Long thought as unrealistic, negative interest rates are a major innovation in monetary policy. Yet, studies of the transmission of negative rates to the real economy through banks are scarce and show mixed results (Altavilla et al. 2019, Eggertsson and Summers 2019, Heider et al. 2019, Abildgren and Kuchler 2020), leaving many questions open about the efficacy of this instrument in spurring bank credit and supporting economic growth.

To contribute to this debate, in a recent paper (Bottero et al. 2021) we employ comprehensive data on bank-firm lending relationships and firms’ employment and investment decisions to study the effects of the adoption of negative interest rate policy (NIRP) by the ECB and answer two key questions. First, what is the impact of NIRP on credit supply and the real economy? Second, do reductions of policy rates in negative territory differ in their transmission to the economy from conventional rate cuts just above the zero lower bound (ZLB) and from other unconventional monetary policies such as quantitative easing (QE)?

The portfolio rebalancing channel of NIRP

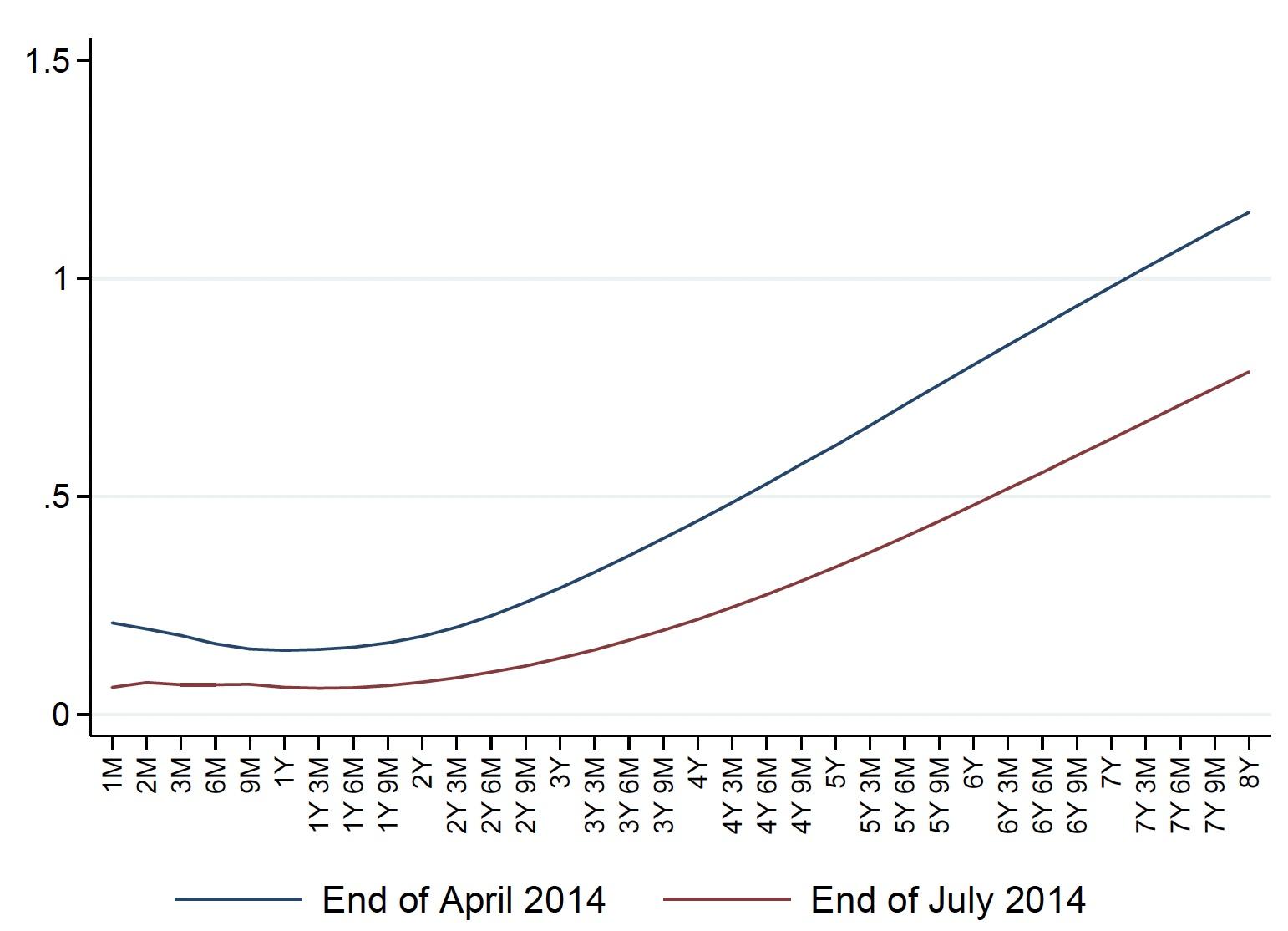

Our analysis starts from the observation that the ECB’s announcement of NIRP in June 2014 ‒ via a cut of the deposit facility rate (the rate at which credit institutions’ excess reserves at central banks are remunerated; DF) to -0.10% ‒ shifted down and flattened the yield curve (Figure 1, panel a). By breaking through the ZLB and leaving undefined the level of the ‘effective’ lower bound, the ECB signalled to market participants that the policy space for further cuts was not exhausted and that interest rates would remain extremely low for long. In turn, market participants revised their expectations, pushing down term premia and reducing yields across the maturity spectrum. Some short-term yields became negative immediately. Facing the prospect of persistently low profitability on long-term securities holdings, coupled with a ‘direct tax’ on excess reserves, credit institutions were incentivised to reshuffle their portfolio towards higher-yielding assets (Schnabel 2020). While a flattening of the yield curve is in principle associated with a repositioning towards medium- to short-term assets within the securities portfolio (holding credit risk fixed), it has different implications if one considers the whole portfolio and the possibility to move up the credit-risk ladder. Indeed, in an effort to maintain profitability, banks may opt to switch out of long-term securities because they are too low-yield and invest in long-term, higher-yield loans. (This may be especially true in the case of NIRP, when the monetary policy actions reduced firms’ debt servicing costs and boosted demand). Within loans, banks could further rebalance toward ex-ante riskier borrowers to maximise interest margins.

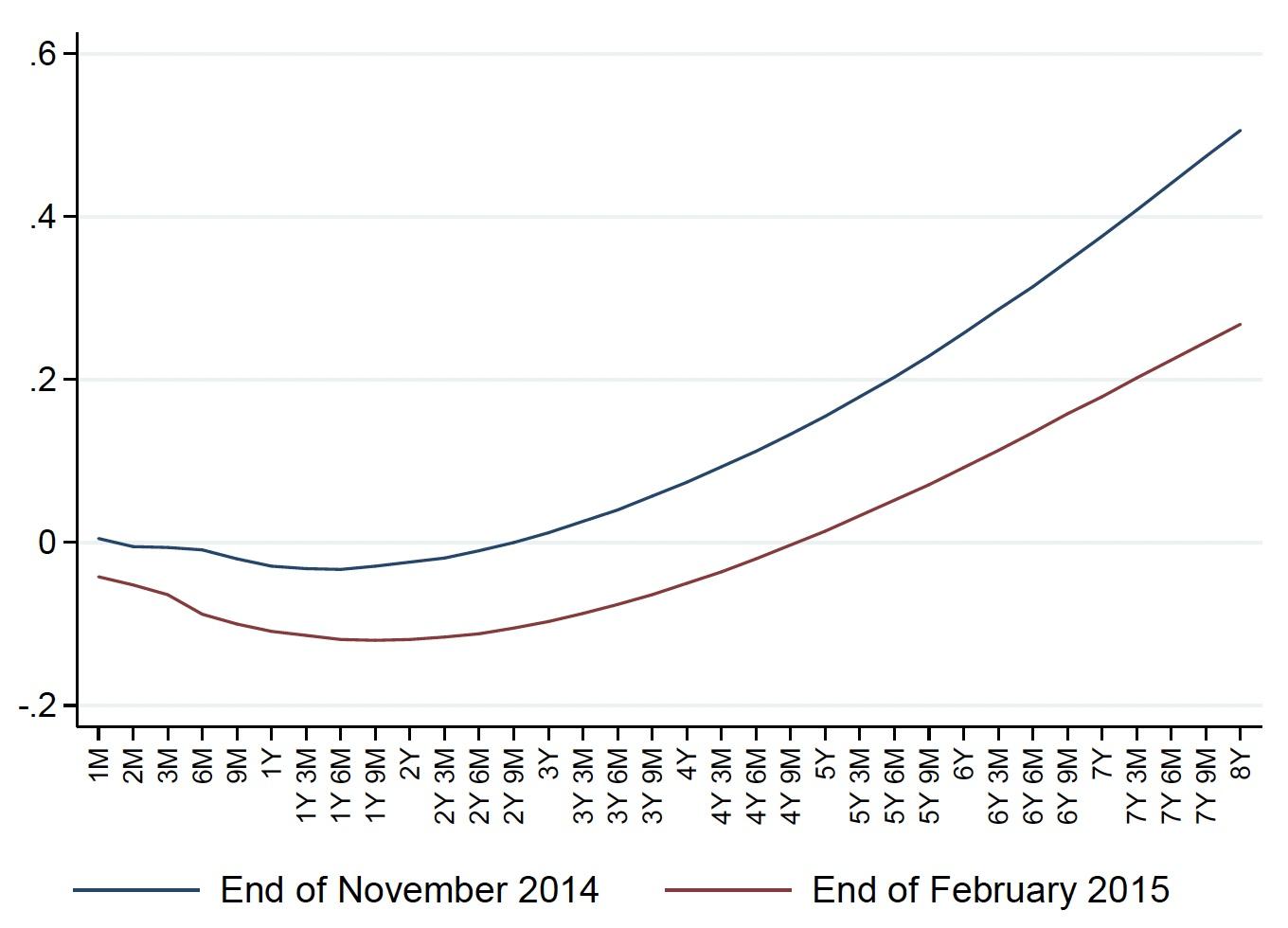

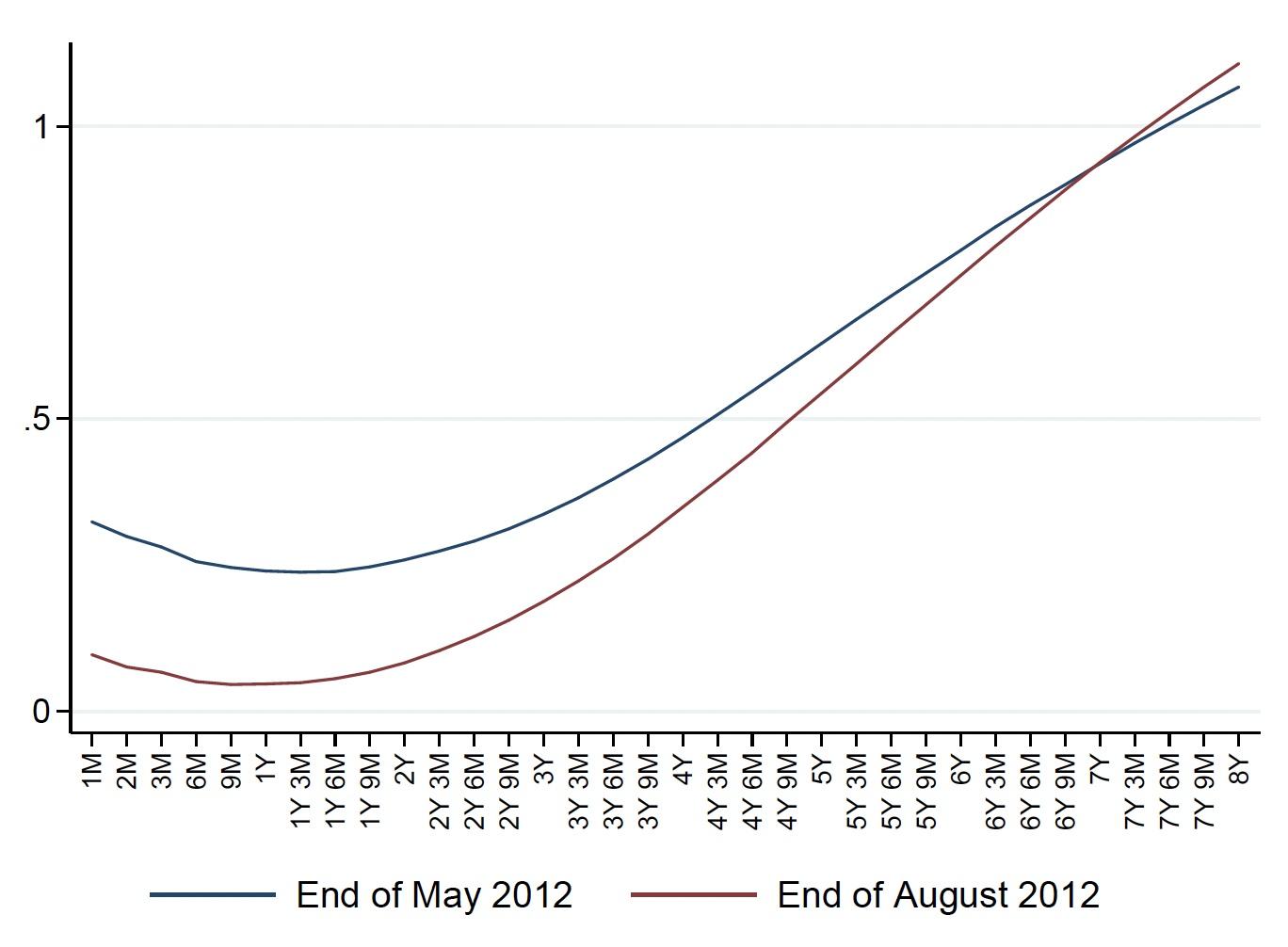

Figure 1 Forward curves around different monetary policy announcements

a) Negative interest rate policy – deposit facility rate cut below zero (June 2014)

b) Announcement of QE programme (January 2015)

c) Conventional deposit facility rate cut above zero (July 2012)

Notes: The charts plot the yield curves before and after the ECB introduction of negative policy rates in June 2014 (panel a), the ECB announcement of QE (Asset Purchase Programme, APP) in January 2015 (panel b), and the ECB deposit facility rate cut of July 2012 (panel c).

Source: Thomson Reuters Eikon.

Thus, NIRP led banks to engage in portfolio rebalancing – that is, to swap low-yield assets (such as excess reserves or low-risk long-term securities) for high-yield ones (such as corporate loans and long-term risky bonds).

According to this logic, NIRP can provide monetary stimulus through a similar transmission channel as alternative monetary policy tools such as QE, which can also generate large expectations shocks, flatten the yield curve (Figure 1, panel b) and encourage financial institutions to invest in riskier assets (Haldane et al. 2016, Krishnamurty and Vissing-Jorgensen, 2011). By contrast, rate cuts just above the ZLB may fail to create equally strong portfolio rebalancing incentives. By acting mostly on the short end of the term structure, these cuts imply some repositioning away from short-term assets towards longer-term ones, including loans (Figure 1, panel c). Compared to a traditional cut, a flattening of the curve implies, for a similar decrease in the short end of the curve, a stronger decrease in the long end (panel a, NIRP and panel b, QE). This rotation not only incentivises banks to move away from short- to long-term assets owing to the decrease in short-term yield but, as these have fallen more strongly than in the case of a standard cut, also favours a repositioning from safer to riskier assets, implying stronger effects on loan supply.

An important additional mechanism by which NIRP can affect banks’ lending decisions is the so-called retail deposit channel, which is premised on the observation that banks are unlikely to fully pass negative rates to retail deposits, especially those held by households. This compresses banks’ intermediation margins and erodes banks’ capital, limiting their ability to intermediate credit (Eggertson et al. 2019, Haider et al. 2019).1

The expansionary effect of NIRP

We empirically investigate and quantify the expansionary effect of NIRP through the rebalancing channel outlined above. We use supervisory loan-level data for the Italian banking system that are double matched with bank and firm characteristics. These granular data allow us to control for time-varying unobserved heterogeneity across firms and hence to mitigate potential concerns that our results work through the effect of NIRP on firms’ credit demand. We measure the degree to which banks are affected by NIRP by exploiting cross-sectional variation in their ex-ante total liquid assets (which comprise excess reserves and other short-term items exposed to NIRP, including interbank assets) and in net interbank position (defined as interbank assets minus interbank liabilities) – both scaled by total bank assets. We argue that the more banks were impacted by the flattening of the yield-curve, the more we should observe them expanding, all else equal, loan supply to riskier loans.

Our main results are as follows. First, we find that after the introduction of NIRP, more exposed banks – through higher ex-ante overall liquidity or net interbank position – show a relatively higher increase in the supply of corporate loans. This effect is present as early as one month after the implementation of the policy, persists for at least six months, and is associated with a significant reduction in loan rates.

Second, the expansion of credit by more exposed banks is concentrated among low-capital banks, which rebalance their assets by increasing the fraction of loans to smaller and ex ante riskier firms. The fact that low capital banks are driving the effect squares with the fact that these institutions are likely more concerned about preserving their profitability. Importantly, over the period analysed the expansion of credit is not associated with higher delinquencies, suggesting that NIRP stimulates credit to more financially constrained, but viable firms.

Third, the increase in credit supply by more liquid banks is associated with sizeable firm-level real effects. In particular, recipient firms exhibit higher investment and wage bills compared to other firms.

Bank-level data for the euro area show that the portfolio rebalancing channel documented for Italy holds in other jurisdictions as well. Furthermore, our analysis finds no evidence of a contractionary retail deposit channel. This result could be due to the fact that, compared to other euro area countries, Italy had higher retail deposit rates at the introduction of NIRP and hence more room for their downward adjustment.

NIRP: Expansionary yet different?

A key question is whether NIRP differs in its transmission to the economy from conventional rate cuts and how it compares to alternative unconventional measures.

Our data show that NIRP works more strongly than rate cuts just above the ZLB. The two rate cuts by the ECB before NIRP – the 2012 deposit facility rate cut and the 2013 main refinancing operation rate cut – only affected the short end of the yield curve and thus did not create as strong incentives to rebalance portfolios away from securities holdings to corporate loans. By contrast, the March 2016 cut, which pushed the deposit facility rate deeper into negative territory, was able to once again shift down and flatten the yield curve, generating rebalancing towards corporate loans.

How does NIRP compare with balance sheet policies such as QE? Our conjecture is that policies that are able to shift down and flatten the yield curve should have a similar effect to that of NIRP. We provide evidence consistent with this conjecture. The ECB’s January 2015 announcement of the introduction of the Asset Purchase Programme is associated with an expansion of credit supply by more liquid banks after the policy, consistent with the flattening of the yield curve. Additional evidence supporting this hypothesis looks at data from two QE events in the US involving large-scale asset purchases by the Federal Reserve in November 2008 and August 2010, respectively. The US data show that more liquid banks have relatively higher loan growth rates and are less likely to tighten commercial lending standards after these QE episodes that shifted down and flattened the yield curve. While suggestive, we believe that these results indicate a promising area of research on how monetary policies impact bank lending and the economy through shifts in the yield curve.

Portfolio rebalancing and monetary policy transmission

The debate about the effects and the desirability of NIRP is highly relevant in the current environment of low-for-long interest rates, and even more so after the Covid-19 pandemic (Lilley and Rogoff 2020). Our analysis documents an expansionary effect of NIRP on bank credit supply and the real economy through a portfolio-rebalancing channel. This mechanism is a more general channel of monetary policy transmission by which shifts in the yield curve – regardless of the monetary policy instrument used to achieve them – affect banks depending on their holdings of liquid assets. In policy discussions, the expansionary effects documented in our paper should carefully be balanced against potential financial stability risks stemming from ultra-low rates over long periods of time. Potential risks include ‘excessive’ bank risk-taking in securities and lending portfolios, and constrained lending capacity due to profitability and capital pressures (Brunnermeier and Koby 2018).

Authors’ note: The views expressed herein are those of the author and should not be attributed to the Bank of Italy, Federal Reserve System, the International Monetary Fund, their respective management or Executive Boards.

References

Altavilla, C, L Burlon, M Giannetti and S Holton, (2019), “The impact of negative interest rates on banks and firms,” VoxEU.org, 8 November.

Altavilla, C, L Burlon, M Giannetti and S Holton, (2021), “Is there a Zero Lower Bound? The Effects of Negative Policy Rates on Banks and Firms,” Journal of Financial Economics, forthcoming.

Bottero, M, C Minoiu, J L Peydró, A Polo, A Presbitero and E Sette, (2021), “Expansionary yet different: credit supply and real effects of negative interest rate policy,” Journal of Financial Economics, forthcoming

Abildgren, K and A Kuchle, (2020), “Firms facing negative deposit rates invest more and create more jobs”, VoxEU.org, 1 December.

Brunnermeier, M K and Y Koby, (2018), “The reversal interest rate,” NBER Working Paper No. 25406.

Eggertson, G and L H Summers, (2019), “Negative interest rate policy and the bank lending channel,” VoxEU.org, 24 January.

Heider, F, F Saidi and G Schepens (2019), “Bank lending under negative policy rates,” VoxEU.org, 17 December 17.

Lilley, A and K Rogoff (2020), “Negative interest rate policy in the post Covid-19 world,” VoxEU.org, 17 April.

Haldane, A, M Roberts-Sklar, C Young and T Wieladek (2016), “QE: The story so far,” Bank of England Working Paper No. 624.

Krishnamurthy, A and A Vissing-Jorgensen, (2011), “The effects of quantitative easing on interest rates: channels and implications for policy”, NBER Working Paper No. 17555.

Endnotes

1 At the same time, Altavilla et al. (2021) show that solid banks can pass negative rates on to their corporate depositors without experiencing a contraction in funding, and that they provide more credit, de facto limiting the working of the retail deposit channel to deposits held by households and/or to weaker banks.