Both casual observations and academic research suggest an association between natural resource abundance and civil conflict. The pattern is perhaps particularly prominent for oil wealth, where there is anecdotal evidence. Consider, for example, ISIL’s strategic control of resources in Syria and Iraq, oil theft by MEND rebels in Nigeria, and attacks on extraction facilities by Darfur insurgents in South Sudan – all examples of oil being at the centre of the conflict, both as a source of funding for the contenders and as a potential prize for the fighting. Yet, establishing a causal link between oil and conflict has proven difficult, and we do not understand fully why conflict outcomes are so different across countries with different characteristics (Bazzi and Blattmann 2014, Cotet and Tsui 2013).

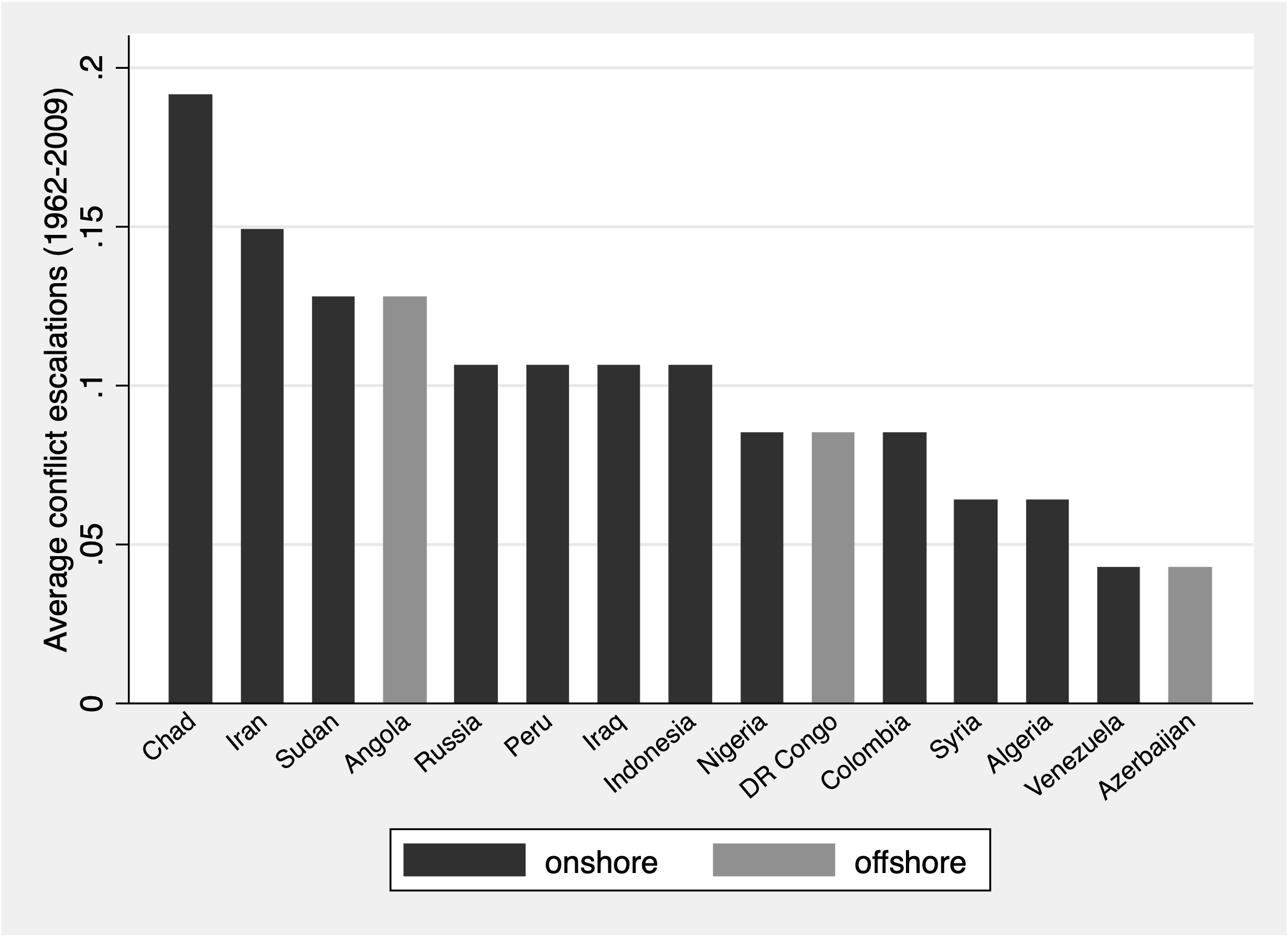

In new research (Andersen et al. 2021), we take a fresh look at the oil-conflict nexus by analysing how conflict and war escalations depend on the location of oil. We start by observing that conflict more often escalates from low-level violence to full-scale civil conflict and war in countries with predominantly onshore oil than in countries with more offshore oil (see Figure 1). This broad pattern begs an important question: Does the location of oil shape how oil windfalls causally affect conflict outcomes? And, if so, what are the mechanisms?

Figure 1

The location of oil matters

Why would natural resources fuel conflict in the first place? The two most prominent explanations are the state prize hypothesis and the opportunity cost mechanism. The former proposes that resource windfalls increase fighting because domestic rebel groups want a piece of the pie. The latter theory instead treats fighting as an economic activity whereby a resource windfall may affect the opportunity cost of engaging in conflict activities, relative to other non-violent activities. Existing empirical research suggests that which of the two mechanisms plays a role in shaping incentives for violence depends heavily on how capital-intensive the extraction of the given resource is.

Dube and Vargas (2013), for example, show that price shocks to the capital-intensive oil sector in Colombia are positively related to violent conflict, while the relationship is negative for the labour-intensive coffee sector. This lends support to the hypothesis that oil income fosters rent seeking behaviour by increasing the state prize, while income from coffee triggers an opportunity cost effect by increasing worker wages.

In our paper, instead of comparing two different types of commodities, we focus on the same commodity – oil – in order to explore a different mechanism. We argue that, while onshore and offshore oil are similar in terms of capital intensity, onshore oil is more easily accessed and appropriated by rebels than offshore oil – for obvious reasons (offshore oil fields are often located far from the shoreline and harder to loot). This affects the relative fighting capacities of government and rebels. Where there is offshore oil, the government enjoys exclusive access to fresh funds from an oil windfall, which gives an advantage over rebel groups. This dampens conflict as the contenders’ conflict capabilities become more asymmetrical, leaning in favour of the incumbent government. Where there is onshore oil, government and rebels can each access the oil and benefit from the windfall, evening out the odds of success in a conflict. This increases conflict intensity relative to an offshore oil windfall, as contenders become more equal in strength.

This interpretation, based on the different ability of government and rebels to access onshore and offshore oil facilities, echoes similar arguments on the importance of conflict financing (Fearon 2004, Collier et al. 2009). It is also in line with recent empirical evidence by Berman et al. (2017), who show that the appropriation of mining revenues by rebel groups contributes to the spreading of conflict to other parts of the country – something the authors attribute to the increased financial ability to sustain larger-scale insurgency.

What is the critical mix of onshore and offshore oil?

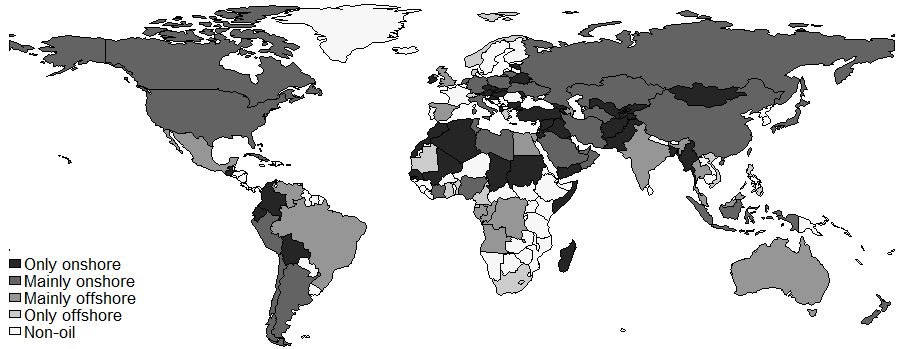

In order to gain a precise insight into how much onshore and offshore production each country has, we construct measures of onshore and offshore petroleum intensity by country, using industry-licensed data from Rystad Energy’s UCube database (2013). Rystad is an independent oil and gas consulting company headquartered in Oslo, Norway, which collects production data from oil and gas companies’ annual reports as well as authorities’ historical production accounts. Based on their data, we calculated for each country the average share of onshore and offshore oil production in GDP over the sample period 1962-2009. A map of the world, with countries sorted by their onshore and offshore oil production, can be viewed in Figure 2.

Figure 2

To achieve a causal interpretation of the link between oil income and the probability that a conflict escalates, we exploit the variation in the global price of crude oil. Oil price variation translates into oil windfalls for a country in proportion to its level of oil production: when the price increases, the country receives a positive windfall; when the price decrease, the windfall is negative. The variation in the price of oil is arguably exogenous for the majority of oil producers that do not have the market power to influence its international price.

A key innovation over previous work is that we let this exogenous variation in a country’s oil income depend on the country’s onshore and offshore petroleum intensities. Doing so, and consistent with our model predictions, we show that an increase in offshore oil income reduces the likelihood of a conflict escalating from low-level violence to civil conflict or war. By contrast, we observe the opposite effect for onshore oil, where an increase in oil income leads to a higher probability that a conflict will escalate into more violence.

These opposite effects suggest that previous null-findings of the relationship between oil and conflict may be a consequence of not taking the onshore-offshore dimension into account. In fact, when we add the onshore and offshore production volumes and look at the effect of an increase in total oil windfalls on conflict escalations, we confirm the null results from the earlier studies (Bazzi and Blattmann 2014, Cotet and Tsui 2013).

Our paper suggests that there exists a threshold amount of onshore oil extraction, above which an oil windfall raises the probability of conflict escalation. Based on the data from Rystad and estimates from our empirical model, we estimate this threshold to be at about 40% of onshore oil in total production. Countries with a share of onshore production above the threshold include conflict-ridden states like Syria, Sudan, Libya, Iraq, and Chad, while countries below the threshold include relatively stable oil-rich countries like Azerbaijan, Cameroon, and Mexico. In other words, if a country has more than about 60% offshore oil in total oil, an oil windfall on average reduces the conflict level.

How do rebels gain from oil?

How plausible is it that onshore oil provides funding for rebels, while offshore oil does not? We test the main argument of the paper using data that measure the relative strength of rebels vis-à-vis the government from Cunningham et al. (2013). When oil windfalls increase in countries with predominantly onshore oil, we see an increase both in rebel’s strength and in the number of active rebel groups. How can rebels gain from having access to oil? Walsh et al. (2018) provide detailed data on how rebels earn income from the exploitation of different types of natural resources, oil fields being one of these sources. We show that rebel groups strengthen more when there is both onshore oil and the oil is appropriable through either direct looting or the extortion of oil companies. This empirical pattern is in line with our conjecture that onshore oil is accessible while offshore is not. Hence, the two ‘types’ of oil have a different impact on the conflict capacity of rebels and governments.

Conclusion

Our research shows that the location of oil represents a key determinant of conflict escalation and de-escalation in oil rich countries. This is due to its asymmetric appropriability by the parts in conflict, with onshore oil more likely to be attacked, looted, and even seized by rebel groups, who can use the proceeds from the looting to increase their fighting capacity. While our findings indicate that countries rich in onshore oil are more likely to degenerate into civil conflict, this does not mean that offshore oil is a blessing for a country's citizens. In fact, offshore oil revenues have often provided steady resources and greater stability to oppressive governments (such as in Congo, Angola, and Equatorial Guinea). A comprehensive welfare assessment of the consequences of oil abundance and its location remains a first order question for future research.

References

Bazzi, S and C Blattman (2014), “Economic shocks and conflict: Evidence from commodity Prices”, American Economic Journal: Macroeconomics 6(4): 1–38.

Berman, N, M Couttenier, D Rohner and M Thoenig (2017), “This mine is mine! How minerals fuel conflicts in Africa”, American Economic Review 107(6): 1564–1610.

Cotet, A M and K K Tsui (2013), “Oil and conflict: What does the cross-country evidence really show?”, American Economic Journal: Macroeconomics 5(1): 49–80.

Collier, P, A Hoeffler and D Rohner (2009), “Beyond greed and grievance: feasibility and civil war”, Oxford Economic Papers 61(1): 1–27.

Cunningham, D E, K S Gleditsch and I Salehyan (2013), “Non-state actors in civil wars: A new dataset”, Conflict Management and Peace Science 30(5): 516–531.

Dube, O and J F Vargas (2013), “Commodity price shocks and civil conflict: Evidence from Colombia”, The Review of Economic Studies 80(4): 1384–1421.

Fearon, J D (2004), “Why do some civil wars last so much longer than others?”, Journal of Peace Research 41(3): 275–301.

Tesei, A, J J Andersen and F M Nordvik (2021), “Oil Price Shocks and Conflict Escalation: Onshore vs. Offshore”, CEPR Discussion Paper 16454.