A few large firms have disproportionate influence on aggregate economic fluctuations (Gabaix 2011, di Giovanni et al. 2012). Nokia in Finland, Dell in Ireland, Samsumg and Hyundai in South Korea, are often cited as examples of the dependence of nations on the economic activities of a few firms. Even in a country as large as the US, the sales of the top 100 firms represent about one third of the GDP, and shocks, specific to these firms, explain about one third of US business cycle fluctuations. In a recent paper (Kleinert et al. 2013), we ask whether large firms also participate in the co-fluctuations of activities across countries. More specifically, we study the role of (large) multinational firms on business-cycle comovement.

Firms, size and ownership

Opening the black box on the ownership structure of firms might help understanding the drivers of international business cycles’ comovement. A closer look at micro-level data helps. In France, majority-owned affiliates of foreign firms represent no more than 5% of the total number of French firms, but their contributions to the manufacturing activities are substantial. They account for 23% of industrial employment, 32% of manufacturing value added, and more than half of total trade. Their contribution to French regions is spectacular. In Alsace, 10% of firms are foreign-owned while they represent about 50% of value added, 70% of exports, and 80% of imports. In Brittany, foreign affiliates represent about 3% of firms in the region, but make up 15% of the region’s value added, and about 2/3 of its trade (import and export). Among the group of foreign affiliates, the concentration of economic activities rests on very few firms. The ten largest foreign affiliates account for 19.1% of total value added in Alsace, 18.3% in Lorraine, and 12.8% in Picardie. The French economy is not different from others. It is granular and rests on the activities of few, but large, multinational firms.

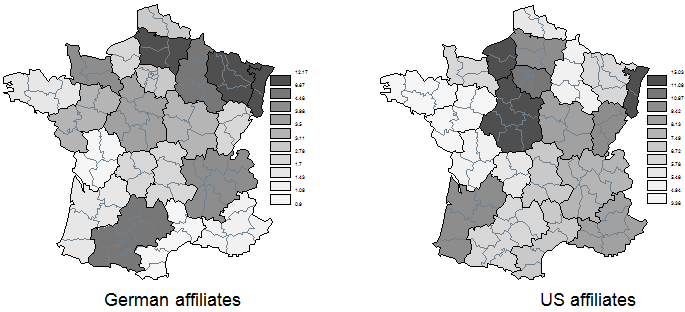

One of the principal characteristics of multinational firms is that their foreign affiliates are likely to be closely linked to their country of ownership and to the activities of their parent company. Because of both their size and their linkages, foreign affiliates are likely to transmit shocks across borders and affect the correlation of business cycles between their home country and host locations. If the nationality of ownership of firms is spread heterogeneously across regions, then we can investigate the role of foreign affiliates in driving comovement. Take German and US affiliates in French regions, whose location across French regions is displayed in Figure 1.

Figure 1. Presence of foreign affiliates in French regions

Focusing on each panel separately, we see that affiliates from a given country locate unevenly across French regions. The German presence is higher in Alsace next to the French-German border, but also in Midi-Pyrénées (around Toulouse) than in other French regions. Taking the two panels together, we further see that US and German affiliates locate in different regions. Regions differ in the intensity of foreign affiliates’ presence, measured in employment shares, but also in the origin of the foreign affiliates they host.

We can exploit this heterogeneity to identify the effect of foreign affiliates on business cycle synchronisation. Interestingly, French regions present very different levels of comovement with countries. For instance, Alsace has a comovement of 0.4 with Germany while Auvergne is negatively correlated with Germany (-0.3). Does the foreign affiliate’s presence across French regions explain these comovements between countries and regions?

Dancing in unison

Our study shows that foreign affiliates drive the real business cycle comovement between the region of location and their parent country. In words, French regions where US affiliates contribute a lot to economic activities, are, all else equal, more synchronised with the US economy. The causal interpretation of our results is granted by the use of two distinct sets of instrumental variables, and the result remains robust to the inclusion of the main driving forces of business cycle comovement listed in the literature (Imbs 2004), as well as to the introduction of country and region level fixed-effects.

The magnitude of the effect of the presence of foreign affiliates on business cycle comovement is economically meaningful. Based on our econometric results, a simulation exercise shows, for instance, that the business cycle correlation between French regions and the US – one of the most important investor in France – would be on average 10.1 percentage points lower without US foreign affiliates.

At this point of the analysis, we can wonder what mechanisms explain the impact of foreign affiliates on business cycle comovement.

- One possibility is that shocks are transmitted along vertically integrated production networks. We restrict our analysis to foreign affiliates engaged in a vertical relationship with their parent. For this subsample of foreign affiliates, we still find an important effect of foreign affiliates on business cycle comovement.

- The findings suggest that shocks are partly propagated through the fragmentation of operations by multinationals across countries. We investigate this further by using precise information on trade by foreign affiliates with their home country. The data disentangle intra-firm trade and arm-length trade of foreign affiliates. We find a stronger business cycle correlation when trade of intermediate inputs takes place within the network of the multinational firm. Intra-firm trade does not, however, play a central role in explaining our results.

- Multinational firm networks are likely to facilitate the transfer of intangible inputs between firms within the company.

- Furthermore, parent and affiliates are tied with tight financial linkages.

These specific features are other potential mechanisms explaining the effect of foreign affiliates on business-cycle comovement. Unfortunately, we don’t have the data to pursue exploration in this direction.

Conclusion

One implication of our results is that a better knowledge of multinational firms’ network is crucial to understand the propagation of shocks across countries. Accounting for such networks in International Real Business Cycle models could help them to better fit with the data. Our findings also suggest that the economic activities of regions and countries depend on the origin of firms they host. Countries and regions should, therefore, care about the origin of foreign direct investment they receive.

References

Di Giovanni, Julian, Andrei Levchenko and Isabelle Méjean (2012), “The role of firms in aggregate fluctuations”, VoxEU.org, November.

Gabaix, Xavier (2011), “The granular origins of aggregate fluctuations”, Econometrica 79(3), 733–772.

Imbs, Jean (2004), “Trade, Finance, Specialization and Synchronization”, Review of Economics and Statistics, 86(3), pp.723-734.

Kleinert, Jörn and Julien Martin and Farid Toubal (2012), “The Few Leading the Many: Foreign Affiliates and Business Cycle Comovement”, CEPR Discussion Papers 9129.