This column is a lead commentary in the VoxEU Debate "Euro Area Reform"

The need for a central fiscal capacity is a recurring element in the discussion on reform of the Economic and Monetary Union (EMU). Bénassy-Quéré et al. (2018) argue that, as part of a package of measures to enhance risk sharing and risk reduction in the EMU, such a central fiscal capacity can provide much needed budgetary support if one or several member states experience a large economic shock. Others also argue that the EMU needs a central fiscal capacity (e.g. European Commission 2018a, Berger et al. 2018). However, there is no consensus about the usefulness and necessity of a central fiscal capacity, as the President of the Eurogroup recently reported (Centeno 2018). One objection is that in light of a high degree of convergence of euro area business cycles (ECB 2018), and negative side-effects through risks of moral hazard and permanent transfers across Member States (Feld 2018, Beetsma et al.2018), the advantages of a central fiscal capacity are outweighed by its disadvantages. Another objection, developed in the remainder of this column, is that the potential stability benefits of a central fiscal capacity can be achieved without any additional fiscal risk sharing: namely, through stronger financial market risk sharingand more effective use of fiscal stabilisers. Completing the Banking Union, building the Capital Markets Union, and ensuring the build-up of buffers in national budgets will deliver a more stable EMU, while the ESM already acts as lender of last resort.

Strengthening financial channels is the most effective way to improve stabilisation

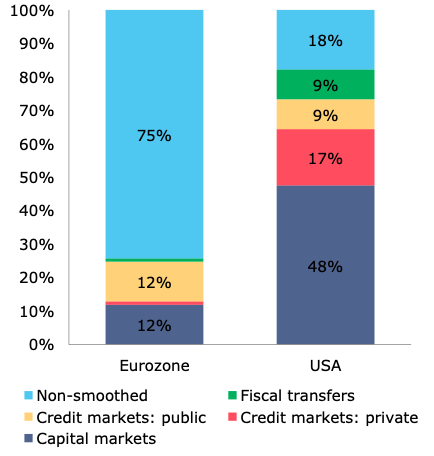

The argument for a central fiscal capacity in the euro area is often inspired by cross-state fiscal transfers in the US. However, capital markets in the US are much more important for shock absorption than fiscal transfers. Figure 1 shows that fiscal transfers across states absorb 9% of asymmetric shocks in the US, while capital markets (cross-border factor income and capital depreciation) absorb 48% and credit provision to the private sector absorbs another 17%. In the euro area, the contribution of capital and credit markets to absorption of asymmetric shocks is limited to 12%. Shock absorption through financial channels is therefore more than five times as small in the euro area compared to the US. Strengthening these financial channels is the most effective way to increase the resilience of the euro area (Buti et al. 2016).

The Banking Union will enhance shock absorption by credit markets. Credit provision to the private sector absorbs on average 17% of asymmetric shocks in the US versus a negligible contribution in the euro area (Figure 1).1 The limited contribution of credit markets in the euro area can be linked to pro-cyclical credit flows and the break-down of interbank lending during the euro area crisis. Completing the Banking Union will strengthen the ability of the banking sector to absorb shocks.The stability and resilience of the banking sector can be increased further through adequate buffers for bail-in and measures to address non-performing loans. The Banking Union will be underpinned by fiscal risk sharing through the establishment of a common backstop to the Single Resolution Fund. Plans for further risk sharing through a European Deposit Insurance Scheme, which is linked to discussions on the regulatory treatment of sovereign exposures on bank balance sheets, would further sever the link between sovereigns and banks.

Building a Capital Markets Union will strengthen capital market shock absorption. Capital markets account for 48% of absorption of asymmetric shocks in the US, compared to only 12% in the euro area (Figure 1). Integrated capital markets contribute to risk sharing through cross-border asset holdings. In addition, well-developed capital markets provide borrowers with alternative financing options if bank lending contracts during a crisis. Adrian et al.(2013) document such substitution from loans to bonds in the US between 2007 and 2009. Despite the relatively low degree of capital market integration, Cimadomo et al. (2018) show that cross-border equity and FDI holdings in the euro area were powerful shock absorbers during the sovereign debt crisis. This is why the development of a Capital Markets Union, supporting cross-border equity and FDI flows, is a promising avenue for further risk sharing. It may take a long time to converge to US levels of capital market integration. However, narrowing only a quarter of the 36%-point gap with the US would already have a stabilisation effect that is similar to the full effect of fiscal transfers in the US.

Figure 1 Channels of shock absorption

(decomposition asymmetric shock absorption)

Source: Alcidi et al. (2017)

Automatic stabilisation at the national level can be powerful if sufficient buffers have been built

Fiscal policy can also provide stabilisation in the wake of a downturn. National fiscal policy in the euro area currently provides twice as much stabilisation compared to federal transfers in the US.Comparing the federal level in the US with the national level in the EU is relevant. In the US, fiscal stabilisation mainly takes place through the federal budget, while stabilisation through state and local level budgets is very limited (Follette and Lutz 2010). In the euro area, anticyclical disbursements from the EU budget provide some indirect stabilisation, but national budgets are the most important channel for fiscal stabilisation. Alcidi and Thirion (2017) show that federal transfers in the US absorb around 10% of regional shocks, while national automatic stabilisers absorb 20% of country-specific shocks in the euro area. Looking at total stabilisation across levels of government, Dolls et al. (2015) find that fiscal stabilisation in the euro area absorbs roughly 47% of combined income and unemployment shocks, versus only 30% in the US.

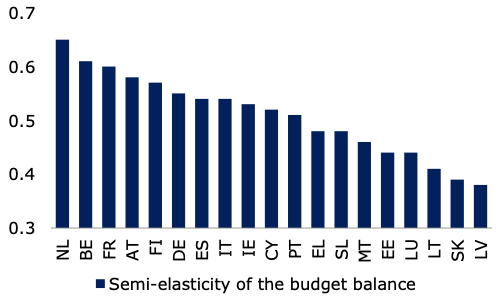

While the degree of national automatic stabilisation in the euro area is much higher than in the US, the differences between Member States are rather pronounced: the budgetary elasticity of Member States varies from 0.3 to more than 0.6 (Figure 2). Member States with low budgetary elasticities have relatively more room to enhance the stabilization properties of their budgetary frameworks, for example by better aligning domestic unemployment benefit systems to the economic cycle.

Figure 2 Automatic stabilisation across Member States

Source: Mourre et al. (2014)

Ensuring a sufficient build-up of buffers along the cycle enables automatic stabilisation during a downturn. Doing so removes the need for pro-cyclical fiscal tightening. This is why the preventive arm of the Stability and Growth Pact (SGP) is centred around a country-specific Medium-Term Objective (MTO) for the structural budget balance.2 The MTOs are set to ensure sustainable debt levels and enough room to manoeuvre for automatic stabilisers, as they provide a safety margin against breaching the SGP’s 3% nominal deficit limit (European Commission 2018b).3

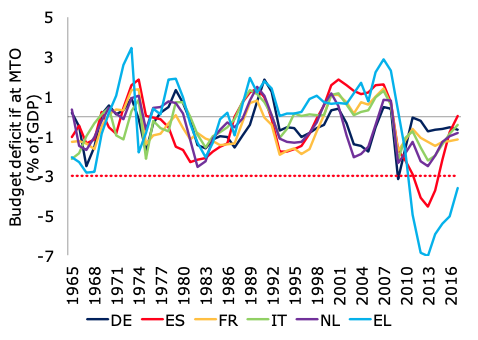

Figure 3 shows that countries at their MTO can absorb virtually all shocks with automatic stabilisers without breaking the 3% nominal deficit limit. The simulation in the figure is based on current budgetary elasticities and ex-post output gaps of the EA12 between 1965 and 2016. The results show that for countries at their MTO, automatic stabilisers can operate fully without breaking the 3% limit in 96% of all cases (98% if cases where financial assistance through the EFSF and ESM was provided are excluded).4 Figure 3 shows these results for six Member States. This simulation illustrates that buffers in national budgets can be a very effective shock absorber, and underline the importance of building-up fiscal buffers.

It should be noted that the output gap – which is used in the calculation of the structural balance to correct for business cycle developments – is a volatile indicator that is often revised ex post. Moreover, the budgetary elasticity can deviate in practice from the elasticity that follows from models, for example in the case of large cyclical fluctuations. Different proposals have been made to give prominence to an expenditure rule as an operational target for national budgetary decision-making and fiscal surveillance (for instance, by Bénassy-Quéré et al. 2018, Darvas et al. 2018, the European Fiscal Board 2018, and the Dutch presidency in the first half of 2016, among others). An expenditure rule combined with a debt target is more under the direct control of policy makers, although the design of such a framework would also require a balancing act in order to take account of the cycle. In the end, any framework must ensure that Member States build sufficient buffers in good times, because this allows them to stabilise in bad times.

Over the past years, efforts have been taken in many Member States to reduce their budget deficits, but a further effort is required as 12 euro area Member States had not reached their MTO in 2017 (Figure 4). The low interest rate environment provides ample additional fiscal space to build these buffers in national budgets, and bolster the ability of national policies to stabilize the economy.

Figure 3 Shock absorption capacity if at MTO

Source: Ameco and Mourre et al. (2014).

Figure 4 Distance to MTO in 2017

Source: Ameco.

The cases of Ireland and Spain call for macro prudential policies and orderly bank resolution

Some argue that the cases of Spain and Ireland provide an example that even Member States with a sound fiscal position can run into trouble (Dullien 2015, European Commission 2017). However, both Spain and Ireland were confronted with contingent liabilities stemming from a real estate boom and the banking sector. If anything, the cases of Ireland and Spain illustrate the importance of preventing the emergence and materialisation of contingent liabilities through policies to prevent macroeconomic imbalances and the establishment of the Banking Union.

The bursting of the real estate boom in Spain and Ireland had a permanent negative effect on fiscal revenues. The effect on government finances was significant due to a high sensitivity of tax revenues to declines in construction activity and asset prices (Lane 2012).5 The reduction in fiscal revenues was permanent, hence a fiscal capacity would not have alleviated the need for a structural budgetary adjustment. Instead, preventing the emergence of imbalances carries a high premium. The pre-crisis governance framework of the EU did not include preventive frameworks, such as the Macroeconomic Imbalances Procedure (MIP) and the macroprudential surveillance by the European Systemic Risk Board. The aim of the MIP is to detect the emergence of imbalances on the housing market in an early stage and could recommend corrective actions. In this light, it is important that the MIP is used to its full potential.

Moreover, bail-outs of the domestic banking sector had an upward effect on government debt of up to 49% of GDP in Ireland, and further increased government debt through an indirect effect on sovereign bond yields.6 The principle of bail-in, which is a central element of the Banking Union, prescribes that instead of taxpayers, first private investors and then the privately filled Single Resolution Fund absorb losses in case of a bank resolution. This significantly lowers the risks for public finances.

As a last resort, the ESM provides funding, subject to conditionality to countries with liquidity needs

If Member States can no longer stabilise their economy due to a loss of market access, the European Stability Mechanism (ESM) can act as a lender of last resort at the euro area level to provide financial assistance. Milano and Reichlin (2017) find that loans by the ESM and its predecessors stabilised no less than 55% of asymmetric shocks in the euro area between 2007 and 2014. A downside of substantial financial support by the ESM is the effect on government debt levels in programme countries. In analogy to the bank resolution framework with loss-sharing through bail-in, a strengthened framework for orderly restructuring of unsustainable sovereign debt would enhance private loss-sharing in case of unsustainable debt levels and prevent a disproportionate adjustment due to debt overhang. This would also allow ESM programmes to focus less on fiscal adjustment and more on growth enhancing reforms.

To conclude, the euro area should focus on completing Banking Union, developing a capital market union, and ensuring that its members have the fiscal space to use automatic stabilisers in a downturn. Doing so would strengthen both financial and fiscal stabilization mechanisms and obviate the need for a central fiscal capacity.

Authors’ note: This column was prepared when all authors were employed at the Ministry of Finance of The Netherlands and represents the authors’ views. A similar article was published in Economisch Statistische Berichten (Aarden et al. 2018).

References

Aarden, T, T van Dijk and J Hanson (2018), “De argumenten voor een Europese stabilisatiefunctie zijn helemaal niet zo sterk”, Economisch Statistische Berichten 103(4764): 348-351.

Adrian, T, P Colla and H S Shin (2013), “Which financial frictions? Parsing the evidence from the financial crisis of 2007-09”, NBER Macroeconomics Annual 2012.

Alcidi, C, P D’Imperio and G Thirion (2017), “Risk-sharing and consumption smoothing patterns in the US and the Euro Area: a comprehensive comparison”, CEPS Working Doc. 2017/04.

Alcidi, C and G Thirion (2017), “Fiscal risk sharing and resilience to shocks: lessons for the euro area from the US”, CEPS Working Doc. 2017/07.

Beetsma, R, S Cima and J Cimadomo (2018), “A minimal moral hazard central stabilisation capacity for the EMU based on world trade”, ECB Working Paper, 2137.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Veron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91.

Berger, H, G Dell’Ariccia and M Obstfeld (2018), “Revisiting the economic case for fiscal union in the euro area”,IMF Research Department Paper.

Buti, M, J Leandro and P Nikolov (2016), “Smoothing economic shocks in the Eurozone: The untapped potential of the financial union”, VoxEU.org, 25 August.

Centeno, M (2018), Letter to Mr Donald Tusk, President of the Euro Summit, Brussels, 25 June.

Cimadomo, J, O Furtuna and M Giuliodori (2018), “Private and public risk sharing in the euro area”, ECB Working Paper 2148.

Darvas, Z, P Martin and X Ragot (2018), “European fiscal rules require a major overhaul”, Les notes du Conseil d’Analyse Économique, 47.

Dolls, M, C Fuest, J Kock, A Peichl, and C Wittneben (2015), “Automatic Stabilizers in the Eurozone: Analysis of their Effectiveness in the Member State and Euro Areal Level and in International Comparison”, Mannheim.

Dullien, S (2015), “Which fiscal capacity for the euro area: different cyclical transfer schemes in comparison”, Berlin Working Papers on Money, Finance, Trade and development, 02/2015.

Dutch Council Presidency (2016), “Improving predictability and transparency of the SGP”, Informal ECOFIN, 23 April 2016.

ECB (2018), “Growth synchronisation in euro area countries”, ECB Economic Bulletin, 05/2018

European Commission (2017), “Reflection Paper on Deepening the EMU”, COM(2017) 291, 31 May.

European Commission (2018a), “Proposal for the Establishment of a European Investment Stabilisation Function”, COM(2018) 387, 31 May.

European Fiscal Board (2018),Annual Report 2018.

Feld, L (2018), “Whither a fiscal capacity in EMU”, VoxEU.org, 31 July.

Follette, G and B Lutz (2010), “Fiscal policy in the United States: automatic stabilizers, discretionary fiscal policy actions, and the economy”, Federal Reserve Working Paper, 2010-43.

Furceri, D and A Zdzienicka (2015), “The Euro Area Crisis: Need for a Supranational Fiscal Risk Sharing Mechanism?”, Open Economies Review 26(4): 683–710.

Lane, P R (2012), “The European Sovereign Debt Crisis”, Journal of Economic Perspectives 26(3): 46-98.

Milano, V and P Reichlin (2017), “Risk sharing across the US and EMU: the role of public institutions”, VoxEU.org, 23 January.

Mourre, G, C Astarita and S Princen (2014), “Adjusting the budget balance for the business cycle: the EU methodology”, European Economy Economic Papers 536.

Endnotes

[1] However, with the establishment of the Banking Union, shock absorption on credit markets is strengthened through European supervision and a common rulebook that enhances the resilience of the European banking sector, and a resolution framework that ensures an efficient and orderly private sector loss-sharing in case of serious problems.

[2] The structural deficit corrects the nominal budget for business cycle developments and the effects of temporary measures.

[3] MTOs are defined instructuralterms.

[4] In Ameco, output gaps for the Member States that adopted the euro after 2007 are not available from 1965 onwards. For Greece, we assume an MTO of 0.

[5] Lane (2012) explains the permanent nature of the income reduction in Ireland and Spain: “In some countries (Ireland and Spain), the credit and housing booms directly generated extra tax revenues, since rising asset prices, high construction activity, and capital inflows boosted the take from capital gains taxes, asset transactiontaxes and expenditure taxes. Faster-growing euro member countries also had inflation rates above the euro area average, which also boosted tax revenues through the non-indexation ofmany tax categories. Finally, low interest rates meant that debt servicing costs were below historical averages.”

[6] http://ec.europa.eu/eurostat/web/government-finance-statistics/excessive-deficit/supplemtary-tables-financial-crisis