Every year, millions of American college students receive a Pell Grant from the federal government to alleviate the costs of going to college (Figure 1). This $30 billion per year programme targets students from lower-income families and gives them a maximum of $6,495 for up to six years to attend college. Such grants make college significantly more accessible (e.g. Angrist et al. 2020). The 2023 federal budget proposes a significant expansion of the Pell Grant programme. If approved, the number of students that are eligible for Pell Grants will increase by around 10%, while the maximum Pell Grant will double between 2023 and 2029.

While the aim of the Pell Grant programme is to make college affordable, Pell Grants also have the potential to stimulate short-run economic activity. A significant rise in the generosity of Pell Grants could raise students’ purchasing power, for example, and could therefore stimulate local economy. Alternatively, some fear that the Pell Grant programme mainly acts as a subsidy for universities, who could raise tuition fees in response to the programme’s expansion (The Washington Post 2022).

Our new paper (De Ridder et al. 2022) puts these theories to the test. We measure the short-term macroeconomic effects of Pell Grants by measuring their fiscal multiplier: the average percentage increase in aggregate income when fiscal spending rises by 1% of aggregate income. If the multiplier exceeds one, private spending rises when fiscal spending increases. If the multiplier is below one, it means that fiscal spending crowds out private expenditure, for instance because fiscal spending raises inflation or requires an increase in taxes.

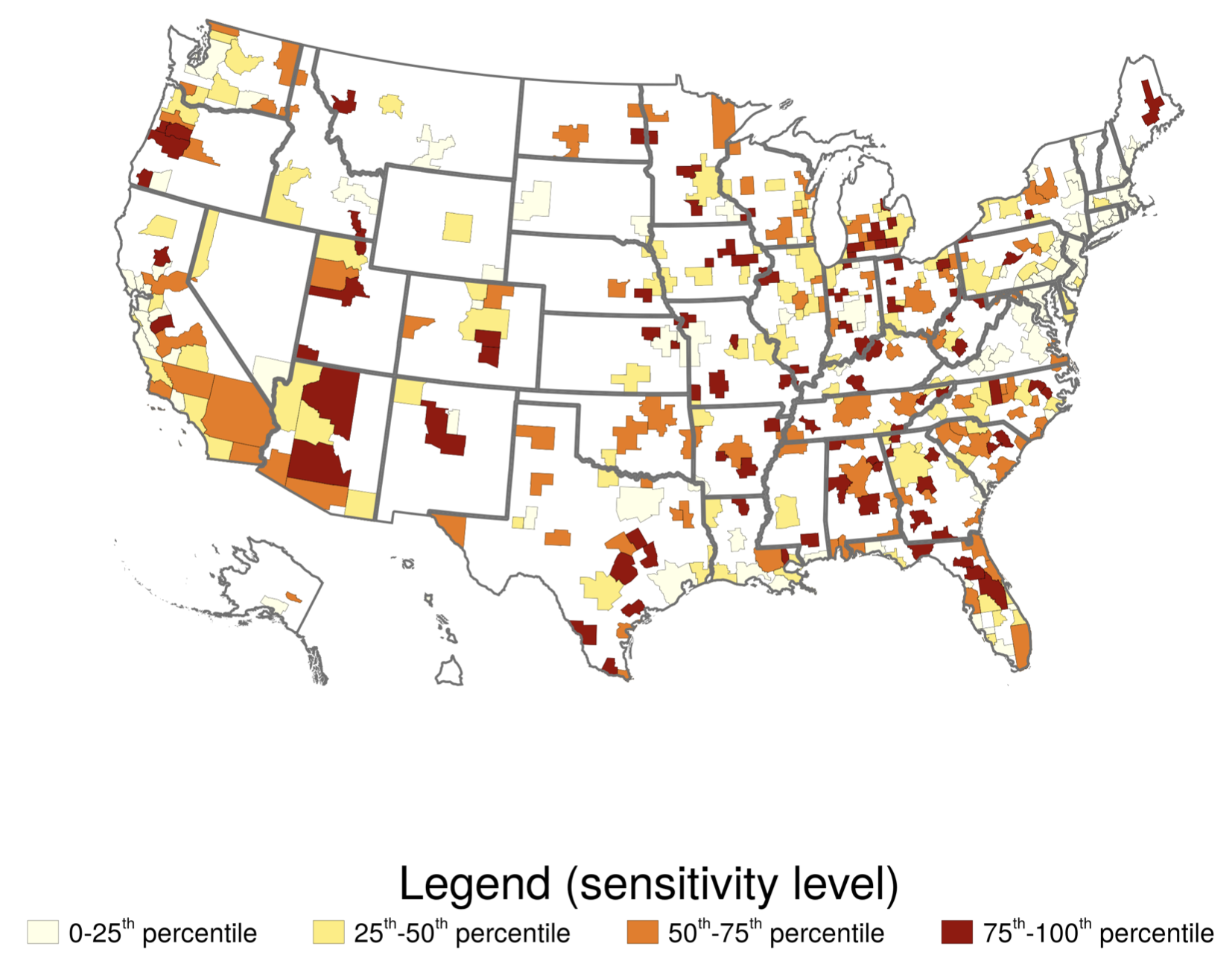

Figure 1 Federal Pell Grant programme: Expenditures and recipients

Source: De Ridder et al. (2022).

Measuring the effect of Pell Grants on local income

To measure the multiplier of Pell Grants, we estimate the change in personal income at the level of a metropolitan statistical area (city) in response to a city-level increase in Pell Grants. Using microdata from the Delta Cost Project, we calculate city-level changes in Pell Grants by adding up changes in the value of Pell Grants received by students enrolled at schools that are located within that city. We then run an instrumental variable regression of the two-year change in a city’s per-capita personal income on the two-year change in Pell Grants as a percentage of personal income.

To measure the effect of Pell Grants on total income causally, we exploit the fact that cities differ in their sensitivity to national changes in the Pell Grant programme. Figure 2 illustrates the distribution of these sensitivities across cities in the data. An increase in the generosity of the programme, therefore, affects cities differently. The identification assumption is that national changes in the Pell Grant programme are unrelated to the relative economic growth of cities with high or low exposure to Pell Grants. This strategy resembles how Nakamura and Steinsson (2014) identify the effect of state-level defence spending on state-level GDP.

Figure 2 City-level sensitivity of local Pell Grant receipts to national generosity

Note: The chart plots the percentiles of city-specific regression coefficients on the relationship between the change in Pell Grants as a percentage of local income on national changes in Pell Grants as a percentage of national income.

Source: De Ridder et al. (2022).

The multiplier of Pell Grants is large

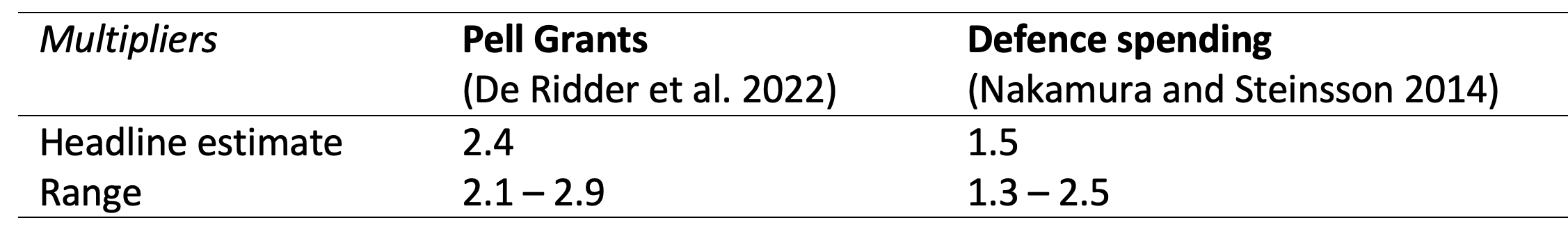

Table 1 summarises our estimates of the multiplier. Our preferred estimate for the multiplier of Pell Grants is 2.4 – i.e. a 1% increase in a city’s Pell Grants over the city’s total personal income causes an increase in personal income of 2.4%. In robustness checks with alternative time samples and more detailed controls for demographic, socioeconomic, and financial variables range we find multipliers ranging from 2.1 to 2.9.

Table 1 Multiplier of federal Pell Grant Programme compared to defence spending

Note: Multipliers measure the percentage increase in local-level income per capita in response to a 1% increase in the ratio of local-level Pell Grants or defence spending over personal income.

These estimates are surprisingly large. For defence spending, for example, Nakamura and Steinsson (2014) estimate a multiplier of 1.5 with a methodology similar to ours, and a range of 1.3 to 2.5 in robustness checks. The multiplier of Pell Grants also exceeds the median (1.9) and the average (2.1) of multipliers found in studies that also rely on geographic, cross-sectional variation to estimate the effect of other forms of fiscal spending (Chodorow-Reich 2019).

Why is the effect of Pell Grants on local income so large? There are two likely drivers. First, Pell Grants are a direct cash transfer. This means that the transfers themselves cause a one-for-one increase in personal income to begin with. Other forms of government spending, such as infrastructure investments or defence spending, only raise income indirectly. Second, Pell Grants are awarded to students from lower-income families. These students have limited borrowing capacity. Economic theory suggests that students are therefore likely to have high marginal propensities to consume (e.g. Auerbach et al. 2021). This may explain why Pell Grants cause local income growth that significantly exceeds the initial cash transfer.

For-profit schools raise tuition fees in response to Pell Grant increases

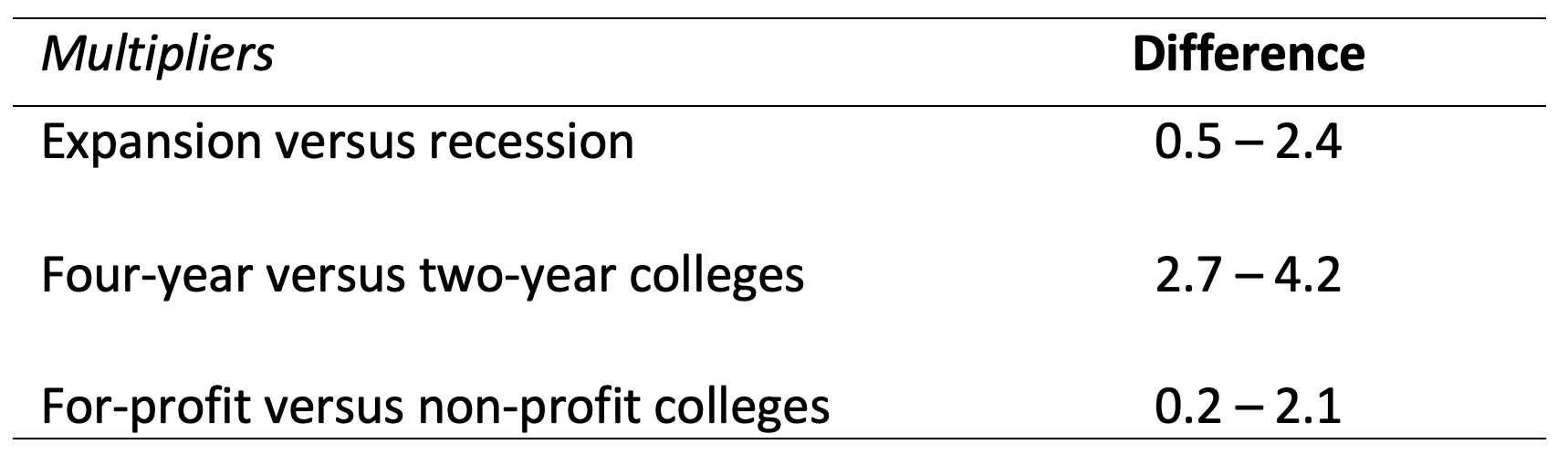

We also explore whether the multipliers of Pell Grants differ by the characteristics of the schools that students attend, as well as the timing of the grants (Table 2). Motivated by previous evidence on the state-dependence of fiscal multipliers (e.g. Auerbach and Gorodnichenko 2012, Ilzetzki et al. 2013, Berge et al. 2021), we compare the multiplier of Pell Grants when a city’s economy is in recession to when it is in expansion. We find that the multiplier is between 0.5 and 2.4 points higher during recessions, which means that the short-term economic benefits of the grants are particularly large when economic activity is low.

The effect of the type of college that a Pell Grant recipient attends is similarly large. When comparing Pell Grants at two-year community colleges versus four-year colleges, we find that the multiplier is between 2.7 and 4.2 points larger at community colleges. This is in line with the idea that Pell Grants have particularly large multipliers when they are awarded to the most financially constrained students.

When comparing for-profit to non-profit colleges, we find that Pell Grants are between 0.2 and 2.1 points lower at for-profit colleges. Why is the effect of Pell Grants on economic activity much smaller when they are received by students at such schools? One hypothesis is that for-profit schools raise tuition fees in response to an increase in the generosity of the Pell Grant programme, to capture the students’ additional income. We test this hypothesis using school-level microdata, from which we derive tuition receipts as the sum of tuition net of any grants or student aid. From regressing changes in tuition on changes in Pell Grants, we find that for-profit schools raise tuition fees at least one to one in response to an increase in Pell Grants. Non-profit schools also raise tuition fees, but to a much more limited degree: tuition fees at these schools rise by less than 0.1% when Pell Grants increase by 1% of original tuition, versus 1.3% at for-profit schools.

Table 2 Comparison of Pell Grant programme multipliers under various conditions

Note: Difference indicates how much higher the multiplier is during recessions or at non-profit or two-year colleges.

Source: De Ridder et al. (2022).

Discussion

The results suggest that changes to the Pell Grant programme can be made to maximise both the programme’s impact on the accessibility of college education and its short-run economic impact. In particular, our results show that Pell Grants that are awarded to students at for-profit colleges mainly benefit those colleges. As they raise tuition fees proportionally to the generosity of the grants, an expansion of Pell Grants does not help students attend these colleges. Limiting eligibility for the expanded Pell Grants to students at non-profit colleges would help maximise the programme’s efficiency.

It is important to highlight that our estimates measure the effect of Pell Grants at the local level. Because the Pell Grant programme has to be financed, the effect of a rise in Pell Grants at the national level could be more modest than our multiplier of 2.4 suggests. Chodorow-Reich (2019) shows that estimates of the local multipliers like ours can measure fiscal spending multipliers at the national level as long as the spending is deficit-financed and when monetary policy does not respond to the increase in spending.

In today’s context, however, those assumptions may be strong. Given that the FOMC’s Summary of Economic Projections indicates that increases in the federal funds rate are likely in the coming months, it is possible that the positive effects of Pell Grants on aggregate demand and consumption could be, in part, offset by a rise in interest rates. Our result that the multiplier of Pell Grants is large during recessions and modest during booms further means that the additional demand created by an increase in the generosity of Pell Grants could have a limited effect on economic activity.

Authors’ note: The views in this column are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve or its staff.

References

Angrist, J, D Autor and A Pallais (2020), “Untangling Financial Aid: Effects in a Randomized Trial”, VoxEU.org, 6 December.

Auerbach, A J and Y Gorodnichenko (2012), “Measuring the output responses to fiscal policy”, American Economic Journal: Economic Policy 4(2): 1–27.

Auerbach, A, Y Gorodnichenko, P McCrory and D Murphy (2020), “What Covid-19 Teaches Us About Fiscal Multipliers”, VoxEU.org, 23 December.

Berge, T, M De Ridder and D Pfajfar (2021), “When is the Fiscal Multiplier Large? Evidence from Four Business Cycle Phases”, European Economic Review, September.

Chodorow-Reich, G (2019), “Cross-Sectional Fiscal Spending Multipliers: What Have We Learned?”, American Economic Journal: Macroeconomics 11(2): 1-34.

De Ridder, M, S Hannon and P Damjan (2022), “The Multiplier of Pell Grants”, Centre for Macroeconomics Working Paper, April.

Ilzetzki, E, E G Mendoza and C A Végh (2013), “How big (small?) are fiscal multipliers?”, Journal of Monetary Economics 60(2): 239–254.

Nakamura, E and J Steinsson (2014), “Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regresions”, American Economic Review 104(3): 753-792.

The Washington Post (2022), “The Biden Plan to Raise College Tuition”, Editorial Board, 29 March.