The Federal Reserve is currently in the process of reviewing “the strategies, tools, and communication practices it uses to pursue its congressionally-assigned mandate of maximum employment and price stability”.1 A review of strategy is also conducted every five years in Canada. The euro area had its last review as far back as 2003, but President Draghi just hinted that a new review will be conducted under his successor’s tenure.

In many central banks, a salient feature of the strategy is the reference to an explicit long-run inflation target which defines price stability. For instance, on January 2012, the Federal Open Market Committee (FOMC) stated that an “inflation at the rate of 2% as measured by the annual change in the price index for personal consumption expenditure is most consistent over the longer run with the Federal Reserve’s statutory mandate.”2 There are several reasons for having a positive inflation target, including the tendency of price indices to overstate inflation, downward nominal wage rigidities, and the probability of hitting the zero lower bound constraint on nominal interest rates.3 These structural features may vary over time. It therefore makes sense for central banks to review their inflation target periodically.4

Low interest rates and more frequent zero lower bound episodes: A new normal?

A recent literature suggests that the average natural real rate of interest (commonly known as r*), which is a key structural factor underlying the optimal choice of an inflation target, has experienced a significant decline in advanced economies (e.g. Laubach and Williams 2016, Holston et al. 2017, Del Negro et al. 2018). This is likely a result of several forces at work – a lower trend growth rate of productivity (Gordon 2015), demographic factors (Eggertsson et al. 2017), and an enhanced preference for safe assets (Summers 2014, Caballero and Farhi 2015). Other things equal, a lower r* should lead to structurally lower nominal interest rates and, hence, more frequent episodes at the zero lower bound hampering the ability of monetary policy to stabilise the economy, and bringing about more frequent (and potentially protracted) episodes of recessions and below-target inflation (e.g. Kiley and Roberts 2017).

The strikingly low level of nominal interest rates in economies which have already exited the trap gives some support to this lower r* story. As an illustration, almost four years after its initial lift-off from the zero lower bound, the effective Fed Fund rate peaked at a mere 2.4% in 2019. This is about 275 basis points (bps) below its previous peak in 2006-07.5 Looking ahead, FOMC members report a median long-term Fed Funds rate estimate of 2.5% in the September 2019 Survey of Economic Projections, about 160 bps below its pre-crisis average.6 It is thus not surprising that the evidence of a lower r* is a key motivation for the Fed’s current strategy review (Clarida 2019).

Several prominent scholars have argued in favour of raising the long-run inflation target in the face of a lower r* (e.g. Blanchard et al. 2010, Ball 2014, Williams 2016). In so doing, central banks would tend to increase the average nominal interest rate and, everything else being constant, would buy a larger buffer against the zero lower bound constraint and its associated welfare costs. However, this policy option is controversial as a higher average inflation also induces some permanent welfare losses due to costly price adjustment and distorted relative prices (e.g. Bernanke 2016).

Is it worth raising the inflation target?

In a recent paper (Andrade et al. 2019b), we quantify this trade-off using an estimated medium-scale New Keynesian dynamic stochastic general equilibrium (DSGE) model.

Our analysis suggests that, at the margin, the costs of an upward adjustment in the inflation target in response to a lower r* are more than compensated by the benefits from a lower incidence of zero lower bound episodes. Our conclusions are based on extensive simulations of a model estimated using US data over a Great Moderation sample.7 The framework features: (i) price stickiness, and partial indexation of prices to non-zero trend inflation, (ii) wage stickiness, and partial indexation of wages to both inflation and technical progress, and (iii) a zero lower bound constraint on the nominal interest rate. The first two features imply the presence of potentially substantial costs associated with non-zero inflation. The third feature warrants a strictly positive inflation rate, in order to mitigate the incidence and adverse effects of the zero lower bound.

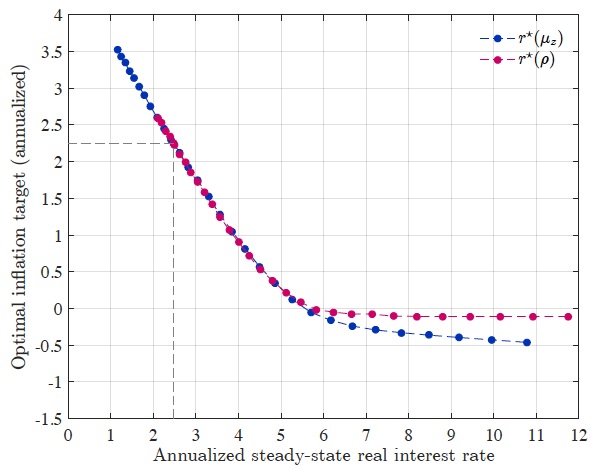

Simulating the model, we compute the optimal inflation target (π*) for various steady-state real interest rates (r*) keeping other parameters unchanged.8 The latter may vary because of either a change in productivity growth (the secular stagnation hypothesis) or a change in the discount rate (the demographics or safe assets hypotheses). Figure 1 presents the resulting (r*, π*) relation.

Figure 1 The relation between r* and π*

Notes: Figure 1 depicts the (r*, π*) relations for the US economy. The blue dots correspond to the case when the real steady-state interest rate r* varies with productivity growth (µ_z). The red dots correspond to the case when the real steady-state interest rate r* varies with the discount rate (ρ). The dashed grey lines indicate the estimated benchmark pre-crisis optimal inflation targets.

The relation is decreasing – as r* increases, the probability of hitting the zero lower bound becomes smaller and smaller, and this calls for a lower π*. For large, and empirically irrelevant values of r* (say above 6%), the zero lower bound probability approaches zero and π* becomes even slightly negative for reasons related to productivity growth that we detail in our paper. For such large values of r*, the relation is in addition flat. By contrast, when r* is low and the probability of the zero lower bound significant, increasing π* to compensate for a drop in r* and more frequent zero lower bound episodes becomes desirable.

By how much?

Our results suggest that the Fed should consider raising its inflation target in response to a lower r*. But can we be more specific? Suppose, for example, that the US experienced a permanent drop of 100 basis points in r* compared to its pre-crisis level.9 By how much should the Fed adjust its target?

According to our simulations, it should increase its long-term inflation goal by 90 to 100 basis points – that is, almost one-for-one.

As detailed in our paper, the adjustment of π* in response to a drop in r* from its pre-crisis level does not depend on the cause (productivity, demography or safe assets) underlying the structural decline in r*. It also remains close to one-for-one under alternative values of key parameters driving the costs of inflation and the incidence of the zero lower bound (such as the degree of indexation, the elasticity across varieties, or the variance of the shocks). It also holds when considering a central bank that is uncertain about the parameters describing the economy, in particular the exact value of the steady state real interest rate.

Beyond specific parameter values, one may also question the assumptions underlying our model and their implications for the trade-off between the costs of inflation and those of the zero lower bound. Figure 1 illustrates that, for the pre-crisis value of the steady state real interest rate, our quantitative model delivers an optimal inflation target of 2.2% – very close to the current 2% target. The quantification of the inflation-zero lower bound trade-off implied by our model does not seem to be much different from the one that led the Fed (and other central banks) to choose a 2% target.

Alternatives to adjusting the target

What would happen in the absence of an upward adjustment in the inflation target? According to our estimates, the probability of hitting the zero lower bound would nearly double in the US (from 5.5 to 11%). In our model, this is quite costly because short-term interest rates – both current and expected – are the only policy instrument available to stabilise the economy. But more frequent zero lower bound episodes may be much less of an issue in reality.

Indeed, there is evidence that despite the zero lower bound constraint, central banks in advanced economies managed to stabilise – at least partially – the economy (e.g. Chung et al 2019, Debortoli et al. 2019, or Eberly et al. 2019). Non-conventional monetary policies such as forward guidance and large-scale asset purchase programs have helped overcome the constraint on their conventional instrument. In addition, stabilising fiscal expansions – with potentially larger multiplier at the zero lower bound – took over constrained monetary authorities. In a way, every major central bank already adjusted to the post-crisis world by making clear that they would rely on these unconventional instruments should they need them in the future.

However, there are limits and risks attached to these alternative policies, especially if they have to be implemented frequently. Risks to financial stability may arise if interest rates are kept at very low levels for long. There are also limits on the assets eligible for central bank purchase programmes and/or risks of potential large losses incurred by a central bank in the case of recurrent large asset purchases – with their associated risks to central bank credibility and independence. And risks to public debt sustainability if too frequent fiscal expansions are needed. In sum, no matter how effective these alternative policies were over the last decade, it is unclear that they will provide enough room for manoeuvre to prevent a new long lasting zero lower bound episode when the next recession hits.

An alternative policy would be to change the central bank reaction function and to adopt strategies through which the monetary authority commits to making up for the inflation foregone during the zero lower bound episode. Simulations reported in our paper illustrate that indeed rules with a strong ‘making-up’ component – such as price level targeting – would significantly reduce the need to increase the inflation target in response to a drop in r* from its pre-crisis level. The optimal inflation target could actually be lower than 2% under such rules.

However, this adjustment of the monetary policy strategy would require that the monetary authority convince the private sector of its willingness to significantly and persistently overshoot its inflation target for (potentially) protracted periods. Andrade et al. (2019a) show that such announcements are often not credible, which undermines the effectiveness of such strategies.

In sum, how to adjust to structurally lower real natural rates of interest is a challenging but inescapable issue for central bankers. To address that question, they would ideally need a ranking of all the policy options discussed above. This goes beyond what our work can provide. That caveat notwithstanding, our results stress that raising the inflation target is an option that should be part of the menu of policies that monetary authorities consider. They also highlight the costs of lowering the inflation target while keeping the reaction function unchanged as is sometimes advocated instead.10

Disclaimer: The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.

References

Andrade, P, G Gaballo, E Mengus and B Mojon (2019a), “Forward guidance and heterogenous beliefs”, American Economic Journal: Macroeconomics 11(3): 1-29.

Andrade, P, J Galí, H Le Bihan and J Matheron (2019b), “The optimal inflation target and the natural rate of Interest”, Brookings Papers on Economic Activity, Fall.

Andrade, P, H Le Bihan and J Matheron (2017), “What would be wrong with lowering the inflation target?”, Banque de France Eco Notepad, 19 December.

Ball, L M (2014), “The case for a long-run inflation target of four percent”, IMF working paper 14/92.

Blanchard, O, G Dell’Ariccia and P Mauro (2010), “Rethinking macroeconomic policy”, Journal of Money, Credit and Banking 42: 199-215.

Caballero, R and E Farhi (2015), “The safety trap,” Review of Economic Studies 85(1): 223-274.

Chung, H, E Gagnon, T Nakata, M Paustian, B Schlusche, J Trevino, D Vilan and W Zheng (2019), “Monetary policy options at the effective lower bound : Assessing the Federal Reserve’s current policy toolkit”, Finance and Economics discussion series 2019-003, Board of Governors of the Federal Reserve System.

Clarida, R H (2019), “The Federal Reserve’s review of its monetary policy: Strategy, tools, and communication practices”, speech at the 2019 US Monetary Policy Forum, sponsored by the Initiative on Global Markets at the University of Chicago Booth School of Business, New York.

Coibion, O, Y Gorodnichenko and J Wieland (2012), “The optimal inflation rate in new Keynesian models: Should central banks raise their inflation targets in light of the zero lower bound?”, Review of Economic Studies 79(4): 1371-1406.

Coenen, G (2003), “Zero lower bound: Is it a problem in the Euro area?”, working paper series 269, European Central Bank.

Debortoli, D, J Galí and L Gambetti (2019), “On the empirical (ir)relevance of the zero lower bound constraint”, NBER Macroeconomics Annuals, vol. 34.

Del Negro, M, D Giannone, M P Giannoni and A Tambalotti (2018), “Global trends in interest rates”, NBER working paper 25039.

Eberly, J C, J H Stock and J H Wright (2019), “The Federal Reserve’s current framework for monetary policy: A review and assessment”, NBER working paper 26002.

Eggertsson, G B, N R Mehrotra and J A Robbins (2017), “A model of secular stagnation: Theory and quantitative evaluation”, American Economic Journal: Macroeconomics 11(1): 1-48.

Fuhrer, J C, G Olivei, E S Rosengren and G Tootell (2018), “Should the Fed regularly evaluate its monetary policy framework?”, Brookings Papers on Economic Activity, Fall.

Gordon, R J (2015), “Secular stagnation: A supply-side view”, American Economic Review 105(5): 54-59.

Holston, K, T Laubach and J C Williams (2017), “Measuring the natural rate of interest: International trends and determinants”, Journal of International Economics 108: 59-75.

Kiley, M T and J M Roberts (2017), “Monetary policy in a low interest world”, Brookings Papers on Economic Activity, Spring.

Schmitt-Grohe, S and M Uribe (2010), “The optimal rate of inflation”, in Friedman, B M and M Woodford (eds), Handbook of Monetary Economics, Ch.13, 653-722, Amsterdam: Elsevier.

Summers, L (2014), “US economic prospects: Secular stagnation, hysteresis, and the zero lower bound”, Business Economics 49: 65-73.

Williams, J C (2016), “Monetary policy in a low r-star world,” Federal Reserve Bank of San Francisco Economic Letter, 15 August.

Endnotes

[1] See https://www.federalreserve.gov/newsevents/pressreleases/monetary20181115a.htm.

[2] See https://www.federalreserve.gov/newsevents/pressreleases/monetary20120125c.htm.

[3] Or the ‘effective lower bound’, since there are some jurisdictions that have adopted slightly negative interest rates.

[4] Furher et al. (2018) recently make the case for regular reviews.

[5] For instance, the average of monthly Fed fund rates is 4.13% over the July 1993-July 2007, a period that includes two interest rates cycles.

[6] Comparable figures are obtained in private sector forecasts. The median Fed fund rate long-term forecast was 2.8% in the May Blue Chip Financial Forecasts Survey, or 2.5% in the July NY Fed Survey of Primary Dealers.

[7] Our setup is close to the one of Coibion et al. (2012).

[8] We assume the central bank maximises the welfare of a representative household.

[9] This is a relatively conservative scenario compared to estimates provided in recent work.

[10] Andrade et al. (2017) discuss in more details why lowering the inflation target would be a bad idea at the current juncture.