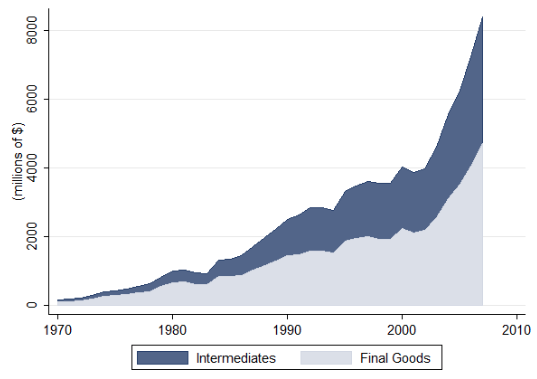

Two remarkable facts of the globalisation process witnessed in the last 25 years are the large increases in both trade in intermediate goods and in capital mobility. Before the 1990s, trade in final goods accounted for most of the value of world exports and international capital mobility was relatively low. In contrast, after the 1990s, trade in intermediate goods, or ‘unbundling of production’, has become more prominent over time (see Figure 1) and global supply chains have emerged – a phenomenon termed ‘New Globalisation’ by Baldwin (2016). There has also been a sizable growth of both gross and net international capital flows (e.g. Lane and Milesi-Ferretti 2007). Some authors have blamed globalisation for the increasing inequality and loss of jobs in developed countries (e.g. Acemoglu et al. 2016). However, there has not been any theoretical analysis of the long-run effect of unbundling of production on inequality between and within countries.

Figure 1 International unbundling of production

Source: Basco and Mestieri (2019a).

A distinctive feature of intermediate goods, which we document in a recent paper (Basco and Mestieri 2019a), is that they are more heterogenous in capital intensity than final goods. Factor proportion (Heckscher-Ohlin) trade models emphasise that trade in goods which are heterogenous in capital intensity creates winners and losers from globalisation because trade alters the relative return to factors of production. Moreover, since capital can be accumulated, trade in intermediates can have dynamic effects through altering countries’ savings rate. In addition, capital mobility implies that trade in intermediates can affect the global allocation of capital. Changes in the global allocation of capital also affect returns to other domestic factors of production (e.g. labour), to the extent that capital and labour are complements in production. In sum, trade in intermediates (unbundling of production) has the potential to affect the redistribution of capital and labour between and within countries.

Unbundling of production exacerbates world welfare inequality

We theoretically analyse the long-run effect of unbundling of production on the world income distribution. Our growth model is similar to Acemoglu and Ventura (2002), but we introduce intermediates heterogenous in capital intensity and allow for capital mobility. Countries only differ on Hicks-neutral aggregate productivity. Our main result is that trade in intermediates generates a reallocation of capital across countries that exacerbates world inequality in both income and welfare. The intuition for this proposition follows from two results.

First, with unbundling of production, countries sort into the production of an endogenous set of intermediates. We show that highly productive countries have a comparative advantage in capital-intensive intermediates since labour is relatively more expensive in these countries and, thus, they specialise and export these intermediates. We provide empirical evidence consistent with this prediction.

Second, the aggregate demand for capital depends on the intermediates that each country produces. Countries that specialise in capital-intensive intermediates are going to import (and accumulate) more capital. This empirical prediction is consistent with the findings of Jin (2012).

These two results imply that high-productivity countries are going to increase their capital stock (via capital imports and accumulation) and, ultimately, their real wages (through the complementarity between capital and labour) and consumption.

Unbundling of production hurts middle-income countries

The above result is true for any distribution of productivities across countries. However, to provide an explicit characterisation of the world output (GDP) distribution, we make the (empirically motivated) assumption that countries’ productivities are log-linear in their ranking. Under this parametrisation, we can analyse how the (long-run) world output share of each country changes with unbundling. We find that low-productivity countries are (mostly) indifferent between both steady states. These countries specialise in labour-intensive intermediates and have small amount of capital in the steady state with unbundling. However, since they have low productivity, they also had a small amount of capital in the old equilibrium. High-productivity countries are the winners of unbundling. These countries specialise in capital-intensive intermediates and accumulate capital in the new steady state. The main losers of unbundling are countries with intermediate productivity. Without unbundling, these countries were productive enough to accumulate a substantial amount of capital and have relatively high output. In contrast, with unbundling, these countries need to compete with other countries to produce intermediates. Since these countries are not very productive, they cannot specialise in the most capital-intensive intermediates and end up accumulating less capital than in the old steady state. This mechanism provides a rationale for why globalisation can make middle-income countries deindustrialise prematurely, as suggested by Rodrik (2016).

Productive southern countries gain from joining the global supply chain

One important factor behind the increase in trade in intermediates is that southern countries (or developing countries) have joined the global supply chain (e.g. Baldwin 2012). The emergence of global supply chains can be illustrated by the location of the main suppliers of Apple in 2019. Its top-200 list includes firms from emerging and developing countries like Brazil, China, India, Korea, Malaysia, Mexico, Philippines, Singapore, Taiwan, Thailand, or Vietnam.1

We also analyse how the world income distribution changes when southern countries join the global supply chain. We find that northern countries are better off when southern countries participate in global supply chains because: (i) they can sell their intermediates to more countries (market effect); and (ii) they specialise in more capital-intensive intermediates (selection effect). For southern countries, the effect depends on the productivity of the country. Productive southern countries can specialise in capital-intensive intermediates, and accumulate more capital and output than before. However, low-productivity countries experience output losses because they do not specialise in capital-intensive intermediates. Our framework provides a novel channel for why the relatively more productive southern countries benefit from being part of a global supply chain.

Unbundling of production increases within-country Inequality

When countries trade in intermediates, the relative demand for and redistribution of factors change. In a related paper (Basco and Mestieri 2019b), we show that unbundling of production increases within-country inequality, as measured for example by the Theil index. The increase in inequality is U-shaped in the aggregate productivity level of the country.2 The intuition is that the more (less) productive countries specialise in capital-intensive intermediates, accumulate more (less) capital and end-up with a larger (smaller) share of capital income in the new steady state. This implies that the largest increases in within-country inequality will be in countries with very high (or low) productivity because they experience the largest changes in capital. We provide suggestive evidence consistent with this result. This result is also consistent with the negative relationship between aggregate productivity and the labour share which we document in Basco and Mestieri (2019a). Thus, the model provides a rationale for how unbundling of production generates within-country inequality and decreases the labour share in developed countries

Concluding remarks

There exists a general consensus among economists that globalisation is good at the world level. However, the increasing discontent with globalisation in developed countries has forced economists to better understand the mechanisms through which it affects the distribution of income between and within countries. In this column, we have discussed that in the most developed (productive) economies, the new globalisation is good at the country level but it generates a redistribution of income towards capital. Thus, the optimal policy for these countries does not seem to be to put the brakes on the emergence of global supply chains but to better redistribute income within the country. Finally, it is worth mentioning that since the new globalisation amplifies competition among countries, the returns to productivity enhancing policies (like education or infrastructure) have increased.

References

Acemoglu, D, D Autor, D Dorn, G H Hanson and B Price (2016), “Import competition and the great US employment sag of the 2000s”, Journal of Labor Economics 34: S141-S198.

Acemoglu, D and J Ventura (2002), “The world income distribution”, Quarterly Journal of Economics 117(2): 659-694.

Baldwin, R (2012), “Global supply chains: Why they emerged, why they matter, and where they are going”, CEPR discussion paper 9103.

Baldwin, R (2016), The Great Convergence: Information technology and the new globalization, Cambridge: Harvard University Press.

Basco, S and M Mestieri (2019a), “The world income distribution: The effects of international unbundling of production”, Journal of Economic Growth, forthcoming.

Basco, S and M Mestieri (2019b), “Trade and inequality: The effects of international unbundling of production”, working paper.

Jin, K (2012), “Industrial structure and capital flows”, American Economic Review 102: 2111–46.

Lane, P R and G M Milesi-Ferretti (2007), “The external wealth of nations mark II: Revised and extended estimates of foreign assets and liabilities, 1970-2004”, Journal of International Economics 73: 223-250.

Rodrik, D (2016), “Premature deindustrialisation”, Journal of Economic Growth 21: 1-33.

Endnotes

[1] The list of top suppliers can be found in the Apple Supplier Responsibility Report 2019.

[2] The model in Basco and Mestieri (2019b) is the same as in Basco and Mestieri (2019a) without capital flows. We make this assumption to be able to determine the location of assets in equilibrium.