After the Global Crisis of 2008-09, many central banks in advanced economies faced the effective lower bound and thus found it necessary to implement unconventional monetary policy to achieve the inflation target of around 2%. Over the past years, the effectiveness of such policy has been increasingly questioned, given that many central banks have struggled to raise underlying inflation and have raised concerns about adverse impacts of unconventional tools. Moreover, a decline in the neutral rate of interest suggests that the nominal policy rate will remain lower than in the pre-crisis period, thereby generating a higher probability of falling into the effective lower bound again when a next crisis or recession happens.

In an attempt to cope with these concerns, central banks increasingly feel more comfortable with traditional monetary policy tools (i.e. using a policy interest rate) due to familiarity with their effectiveness. Many believe that unconventional monetary tools should be used only in extreme circumstances. In such circumstances, there has been a growing focus on alternative frameworks such as (1) raising the inflation target (for example 4% rather than 2%), (2) price-level targeting, (3) nominal GDP targeting, and (4) nominal wage targeting. This column focuses on the latter two frameworks.

Nominal GDP targeting as a new monetary policy framework

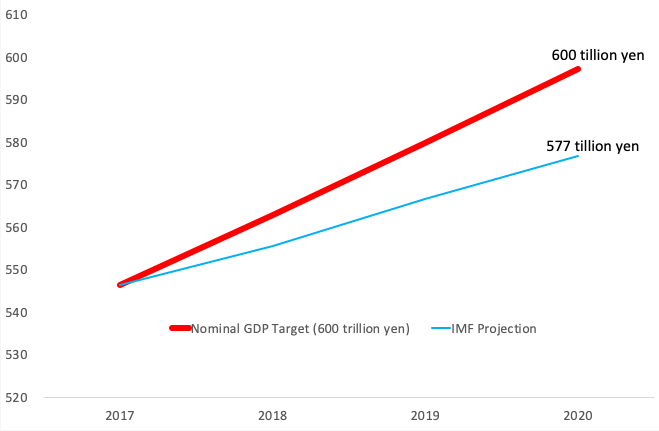

Nominal GDP targeting aims to achieve a specific nominal GDP level (the product of the real GDP level and a GDP deflator). It may be easier for the public to understand the numerical nominal GDP target than the 2% inflation target. For example, the Bank of Japan (BOJ) finds it difficult to convince the public that inflation has to be raised by setting the 2% target. Japan’s experience suggests that there is asymmetry between raising inflation to achieve the 2% inflation target and lowering inflation to achieve the 2% inflation target. This is because nominal wage growth does not necessarily catch up with inflation since wage negotiations are often backward looking or based on past inflation, as is the case in Japan. Figure 1 indicates higher inflation since Quantitative and Qualitative Easing (QQE) has resulted in a further decline of the real wage level (per employee) despite a modest increase in the nominal wage level.

Figure 1 Japan’s nominal and real cash earnings (Year 2000=100)

Source: Ministry of Health, Labor, and Welfare.

Formally, nominal GDP targeting has at least three advantages over flexible inflation targeting and/or price-level targeting (McKibbin and Panton 2018):

- One is that the central bank does not need to know potential GDP precisely on a real-time basis, as nominal GDP targeting allows a range of outcomes for inflation and real GDP.

- Another advantage is that the central bank under nominal GDP targeting will not tighten monetary policy when a negative supply shock (such as a sharp oil price hike for an oil importing economy) raises inflation but exerts downward pressures on production activities, thereby preventing the economy from falling deeper into recession. Under flexible inflation targeting and price-level targeting, a price hike driven by a supply shock might prompt a central bank to tighten monetary policy – partly because it is difficult to distinguish such a supply shock from a demand shock on a real-time basis. Thus, nominal GDP targeting can achieve output stabilization more firmly than flexible inflation targeting and price-level targeting.

- The third advantage is that price-level targeting attempts to make up for past deviation from actual GDP levels from a long-term nominal GDP target path if undershooting or overshooting for many years increases such deviation. Thus, nominal GDP targeting is history-dependent, like price-level targeting. Summers (2018) proposes nominal GDP targeting of about 5-6% in the US due to the property that the expected rate of inflation rises as the expected real growth in GDP declines.

Nonetheless, nominal GDP targeting has a few technical problems that make it difficult for a central bank to use it operationally, including frequent revisions of GDP data, lack of monthly GDP data, and the release of GDP data with a lag. These issues are quite relevant in Japan since the GDP revisions are often large and the first GDP estimate is released with a long lag (after one and a half months for the first estimate). A nominal GDP target may also wrongly give the public the impression that the central bank is able to raise potential GDP growth. The government may exert pressure on the central bank if nominal economic growth is not sufficient. Nominal GDP targeting may undermine the government’s incentive to raise potential economic growth through structural reforms and economic growth strategies.

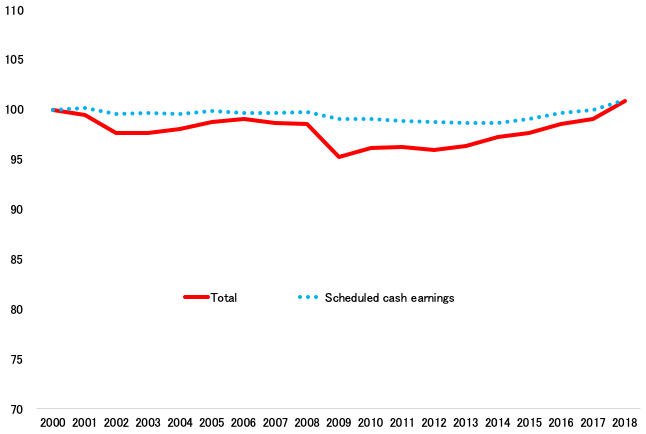

The Japanese government introduced nominal GDP targeting in 2015 with the numerical target of around 600 trillion yen by 2020. In late 2016, a major revision on the System of National Accounts (SNA) was made which added about 32 trillion yen to Japan's nominal GDP in fiscal year 2015. This upward revision has made it easier for the government to achieve its target. Nonetheless, the target of 600 trillion yen remains challenging as it requires an average rate of nominal GDP growth of about 3% in 2018–2020 – much higher than the average rate of 2% in 2013–2017 (Figure 2). Moreover, the nominal GDP target is much greater than the IMF’s projection of April 2018. More importantly, the adoption of nominal GDP targeting appears to have limited impact on inflation as well as on inflation and growth expectations in Japan because of the lack of concrete measures to achieve the target. The media and the public hardly pay attention to the nominal GDP target, which suggests a lack of credibility.

Figure 2 Japan’s government nominal GDP target and IMF projections (trillion yen)

Source: Cabinet Office; International Monetary Fund.

Nominal wage targeting as a new monetary policy framework

Nominal wage targeting sets a numerical nominal wage target level (based on desirable nominal wage growth path like price-level targeting). It is somewhat similar to nominal GDP targeting since nominal GDP includes nominal wage (and corporate profits). A central bank may find it easier to explain its policy objective to the public since nominal wage targeting is directly associated with workers’ income and thus easier to understand for the general public. It may stimulate people’s spending. Nominal wage targeting is possible as long as labour productivity growth remains nearly constant. However, there are several technical issues related to nominal wage targeting. Nominal wages are relatively sticky as firms and labour unions typically conduct wage negotiations once a year or for multiple years in many economies, including Japan and Europe. Wages tend to be set based on past inflation, as already pointed out. Productivity data are highly volatile and difficult to measure, especially when an economy shifts from manufacturing to non-manufacturing (such as health and elderly care).

In Japan, wages are determined differently between full-time and part-time employees. As for full-time employees, wages or cash earnings are comprised of scheduled cash earnings (comprised of ‘base pay’ and ‘regular pay’ with the latter determined mechanically by the number of working years and age), bonuses (provided in summer and winter per year), and overwork allowances. Among these types of wages, scheduled cash earnings are most important since it contributes to permanent income growth. Firms are generally reluctant to raise scheduled cash earnings (especially, base pay) as it is a fixed cost that cannot be cut in during a downturn. Firms prefer raising bonuses as they can be more flexibly adjusted (biannually) in line with ongoing actual profit levels. Figure 3 indicates that total cash earnings per full-time employee have remained stagnant since 2000, managing to return to the 2000 level only recently. The more rapid growth in total cash earnings than scheduled cash earnings indicates that the recent wage increase has been driven mainly by volatile bonus payments

Figure 3 Cash earnings for full-time employees: Total and scheduled (year 2000=100)

Source: The Ministry of Labor, Health and Welfare.

By contrast, part-time employees’ wages are set on an hourly basis by taking into account demand and supply factors. The number of part-time or non-regular workers, which account for a third of total employment, has been growing, since housewives and retired elderly people tend to choose part-time positions. Those workers make up most of the labour shortages. Part-time employees’ wages account for about 40% of full-time employees’ wages based on hourly cash earnings, so that firms in labour-intensive sectors (such as taxis, restaurants, supermarkets, department stores, delivery of cooked food, security works) prefer part-time workers to contain their sales prices. Being aware of the wage gaps, the Japanese Diet passed a work reform bill in June 2018 including the implementation of “equal pay for equal work” between regular and nonregular employees. This new regulation is expected to raise wages of non-regular workers by lowering wages of regular workers, given that many firms want to contain total employment cost. Meanwhile, resultant unattractive wages for regular workers may make it more difficult for firms to attract regular workers. The effectiveness of the new regulation is unclear since the definition of equal pay is not clear once taking into account different responsibilities and contract burden assigned to regular workers.

In such an uncertain environment, firms may not feel comfortable about nominal wage targeting since they do not want to commit to such wage hikes due to a high degree of uncertainty about the Japanese economy (expected declining markets and tougher competition). Firms may simply ignore the target due to the practical difficulty of implementing it at the corporate sector level given the complex wage settling structure mentioned earlier. In the 2018 wage negotiation, the Japanese government demanded a wage hike of more than 3%. Through negotiations, large firms managed to settle on a 2.5% wage hike, but base pay growth remained less than 1%. As small and medium-sized enterprises do not necessarily follow those wage results, nominal wage growth may remain sluggish and smaller than inflation. In setting nominal wage targets, the wage setting structure needs to be taken into account and the types of wages – base pay, regular pay, bonuses, nonregular workers wage, etc. – to be targeted need to be carefully examined. Due to severe labour shortage, the wage differences between regular and non-regular workers are likely to shrink and wage growth may start to pick up more forcefully in the future. However, it may take some years to see this since firms need some time to change their business customs and styles and find ways to improve productivity – through M&A as well as greater use of IT, AI, and robotics – and pay higher wages.

Conclusions

The search for a better monetary policy framework has much attention globally in recent years. A number of alternatives have been put forward with the objective of achieving price stability more firmly in the low neutral interest rate environment. Such discussions are rare in Japan, however, because of the public’s limited understanding of the 2% price stability target to begin with and people’s resistance to higher prices. Nominal GDP targeting and nominal wage targeting might be easier for the public to understand than the current 2% inflation target. However, nominal GDP targeting – adopted by the Japanese government in 2015 – appears to have limited impact on inflation as well as on inflation and growth expectations because of the lack of concrete measures to achieve the target. Nominal wage targeting may be difficult to implement soon in Japan not only because of uncertainty on labour productivity growth in the increasingly services-oriented economy, but also the complicated wage setting structure.

References

McKibbin, W J and A Panton (2018), “25 Years of Inflation Targeting in Australia: Are There Better Alternatives for the Next 25 Years?” CMBA Working Paper No. 19.2018.

Shirai, S (2018), Mission Incomplete: Reflating Japan’s Economy (Second Revision), Asian Development Bank Institute.

Summers, L (2018), Why the Fed Needs a New Monetary Framework, Brookings.