Potential output and the output gap are key metrics for policymakers to assess the cyclical position and productive capacity of the EU and euro area economies (Ademmer et al. 2019). Output gap estimations, despite being subject to uncertainty in real time, provide valuable information to policymakers, most notably when the economy is hit by large and overlapping shocks, as is the case with the Covid-19 pandemic.

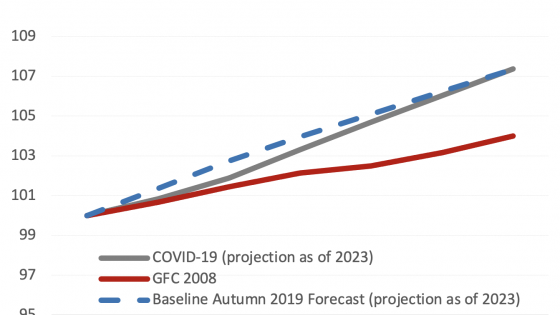

In this context, a key macroeconomic take away from a recent joint OGWG-ECFIN-JRC conference on “Assessment of output gaps and potential output in the context of the COVID-19 pandemic and its aftermath” is that the Covid-19 shock to the EU’s potential output is very different from that of the 2008-09 Global Crisis. Participants largely agreed that the Covid-19 shock is likely to be more temporary in nature and that strong policy support has limited the kind of scarring effects that persisted long after the Global Crisis (Figure 1).

Figure 1 Financial and Covid shocks are very different

Source: European Commission

Estimation of output gaps and potential output in the face of crises

The EU’s Output Gap Working Group (OGWG) has been responsible, over the last 20 years, for the development of the EU’s Commonly Agreed Methodology for producing potential growth and output gap estimates (EUCAM). Given the complex dynamics of ever-evolving economic systems, EUCAM will always be ‘work in progress’. Indeed, over the two decades of its existence, the OGWG has been ‘learning by doing’, particularly when EUCAM was confronted with major economic shocks.

- Having overestimated potential substantially in the pre-2008 boom, the productivity and structural unemployment components of EUCAM were subsequently revised. More external oversight was introduced, with peer reviews by independent academic experts and systematic cross-checks against alternative methodologies (the ‘Plausibility Tool’).

- A decade later, criticism addressed at EUCAM and its role in the EU’s fiscal surveillance procedures focused on the plausibility of closing output gaps amid protracted low inflation (Brooke 2019, Tooze 2019). Following a careful weighing of the evidence (Buti and Carnot 2018, Buti et al. 2019), the methodology was left unchanged.

- Finally, Covid-19 necessitated a series of temporary adjustments to EUCAM to avoid excessive procyclicality in the potential output estimates (Thum-Thysen et al 2022). These adjustments ensured that almost all of the pandemic-related downturn in actual GDP went into the output gap estimates, reflecting the view that the ‘frozen’ capital and labour components of the EU’s supply-side capacity could emerge largely unscathed from the pandemic – as long as the policy response was sufficiently robust and the recovery was rapid.

The joint Commission-OGWG conference helps support the OGWG in its responsibility to review new analytical insights that could lead to improvements in EUCAM.

Covid-19 affects humans, not machines

Michael Burda (Humboldt University Berlin) stressed that the most significant impact of the crisis was on the labour part of the production function in terms of illness, labour hoarding, and search and matching effects. In the EU, reliance on labour hoarding was larger than in the US, resulting in labour productivity per person rising in the initial phase of the crisis in the US but temporarily falling in the EU. He also noted that mismatch and labour shortages are on the rise (currently more so in the US than in the EU), and that the Phillips curve model was especially challenged in the pandemic-context due to labour hoarding (since it does not account for unfilled vacancies and search-and-matching).

Post pandemic, total factor productivity will revert to its weak pre-pandemic trend

Nicholas Bloom (Stanford University) and Gregory Thwaites (Nottingham University) looked at productivity growth from the past, present and future perspectives. They argued that the secular decline of productivity growth in advanced economies is due to the fact that ‘ideas are getting harder to find’. Total factor productivity (TFP) growth rates have continued to decline despite a massive increase in research efforts in the US since the 1950s. Turning to the present, private sector TFP dropped by up to 4% during the pandemic, with a projected 1% aggregate TFP reduction over the medium term. ‘Within-firm’ productivity dropped sharply and is only partly offset by positive ‘between-firm’ effects, as less productive sectors, and less productive firms within those sectors, contracted. With respect to future productivity trends, despite changes induced by the crisis, such as working from home, their central scenario is that economies will return to their relatively weak pre-pandemic productivity patterns.

Transitory effects of Covid-19 on potential… though uncertainty remains

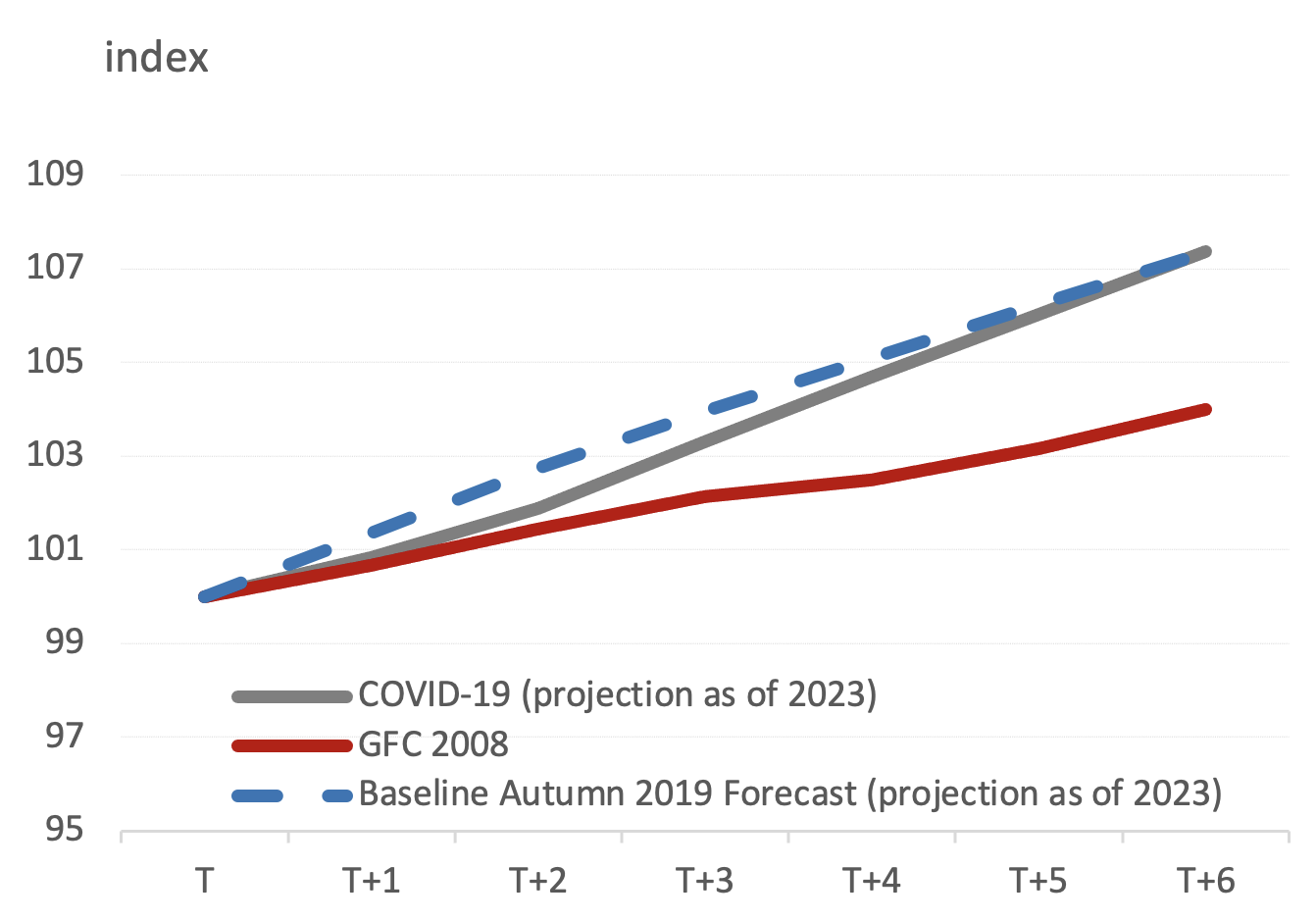

While all participants acknowledged that it was still too early to assess the full implications of the complex mix of pandemic-induced demand- and supply-side disruptions, an assessment of the latest evidence provided grounds for optimism. The message from the presentations from the European Commission (Anna Thum-Thysen), the OECD (Yvan Guillemette), the IMF (Allan Dizioli), and the ECB (Katalin Bodnar and Bela Szörfi) on the impact of Covid-19 was generally upbeat (Figure 2). Speakers suggested that the lasting impact of the pandemic on potential output, assuming ongoing policy support, was likely to be relatively limited and short-lived. Despite this optimism, all speakers stressed that downside risks needed to be closely monitored. Negative long-term implications of Covid-19 could still arise from adverse sectoral developments; the withdrawal of part of the labour force from the labour market; underinvestment and earlier obsolescence of physical capital; a wave of delayed bankruptcies; the negative effects of Covid-19 on human capital accumulation; as well as frictions in the reallocation of labour and capital.

Figure 2 Potential growth estimations in spring 2021

Source: European Commission European Economic Forecast, OECD Economic Outlook, IMF World Economic Outlook, Spring 2021 vintages

Avoiding hysteresis and the clogging up of reallocation channels

Ethan Ilzetzki (London School of Economics) argued that statistical trend/cycle decomposition methods track actual output too closely and thereby identify a loss of potential output when GDP slumps for a prolonged period. This can lead to misguided policy advice, in particular an insufficient demand boost from fiscal policies. Monetary and fiscal policies can and should lean against the risks of cyclical underemployment becoming structural (hysteresis) or a prolonged period of low demand affecting potential (scarring).

Atanas Hristov (DG ECFIN) proposed a possible improvement to the estimation of the ‘non-accelerating wage rate of unemployment’ (NAWRU). His model of the labour market takes into account changes to the labour input both at the extensive (employment) and the intensive (hours worked, effort) margins. First evidence suggests that this could outperform the existing EUCAM specification, in particular in combination with a proposed new labour hoarding indicator based on firm-level data (Hristov and Thum-Thysen 2022).

Finally, addressing uncertainty about the long term effects of Covid-19, Pilar Cuadrado (Bank of Spain) presented alternative estimates based on production function, sectoral, and statistical approaches. Although short-run estimates differed considerably across the three methodologies, all of the estimates involved a fast recovery of potential growth rates to close to pre-pandemic values, pointing to the absence of sizeable scarring effects on Spanish potential growth.

Developing more robust capital input data and exploiting the potential of Big Data

All trend/cycle decomposition exercises ultimately depend on the quality of the input data. For production function approaches, capital stock data are crucial. Robert Stehrer (WiiW) and Eurostat (J Cabeca, A Panizo Espuelas, Jenny Runessen, and Christine Gerstberger) reported on their efforts to improve the cross-country comparability of national accounts capital stock data and to compile and publish capital productivity and multifactor productivity indicators by the end of 2021.

Marco Ratto and Luca Onorante (JRC) presented the results of a project to ‘nowcast’ GDP in the context of the crisis. Their approach joins nowcasting techniques and timely available ‘big data’ (such as internet search terms and real-time mobility data) to gauge the crisis impact. They concluded that big data can be useful for analysing the economy both during the Covid-19 crisis and in more normal times. But analysts should cross-check the signal coming from a number of models and should carefully select data sources.

Price inflation may not be a good gauge of the output gap amid persistent demand shocks

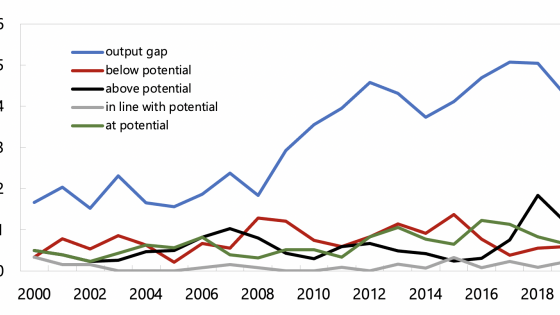

Kieran McMorrow (DG ECFIN) discussed whether a co-movement or decoupling relationship should currently be expected between output gaps and inflation. He raised concerns about the trend/cycle decomposition methodology used by the ‘Campaign Against Nonsense Output Gaps’ (CANOO) (Brooks 2019), which postulates co-movement of output gaps and inflation. This approach disregards the possibility of trends in price inflation and fails to provide accurate signals in different cyclical circumstances.

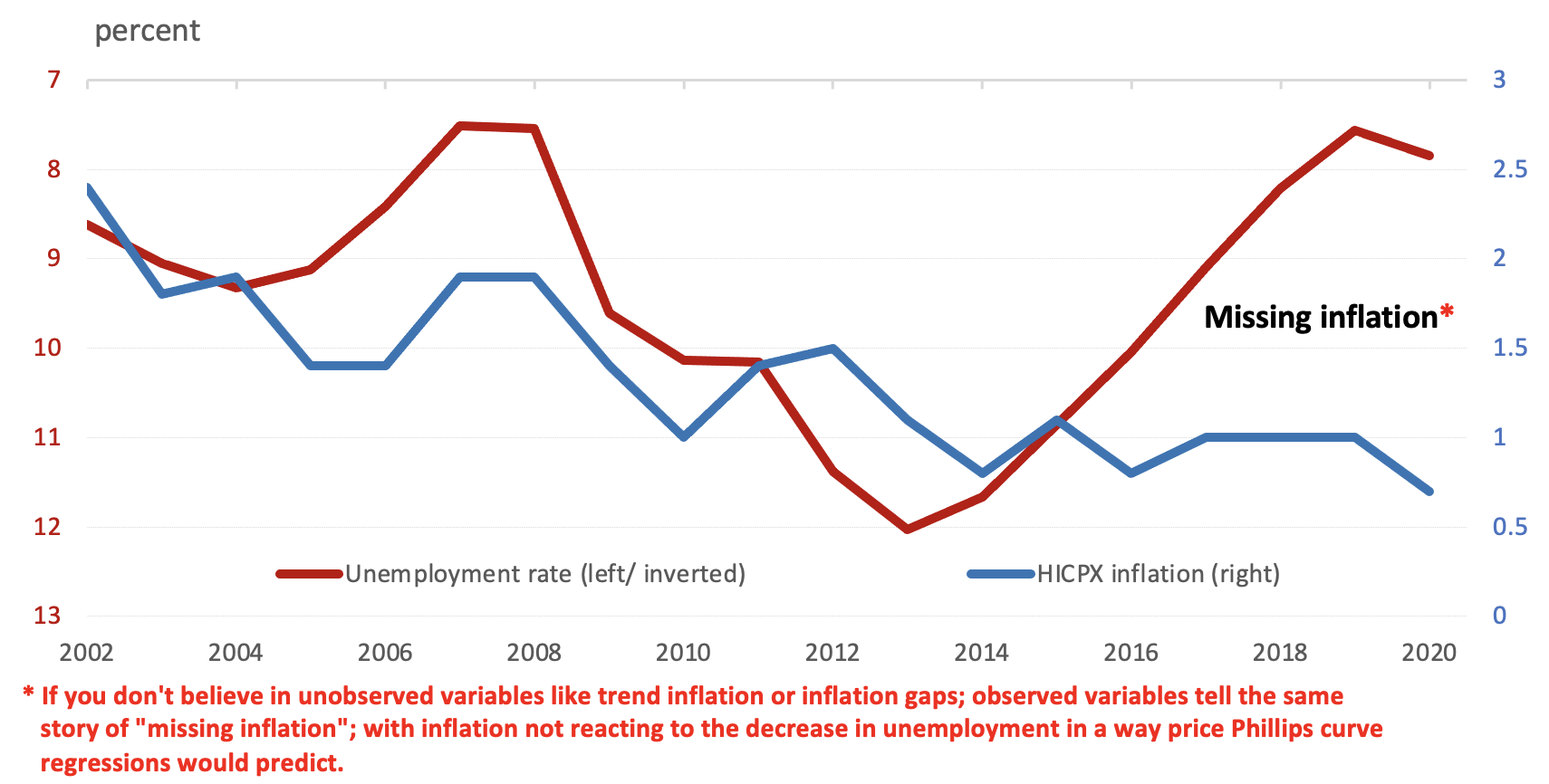

Picking up on the ‘missing inflation puzzle’, Werner Roeger (DIW) looked at the relationship between the output gap and inflation in the presence of persistent demand shocks. He showed that a change in trend inflation can occur in a long-lasting liquidity trap or secular stagnation environment. This offers a plausible explanation as to why the euro area experienced a closing output gap with low inflation before the pandemic (Figure 3).

Figure 3 Unemployment and core inflation in the euro area

Note: HICPX is HICP inflation excluding energy and food and hence abstracting from large swings in oil prices and food commodity prices, respectively. Such a measure of HICP excluding food and energy can be interpreted as an ‘anchor indicator’ for inflation.

Source: Bobeica and Sokol (2019)

Andreas Zervas (Greek Ministry of Finance) explored the stability of the wage and price Phillips curves for the euro area. His results suggest a fall in the estimated effect of the business cycle variables (output or the unemployment gap) on inflation.

New approaches to output gap calculation could also help to reduce uncertainty

The concluding session was devoted to the exploration of alternative trend/cycle decomposition approaches. Fabio Canova (Norwegian Business School) investigated the properties of output gaps and of transitory fluctuations in a variety of DSGE models. He proposed a number of explanations for the distortions generated by popular statistical filters. He concluded that gaps were best approximated with a polynomial filter, and that a differencing approach should be adopted for transitory fluctuations.

Knut Aastveit (Norges Bank) went on to argue that a dynamic factor model can substantially reduce revisions of real-time output gap estimates for the US economy. A combination of forecasted and nowcasted data greatly reduces the end-of-sample imprecision in his gap estimate, with benefits for real-time policy advice.

Vasja Sivec (STATEC Lux) proposed to estimate the output gap with inequality constraints. This new method corrects the output gap when it is inconsistent with macroeconomic theory and leaves it unconstrained otherwise. Using a vintage dataset from 2004 to 2021, he showed that the new output gap estimates are better correlated with selected cyclical macroeconomic variables; revisions are smaller; and forecasting power increases.

Authors’ note: All views expressed are summarised to the best of our understanding from the various conference participants’ contributions and should not be interpreted as the views of the European Commission.

References

Aastveit, K and T Trovik (2014), “Estimating the output gap in real time: A factor model approach”, The Quarterly Review of Economics and Finance.

Ademmer, M, J Boysen-Hogrefe, K Carstensen, P Hauber, N Jannsen, S Kooths, T Rossian and U Stolzenburg (2019), “Schätzung von Produktionspotenzial und -lücke: Eine Analyse des EU-Verfahrens und mögliche Verbesserungen“, Kieler Beitraege zur Wirtschaftspolitik 19.

Bloom, N, C I Jones, J Van Reenen and M Webb (2020), “Are Ideas Getting Harder to Find?”, American Economic Review 110(4).

Bloom, N, P Bunn, P Mizen, P Smietanka and G Thwaites (2021), “The impact of COVID-19 on productivity”, NBER Working Paper 28233.

Bobeica, E and A Sokol (2019), “Drivers of underlying inflation in the euro area over time: a Phillips curve perspective”, ECB Economic Bulletin 4/2019.

Brooks, R (2019), “The campaign against nonsense output gaps (CANOO)”, Twitter.

Buti, M and N Carnot (2018), “The case for a central fiscal capacity in EMU”, VoxEU.org, 7 December.

Buti, M, N Carnot, A Hristov, K McMorrow , W Roeger and V Vandermeulen (2019), “Potential output and EU fiscal surveillance”, VoxEU.org, 23 September.

Chalaux, T and Y Guillemette (2019), “The OECD Potential Output Estimation Methodology”, OECD Economics Department Working Papers 1563.

Canova, F (2020), "FAQ: How do I extract the output gap?", Working Paper Series 386, Sveriges Riksbank (Central Bank of Sweden).

Croitorov, O, P Pfeiffer, M Ratto and W Roeger (2021), “Output Gap and Inflation with Persistent Demand Shocks” (forthcoming).

Dizioli, A (2021), “A Pandemic Forecasting Framework: An Application of Risk Analysis”, IMF Working Papers 226.

Gullemette, Y and T Chalaux (2018), “If potential output estimates are too cyclical, then OECD estimates have an edge”, OECD Economics Department, 16 October.

Hristov, A (2022), "Labour Effort and the European Wage Phillips Curve", (forthcoming).

Hristov, A and A Thum-Thysen (2022), "Measuring Labour Hoarding with Existing Firm-Level Survey Data", (forthcoming).

Hristov A, V Vandermeulen and R Raciborski (2017), “Assessment of the plausibility of the output gap estimates”, European Economy Economic Brief 023, April.

Roeger W, K McMorrow, A Hristov and V Vandermeulen (2019), “The current debate on output gaps and cyclical indicators”, European Economy Discussion Papers, July.

Thum-Thysen, A, F Blondeau, F d’Auria, B Döhring, A Hristov and K McMorrow (2022), “Estimation of output gaps and potential output against the backdrop of the COVID-19 pandemic: the EUCAM approach”, Quarterly Report on the Euro Area, (forthcoming).

Tooze, A (2019), “Output gap nonsense”, Social Europe, 30 April.

Turner, D, M C Cavalleri, Y Guillemette, A Kopoin, P Ollivaud and E Rusticelli (2016), “An investigation into improving the real-time reliability of OECD output gap estimates”, OECD Economics Department Working Papers 1294.

Sivec, V (2022), “Shadow Output Gap”, (forthcoming).

Zervas, A (2021), “Is the Phillips curve in the Euro area stable?” (forthcoming).