China has emerged as a world trading power thanks to its deep economic reforms beginning in the 1980s, as well as its membership in the WTO since 2001. China’s share of global manufacturing exports surged from 2% to 16% between 1990 and 2011 (Acemoglu et al. 2016). Starting in 2018, the Trump administration introduced a series of tariffs on imports from China, triggering retaliation. The resulting US-China trade war stimulated several studies on the effects of the costs and benefits of protection (e.g. Amiti et al. 2019, Flaaen and Pierce 2019, Fajgelbaum et al. 2020, Flaaen et al. 2020).

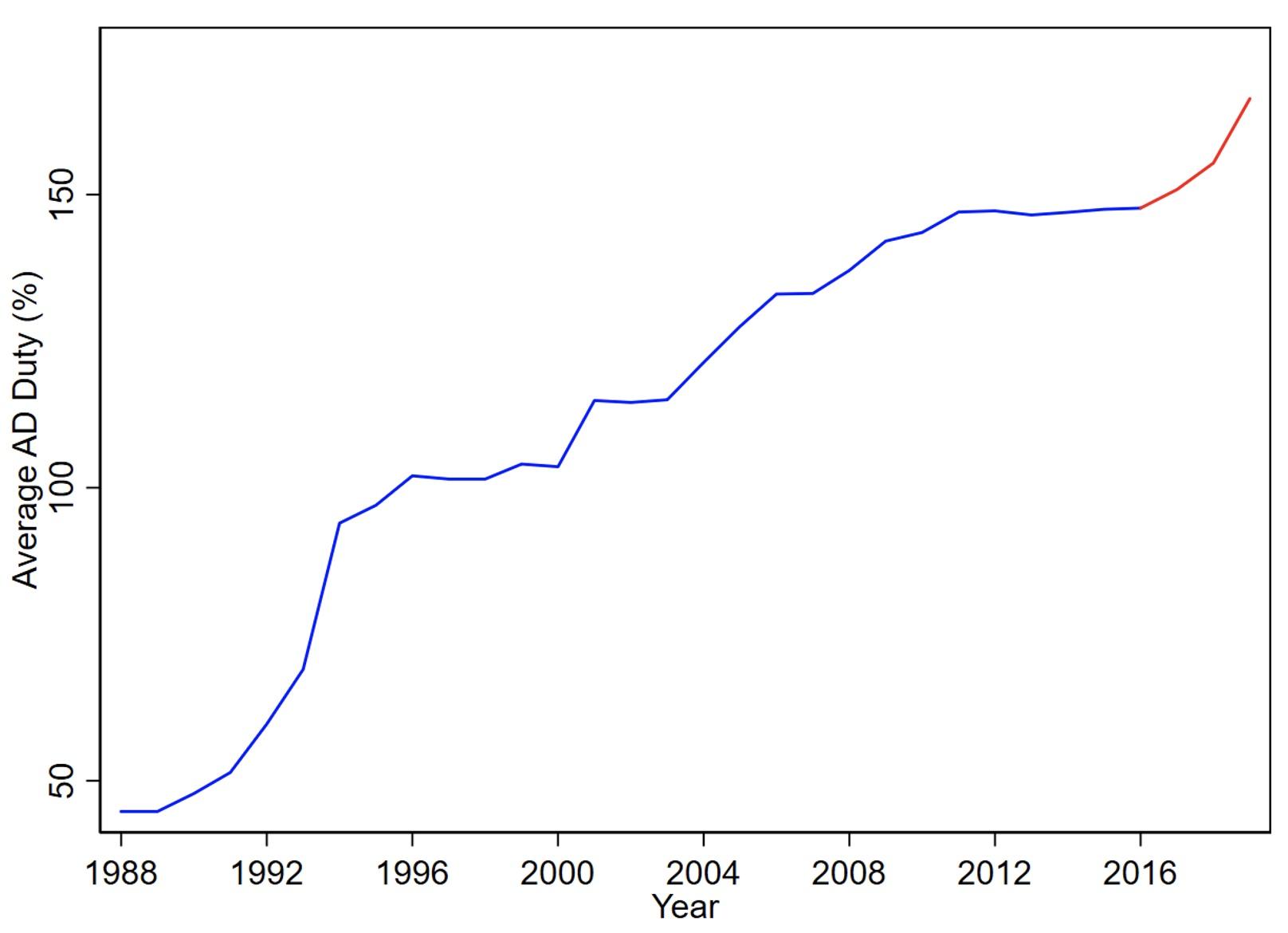

However, the US had targeted China with special tariffs for decades and long before Donald Trump took office in 2017. The main trade policy instrument was antidumping (AD). Over 1988-2016, the average US AD duty against China more than tripled, from 45% to 148% (Figure 1). Under President Trump, it was further increased to 166%.

Figure 1 Average AD duty against China, 1988–2019

Notes: The figure plots the average AD duty applied by the US on imports from China during 1988-2016 (in blue) and during Trump's presidency in 2017-2019 (in red).

Source: Authors' calculations based on an extended version of the Temporary Trade Barriers Database of Bown (2014).

Global supply chains and increased trade in intermediate goods also emerged during this three- decade period (e.g. Yi 2003, Johnson and Noguera 2012, Antràs 2020). In a world in which production processes are fragmented across countries, the effects of tariffs propagate along supply chains, with firms in downstream industries suffering from protection upstream. For example, some producers have complained that Trump’s tariffs on steel and aluminium have put their “plans to expand on hold, costing American jobs.”

In a new paper (Bown et al. 2021), we examine the effects of trade protection along supply chains. The focus is on AD duties, the most commonly used trade barrier by the US and other WTO members prior to the Trump administration (Blonigen and Prusa 2016). Our main analysis studies the effects of US AD duties applied against China – its most frequent target – over 1988-2016. It relies on detailed information on US AD duties and other forms of protection, combined with disaggregated US input-output data that is used to identify vertical linkages between industries.

The study makes two important contributions to the literature on the downstream effects of trade policy (e.g. Amiti and Konings 2007, Goldberg et al. 2010, Halpern et al. 2015, Conconi et al. 2018). First, we propose a new instrumental variable for AD duties. Second, we use this instrument to identify the causal impact of trade barriers along supply chains. Our evidence is that tariffs have large negative effects on downstream industries, increasing production costs and decreasing employment, wages, sales, and investment.

Political importance of antidumping protection

Previous studies provide an economic rationale for allowing flexible protectionist measures such as AD duties in trade agreements: the ability to protect industries in the face of import surges can act as a ‘safety valve,’ allowing countries to sustain trade policy cooperation (Bagwell and Staiger 1990, Bown and Crowley 2013).

Our analysis emphasises the political economy motives for trade barriers (in the spirit of Bagwell and Staiger 2005): protecting certain industries can help politicians gain votes. These motives are particularly important in the US, where swing-state politics creates incentives to favour key industries.

Endogeneity of trade policy

As pointed out by Trefler (1993), a key challenge to identify the effects of tariff changes is the endogeneity of trade policy. When studying the impact of tariffs along supply chains, a major concern is that the results might be confounded by omitted variables correlated with both the level of protection in upstream industries and the performance of downstream industries.

For example, productivity shocks experienced by foreign input suppliers can benefit US firms in downstream sectors (for example, allowing them to purchase inputs at lower prices) and also increase input protection (for example, making it easier for an industry that petitions for AD to provide evidence of injury). Omitting these productivity shocks would thus work against finding negative effects of tariffs along supply chains.

Our instrument is the interaction between an industry's historical experience at filing AD petitions and its importance in politically important battleground states of the US. The logic of our identification strategy is that AD protection should be skewed to favour industries that are important in swing states, but only if they can exploit this political advantage thanks to their prior knowledge of the complex procedures to petition for AD duties.

The first component of the instrument builds on previous studies emphasising the legal and institutional complexity of the AD process. As a result, industries with prior experience at filing AD cases face lower petitioning costs and a higher probability of success in new cases (Blonigen and Park 2004, Blonigen 2006).

The second component builds on insights from the literature on the political economy of trade policy. Several studies show that US trade policies are biased toward the interests of swing states (e.g. Muûls and Petropoulou 2013, Conconi et al. 2017, Ma and McLaren 2018, Fajgelbaum et al. 2020). Our paper provides novel evidence that swing-state politics influences US AD duties. We show that representatives from swing states have a disproportionate share of seats on the two key committees that oversee US trade policy in Congress. These committees can impact decisions of the International Trade Commission (ITC) – one of the two key government agencies tasked with administering US antidumping – through various channels (e.g. appointment confirmations, budget allocation, oversight hearings). Indeed, we find that ITC commissioners are more likely to vote in favour of AD when the petitioning industry is important in swing states.

Our analysis emphasises the importance of dealing with the endogeneity of trade policy. If we ignore this concern, we find no systematic effect of tariffs along supply chains. When instead we instrument for trade policy, we find that higher tariffs have large negative effects on downstream industries.

Effects of protection in downstream sectors

Our main results concern the effects of protection on employment. We show that AD duties decrease the growth rate of employment in downstream industries, with no significant effect in the protected industries. In terms of magnitude, our baseline estimates indicate that the US economy could have added 4.8% more jobs in 1988-2016 without AD protection on Chinese inputs. The most negatively affected sectors were large non-manufacturing industries (e.g. construction), which intensively rely on inputs that were highly protected (e.g. steel).

Beyond employment, we also show that tariffs have negative effects on other key economic outcomes. For example, they also significantly decrease the growth rate of wages, sales, and investment in downstream industries. The mechanism behind the negative effects of tariffs along supply chains is that AD duties decreased US imports of targeted products from China and increase prices, thereby increasing production costs for downstream industries.

References

Acemoglu, D, D H Autor, D Dorn, G H Hanson and B Price (2016), “Import Competition and the Great US Employment Sag of the 2000s”, Journal of Labor Economics 34: 141-198.

Amiti, M and J Konings (2007), “Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia”, American Economic Review 97: 1611-1638.

Amiti, M, S J Redding and D E Weinstein (2019), “The Impact of the 2018 Trade War on U.S. Prices and Welfare”, Journal of Economic Perspectives 33: 187-210.

Antràs, P (2020), “Conceptual Aspects of Global Value Chains”, forthcoming in World Bank Economic Review.

Bagwell, K and R W Staiger (1990), “A Theory of Managed Trade”, American Economic Review 80: 779-795.

Bagwell, K and R W Staiger (2005), “Enforcement, Private Political Pressure and the GATT/WTO Escape Clause”, The Journal of Legal Studies 34: 471-513.

Blonigen, B A (2006), “Working the System: Firm Learning and the Antidumping Process”, European Journal of Political Economy 22: 715-731.

Blonigen, B A and J H Park (2004), “Dynamic Pricing in the Presence of Antidumping Policy: Theory and Evidence”, American Economic Review 94: 134-154.

Blonigen, B A and T J Prusa (2016), “Dumping and Antidumping Duties,” in K Bagwell and R W Staiger (eds), Handbook of Commercial Policy, Volume 1B, 107- 159, Elsevier.

Bown, C P (2014), “Temporary Trade Barriers Database”.

Bown, C P, P Conconi, A Erbahar and L Trimarchi (2021), “Trade Protection Along Supply Chains”, CEPR Discussion Paper 15648.

Bown, C P and M A Crowley (2013), “Self-Enforcing Trade Agreements: Evidence from Time-Varying Trade Policy”, American Economic Review 103: 1071-1090.

Conconi, P, D DeRemer, G Kirchsteiger, L Trimarchi and M Zanardi (2017), “Suspiciously Timed Trade Disputes”, Journal of International Economics 105: 57-76.

Conconi, P, M García-Santana, L Puccio and R Venturini (2018), “From Final Goods to Inputs: The Protectionist Effect of Rules of Origin”, American Economic Review 108: 2335-2365.

Flaaen, A, A Hortaçsu and F Tintelnot (2020), “The Production Relocation and Price Effects of U.S. Trade Policy: The Case of Washing Machines”, American Economic Review 110: 2103-27.

Flaaen, A and J Pierce (2019), “Disentangling the Effects of the 2018-2019 Tariffs on a Globally Connected U.S. Manufacturing Sector”, FEDS Working Paper 2019-086.

Goldberg, P K, A K Khandelwal, N Pavcnik and P Topalova (2010), “Imported Intermediate Inputs and Domestic Product Growth: Evidence from India”, Quarterly Journal of Economics 125, 1727-1767.

Johnson, R C and G Noguera (2012), “Accounting for Intermediates: Production Sharing and Trade in Value Added”, Journal of International Economics 86: 224-236.

Ma, X and J McLaren (2018), “A Swing-State Theorem, with Evidence,” NBER Working Paper No. 24425.

Muûls, M and D Petropoulou (2013), “A Swing State Theory of Trade Protection in the Electoral College”, Canadian Journal of Economics 46: 705-724.

Trefler, D (1993), “Trade Liberalization and the Theory of Endogenous Protection: An Econometric Study of U.S. Import Policy”, Journal of Political Economy 101: 138-160.

Yi, K-M (2003), “Can Vertical Specialization Explain the Growth of World Trade?”, Journal of Political Economy 111: 52-102.

Endnotes

1 “The Trouble with Putting Tariffs on Chinese Goods,” The Economist, May 16, 2019.