The importance that management plays in explaining firms' performance is long known (Walker 1887), but the availability of new data measuring structured management practices (Bloom et al. 2017) has brought a resurgence of interest. More recently, we also have learned that management not only is crucial to explaining differences in performance between firms, but also plays a key role in explaining productivity and income differences across countries (Scur et al. 2021) as firms in less developed countries appear to have significantly worse levels of managerial practices.

However, while the implications of poor management in developing countries are becoming well known, what drives these differences is less well understood. Until recently, large-scale surveys measuring managerial practices were available only in developed countries (e.g. the US). To address this knowledge gap, we collaborated with the Government of Mexico and the Mexican National Statistical Office to implement a large-scale and nationally representative survey of more than 25,000 firms covering both manufacturing and services sectors. The response rate was well over 90%, and the survey allows us to analyse differences between Mexican and US firms and study the drivers of the low management levels among firms in Mexico.

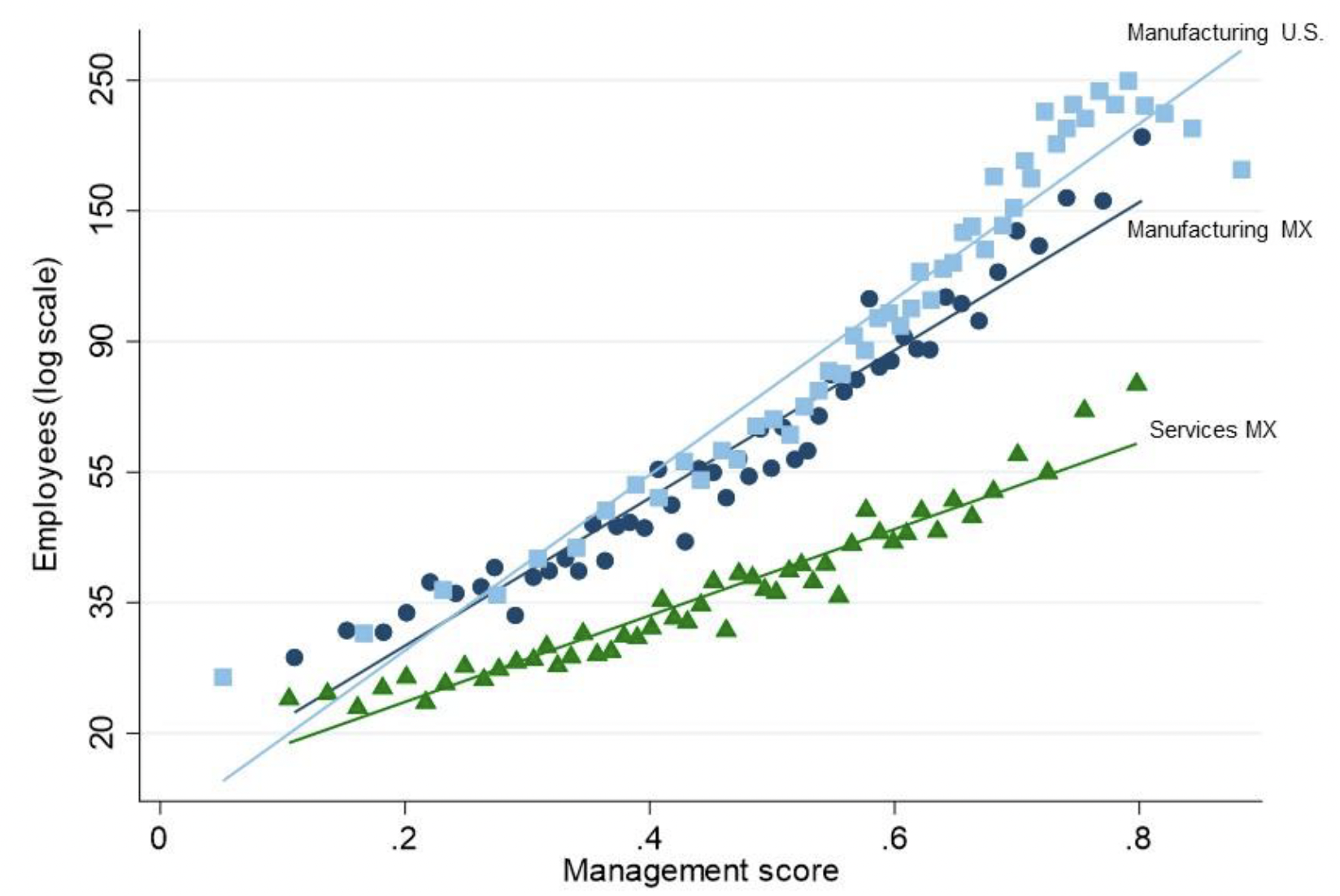

In a recent paper (Bloom et al. 2022), we confirm that management scores are positively associated with various measures of firm performance such as productivity, profitability, exports, size, and innovation (see Figure 1).

Figure 1 Performance and management in Mexico

Notes: 6,643 observations on manufacturing firms and 17,684 observations on service firms. Along the x-axis, we measure deciles of the management score. Source: Bloom et al. (2022)

Similarly, we document that, on average, firms in Mexico have significantly lower levels of management than those in the US. Finally, we provide evidence suggesting that these differences are driven by frictions which both reduce incentives for firms to invest in managerial improvements and make it hard for better-managed firms to reap returns in terms of expanding their scale.

Distortions disincentivise better management

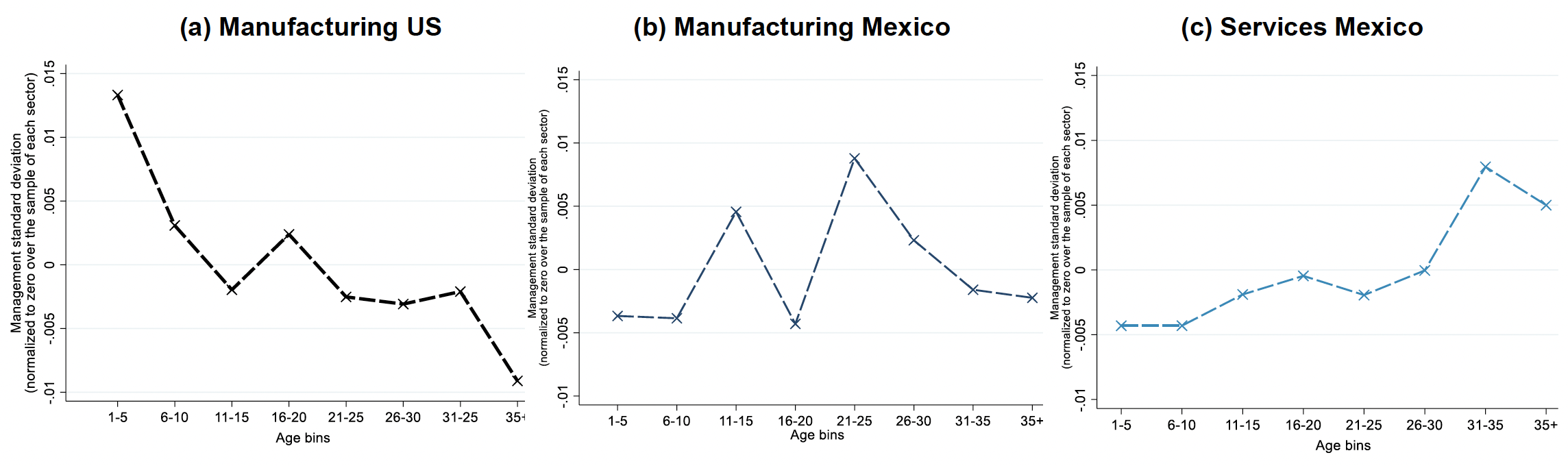

Market forces should lead better-managed firms to grow as they are more productive. This is broadly the case in the US and in Mexico better-managed firms tend to be larger. However, there are also significant differences. As shown in Figure 2, we find that the slope of the relationship between size and management is lower in Mexico, especially for firms outside of manufacturing (‘services’). This result, together with the finding that (a) managerial scores are not only lower but also more dispersed in Mexico, especially in services, and (b) this dispersion does not decrease with age as normal selection effects would imply (see Figure 3), indicates that larger market distortions in Mexico could explain why firms are more poorly managed. In fact, market distortions reduce the capacity of firms to scale up when they have the potential to do so thanks to their better management.

Figure 2 Firm size and management

Notes: Bin scatter with 50 quantiles from Mexican and U.S. firm-level management data. Lines are OLS regressions for log(employment) on management scores. 6,643 observations on Mexican manufacturing; 17,684 observations on Mexican services; and 32,000 US manufacturing plants (Bloom et al. 2019) aggregated into 18,000 firms.

Figure 3 Firm age and management: Spread

Notes: Variance of management score as a function of firm age. 6,643 observations on Mexican manufacturing; 17,684 observations on Mexican services; and 32,000 US manufacturing plants

The importance of accessing a large and competitive market

Access to larger and more competitive markets creates incentives for managers to improve the organisations and introduce more structured and data-driven managerial practices. Returns from improving managerial practices have higher payoffs when firms transact in larger and more competitive markets. Consistent with this idea, Mexican firms that are closer to the US border tend to be significantly better managed (see Figure 4). However, this association holds only for manufacturing firms in panel (a) and is stronger for such firms in sectors that are more export oriented. Services firms, typically producing non-tradables, are not influenced by the proximity to the US market. Instead, they are affected by the size and competitiveness of the local markets. For services firms, what matters is the proximity to larger and richer metropolitan markets, as shown in panel (b).

Access to the relevant market (the US market for manufacturing firms and local markets for services) also leads to stronger selection forces. Proximity to the US border increases the size-management relationship for manufacturing firms, but not for services. On the other hand, local market size strengthens the size-management relationship for services firms, while the same is not observed for manufacturing. These results point to an important role of market frictions on reallocation.

Figure 4 Management scores by state

Notes: 6,643 observations on Mexican manufacturing; 17,684 observations on Mexican services. Authors' calculations with data from ENAPROCE 2015 and 2018, INEGI.

Institutions matter

Institutions play a key role in determining how markets function and generating incentives for firms to improve their organisation. As shown by Akcigit et al. (2021) and Iacovone et al. (2019), better institutions, measured by the strength of the local contracting environment or levels of trust, lead firms to be more likely to hire external (non-family related) professional managers. This has implications for the quality of management levels as these managers tend, on average, to be better than family-related managers (Lemos and Scur 2018).

In the case of Mexico, as recently suggested by Levy (2018), contract enforcement is a crucial factor associated with market distortions and misallocation. In line with these results, we find that institutional weaknesses are associated with a smaller impact of management on firm size. In the presence of lower levels of contract enforcement, higher levels of crime or corruption, better-managed firms are less capable of benefiting from their superior management and, consequently, of growing.

Figure 5 Institutions as sources of misallocation

Notes: 6,643 observations on Mexican manufacturing; 17,684 observations on Mexican services

Conclusions

Our results have implications for policymakers in developing countries as they highlight a specific channel through which distortions lead to lower economic performance. Misallocation means lower aggregate management quality and productivity, and less incentive to improve. Expanding market access, promoting contestable local markets, as well as improving contract enforcement, reducing crime and corruption, are key mechanisms to improve firms' organization and performance. These types of structural and market-driven interventions complement well those more short-term interventions discussed in previous columns suggesting that, even in the presence of market distortions, it is possible to improve management with targeted consulting services supporting firms either individually (Bloom et al. 2013, Bruhn et al. 2018) or even better through group consulting (Iacovone et al. 2022). Given the results of recent work by Cette et al (2020) and Patnaik et al. (2021) showing that better-managed firms not only are more productive but also more resilient in the face of shocks such as those due to the Great Recession and COVID-19, we think the agenda of improving managerial practices is especially timely, and that our results point to specific areas of reforms to create the appropriate incentives for firms to improve their management and productivity.

References

Akcigit, U, H Alp, and M Peters (2021), "Lack of selection and limits to delegation: Firm dynamics in developing countries", American Economic Review 111(1): 231-275.

Bloom, N, E Brynjolfsson, L Foster, R Jarmin, M Patnaik, I Saporta Eksten, and J Van Reenen (2017), “Adding a piece to the productivity puzzle: Management practices”, VoxEU.org, 17 May.

Bloom, N, B Eifert, A Mahajan, D McKenzie, and J Roberts (2013), "Does management matter? Evidence from India", The Quarterly Journal of Economics 128(1): 1-51.

Bloom, N, L Iacovone, M Pereira-López, and J Van Reenen (2022), “Management and misallocation in Mexico”, CEPR Discussion Paper 16979.

Bruhn, M, D Karlan, and A Schoar (2018), "The impact of consulting services on small and medium enterprises: Evidence from a randomized trial in Mexico", Journal of Political Economy 126(2): 635-687.

Cette, G, J Lopez, J Mairesse, and G Nicoletti (2020), “Managerial practices influence the ability of economies to weather large shocks”, Vox.EU.org, 2 December.

Iacovone, L, W Maloney, and N Tsivanidis (2019), "family firms and contractual institutions", World Bank Policy Research Working Paper Series 8803.

Iacovone, L, W Maloney, and D McKenzie (2022), “Improving management with individual and group-based consulting: Results from a randomized experiment in Colombia”, The Review of Economic Studies 89(1): 346–371.

Levy Algazi, S (2018), "Under-rewarded efforts: The elusive quest for prosperity in Mexico", IDB Publications 8971, Inter-American Development Bank,.

Lemos, R and D Scur (2018), "All in the family? CEO choice and firm organization", CEP Discussion Paper 1528

Patnaik, M, A Lamorgese, A Linarello, and F Schivadi (2021), “Management practices boosted firm performance in COVID-19 by facilitating remote work: evidence from Italy”, VoxEU.org, 1 May.

Scur, D, R Sadun, R Lemos, N Bloom, and J Van Reenen (2021), “The world management survey at 18”, Oxford Review of Economic Policy 37(2): 231–258.

Walker, F (1887), “The source of business profits”, Quarterly Journal of Economics 265: (1886-1906).