The international taxation of multinational enterprises (MNEs) recently received renewed media and public opinion attention following the commitment by finance ministers of the G7 at their meeting in London on 4-5 June 2021 to a global minimum tax of at least 15% on a country-by-country basis. Negotiations on reforms of international corporate tax rules, including the introduction of a minimum level of taxation, have been ongoing at the OECD Inclusive Framework for a while (OECD 2020), but one of the main novelties of the G7 communiqué stands in the reference to a rate – at least 15% – at which multinationals should be taxed. A crucial political step would be reaching an agreement at the G20 level.

Profit shifting is the phenomenon that the international community is trying to address by discussing such reforms and it is at the basis of the frequent claim recalled in the public debate around MNEs “not paying their fair share of taxes”. It essentially consists of MNEs shifting their profits from high-tax to low-tax countries by exploiting loopholes in tax rules to reduce their global tax burden. The existence of tax rate differentials among countries represents the main incentive for MNEs to shift profits (Laffitte et al. 2020) and that is why setting a minimum floor to corporate taxation is expected to be an efficient way of curbing profit shifting.

Many studies have analysed how MNEs shift their profits in response to changes in corporate tax rate differentials finding that, on average, if a country increases its corporate taxation by a one percentage point with respect to other countries, MNEs will decrease profits reported in that country by around 1% and shift them to other countries with a lower level of taxation (Heckemeyer and Overesch 2017, Huizinga and Laeven 2008, Beer et al. 2020, Dharmapala 2014). These studies, however, assume that the MNE response to changes in corporate tax rates is the same, irrespective of whether the change in taxation occurs in a high-tax or in a low-tax country, while one study (Dowd et al. 2017) also tries to explore whether the MNE response to changes in tax rates is more intense in low-tax countries and found significant evidence in this direction.

As a result of the OECD action plan on base erosion and profit shifting (BEPS), analysis of profit shifting recently benefitted from the availability of new comprehensive data on MNE global activities, provided by the country-by-country reports (CbCRs) submitted by MNEs to tax authorities as of 2018. This new source of data fills the gaps in existing datasets on MNE activities, by providing data on profits reported in tax havens and provides a complete picture of MNE activity in all countries where they are based and where they have operations. There has not yet been an analysis on global profit shifting using firm-level country-by-country reports of MNEs with different nationalities.1

In a new paper (Bratta et al. 2021) based on global country-by-country reports microdata,2 we assess the MNE profit-shifting response to tax rate differentials. We find that, with respect to the 1% profit shifting response cited above, MNEs are eight times more sensitive to changes in tax rates occurring in countries with a tax rate much lower than the world average and 60% less sensitive to changes in tax rates among countries with similar tax rates.

In other words, if a country whose rate is much lower than the world average increases its tax rate by one percentage point, profits reported in that country by MNEs would decrease by almost 6% (instead of 1%), whereas if a country with a rate close to the world average decided to decrease its rate in order to be more competitive, this would have hardly any effect in attracting more MNEs profits.

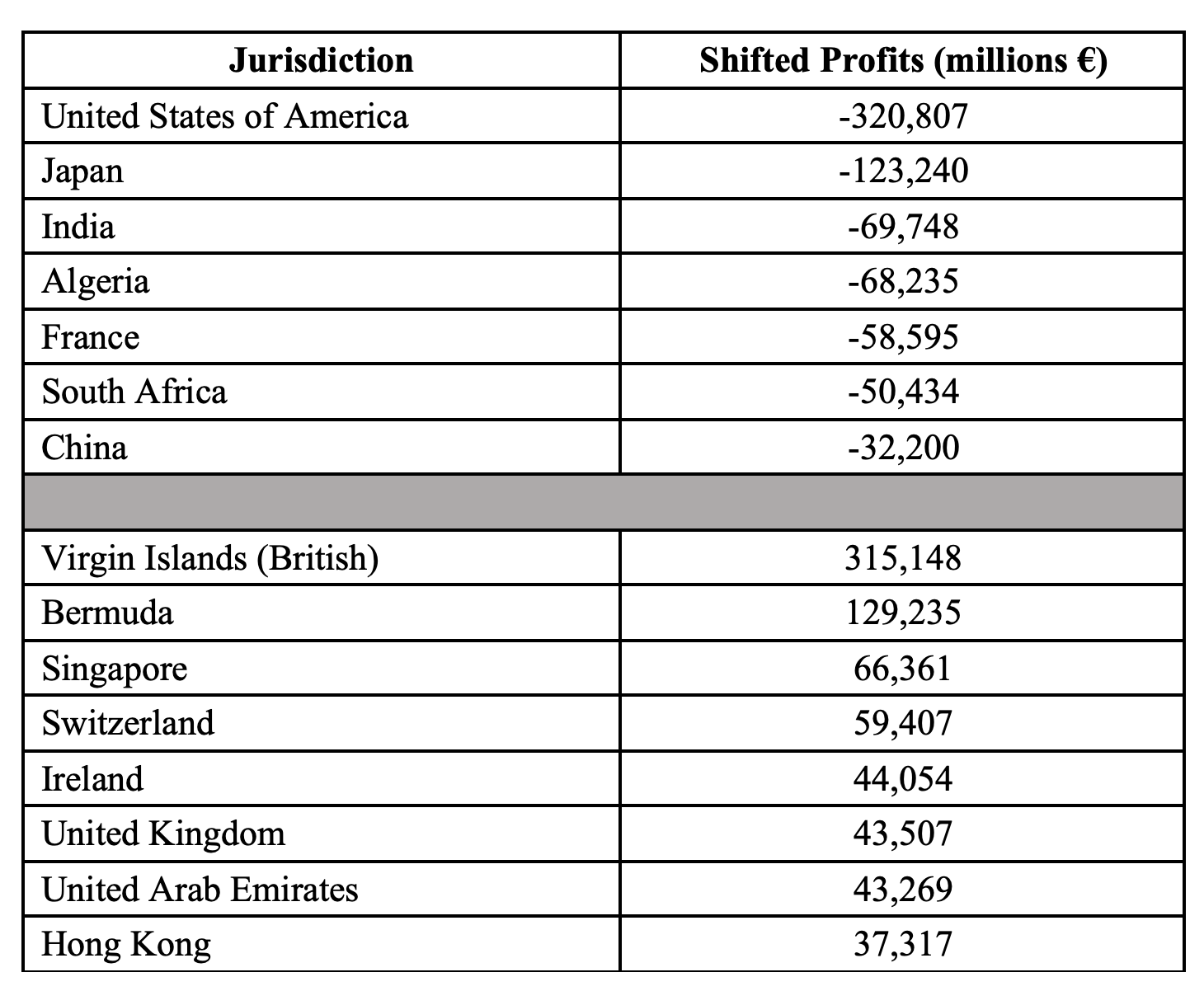

This scenario reflects a rather high concentration of profit shifting in few countries. In fact, 80% of total estimated profits shifted are found to involve seven jurisdictions of origin and eight jurisdictions of destination (Table 1).

Table 1 Estimated global shifted profits by main jurisdictions involved

Source: Bratta et al. (2021)

Figure 1 shows the average share of shifted profits over total reported profits for three categories of countries: countries with a very high negative corporate income tax rate differential (bars on the left), countries with a very high positive corporate income tax rate differential (bars on the right), and a residual group composed of all remaining jurisdictions in between (bars in the middle). The grey bars show the profit shifting response to tax rate differentials according to the conventional linear approach, which we have also investigated in our paper, therefore assuming that the MNE response is the same no matter how big the tax rate differential is. The yellow bars show the profit-shifting response to tax rate differential according to the non-linear pattern, therefore allowing for profit-shifting response to change according to how big the tax rate differential is. The average share of shifted profits over total reported profits is higher for countries with negative corporate income tax rate differentials (bars on the left). Shifted profits account for a greater share of total profits in the non-linear case compared to the linear case for countries with a corporate income tax rate that is very distant from the average – either lower (bars on the left) or higher (bars on the right). For countries with a corporate income tax rate more in line with the average (bars in the middle), the linear case provides a higher share of shifted profits compared to the non-linear case. This supports the finding that the linear approach adopted until now underestimates the relative magnitude of profit shifting in countries with corporate income tax rate differentials very distant from the average, while over-estimating profit shifting in countries whose corporate income tax rate is closer to the average.

Figure 1 Average share of profit shifting over total profits by average corporate income tax rate differential

Source: Bratta et al. (2021).

This non-linear response to tax rate differentials suggests that low-tax countries do not have any incentive to increase their tax rate as this would lead to a reduction in the tax base. Hence, they may be seen as prisoners of their own low tax rate. Conversely, countries with a corporate tax rate close to the world average would not benefit from reducing their rate as their attractiveness, from a taxation perspective, would still be limited; any effort in tax competition among high-tax countries would be then extremely inefficient.

In our paper we also find that profit shifting increases with MNE size but to a decreasing degree, suggesting that MNEs incur fixed costs when shifting profits that only become sustainable above a certain MNE size. The existence of fixed costs in profit shifting is also put forward in other studies (Bilicka 2019). We also observe different patterns of profit shifting among multinationals headquartered in Europe, the Americas, and Asia-Oceania.

In terms of policy implications, the non-linearity of profit shifting to tax rate differentials seems to suggest that, given that shifted profits appear to be concentrated in few countries and that the response of profits to tax rate in these countries appears to be highest, policies aimed at guaranteeing a minimum level of taxation may be effective and efficient to curb profit shifting since they would reduce tax rate differentials.

References

Beer, S, R De Mooij and L Liu (2020), “International corporate tax avoidance: A review of the channels, magnitudes, and blind spots”, Journal of Economic Surveys 34(5): 660-688.

Bilicka, K A (2019), “Comparing UK tax returns of foreign multinationals to matched domestic firms”, American Economic Review 109(8): 2921-53.

Bratta, B, V Santomartino and A Acciari (2021), “Assessing profit shifting using Country-by-Country Reports: a non-linear response to tax rate differentials”, DF Working papers, 11/2021.

Dharmapala, D (2014), “What do we know about base erosion and profit shifting? A review of the empirical literature”, Fiscal Studies 35(4): 421-448.

Dowd, T, P Landefeld and A Moore (2017), “Profit shifting of US multinationals”, Journal of Public Economics 148: 1-13.

Fuest, C, F Hugger and F Neumeier (2021), “Corporate Profit Shifting and the Role of Tax Havens: Evidence from German Country-By-Country Reporting Data”, CESifo working papers.

Heckemeyer, J H and M Overesch (2017), “Multinationals’ profit response to tax differentials: Effect size and shifting channels”, Canadian Journal of Economics/Revue canadienne d'économique 50(4): 965-994.

Huizinga, H and L Laeven (2008), “International profit shifting within multinationals: A multi-country perspective”, Journal of Public Economics 92(5-6): 1164-1182.

Laffitte, S, J Martin, M Parenti, B Souillard and F Toubal (2020), “International corporate taxation after COVID-19: Minimum taxation as the new normal”, VoxEU.org, 14 April.

OECD (2020), “Tax Challenges Arising from Digitalisation – Report on Pillar Two Blueprint: Inclusive Framework on BEPS”, OECD/G20 Base Erosion and Profit Shifting Project, Paris: OECD Publishing.

Endnotes

1 Fuest et al. (2021) performs analysis on firm-level country-by-country data but only on German MNEs.

2 Our dataset includes country-by-country reports filed by Italian and foreign MNEs having at least one subsidiary in Italy, thus being one of the most comprehensive and detailed datasets used for profit shifting analysis until now. Based on aggregated OECD data, we estimate that our dataset covers around 60% of total country-by-country reports filed globally.