Previous analysis has shown that the global financial crisis led to a rise in global macroeconomic uncertainty. Nick Bloom and others have highlighted the adverse effect of heightened uncertainty on economic activity – in particular by causing firms to cut back on hiring and investment, and leading households to become more cautious in their spending (Bloom 2011, Baker et al. 2011). But there is less empirical evidence about its impact on activity in the UK, particularly during the recent recession, where uncertainty has been elevated for an extended period.

How has uncertainty evolved over the recent recession in the UK?

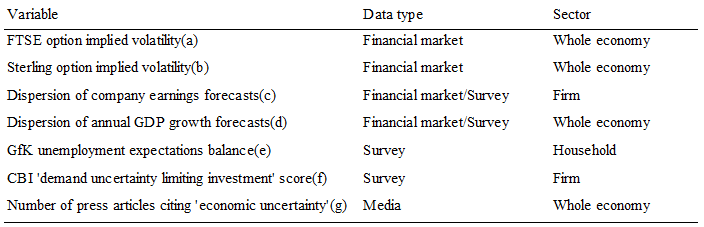

While economic uncertainty is not directly observable, there are a number of financial market and survey indicators that provide a good proxy for different types of uncertainty. Table 1 summarises some of those that can be used to observe the uncertainty faced by UK households and companies indirectly.

Table 1. Indicators of economic uncertainty for the UK

We can use these to construct a summary indicator to assess how economic uncertainty has evolved over time (Figure 1).1 Our recent work suggests that this summary indicator reveals two important facts about the recent financial crisis:

- First, unsurprisingly, UK economic uncertainty has been at historically high levels in recent years, which is consistent with other international studies (see Baker, Bloom and Davis 2012, 2013; World Economic Outlook 2011).

- Second, the recent shock to UK uncertainty looks unusually persistent.

The aggregate measure has been over one standard deviation above its mean for most of the past five years and remains elevated relative to normal pre-recession levels (Haddow, Hare, Hooley and Shakir 2013).

The unusual persistence of the recent period of heightened uncertainty could be interpreted two ways:

- On the one hand, the initial shock to uncertainty in the UK might have been followed by additional uncertainty shocks.

The intensification of the Eurozone sovereign-debt crisis and continuing headwinds from the UK Government’s fiscal consolidation are good examples of these.

- On the other hand, it might also be that the low level of uncertainty prior to the crisis was simply misplaced.

People may have mistakenly believed that the economic cycle had become much less volatile than was actually the case.

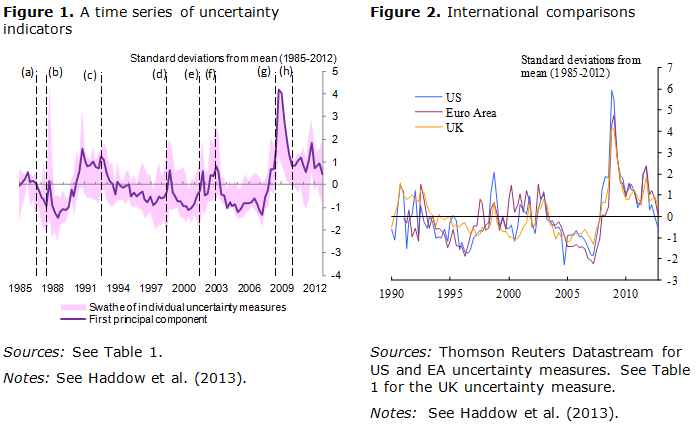

The similarity between the recent evolution of uncertainty in the UK and in other countries (Figure 2) suggests that external factors, such as global financial stress, have been important drivers of the uncertainty shock in the UK.

Empirical estimates of the impact of uncertainty shocks on the UK economy

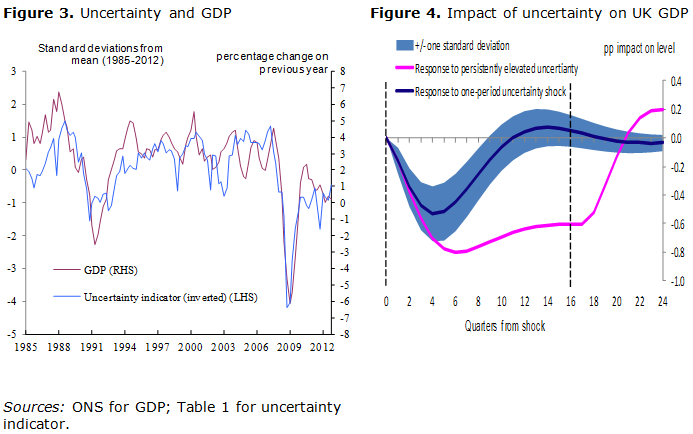

We know that uncertainty is strongly correlated with activity. The correlation between our new uncertainty index and UK GDP growth is around -0.7 (Figure 3). And we are not alone in finding such a connection, amongst others, Kose and Terrones (2012) find that uncertainty is systematically high during recessions and low during expansions (see Kose et al. 2012) A key question that requires more systematic analysis is how much heightened uncertainty has contributed to the recent weakness of the UK recovery.

To get a handle on this, we estimate a vector autoregression that includes our uncertainty measure along with other UK macroeconomic variables (see Denis and Kannan 2013 for a similar approach for uncertainty shocks on UK industrial production). It suggests that uncertainty shocks have a negative and statistically significant impact on UK GDP.2 A one-standard-deviation shock to uncertainty has a peak impact on UK GDP of around -0.5pp (Figure 4).

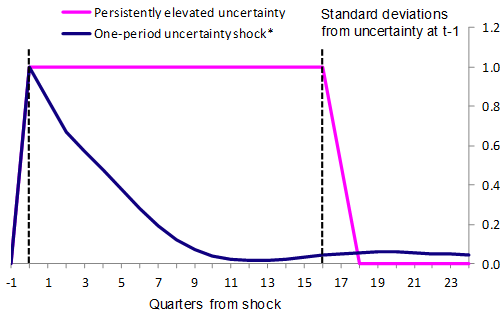

Figure 5. Assumed paths for uncertainty for persistent and one-period shocks

Notes: * Following shock at time period = 0, uncertainty evolves according to the dynamics of the model.

In the past, uncertainty shocks have tended to unwind fairly quickly (Figure 1), so the effects have not been persistent. Indeed, the vector autoregression estimates suggest that half the rise in uncertainty dissipates within a year and the level of GDP recovers within three (Figure 4).

But the recent UK experience suggests that uncertainty shocks can be large and persistent, so the impact on activity might not always be so short lived. For example, we construct an illustrative scenario in our vector autoregression by holding the uncertainty index above normal for 16 quarters (Figure 5). Unsurprisingly, this implies a larger and more persistent impact on GDP (magenta line in Figure 4) and a sharp pickup in growth when uncertainty falls back.

Conclusions

A wide range of measures suggest that UK households and companies have become more uncertain about future economic prospects since the onset of the financial crisis. With little precedent of such extended periods of high uncertainty, it is difficult to know how this will affect the behaviour of households and companies going forward.

We find that elevated uncertainty has been a factor restraining economic recovery in the UK. Simple empirical estimates suggest that, as long as elevated uncertainty remains, a restraining effect on the level of consumer spending and investment may continue.

References

Baker, S, Bloom, N, and Davis, S (2012), ‘Uncertainty and the economy,’ Policy Review 175.

Baker, S, N Bloom, and S Davis, (2013), ‘Measuring economic policy uncertainty,’ Chicago Booth Research Paper No. 13-02.

Baker S, N Bloom and S Davis (2012), “The Rocky Balboa Recovery”, VoxEU.org, 20 June.

Bloom, Nick (2011), “The uncertainty shock from the debt disaster will cause a double-dip recession", VoxEU.org, 22 August.

Dennis, S and Kannan, P (2013), ‘The impact of uncertainty shocks on the UK economy’, IMF Working Paper No. 13/66.

Kose, M and Terrones, M (2012), ‘How Does Uncertainty Affect Economic Performance?’. Box 1.3, World Economic Outlook, October, 49-53.

Kose, M Ayhan, Terrones, Marco (2012), “Uncertainty weighing on the global recovery”, VoxEU.org, 18 October.

Haddow, A, Hare, C, Hooley, J and Shakir, T (2013), ‘Macroeconomic uncertainty; what is it, how can we measure it and why does it matter?’, Bank of England Quarterly Bulletin, Vol. 53, No. 2, pages 100-109.

IMF World Economic Outlook (2011), ‘World economic outlook, Slowing growth, rising risks’. September 2011.

1 These are combined into a single uncertainty index using Principal Components Analysis.

2 This is robust to the inclusion of other variables such as credit and confidence.