The worldwide rise of superstar companies has been impressive. According to estimates by the McKinsey Global Institute (quoted in Economist 2016), 10% of the world’s public companies generate 80% of all profits. Within countries, very large companies’ sales also account for a sizeable share of GDP and profits. Thanks to significant improvements in data availability, the literature has started to focus on the macroeconomic implications of such concentration of economic activity and wealth in the corporate sector. Gabaix (2011), in a very important piece of work, showed that microeconomic shocks at the top firms (the so-called granular residuals) explain about 30% of aggregate GDP fluctuations in the US. One would expect idiosyncratic shocks at firms to die out in the aggregate given the law of large numbers – positive shocks at some firms could offset negative shocks at others. However, Gabaix (2011) challenged this view, and showed that when the firm size distribution follows a power law distribution, idiosyncratic shocks do not cancel each other out, and can therefore generate big aggregate fluctuations.

One channel through which these general equilibrium effects can build up is supply-chain linkages. The recent Volkswagen (VW) scandal provides an interesting example. According to Fortune Magazine, 500 companies that supply parts for VW’s Golf model were forced to build up inventories because the German carmaker temporarily stopped buying.1

There have been other attempts in the literature to understand the macroeconomic implications of the presence of very large firms in the economy. Blank et al. (2009) applied the concept of granularity to the German banking sector, and found that positive shocks at large banks reduced the probability of distress at smaller banks. Freund and Pierola (2015) showed that the five biggest firms make up 30% of total non-oil exports in 32 countries, and that in many cases, the total revealed comparative advantage of a country can be created by a single firm. Recently, Autor et al. (2017) showed that the rise of superstar firms has shrunk workers’ share of income – from manufacturing to retailing, giant companies have managed to secure a larger and larger share of the market and this type of ‘winner takes all’ competition has not been good for all workers.

Aggregate fluctuations in Europe have substantial microeconomic origins

Our recent paper provides an empirical test of the relevance of idiosyncratic shocks at large firms (the granular residuals) in the euro area (Ebeke and Eklou 2017). To perform this empirical exercise, we use statistical information for approximately 14 million firms for eight large euro area countries (Austria, Belgium, Finland, France, Germany, Italy, Portugal, and Spain) from 2000 to 2013. We start by investigating the ‘granular hypothesis’, that is, how strongly the granular residual explains aggregate macroeconomic fluctuations (GDP, investment, exports, unemployment). We compute several measures of the granular shocks by aggregating big-firm specific shocks (labour productivity or total factor productivity).

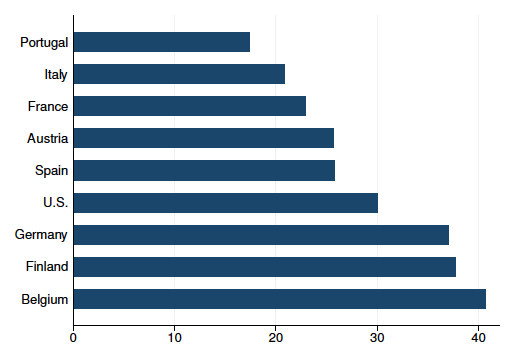

Figure 1 shows that the share of the 100 biggest firms’ sales in the sample is, on average, 29% of national GDP over the period, which is close to the percentage found for the US by Gabaix (2011). It is worth noting that there is a significant variation in the share of sales in GDP across countries. For instance, the 100 biggest firms in Belgium have the highest share of GDP over the period (40%), Germany and Finland also exhibit large shares (37%), while Portugal has the lowest proportion at 17%.

Figure 1 Top 100 large firms’ sales (% of GDP)

Source: Authors’ calculations using Orbis data. The US data are from Gabaix (2011).

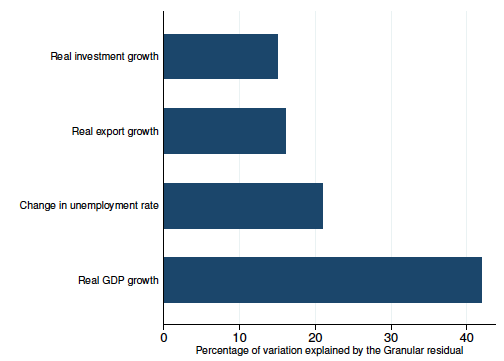

After constructing time series of granular residuals for each country, we assess their explanatory power in various macroeconomic regressions of GDP growth, investment growth, export growth, and change in unemployment rate. We find that the explanatory power of the granular residuals in our sample is indeed large. Figure 2 shows that these idiosyncratic shocks at top firms explain over 40% of the variation in real GDP growth, which is greater than the actual share of GDP of the top firms (29% over the period of analysis). This result is important as it suggests that large firms may affect aggregate fluctuations through other channels than their size, including via input/output linkages with the rest of the economy. In addition, we find that granular residuals explain more than a quarter of the variance of the unemployment rate, and about 15% of the variability of aggregate investment and exports.

Figure 2 Explanatory power of idiosyncratic shocks at the 100 biggest firms

Notes: The figure shows the R-squared (in percent) from panel regressions where each macroeconomic outcome is regressed on the granular residual.

Sources: Authors’ calculations.

Propagation effects: Idiosyncratic shocks at top firms and SME responsiveness

We test the hypothesis that idiosyncratic shocks at the 100 biggest firms can result in significant fluctuations in SME output. This may represent one channel through which shocks at large firms drive aggregate fluctuations in the euro area. Major corporations spend billions of dollars annually buying products and services from other companies (mostly SMEs) specialised in activities such as landscaping, cleaning services, logistics, software development, advertising, office supplies, and so on. To investigate the strength of spillovers from big firms to SMEs, we regress SME sectorial value-added growth on the granular residuals, country characteristics, and sector-time invariant characteristics. We also investigate the possibility that the effect of the granular residuals on SME growth may differ for different SME characteristics (sector and financial leverage (total debt over assets)).

Our results indicate substantial spillovers from large firms to SMEs. These spillovers are more significant for SMEs in the manufacturing and professional service sectors (Figure 3). However, there are not statistically meaningful spillovers into other sectors, for instance the construction sector.

Figure 3 Spillovers from large firms to SMEs

Notes: The figure shows the response (in percentage points) of SMEs’ sectorial real value-added growth to a 1 standard deviation increase in the granular residuals for various sectors. The underlying regressions control for SMEs characteristics, and various country, sector and time fixed effects.

Source: Authors’ calculations.

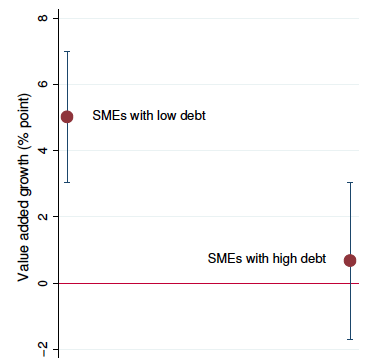

Not all SMEs are well enough equipped to seize the business opportunities arising from positive idiosyncratic shocks happening in large firms. The ability of highly leveraged SMEs to expand production capacities may be limited (Figure 4). A high leverage may constrain SMEs’ abilities to obtain external financing for new investments and or incentivise shareholders to decide on new investments.

Figure 4 Spillovers from large firms to SMEs: The role of leverage

Notes: The figure shows the response (in percentage points) of SMEs’ sectorial real value-added growth to a 1 standard deviation increase in the granular residuals for various levels of SMEs leverage. “Low debt” represents the situation where the ratio of SMEs debt-to-assets is lower than the sample’s median. “High debt” represents the case of SMEs debt-to-assets ratio larger than the sample’s median. The underlying regressions control for SMEs characteristics, and various country, sector and time fixed effects.

Sources: Authors’ calculations.

Conclusion

We have shown that almost half of aggregate macroeconomic fluctuations in the euro area are the result of idiosyncratic microeconomic shocks stemming from large firms. We have also shown that this result is in part due to general equilibrium effects in the form of spillovers from large firms to SMEs. However, these spillovers are heterogeneous in nature: they are bigger for SMEs in the manufacturing sector and for SMEs with healthy balance sheets.

The increasing influence of large firms worldwide, and in Europe, suggests the need to give more consideration to sectoral policies to supplement traditional demand-side policies. The usual fine-tuning of the economy may prove particularly challenging when a large component of aggregate shocks is idiosyncratic in nature, and originates from a small number of extremely large firms. Very large firms can react differently to domestic policy shocks given their initial conditions and global presence. This poses a challenge for policymakers, especially when the performance gap between these giant superstars and SMEs widens, making domestic economic shocks more asynchronous and the economy more difficult to guide through policy interventions. The perception of what constitutes macroeconomic fundamentals remains more than ever an open debate.

References

Autor, D, D Dorn, L Katz, C Patterson and J Van Reenen (2017), “The Fall of the Labor Share and the Rise of Superstar Firms”, CEP Discussion Paper No, 1482.

Blank, S, C M Buch and K Neugebauer (2009), “Shocks at Large Banks and Banking Sector Distress: The Banking Granular Residual”, Journal of Financial Stability 5(4): 353– 373.

Ebeke, C and K Eklou (2017), “The granular origins of Macroeconomic Fluctuations in Europe”, IMF Working Paper No. WP17229.

Economist (2016), “The Rise of The Superstars”, 17 September.

Freund, C and M D Pierola (2015), “Export Superstars”, The Review of Economics and Statistics 97(5): 1023–1032.

Gabaix, X (2011), “The Granular Origins of Aggregate Fluctuations”, Econometrica 79(3): 733–772.

Endnotes

[1] http://fortune.com/2016/08/23/vw-and-suppliers-settle-their-dispute-after-marathon-talks/ (accessed 17 August 2016).