In 2017, the world economy made a gradual recovery. The robustness of both the US’ and China’s economic growth significantly contributed to this. The continuation of monetary easing policies in major countries, low inflation and low interest rates worldwide, and a gradual increase of crude oil and resource prices were also significant factors that supported the growth of the world economy. Many emerging countries are resource-rich countries, thus the rally in oil and resource prices was a significant positive factor in their economic recovery.

A considerable increase in sales of high-tech products was another positive factor. Global semiconductor sales and the value of Japanese robot shipments rapidly increased to record high levels. This was due to factors such as the launches of new smartphones, and the brisk advancement of digitisation and informatisation with regard to automobiles and so on.

It appears as if this trend will continue through 2018. It is expected that monetary easing policies in major countries, and hence low interest rates, will continue. Furthermore, while there are geopolitical risks, it is anticipated that oil and resource prices will remain steady against the backdrop of moderate world economic growth. As for demand for high tech products, as the era of artificial intelligence (AI) approaches, a further upsurge in sales related to the Internet of Things (IoT), robots, and so on is expected (WEO 2018).

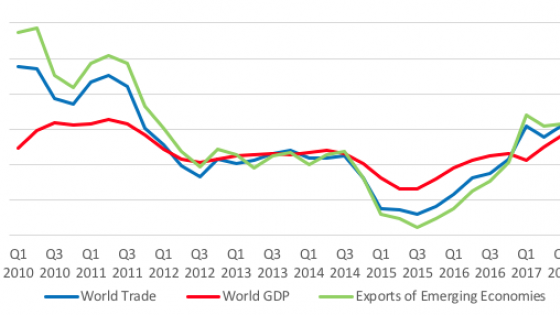

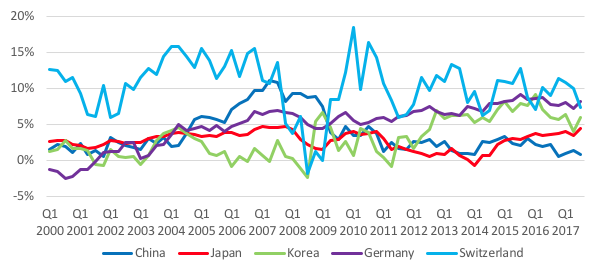

Along with the recovery of the world economy, exports by both developed and emerging countries have been increasing (see Figure 1). For emerging countries, the growth of exports to developed countries has been a major engine for economic growth, and this indicates that the economies of both developed and emerging countries have been recovering (IMF 2018).

Figure 1 Nominal GDP growth and trade growth

Note: Nominal, year-on-year basis.

Source: IMF, Oxford Economics

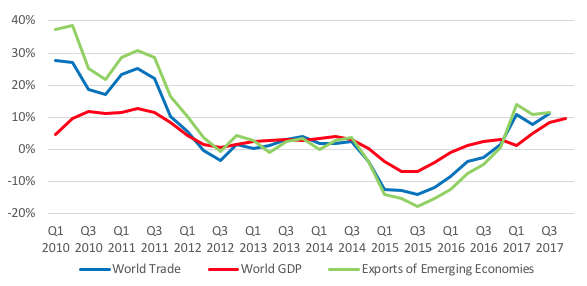

There was a rapid rise in the first decade of the 21st century in the proportion of emerging countries that contributed to world trade, but that proportion has been decreasing (see Figure 2). Nevertheless, as can be seen in Figure 1, the export growth rate of emerging countries exceeded that of developed countries for the first time in two and a half years in 2017, so it is a matter of time before the share of world trade accounted for by emerging countries starts increasing.

Figure 2 Share of emerging economies

Source: IMF

The growth of exports by emerging countries is not necessarily entirely desirable. This is because if there are rising concerns in developed countries that increases in imports from emerging countries will cause the hollowing-out of domestic industries and loss of employment, the long-awaited economic recovery in the emerging countries could become destabilised.

Looking at the examples of China, Japan, South Korea, Germany, and Switzerland, which are on the ‘monitoring list’ of the US’ Semiannual Report on International Economic and Exchange Rate Policies, the trade deficit ratio of the US with regard to each of these economies has not been growing, and it currently appears as though the US does not have much reason to push for the correction of trade imbalances (US Department of the Treasury 2017). Nevertheless, there are signs that the US may increase its pressure on such economies to correct trade imbalances.

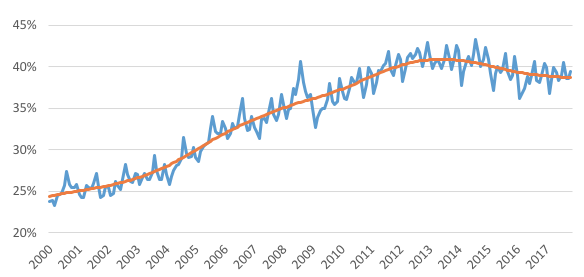

For example, the percentage of consumer goods imports of the US accounted for by China not only continues to be at a high level, but also has started rising again (Figure 3). Tax reforms are currently being established with the intention of significantly lowering taxes, so while it does not appear that the US will immediately fall into an economic recession, if its economy starts slowing down and calls for a return to domestic production rise, the appreciation of the yuan could grow stronger and be tricky to address.

Figure 3 Percentage of consumer goods imports accounted for by China in the US

Note: Consumer goods do not include food products and automobiles. The percentage of imports from China is the ratio of consumer goods imports to the US accounted for by imports from China, and is a 4-quarterly moving average.

Source: BEA

The challenge for Japan: Overcoming a new ‘ceiling on international balance of payments’

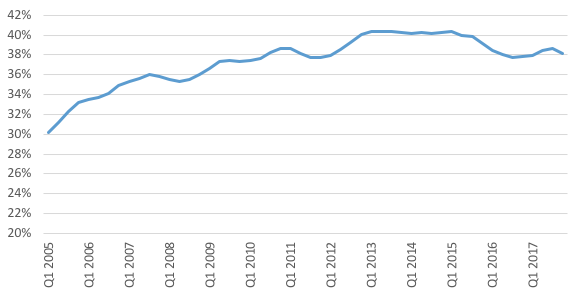

According to the standards of the US, Japan’s international balance of payments is also at a relative high level. While it is assuring that Japan’s current account surplus as a percentage of GDP among the five economies listed in the monitoring list is the lowest after China’s, and that the trade deficit of the US with Japan has stabilised, Japan is the only country among the five named in the exchange rate policy report of the US to have a current account surplus that has been on an upward trend since the beginning of 2017 (Figure 4).

Figure 4 Current account to GDP, 2000-2017

Note: Seasonally adjusted.

Source: National statistics.

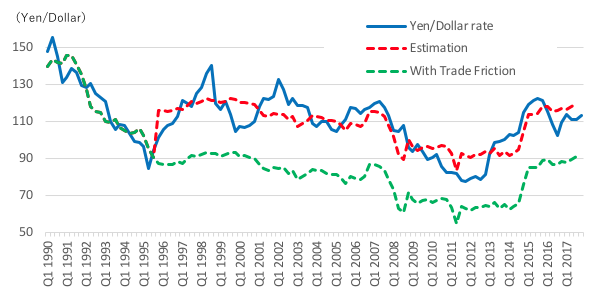

Incidentally, measuring how much trade friction factors were underlying the strong yen exchange rate in the first half of the 1990s, when trade friction between Japan and the US was deepening, yields a surprisingly large result of just below 30 yen (Figure 5). The economic environment surrounding Japan and the US is obviously different now than it was then, and the impact on exchange rates certainly differs greatly depending on the economic situation and degree of trade friction. Nevertheless, it seems to be necessary to keep in mind that the yen market is sensitive to trade friction.

Figure 5 Estimation in case of continuation of trade friction in the dollar-yen market

Note: The explanatory variables are yen and dollar interest rates, crude oil price, stock prices in Japan and the US, Japan’s trade balance, trade balance of the US with Japan, and trade friction dummy.

Source: Ministry of Finance, Bank of Japan, Nikkei, U.S. Department of Energy, U.S. Census Bureau, Dow Jones, Thomson Reuters.

Currently, the economies of developed countries are generally in good shape, and there does not appear to be much further spreading of protectionism, even with regard to increases in exports by emerging countries. Nonetheless, taking into consideration the fact that there appear to be several factors that could trigger such a situation, Japan cannot feel assured.

In order to prevent the spread of economic and trade friction, in principle, a reduction of the imbalance of the international balance of payments and exchange rate stability are crucial. For Japan, it is essential to shift from growth that is dependent on the economic growth of the world economy toward economic growth that is focused on domestic demand, using lessons from the labour shortage.

The population is decreasing, and markets are becoming saturated, so growth centring on domestic demand is obviously no longer easy. Nevertheless, against the backdrop of technological innovation, in the US and China, a series of new business models and services have been emerging and spreading, such as the ‘sharing economy’ in which automobiles, accommodations, and so on are lent out, and cashless payments are made with smartphones. This means that major process innovation is taking place, and the creation of completely new demand is leading to the cultivation of new growth frontiers.

The current recovery of the Japanese economy appears to have continued through December 2017, and, if this is the case, it indicates that economic expansion has continued for 61 straight months. This is the longest period of post-war economic expansion after the 73-month long ‘Izanami boom’ (from February 2002 through February 2008), and many expect it to continue in 2018 as well.

Nonetheless, it is necessary to recognise that a new ceiling on the international balance of payments is waiting. This will not involve insufficient foreign exchange reserves putting a ceiling on economic growth as it did in the past in Japan. On the contrary, this is a situation in which if the international balance of payments surplus with regard to, for example, exports to and foreign direct investment in the US becomes too large and goes beyond a certain range, economic growth could be inhibited by trade friction and domestic currency appreciation.

The growth of the Japanese economy in 2018 will depend on how the limitations of the new ceiling on the international balance of payments are faced and overcome. The direction for this lies in realising domestic demand-led economic growth in which wage increases of companies bring about the expansion of consumption, and in promoting domestic process innovation and realising the cultivation of growth frontiers and growth itself.

Editors’ note: This column was reproduced with permission from the Research Institute of Economy, Trade and Industry (RIETI).

References

International Monetary Fund (2018), “Real GDP growth: Annual percent change”, IMF Data Mapper.

Nakajima, A (2018), “New Ceiling on International Balance of Payments for Japan: Process innovation and cultivation of growth frontiers are necessary”, RIETI, 4 January.

US Department of the Treasury (2017), Foreign Exchange Policies of Major Trading Partners of the United States: Semiannual Report on International Economic and Exchange Rate Policies, October.

World Economic Outlook (2018), “Brighter Prospects, Optimistic Markets, Challenges Ahead”, WEO Update, January.