Money markets are an important cornerstone of the financial system. Banks, non-bank financial institutions such as investment funds and money market funds, as well as non-financial corporations rely on money markets for their short-term funding and collateral needs. Money markets are also key for the implementation and transmission of monetary policy. Short-term money market rates often serve as operational targets for central banks and represent the first step in monetary policy transmission. In addition, money market rates are important for credit conditions in the economy, as money market rates serve as a benchmark for the pricing of credit and are therefore an important determinant for the level of lending rates faced by firms and households. To ensure a smooth transmission of the monetary policy stance, it is therefore important that money market rates be well-aligned with central bank policy rates.

In the euro area, money markets have gone through substantial changes and turbulent periods over the past 15 years. First, they experienced bouts of volatility during the Global Crisis and the euro area sovereign debt crisis, affecting in particular unsecured money market rates and secured rates collateralised by stressed sovereigns’ government bonds. Second, there was a shift from unsecured to secured money markets.1 Third, tensions in money markets during the global and euro area sovereign debt crises led to a large demand by banks for liquidity provided by the central bank. Fourth, new Basel III regulations, in particular the liquidity coverage ratio (LCR) and the leverage ratio (LR), have been phased in since 2015. These regulations may interact with money market functioning in a variety of ways. The liquidity coverage ratio requires banks to hold high-quality liquid assets (e.g. reserves and government bonds) and such assets are traded in money markets. The leverage ratio is calculated based on the size of banks’ balance sheets and money market borrowing has a bearing on bank balance sheet size.

In a recent paper (Corradin et al. 2020), we discuss these changes and study the interactions between money markets, new Basel III regulations, and central bank policies (liquidity provision, asset purchases, and the Securities Lending Programme). We also assess the macroeconomic impact of money market conditions and discuss the implications of money market developments for monetary policy implementation and transmission.

Measuring euro area money market activity

To measure money market activity, we consider several metrics in both secured and unsecured euro area money markets: volumes, rates, and the dispersion index of money market rates. We rely on several data sources to measure money market activity. In order to go back in time to prior to the Global Crisis, we use the daily euro overnight index average (EONIA) rates and volumes starting from 2005 and, for secured (repo) markets, we rely on daily aggregated data on transactions executed on the Brokertec and MTS platforms with French, German, Italian, and Spanish sovereign securities as collateral. We focus on transactions with one-day maturity as this is the most common maturity in euro area money markets.

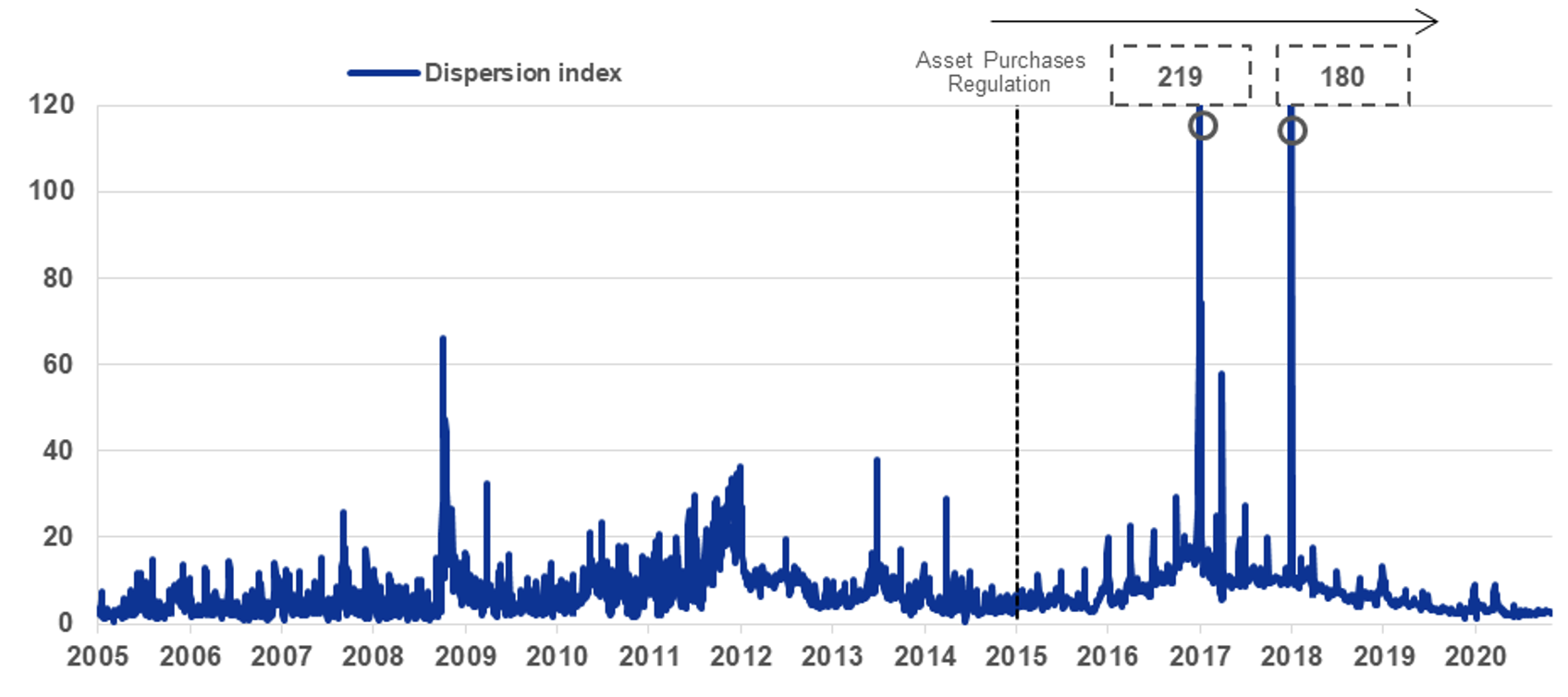

Dispersion of money market rates – proposed by Duffie and Krishnamurthy (2016) – combines the information content of money market rates and volumes. It is measured as the weighted mean absolute deviation of the cross-sectional distribution of the one-day rates (Figure 1). Intuitively, the dispersion index levels are low in relatively frictionless markets. Increases in the dispersion levels indicate that money market rates do not move in lockstep which can signal impairments in the transmission of monetary policy stance to private market rates.

Figure 1 Cross-sectional dispersion of one-day money market rates, 2005-2020

Note: Dispersion Index (in basis points) constructed using EONIA, DE, FR, IT, ES general collateral and special repo rates, volume-weighted.

Source: Corradin et al. (2020), following Duffie and Krishnamurthy (2016).

There are two specific channels through which money market rate dispersion may matter for central banks. First, money market rate dispersion can be a sign of market segmentation. A high degree of money market segmentation may lead to an increased demand of banks for central bank liquidity. Second, money market rates determine funding costs of banks. If funding costs increase for some banks, their profitability decreases, which may affect their ability to lend to the real economy and affect the transmission of monetary policy. For example, Altavilla et al. (2019) document that the cross-sectional dispersion in unsecured interbank money market rates significantly raises lending rates banks charge to firms, with a peak effect of around 100 basis points during the Global Crisis and the euro area sovereign debt crisis.

Euro area money markets over the past 15 years

Looking back over the 2005-2020 period, our analysis documents that euro area money market conditions tend to worsen if financial stress increases, or if central bank asset purchases induce scarcity effects while the Securities Lending Programme is not sufficiently active.2

With regard to financial stress, before 2015, dispersion across money market rates tended to be high during crisis periods and positively related to the VSTOXX, a proxy for financial market volatility (Figure 2). Money market volumes decreased with higher financial stress, pointing to an overall decrease in money market activity. Since 2015, the evolution of the dispersion index has no longer been tightly linked to financial market stress. A recent example is the COVID-19 induced market turbulence in the spring of 2020 whereby the dispersion of one-day money market rates remained low even as the indicators of financial stress increased dramatically.

Figure 2 Cross-sectional dispersion of one-day money market rates and financial stress, 2005-2020

Note: Dispersion index (in basis points) and VSTOXX (in percent; index of stock market volatility based on EURO STOXX 50 options).

Source: Corradin et al. (2020) and DataStream.

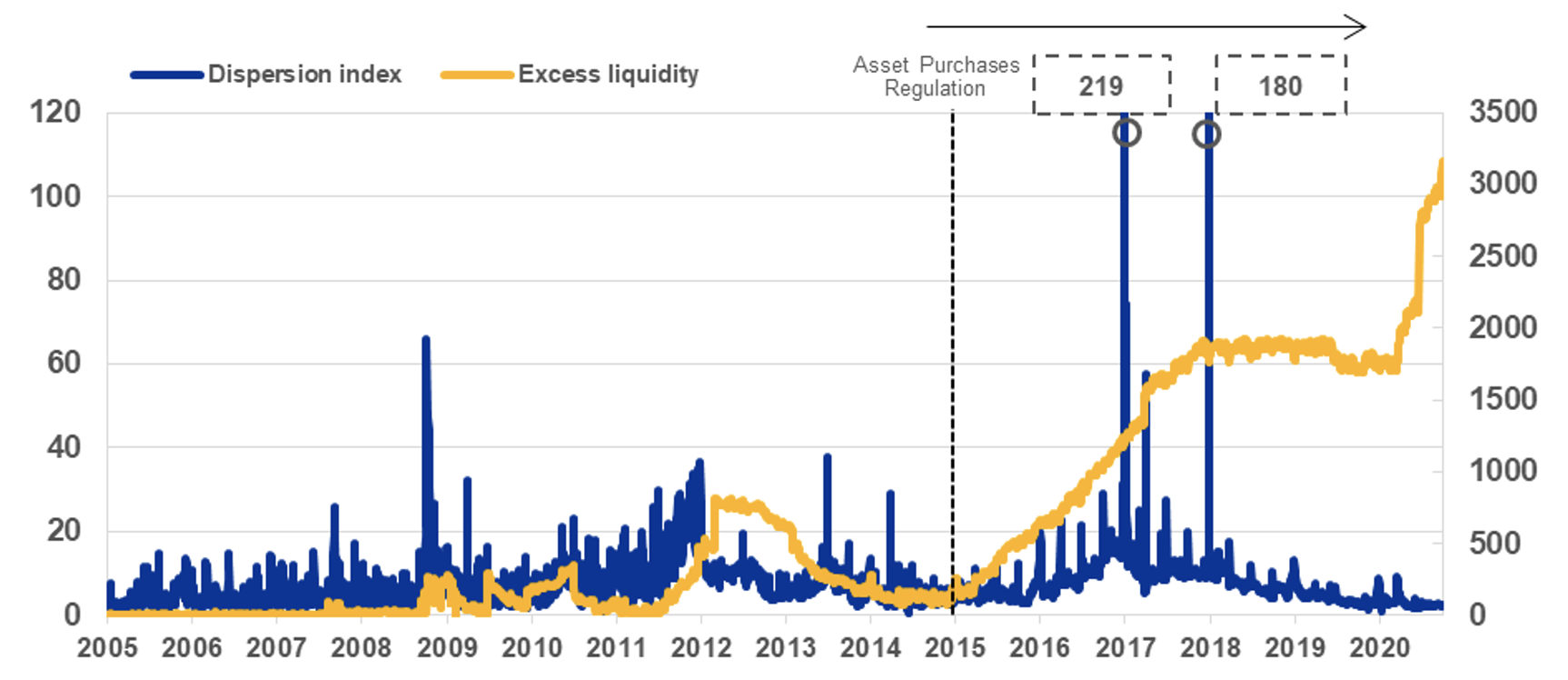

With regard to central bank liquidity provision, before 2015, the dispersion of one-day money market rates was negatively related to the Eurosystem liquidity provision, suggesting that central bank liquidity provision was associated with lower money market tensions (Figure 3). This is consistent with evidence presented in Garcia-de-Andoain et al. (2016), who document that liquidity provision by the Eurosystem during the global and sovereign debt crises stimulated the supply of liquidity in the unsecured money markets, especially to banks located in stressed countries during the euro area sovereign debt crisis.

Consistent with higher central bank liquidity provision supporting money market functioning in crisis times, additional provision of central bank liquidity over the course of 2020 helped keep the dispersion of one-day money market rates at low levels during the COVID-19 pandemic. Additional liquidity was provided to banks through untargeted operations such as additional long-term refinancing operations and the Pandemic Emergency Long-Term Refinancing Operations (PELTROs), as well as through the Targeted Long-Term Refinancing Operations (TLTROs).

Figure 3 Cross-sectional dispersion of one-day money market rates and excess liquidity, 2005-2020

Note: Dispersion index (in basis points, left-hand scale) and excess liquidity (in EUR billion, right-hand scale).

Source: Corradin et al. (2020) and SDW.

During 2015-2016, our results indicate an increase in the money market rate dispersion index, without an accompanying increase in financial market stress (Figure 2) and while excess liquidity levels were at all-time highs, primarily driven by the Public Sector Purchase Programme (Figure 3). Asset purchases withdraw government bond collateral from the financial system and government bonds are the main type of collateral used in secured money markets. The evidence is suggestive of central bank asset purchases inducing scarcity effects in some money market segments (Arrata et al. 2020, Brand et al. 2019, Corradin and Maddaloni 2020).

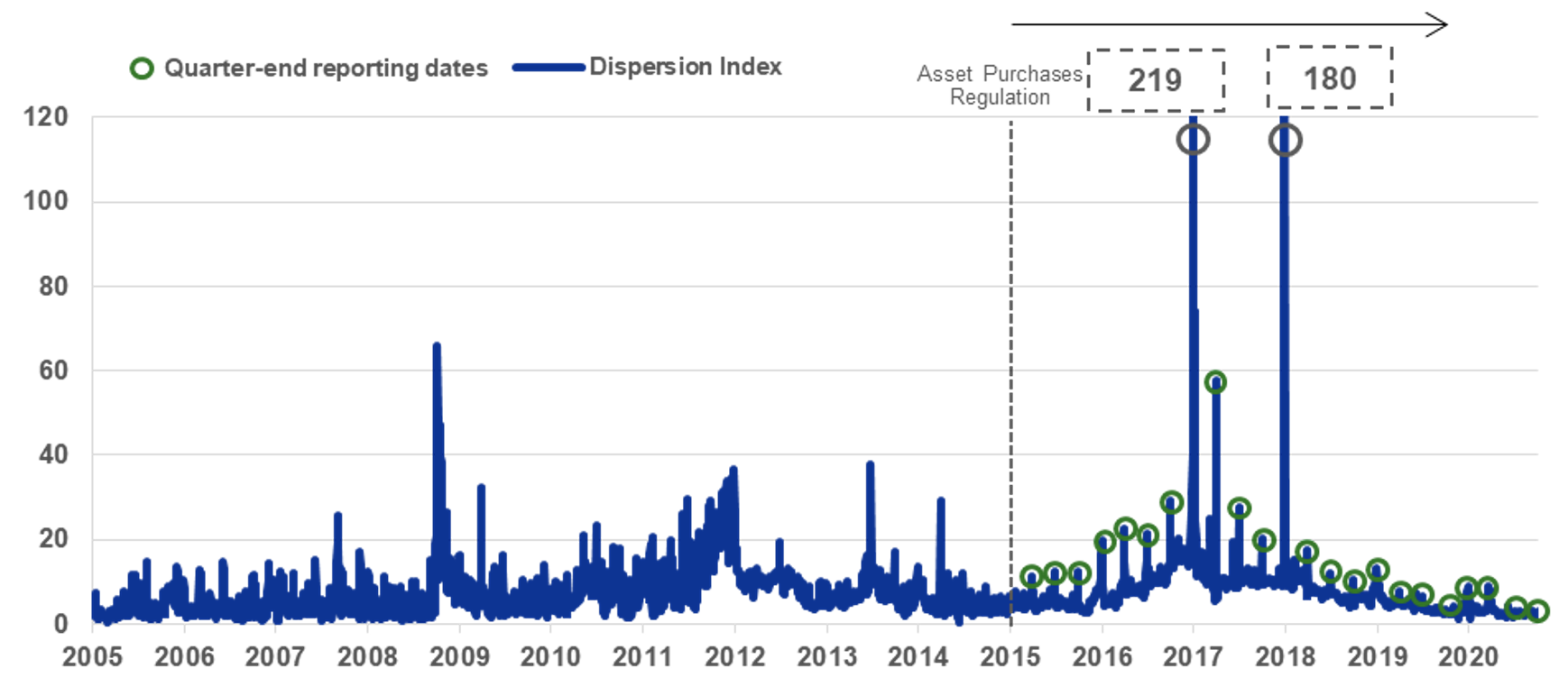

Interestingly, the dispersion decreased again after the easing of the terms of the Securities Lending Programme in December 2016 (Figure 4). Additional analysis indeed indicates that from December 2016 onwards, securities lending volumes have been negatively related with the dispersion index. Once the cash-collateral option was introduced in December 2016, the Eurosystem Securities Lending Programme helped alleviate the scarcity effects (Jank and Moench 2018).

Figure 4 Cross-sectional dispersion of one-day money market rates and securities lending, 2015-2020

Note: Dispersion index (in basis points) and securities lending (in EUR billion, right-hand scale).

Source: Corradin et al. (2020) and SDW.

We further study how new Basel III regulations, such as the leverage ratio and the liquidity coverage ratio, affected money market activity. These regulations started being phased in (in the case of the liquidity coverage ratio) or publicly reported (in the case of the leverage ratio) as of 2015. We document that the leverage ratio requirement led to reduced borrowing, higher rates, and increased dispersion in money market rates at quarter-ends, i.e. at the time when leverage ratios are reported to the regulators. We do not find evidence of month-end effects, suggesting that liquidity coverage ratio requirements – which are reported by banks at the end of the month – did not have a significant effect on euro area money markets over 2015-2019.3 This may be due to the large Eurosystem balance sheet size, which ensured an ample supply of central bank liquidity, facilitating the fulfilment of liquidity requirements.

Figure 5 Cross-sectional dispersion of one-day money market rates and regulation, 2005-2020

Notes: Dispersion index (in basis points) and quarter-ends (regulatory reporting dates).

Sources: Corradin et al. (2020).

We also analyse the macroeconomic impact of money market conditions, through a lens of a stylised general equilibrium model with secured and unsecured money markets developed in De Fiore et al. (2019a). This analysis shows that tighter money market conditions may force banks to divert resources into ‘unproductive’ but liquid assets (e.g. central bank reserves) or to de-leverage. As a result, lending capacity of banks may be impaired which triggers a decline in output. Well-functioning secured markets cushion the macroeconomic impact. If secured markets do not function smoothly, however, central bank balance sheet expansion is needed to mitigate output declines.

Conclusions

Several take-aways emerge from our analysis. First, looking back over the past 15 years, our analysis documents that euro area money market conditions tend to worsen if financial stress increases, or if central bank asset purchases induce scarcity effects while the Securities Lending Programme is not sufficiently active.

Second, with regard to the impact of Basel III regulations, we document that the leverage ratio regulation impacts money markets at quarter-ends due to ‘window-dressing’ effects, reducing volumes and rates, and raising money market rate dispersion. Liquidity requirements do not appear to affect money markets significantly over 2015-2019. This may be due to the large Eurosystem balance sheet size, which facilitates the fulfilment of liquidity requirements through the ample supply of central bank liquidity.4

Going forward, money market developments should be monitored, as factors interacting with money market conditions may change. One factor in particular deserves attention: non-banks becoming important participants in money markets. Unlike banks, these participants may not have access to operations with the central bank. This has a bearing on the formation of some money market rates, like the euro short-term rate (€STR). Were the transmission across money market rates to worsen, with potentially widening dispersion driven by non-banks, this could have implications for monetary policy implementation in the future.

Authors’ note: The views expressed here are those of the authors and do not necessarily represent the views of the ECB or the Eurosystem. This column features research-based analysis conducted within the ECB Research Task Force (RTF) on the interaction between monetary policy, macroprudential policy and financial stability (https://www.ecb.europa.eu/pub/economic-research/research-networks/html/researcher_research_task_force_rtf.en.html).

References

Altavilla, C, G Carboni, M Lenza and H Uhlig (2019), “Interbank rate uncertainty and bank lending”, ECB Working Paper No 2311.

Arrata, W, B Nguyen, I Rahmouni-Rousseau and M Vari (2020), “The scarcity effect of QE on repo rates: Evidence from the euro area”, Journal of Financial Economics 137(3): 837-856.

Bindseil, U and L Laeven (2017), “Confusion about the lender of last resort”, VoxEU.org, 13 January.

Bonner, C and S Eijffinger (2012), “Basel liquidity rules and their impact on the interbank money market”, VoxEU.org, 13 October.

Brand, C, L Ferrante and A Hubert (2019), “From cash- to securities-driven repo markets: The role of financial stress and safe asset scarcity”, ECB Working Paper No. 2232.

Corradin, S, J Eisenschmidt, M Hoerova, T Linzert, G Schepens and J-D Sigaux (2020), “Money markets, central bank balance sheet and regulation”, ECB Working Paper No. 2483.

Corradin, S and A Maddaloni (2020), “The importance of being special: Repo markets during the crisis”, Journal of Financial Economics 137(2): 392-429.

Corradin, S, F Heider and M Hoerova (2017), “On collateral: Implications for financial stability and monetary policy”, ECB Discussion Paper No. 2107.

De Fiore, F, M Hoerova and H Uhlig (2019a), “Money markets, collateral and monetary policy”, ECB Working Paper No. 2239.

De Fiore, F, M Hoerova and H Uhlig (2019b), “The macroeconomic consequences of impaired money markets”, VoxEU.org, 25 May.

Duffie, D and A Krishnamurthy (2016), “Passthrough efficiency in the Fed’s new monetary policy setting”, In Designing Resilient Monetary Policy Frameworks for the Future, Federal Reserve Bank of Kansas City, Jackson Hole Symposium, pp. 1815-1847.

Garcia-de-Andoain, C, F Heider, M Hoerova and S Manganelli (2016), ”Lending-of-last-resort is as lending-of-last-resort does: Central bank liquidity provision and interbank market functioning in the euro area”, Journal of Financial Intermediation 28: 32-47.

Jank, S and E Moench (2018), “The Impact of Eurosystem bond purchases on the repo market”, Bundesbank Research Bulletin 21.

Endnotes

1 See De Fiore et al. (2019b) for evidence and analysis of the macroeconomic impact of this development.

2 Large-scale purchases of securities by a central bank are likely to gradually lead to fewer securities being available on the market (the scarcity effect). Lending central bank securities holdings back to the market allows them to continue to be used by others for their transactions. Securities lending can limit unsettled trades and alleviate tensions when securities are scarce, thus helping to reduce the cost of acquiring good quality collateral.

3 Bonner and Eijffinger (2012) provide evidence on the impact of the liquidity coverage ratio (LCR) on unsecured interbank markets. They show that Dutch banks further away from the required ratio pay and charge relatively higher interest rates, increase borrowing, and decrease lending.

4 Regulatory changes in the aftermath of the Global Crisis have also led to a higher demand for collateral assets. The implications of the increasing role of collateral in financial markets for financial stability and monetary policy are reviewed in Corradin et al. (2017). Bindseil and Laeven (2017) discuss the role of collateral in the lender-of-last-resort function of central banks.