was in place – this could apply to Italy if hit by a large shock.

Our proposal should not be seen as a Trojan horse that restrains fiscal policy. If fiscal policy preserves sufficient fiscal space, including a sustainable level of public debt, there is no contradiction between fiscal discretion and a sovereign restructuring mechanism. On the contrary, as Panizza (2013) emphasises, in normal times all countries could benefit from a Eurozone architecture that includes a structured mechanism for dealing with sovereign insolvency. Moreover, by proposing a two-stage mechanism and reallocating emergency funds towards longer programmes, we want to strike a balance between perverse incentives for governments to rack up debt on the one hand, and delaying ESM programme requests in a ‘gamble for resurrection’ on the other.

Conclusion

The no-bailout clause enshrined in the European treaties can only be rendered credible if an orderly restructuring of government debt is made feasible. An explicit framework for sovereign debt restructuring has many advantages compared to the status quo. Above all, it anchors expectations of market participants by providing a rule-based framework for orderly debt restructuring and serving as a disciplining device for national fiscal policy.

Our proposal demands the participation of creditors in ESM programmes based on a two-stage process. It tailors debt relief to a country’s needs and acknowledges the difficulty of distinguishing between funding and solvency problems in an acute crisis. It would be implemented through amending the ESM guidelines and come into effect through the introduction of (CPCs) in debt contracts. The ease of its introduction and the gradual phase-in mean the swift adoption of such a mechanism is politically feasible today.

References

Andritzky, J, D Christofzik, L P Feld, and U Scheuering (2016), “A mechanism to regulate sovereign debt restructuring in the euro area”, German Council of Economic Experts, working paper, Wiesbaden

Eidam, F (2016), “An analysis of euro area bond maturities and simulation of the introduction of new CACs”, (forthcoming), German Council of Economic Experts, working paper, Wiesbaden

European Commission (2015), Fiscal Sustainability Report.

IMF (2015), The Fund’s lending framework and sovereign debt – further considerations, April

Panizza, U (2013), “Do we need a mechanism for solving sovereign debt crises? A rule-based discussion”, Graduate Institute of International and Development Studies, working Paper 3, Geneva

Endnotes

[1] The Council is politically independent and mandated by law to support all decision-makers in the economic and political sphere, as well as the general public in Germany, to form views about economic policy and its potential risks. To this end, every November it presents an annual report to the German federal government and the general public.