Starting with the Great Financial Crisis of 2007–2009 and reinforced by the ongoing COVID-19 crisis, the concept of economic ‘uncertainty’ has received increased attention from economic analysts and policymakers. Given its dampening effect on firms’ investment and hiring decisions (Bloom et al. 2007, Meinen and Roehe 2017, Bloom 2009) as well as consumer spending (Gieseck and Largent 2016, Ghirelli et al. 2021, Coibion et al. 2021), it is a key variable for explaining and forecasting economic growth.

As uncertainty is not directly observable, economists have so far resorted to different proxies to measure it, such as the dispersion of economic agents’ views on the economic outlook (Bachmann et al. 2013), indicators based on forecast errors, or indicators tracking uncertainty by text mining news articles in the press.1 All of the proposed measures come with their own strengths, but also weaknesses. Dispersion-based measures suffer from the fact that disparity in views about the future is not solely driven by uncertainty, but also by genuine differences of views and understanding of the same phenomena. The main downside of proxying uncertainty by the average size of forecasting errors is that they can only be calculated ex-post with a significant time lag, i.e. the approach only allows monitoring past levels of uncertainty. Finally, the design of gauges like the Economic Policy Uncertainty Index (EPUI) by Baker et al. (2016) arguably involves some degree of subjectivity (choice of newspapers, selection of search terms).

The European Commission’s new uncertainty indicator

Since May 2021, the European Commission has enriched the toolbox available to EU policymakers for monitoring economic uncertainty by embedding a new, direct measure of uncertainty in its monthly Joint Harmonised EU Programme of Business and Consumer Surveys (BCS).2 Data for previous months are available for some member states and sectors from a testing phase, allowing for the calculation of an EU uncertainty index as from April 2019.

New survey questions ask managers and consumers to indicate how difficult it is to make predictions about their business situation and household finances, respectively. The approach thus bears similarity to survey-based uncertainty indicators available for the US and UK that exploit the distribution of own-firm sales projections of business executives (Bunn et al. 2021). Enquiring the deviation of possible economic outcomes around a central expectation, the Commission’s new measures of uncertainty are a complement to its existing indicators of ‘confidence’, which capture the central expectation itself.

The new uncertainty indicators track the pandemic well

The years 2020 and 2021 provide a unique testing environment for the new uncertainty indicators, as they have been dominated by the outbreak of an unknown infectious disease and the subsequent fight against it by means of restrictions to economic activity and social interactions. The latter caused considerable economic uncertainty as they created unprecedented disruptions to economic activity in several sectors and were put in place and withdrawn at short notice, depending on the inherently unpredictable evolution of the pandemic.

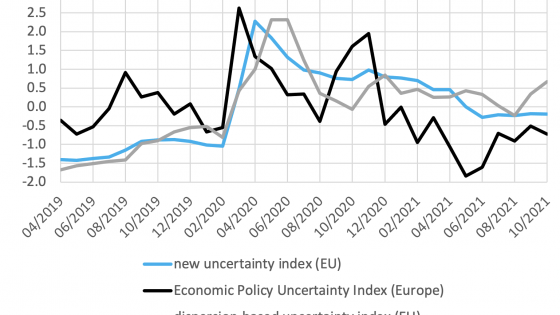

The new uncertainty measure evolved broadly in line with the stringency of the government-mandated restrictions to activity put in place to contain the spread of the COVID pandemic (see Figure 1). The EU uncertainty index peaked at the height of the first wave of the pandemic, when unprecedented lockdown measures were enacted.

Figure 1 EU uncertainty, COVID-19 stringency indices

Sources: European Commission, University of Oxford

Note: The stringency indices are compiled by the University of Oxford and report the strictness of enacted virus containment measures.

The second wave of the pandemic in autumn/winter 2020 created a much smaller increase in uncertainty, as the containment measures enacted were no longer unprecedented, and managers and consumers had gained some ‘experience’ of their likely impact, and how to adjust. Moreover, announcements about the discovery of effective vaccines in autumn 2020 arguably provided an anchor point for the expectations of people and business that the pandemic would be overcome in the medium term.

In spite of its gradual decrease over the last one and a half years, uncertainty remains above pre-pandemic levels. This seems plausible, taking into account that the pandemic health threat is still lingering, on the continent but also beyond, especially where vaccination rates have remained low so far. Moreover, the long-term impact of the pandemic crisis on the economy is still difficult to gauge.

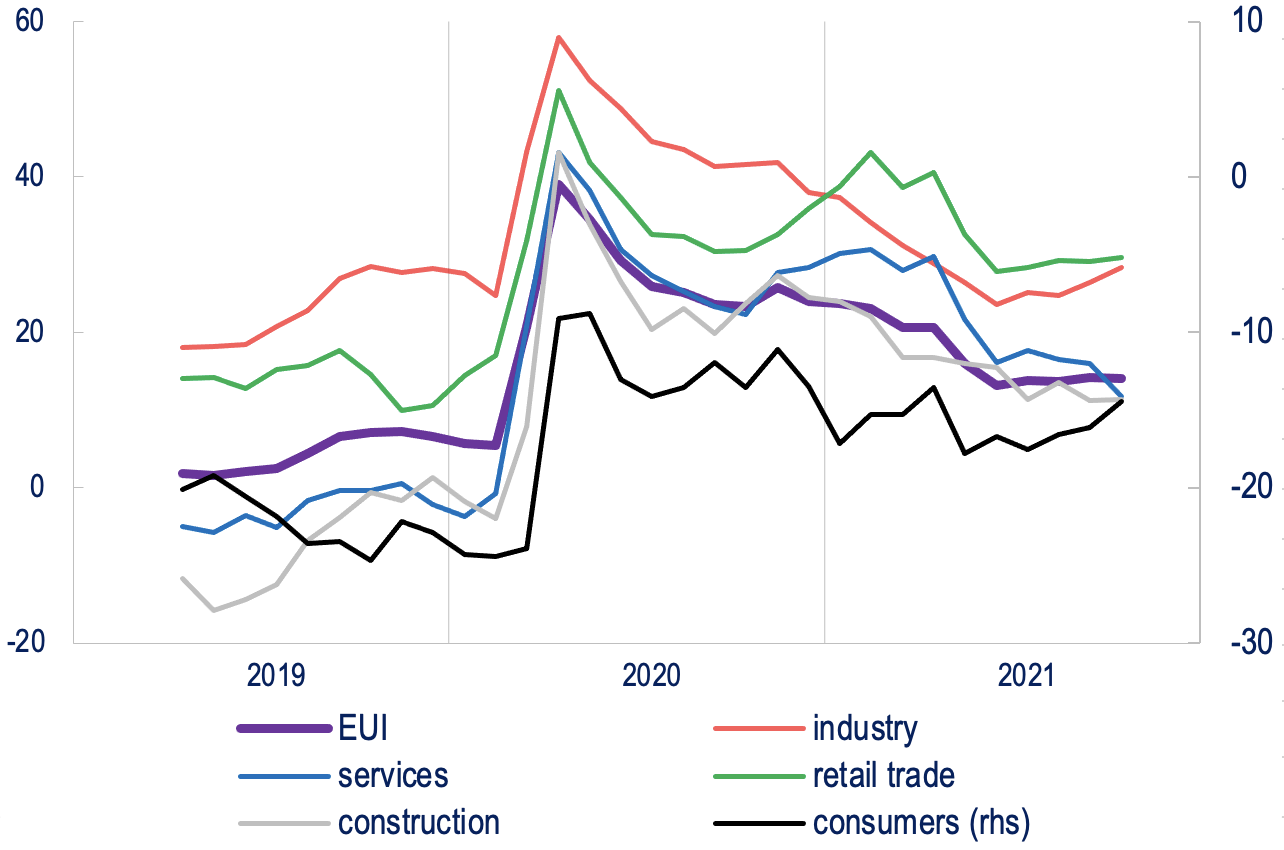

Economic uncertainty is more than a mirror image of confidence

Since 2019, economic uncertainty has been negatively correlated to developments in confidence (Figure 2), which in turn are closely related to economic developments. Thus, rising uncertainty has generally coincided with negative developments in confidence/the economy. However, the new survey-based measure of uncertainty is more than a simple mirror image of existing indicators of confidence. This can be illustrated by the fact that by summer 2021, confidence in all surveyed business sectors had strongly rebounded to levels significantly above those in spring/summer 2019.3 By contrast, uncertainty in summer 2021 remained clearly above its level two years ago.

Figure 2 EU confidence versus uncertainty

New uncertainty indicator is comparable to existing gauges, but less volatile

Comparison with a selection of existing measures of uncertainty (Figure 3) suggests that the new indicator follows broadly the same trend, but is less volatile and provides reliable informational content at an early stage (European Commission 2021). One interesting difference between the indices is the speed at which uncertainty subsides. Both the new uncertainty and the dispersion-based index suggest that uncertainty has evaporated only very gradually. It took the dispersion-based index until August 2021 to (temporarily) fall back to pre-pandemic levels. The new uncertainty index is still higher than before the outbreak of COVID-19. The EPUI, by contrast, signals that uncertainty was back to pre-pandemic levels already in August 2020. Following another peak during the second (autumn 2020) wave of the pandemic, the EPUI fell even more significantly below pre-pandemic levels in May/June 2021. The current level of the EPUI corresponds to its reading in February 2020, i.e. on the eve of the outbreak of COVID-19 on the continent. The relatively fast normalisation of uncertainty levels according to the EPUI is likely to be rooted in its focus on media content, which tends to be fast in picking up new, uncertainty-generating developments but equally quick in dropping them, once their news content has vanished.

By contrast, the Commission’s new uncertainty index suggests that managers’ and consumers’ perceived uncertainty can persist even when media attention has shifted away from the uncertainty-generating event or circumstance.

Figure 3 New EU uncertainty, dispersion-based and EPUI indicator (standardised)

New uncertainty indicator offers interesting sectoral breakdowns

A distinctive feature of the new survey-based uncertainty indicator is that it provides for a breakdown of business uncertainty by sectors and branches, or, for consumers, by socioeconomic groups (Figure 4).

Figure 4 New EU uncertainty indicator and sectoral breakdown

While all sectoral uncertainty indicators show a sudden spike in spring 2020, there are some important differences in the aftermath of the initial hit of the pandemic.

Uncertainty in industry has followed an almost uninterrupted downward path and remained unaffected by the second wave of the pandemic, reflecting the fact that the virus containment measures taken during the second wave focussed on contact-intensive activities in the services and retail sectors. In the summer of 2021, uncertainty among industry managers had sunken back to pre-pandemic levels.

By contrast, in the services and retail trade sectors, the rapid decrease of uncertainty that followed the first wave of the pandemic got interrupted by a renewed and rather protracted increase reflecting the second and third infection waves. Only as of May 2021 have indicators been posting significant drops again. In summer 2021, uncertainty in services and retail trade had only subsided by around 60% of the initial increase in the first wave of the pandemic.

In the construction sector, the pattern after the first wave of the pandemic was mid-way between the steady decline recorded in industry and the marked second increase in services and retail trade. While uncertainty among construction managers has continued to fall in recent months, it remains significantly above pre-crisis levels.

Uncertainty among EU consumers closely traces the impact of the different waves of the pandemic and the related restrictions to consumers’ professional and leisure activities. Consumer uncertainty remained high in summer 2021 and has tended to increase again in recent months.

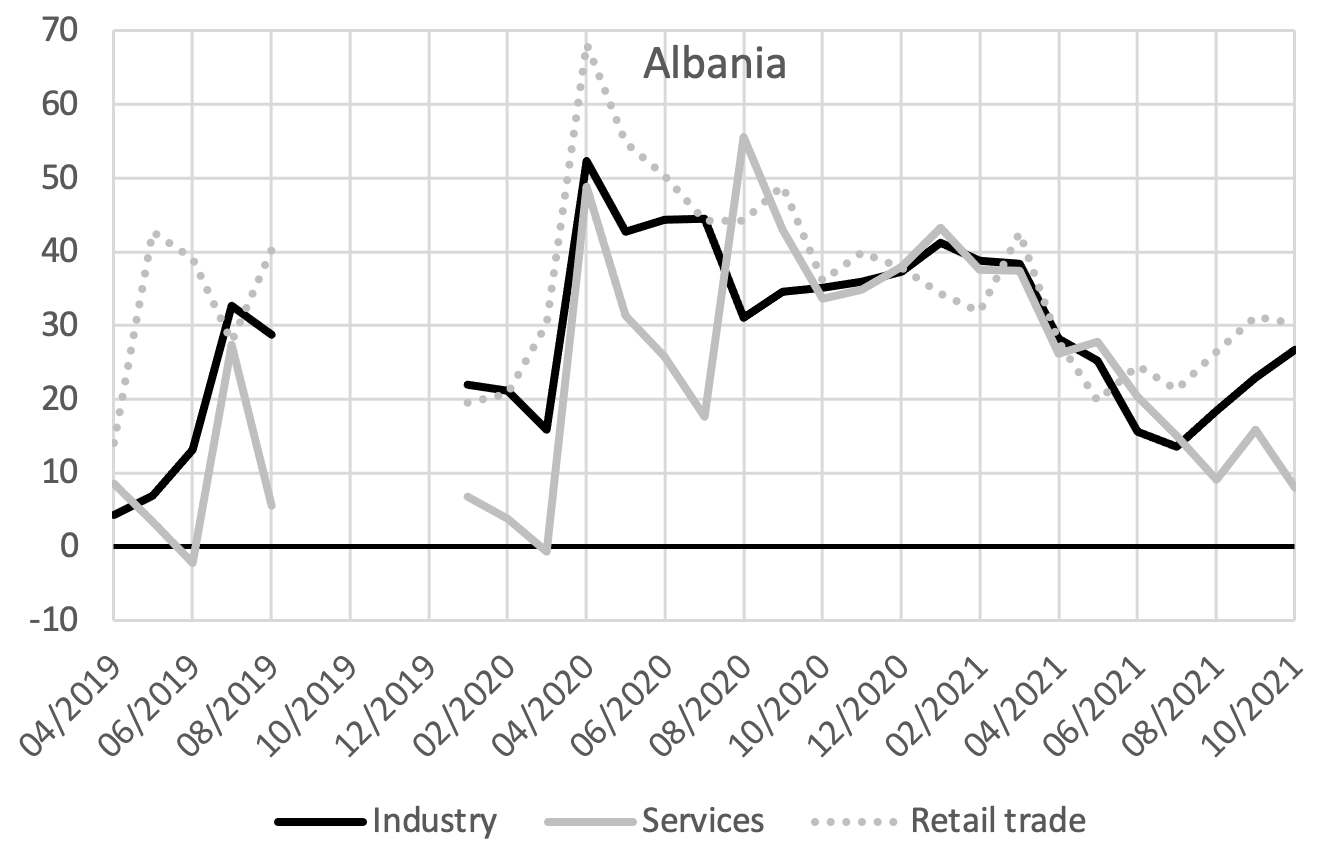

Developments are broad-based across countries

To illustrate the rather broad-based nature of the described developments and sectoral differences across countries, Figure 5 displays a selection of uncertainty indicators for countries and business sectors where data collection started in 2019 or early 2020.

Figure 5 Business uncertainty indicators in Germany, Finland, and Albania

The figure illustrates the dichotomy between industry, where uncertainty was back to (Germany, Albania) or even below (Finland) pre-pandemic levels in summer 2021, and retail trade and services, where uncertainty levels remain elevated compared to pre-crisis levels. The uptick of uncertainty in industry after the summer 2021 is likely to be a reflection of growing supply constraints in the sector due to the shortage of certain input components and raw materials (Verwey et al. 2021).

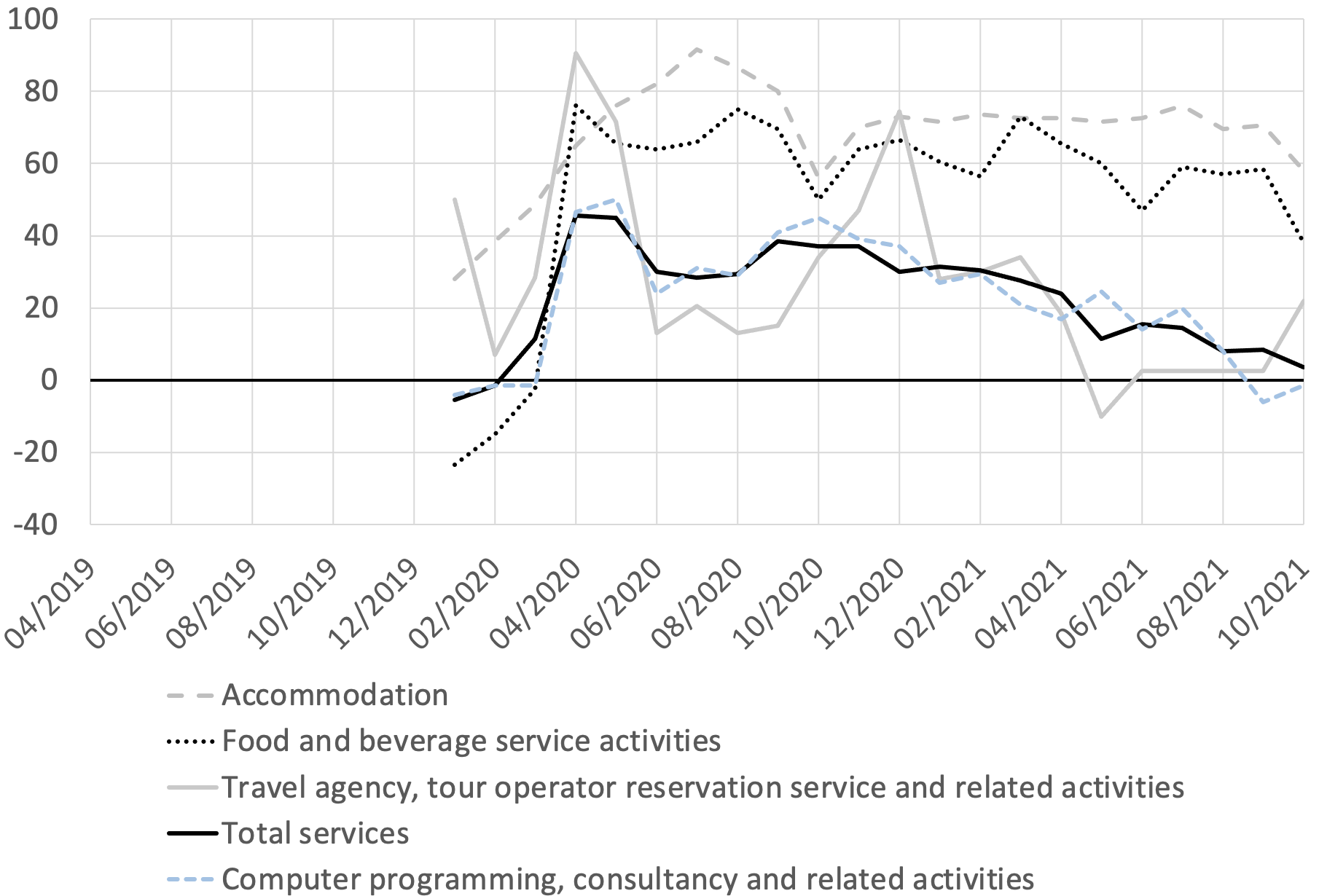

Uncertainty results are also available at branch level

The differentiated impact of the lingering threat of the pandemic on uncertainty across different industries can be further illustrated by zooming into services sub-sectors (branches). Figures 6 and 7 show the uncertainty indicator for a selection of services sub-sectors, as well as the sectoral total. The evolution of uncertainty for the total services sector (down, but still above pre-pandemic levels) masks opposing realities: in client-facing services, hardest hit by past and (potential future) restrictions, uncertainty has not yet dissipated. Namely, in accommodation and gastronomy it remains almost as high as at the peak of the first infection wave and has only recently started to ease. The same goes for travel agencies/tour operators in Germany (but not in Finland). On the other side of the spectrum, in computer programming, consultancy and related activities, uncertainty has fully returned to pre-pandemic levels.

Figure 6 New uncertainty indicators by services sub-sector (Germany)

Figure 7 New uncertainty indicators by services sub-sector (Finland)

Conclusions

The European Commission’s new measure of economic uncertainty shows a plausible empirical performance, at the EU, country and sector levels. From a conceptual point of view, the new indicator has the advantage that it is directly based on answers of firms and consumers on the foreseeability of future economic developments. It is thus a genuine and direct measure of perceived uncertainty. It has the additional advantage that it provides a breakdown of business uncertainty by sectors and branches, or, for consumers, by socio-economic groups.

The Commission started publishing the new uncertainty indicators in October 2021, in its regular press release of latest business and consumer survey results.4 The new indicators will be key in monitoring the vulnerability of the EU economies to future economic shocks.

References

Altig, D, S Baker, J M Barrero, N Bloom, P Bunn, S Chen, S Davis, J Leather, B Meyer, E Mihaylov, P Mizen, N Parker, T Renault, P Smietanka and G Thwaites (2020), “Economic uncertainty in the wake of the COVID-19 pandemic”, VoxEU.org, 24 July.

Bloom, N, S Bond and J Van Reenen (2007), “Uncertainty and investment dynamics”, Review of Economic Studies 74(2): 391-415.

Meinen P and O Roehe (2017), “On measuring uncertainty and its impact on investment: cross-country evidence from the Euro area”, European Economic Review 92: 161–179.

Bloom, N (2009), “The Impact of Uncertainty Shocks”, Econometrica 77(3): 623-685.

Gieseck, A and Y Largent (2016), “The Impact of Macroeconomic Uncertainty on Activity in the Euro Area”, Review of Economics 67(1): 25-52.

Ghirelli, C, M Gil, J J Perez and A Urtasun (2021), “Measuring economic and economic policy uncertainty and their macroeconomic effects: the case of Spain”, Empirical Economics 60: 869–892.

Coibion, O, D Georgarakos, Y Gorodnichenko, G Kenny and M Weber (2021), “The effect of macroeconomic uncertainty on household spending”, VoxEU.org, 31 July.

Bachmann, R, S Elstner and E R Sims (2013) “Uncertainty and economic activity: evidence from business survey data”, American Economic Journal: Macroeconomics 5: 217–49.

Baker, S R, N Bloom and S J Davis (2016), “Measuring economic policy uncertainty", The Quarterly Journal of Economics 131(4): 1593–1636.

Bunn, P, D Altig, L Anayi, J M Barrero, N Bloom, S Davis, B Meyer, E Mihaylov, P Mizen and G Thwaites (2021), “COVID-19 uncertainty: A tale of two tails”, VoxEU.org, 16 November.

European Commission (2021), European Business Cycle Indicators, 3rd quarter 2021, Special topic: New survey-based measures of economic uncertainty.

Verwey M, O Dieckmann and P Wozniak (2021), “From recovery to expansion, amid headwinds: The Commission's Autumn 2021 Forecast”, VoxEU.org, 16 November.

Endnotes

1 For a recent discussion and comparison of further uncertainty measures available for the US and the UK, see Altig et al. (2020).

2 The new questions became a compulsory element of the BCS surveys in industry, services, construction, retail trade and among consumers. Data are also available for candidate countries. The data are available for download on the European Commission’s website under the headline “Uncertainty indicators”. For details of the construction of the EU aggregate, see European Commission, European Business Cycle Indicators, 3rd quarter 2021, Special topic: New survey-based measures of economic uncertainty, and the BCS User guide.

3 Average confidence in the EU in the period April-August 2019 was -4.8 in industry and 11.1 in services. In June-October 2021 it was up to 12.1 and 17.4, respectively.

4 See Business and consumer surveys | European Commission (europa.eu)