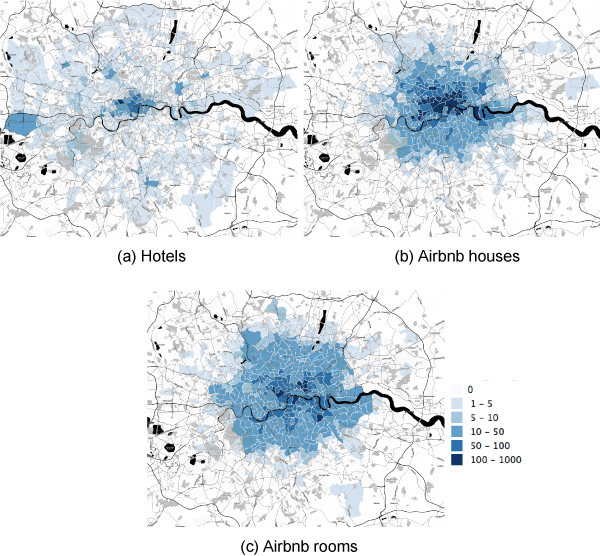

The collaborative economy is statistically elusive. Firstly, there is no commonly accepted definition. Further, the collaborative economy is cross-sectoral and does not fit easily inside official classification schemes, such as the European Nomenclature of Economic Activities (NACE), which are functionally organised.1 Typical economic variables such as revenue and employment are difficult to trace because, in contrast to traditional pipe enterprises, collaborative platforms are able to spread supply across an array of small-scale non-professional providers2 (Figure 1). The earnings of these providers may fall through the net of enterprise surveys and may be under-reported in labour force surveys. Finally, many platforms do not publish their accounts or disaggregate them across country boundaries. Consequently, ad hoc statistical methods using site usage data can offer a temporary solution.3

Figure 1 Airbnb providers compared to hotels

Source: Quattrone et al. (2016).

Note: Heat maps of the number of hotels, Airbnb houses, and Airbnb rooms in each London ward. The darker the ward, the higher the number.

Definition

We define the collaborative economy as activities facilitated by digital platforms that create an open marketplace for the temporary usage of goods or services provided by private individuals. Collaborative economy transactions do not involve a change of ownership (European Commission 2016a). This definition captures the rapidly growing platforms that have entered sectors such as transport and accommodation but excludes other parts of the platform economy, for example e-commerce and social networking.

Methodology

We estimate revenues and employment4 in the collaborative economy in four sectors at country level: transport, accommodation, finance, and online skills (on-demand household services, on-demand professional services) based on the following approach:5

i) Establish the population of collaborative economy platforms by applying the above definition.

ii) Survey the population for revenues.

iii) In parallel, collect usage data on each platform.6

iv) Based on survey responses, calculate ratios of revenue/usage for each sector.

- Adjust platform revenues by EU GDP per capita/GDP per capita of platform country of operation.

- Apply revenue/usage coefficient to platforms that did not respond to survey.

- Adjust extrapolated platform revenues by GDP per capita of platform country of operation/EU GDP per capita.

v) Calculate provider revenues (country, sector) from average commission of platforms.

vi) Estimate full-time equivalent employment based on turnover per person employed for relevant services sectors.

Assumptions

The methodology relies on a few heroic assumptions. Whilst only platforms with an important share of peer-to-peer providers were selected, all revenues of selected platforms were taken into account due to insufficient information to separate out professional providers. (Empirically, the proportion of professional providers seems to increase with platform growth, in some cases becoming significant.) International platform revenues are allocated to a single country based on URL code.7 This assumption is weaker when applied to international platforms that provide a market place for tradable services, as these might not be provided in the same country as the platform is located.

Statistically, there a risk that the collaborative economy universe may be incomplete or over-specified due to the interpretation of the definition. Also, the reliability of the revenue/usage ratios is partly dependent on the survey response rate, which was approximately 11%. Finally, the adjustment of revenues by GDP per capita may not entirely reflect price differences for sector-specific collaborative economy services. In spite of these assumptions and associated risks, we consider that the methodology delivers realistic country/sector economic estimates.

Revenues

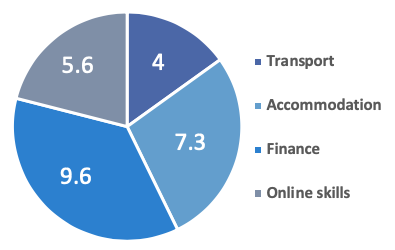

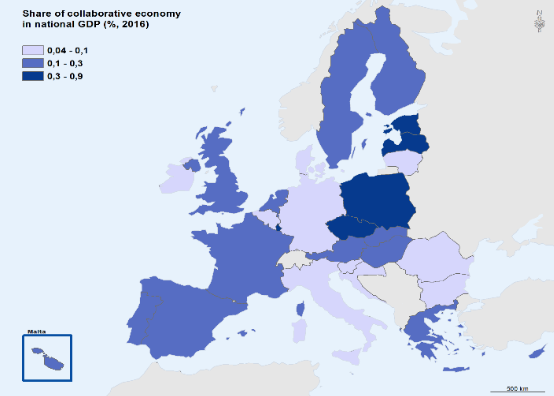

Nearly 700 collaborative platforms were identified in the EU. The revenues (gross output) of the collaborative economy was estimated to be 0.17% of EU GDP (Figures 2 and 3). On a national basis, the size of the collaborative economy ranged from 0.9% of GDP in Estonia to 0.04% of GDP in Belgium. The finance sector (crowd-lending and crowd-equity funding) accounts for the largest proportion of revenues, followed by accommodation. A handful of international platforms account for around 40% of total revenues; the remainder is spread between many small platforms operating domestically.

Figure 2 Revenues per sector (€ billion)

Source: Own calculations

Figure 3 Share of collaborative economy in national GDP

Employment

The amount of employment in the collaborative economy was estimated by dividing revenues at country and sector level by turnover per person employed for the respective services sectors, based on Eurostat data. This provides an estimate of the number of people who work in the collaborative economy.

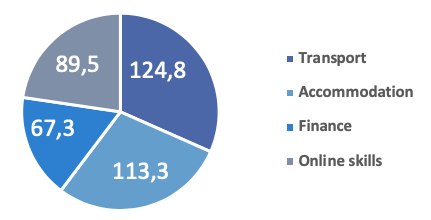

Figure 4 Collaborative economy workers, 2016 (thousands)

Source: Own calculations

The collaborative economy provides work for approximately 395,000 people active across the EU, representing about 0.15% of EU employment (Figure 4). The national distribution is broadly in line with revenues. The actual number of providers may be higher if, for example, collaborative economy services are provided more cheaply than traditional services with the same labour inputor if the labour input is spread more thinly over more providers. Based on the methodology of Harris and Krueger (2015), de Groen and Maseli (2016) estimate that there are 900,000 participants in the EU collaborative economy workforce. EU-based surveys (EC 2016b, JRC 2018) suggest there could be far more individual providers who are working a few hours monthly for additional income.

Conclusion

The collaborative economy represents a challenge for statisticians and economists due to its platform business model, cross-sector and cross-border capacity, and rapid growth. However, the digital context of platforms offers an opportunity to use usage data as a proxy for economic value. As platform business models continue to grow, including multi-sided models where revenue streams are separate from user interaction, reliance on usage data and other alternative forms of data is likely to increase.

References

de Groen, WP, and I Maseli (2016), “The impact of the collaborative economy on the labour market”, Impulse Paper No. 08, European Commission, DG Internal Market, Industry, Entrepreneurship and SMEs Directorate-General.

Demary, V, and B Engels (2016), “Collaborative Business models and efficiency - potential efficiency gains in the European Union”, Impulse Paper No. 07, European Commission, DG Internal Market, Industry, Entrepreneurship and SMEs Directorate-General.

Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, Technopolis, Trinomics, VVA Consulting (2018), “Study to monitor the economic development of the collaborative economy at sector level in the 28 EU Member States”, EU publications.

European Commission (2016a), “A European agenda for the collaborative economy”, COM (2016) 356 final.

European Commission (2016b), “Eurobarometer survey - the use of collaborative platforms”, EU Open Data Portal.

Harris, SD, and AB Krueger (2015), “A proposal for modernizing labor laws for twenty-first century work: The ‘independent worker’”, Discussion Paper 2015-10, The Hamilton Project, Brookings Institution, Washington DC.

Joint Research Centre (2018), “Platform workers in Europe - evidence from the COLLEEM survey – Study”, EU publications.

Quattrone, G, D Proserpio, D Quercia, L Capra and M Musolesi (2016), “Who benefits from the sharing economy of Airbnb?”, Research Gate: 10.1145/2872427.2874815, 1385-1394.

Endnotes

[1] NACE G47.9 includes a sub-branch for sales via internet (and mail order houses) within retail trade but there is no comparable sub-branch for platforms beneath specific services sectors.

[2] A detailed comparison of pipe and platform business models is contained in Demary and Engels (2016).

[3] In addition to the methodology described here, the size of the collaborative economy workforce has been estimated based on online searches (Harris and Krueger 2015, de Groen and Maseli 2016).

[4] Employment in a collaborative economy context is mainly casual work without a traditional employer-employee relationship.

[5] For a full description of the methodology and results, see Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs(European Commission), Technopolis, Trinomics, VVA Consulting (2018).

[6] Usage data was acquired from SimilarWeb. This includes data from search engines and internet traffic.

[7] For international platforms, specific methods were used to disaggregate revenues geographically. For instance, in the case of Airbnb, nights spent at tourist accommodation establishments (ESTAT) nationally was used for disaggregation.