Does an economy's productivity respond to changes in aggregate demand? Standard macro models suggest that it does not. Typically, productivity is determined by technology and hence shocks that move demand, such as monetary shocks, have no effect on aggregate productivity.

But in reality, variations in monetary and fiscal policy explain as much as one-half of the observed variation in aggregate total factor productivity (TFP) over the business cycle (e.g. Evans 1992).1 Aggregate TFP decreases following contractionary monetary shocks (such as a hike in the interest rate) and rises after expansionary shocks. One way of interpreting this result is that the standard model is basically right, but the measurement of productivity is biased. For example, low capacity utilisation could make productivity appear artificially low during downturns.

In a recent paper (Baqaee et al. 2021), we offer an alternative explanation. We argue that aggregate TFP is not an exogenous primitive, but rather an endogenous outcome that depends on how resources are allocated across firms. When firms have non-uniform markups, the reallocation of resources across firms triggered by a demand shock will have a first-order effect on aggregate TFP. In other words, monetary shocks should affect productivity.

As a result, monetary shocks have distinct – and complementary – demand- and supply-side effects. The demand-side effects are the transmission mechanisms described in traditional models. Nominal rigidities (i.e. sticky prices) prevent firms from raising prices immediately following a monetary easing. Real rigidities, which arise from strategic complementarities in pricing, further contribute to low prices in the short term. Low prices relative to income increase the demand for goods, which boosts labour demand, employment, and – because of increased employment – output. This constitutes the demand-side effect.

However, a monetary easing also increases aggregate productivity. This generates an endogenous positive ‘supply shock’ that amplifies the effects of the positive ‘demand shock’ on output. The supply-side transmission channel increases the responsiveness of output to demand shocks and flattens the Phillips curve.

The model

Consider an economy in which firms have different markups. In this setting, the steady state exhibits misallocation – firms with relatively high markups under-produce relative to firms with relatively low markups. A social planner could increase output, holding fixed the overall quantity of inputs, by transferring some resources from low-markup to high-markup firms.

A monetary easing triggers exactly these types of reallocations. That is, a monetary easing reallocates resources away from low-markup firms and towards high-markup firms, thereby raising aggregate productivity and output. This is because empirically, large firms tend to have both higher markups and lower pass-throughs of marginal costs into prices (e.g. Berman et al. 2009, Amiti et al. 2019). When faced with an increase in nominal marginal costs, high-markup firms raise their prices by less than their low-markup counterparts in order to remain competitive. The result is that a positive demand shock, such as a monetary easing, will compress the distribution of markups, shift resources toward high-markup firms, and thus improve aggregate productivity.2

The dynamics in aggregate TFP that arise from reallocations between high- and low-markup firms can be integrated into the New Keynesian framework. The workhorse three-equation model, which consists of the Phillips curve, dynamic IS equation, and monetary policy rule (e.g. Galí, 2015) becomes a four-equation model, with an additional equation governing endogenous movements in aggregate TFP. This model is calibrated by a few sufficient statistics that are observable from the firm distribution.3

Linking micro and macro evidence

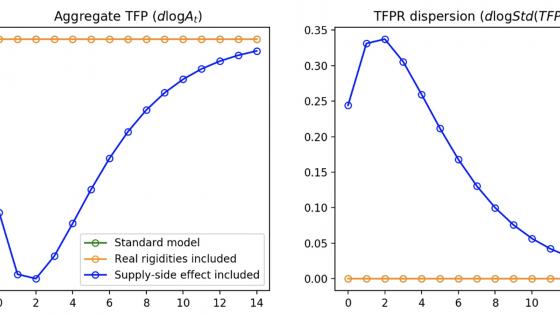

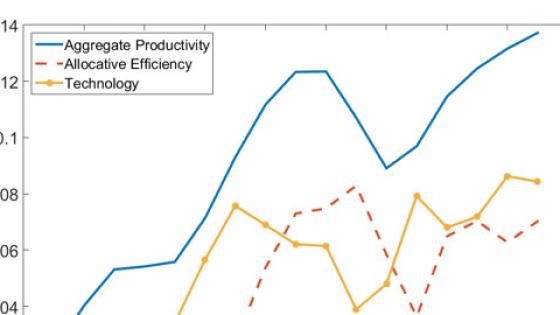

The dynamics predicted by our model can be seen in both macro- and micro-level data. At the macro level, changes in allocative efficiency explain the sensitivity of aggregate productivity and labour productivity to demand shocks (as described at the start of this column). The left panel in Figure 1 shows how aggregate TFP moves due to shifts in the allocation of resources following a contractionary shock in our four-equation model. The response is hump-shaped and procyclical, matching the empirical aggregate productivity response documented by Evans (1992) and Christiano et al. (2005).4

Figure 1 Impact of a contractionary 100 basis point (annualised) interest rate shock

Note: The left panel shows the impact on aggregate TFP. The right panel shows the impact on TFPR dispersion.

This procyclical movement in aggregate TFP is coupled with countercyclical dispersion in firm-level revenue productivity (TFPR) (under constant returns to scale, a firm's revenue productivity is just the firm's markup). Kehrig (2011) finds that the dispersion of plant-level TFPR is about 10% higher during recessions than booms; the right panel in Figure 1 shows that an increase in TFPR dispersion of this magnitude naturally arises in response to a contractionary monetary shock.

As such, our theory links together both macro- and micro-level evidence – the cyclical patterns in productivity measured at the economy-level and at the firm-level – and shows that both can be driven by demand shocks.

The magnitude of supply-side effects

We gauge the magnitude of supply-side effects using data from Belgium, where we pair empirical estimates of firms' desired pass-throughs provided by Amiti et al. (2019) with data on the firm-sales distribution. We adopt the calibration approach described in Baqaee and Farhi (2020b). This method is non-parametric, which means that we can match observed sales and pass-throughs distributions exactly without specifying functional forms that may mute some features of the data.

The supply-side channel of monetary policy transmission is quantitatively important: in a static version of the model, supply-side effects flatten the Phillips curve by about 71% compared to a model with demand-side effects alone. As a point of comparison, real rigidities – a mechanism discussed at length in the literature – flatten the Phillips curve in our calibration by 73%.

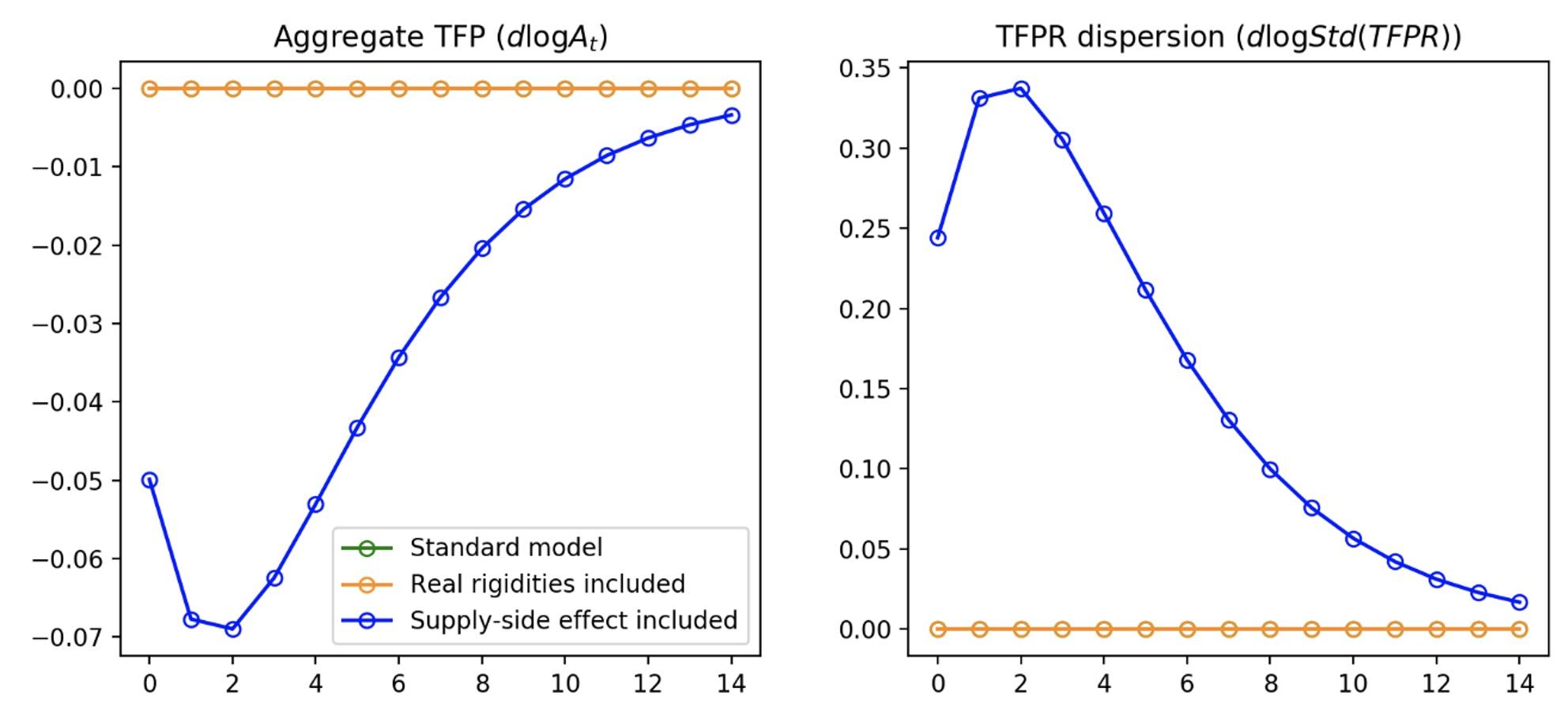

Figure 2 Impact of a contractionary 100 basis point (annualised) interest rate shock

Note: The left panel shows the impact on output due to nominal rigidities, real rigidities, and supply-side effects. The right panel shows the flattening of the Phillips curve due to real rigidities and supply-side effects.

In the dynamic version of the model, the supply-side effect amplifies both the impact and persistence of interest rate shocks on output, as shown in Figure 2. The left panel shows the effect of a 100 basis point increase in the (annualised) interest rate on output. Supply-side effects deepen the loss in output by 20% on impact. The role of this channel also rises over time, as shown in the right panel; supply-side effects increase the ‘initial’ half-life of the shock's effect on output by 24%.5

Conclusion

The link between demand shocks and aggregate productivity has important implications for how monetary shocks transmit to real economic outcomes. Our analysis suggests that this link depends on an economy's industrial organization, which means that changes in the firm distribution (such as an increase in industrial concentration) can have a material impact on monetary policy transmission.

The hope is that, by building models with realistic firm heterogeneity, we are better able to guide monetary interventions. For example, the supply-side effects of monetary policy discussed in this column yield questions about optimal monetary policy when taking endogenous productivity changes into account. We are currently pursuing questions in this vein in ongoing work.

References

Amiti, M, O Itskhoki and J Konings (2019), “International shocks, variable markups, and domestic prices”, The Review of Economic Studies 86(6): 2356–2402.

Baqaee, D R and E Farhi (2017), “Productivity and misallocation in general equilibrium”, NBER Working Paper No 24007.

Baqaee, D R and E Farhi (2020a), “Productivity and misallocation in general equilibrium”, The Quarterly Journal of Economics 135(1): 105-163.

Baqaee, D R and E Farhi (2020b), “The Darwinian returns to scale”, NBER Working Paper No 27139.

Baqaee, D R, E Farhi and K Sangani (2021), “The supply-side effects of monetary policy”, NBER Working Paper No 28435.

Berman, N, P Martin and T Mayer (2009), “Exporters (good ones) don’t pass-through”, VoxEU.org, 22 October.

Christiano, L J, M Eichenbaum and C L Evans (2005), “Nominal rigidities and the dynamic effects of a shock to monetary policy”, Journal of Political Economy 113(1): 1–45.

Evans, C L (1992), “Productivity shocks and real business cycles”, Journey of Monetary Economics 29(2): 191–208.

Galí, J (2015), Monetary policy, inflation, and the business cycle: An introduction to the New Keynesian framework and its applications, Princeton: Princeton University Press.

Kehrig, M (2011), “The cyclicality of productivity dispersion”, Working paper CES-WP-11-15, US Census Bureau Center for Economic Studies.

Meier, M and T Reinelt (2020), “Monetary policy, markup dispersion, and aggregate TFP”, ECB Working Paper No 2427.

Endnotes

1 Evans (1992) concerns aggregate TFP as measured by the Solow residual.

2 In Baqaee et al. (2021), we show that the necessary condition to link monetary easing with an increase in aggregate TFP is that markups be negatively correlated with realized pass-throughs. This will be the case if markups are negatively correlated with desired pass-throughs (i.e. pass-throughs conditional on a price change) or if markups are negatively correlated with price flexibility. The case of heterogeneous price flexibility is commented on by Baqaee and Farhi (2017) and has been recently analyzed by Meier and Reinelt (2020). Meier and Reinelt (2020) micro-found a negative correlation between markups and price flexibility due to a precautionary motive.

3 These are: the average markup, the average price elasticity of demand, the average desired pass-through, and the covariance of markups and desired pass-throughs.

4 Christiano et al. (2005) estimate a positive, hump-shaped response of labour productivity to monetary easing. In the one-factor model presented in Baqaee et al. (2021), labour productivity and aggregate TFP are the same.

5 The standard model features a constant half-life. In the model with misallocation, aggregate TFP follows a second-order equation, and thus the model no longer has a constant half-life. The 24% statistic we report captures the half-life implied by the initial rate of decay in the impulse response of output.