In a public health crisis, the EU has limited authority and few tools at its disposal to help fight it. The EU Commission can help by coordinating member states’ policies, via joint procurement of medical equipment or the safe return of Europeans overseas, for example. It can use its limited funds for virological and epidemiological research and help redirect EU budget items to support health systems. At times, the Commission has had to keep member states from harming the common interest, such as excessive use of border controls or export bans.

Economic policies are also largely in the hands of national governments. It is they who decide how to support a struggling economy under lockdown, whether to defer taxes, subsidise lending to companies, increase sick pay, institute schemes to keep workers on the payroll and the like. And national governments will have to foot the bill for these measures.

The COVID-19 crisis, however, is bound to be so expensive that some national governments may be overwhelmed by the subsequent increase in public debt (see chapters in Baldwin and Weder di Mauro 2020). In that case, two equally dangerous scenarios are possible. Either some member states, fearful of a high future debt burden, may not spend as much as is needed to preserve their economies and will end up much worse off than countries that are able to spend more. Or these member states do spend as much as needed, but may face increasingly high interest rates as markets doubt that public debt is sustainable, at which point the euro area may face yet another existential crisis.

To avoid these two scenarios, we propose a Pandemic Solidarity Instrument (PSI) that would lead to a partial sharing of the fiscal costs of this crisis through the issuance of a one-off EU – not euro area – asset in the market. The funds raised through this asset would then be used to:

- help countries to cover the costs that are directly related to fighting the virus

- ensure firms have enough liquidity to survive the lockdown, via the European Investment Bank (EIB)

- subsidise firms to keep workers on the payroll, via new European co-financing of national short-work schemes

- kickstart the economy, once it is safe to do so, where the hit was hardest, via new European co-financing of national stimulus plans.

Our proposal would not add another layer of market-access insurance for euro area countries.1 There are already two powerful institutions providing those. The first is the ECB, which not only sets monetary policy for most European countries, but is also de facto the lender of last resort to euro area governments – much like national central banks everywhere. With its recent Pandemic Emergency Purchase Programme (PEPP), the ECB has made sure that all countries will have low funding costs during this crisis. The second institution is the European Stability Mechanism (ESM), the euro area’s bailout fund, which can provide loans and precautionary credit lines to countries that struggle to fund themselves on markets. Non-euro countries have access to the EU’s balance-of-payment facility, which provides similar help. Our proposal rather fills a gap left by the EU budget: it is currently unequipped in terms of both size and structure to provide the kind of burden sharing across the entire Union that is needed in this unprecedented crisis.

The economic hit, and possible fiscal response needed, and the impact on debt

It is near impossible to predict the economic fallout from this crisis. Governments have not shut down societies in living memory, and at the time of writing, it was still unclear when countries in Europe will be ready to lift the restrictions on workers and the economy, and how strongly the economy will rebound.

But we can draw on first estimates. The OECD and the IMF (as well as various national bodies) have recently published their assessments of the economic impact of the current shutdown in Europe. The conclusions are roughly similar. We follow the OECD’s assessment, which calculates that economic output under lockdown is 25% lower than would otherwise be the case. If we assume a lockdown of three months and a linear recovery over the next three months, output would be 8.3% lower than it would otherwise have been. For the EU, this would mean about €1.2 trillion in lost output for 2020.2

There are two effects on government balances.

The first is a hit to GDP reduces tax revenues. A revenue shortfall of 8.3% amounts to €560 billion in lower revenues for EU-27 governments in 2020 (roughly 4% of 2019 EU-27 GDP).3

Second, governments are scrambling to enact support packages for firms and workers, in the form of liquidity loans, grants to the self-employed and subsidised short-work schemes to encourage firms to keep workers on the payroll, and one-time cash grants to the hardest hit in society. Later on, when confinement measures are gradually lifted, they will have to put in place sizable stimulus packages. Some of these policies will limit the revenue shortfall, as they stabilise incomes and consumption which are then taxed. Others are liquidity provisions which will be repaid. But by and large, these measures add to public deficits, which governments will have to fund on markets.

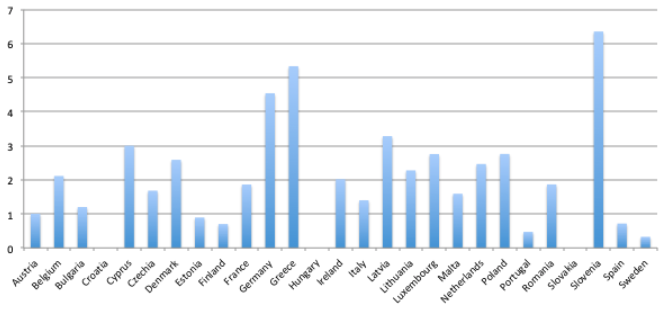

Figure 1 Direct fiscal expenditures in response to COVID-19 (% of GDP)

Source: Redeker and Hainbach (forthcoming).

All member states of the EU are having to impose shutdowns. But the impact of COVID-19 will be asymmetric, for three reasons.

First, the health impact may be different across countries, for various reasons. Italy was unfortunate that it was hit first, without being able to draw on lessons other than those from China. Differences in social interaction across the EU may also have contributed, as well as different healthcare structures and funding.

Second, the economic structure of EU countries differs. Some countries, such as Germany, are heavily reliant on manufacturing; others on services, especially tourism. Manufacturing not only stands a good chance of making a full and relatively swift recovery; there is also a good chance for some pent-up demand, as some purchases will be postponed. Services, on the other hand, stand to suffer for a longer period: customers may continue to fear infection, and are less likely to make up for foregone purchases (people are unlikely to go to the restaurant twice because they missed out on a visit during the lockdown). More services- and tourism-oriented economies will therefore be hit harder.

Third, countries start from different positions. Italy was already struggling economically and labouring under a debt burden of over 130% of GDP. In Spain, unemployment still stood at 14% as a result of its long-lasting economic crisis. Not all countries are therefore in a position to shake off a public health crisis without considerable long-term economic damage.

Three scenarios for Europe’s economic response

For these reasons, Italy and Spain are likely to suffer most, both economically and in terms of health outcomes. This leads to the following three scenarios for the economic response to the crisis in Europe.

Scenario 1: Timidity and divergence

Countries in the EU enact support and stimulus packages according to their respective economic and fiscal strength. Countries with high debt burdens and struggling economies, such as Italy or Spain, implement the most urgent support measures only; while economically and fiscally strong countries support their firms and workers generously, and stimulate a swift recovery after the lockdown ends.

As a result, economic fortunes in Europe diverge drastically, as some member states limit the economic fallout and generate a proper recovery, while others see a sizable part of their private sector go into bankruptcy, leading to mass unemployment and long-term economic scars. The effect on public debt in the most vulnerable countries is uncertain: a timid response to the unfolding economic crisis could well make public debt (relative to GDP) increase faster than a bolder policy response and stimulus. In any case, this is a nightmarish scenario for Europe. Divergences of economic fortunes within the Single Market were already substantial before the crisis. In this scenario, they would become politically untenable and would give rise to economic nationalism in countries like Italy, probably leading to calls for an exit from both the Single Market and the euro. Worsening economic prospects in some countries would also have negative spill-over effects on others, as bankruptcies would raise the cost of imports, and there would be lower demand for exports.

Scenario 2: Overburdening vulnerable member states

The ECB’s PEPP and access to the ESM convince all countries that their response to the on-going crisis should be as bold as is necessary to minimise the economic fallout. For the reasons noted above, that bolder response may lower public debt relative to scenario 1. But countries will end up with a much higher debt burden. As the ECB withdraws PEPP support, markets may reassess whether Italian or Spanish debt is sustainable.

The ECB’s PEPP programme can be defended on legal grounds (Grund 2020), but the ECB is still barred from financing governments directly. Monetising public debt is therefore the absolute last resort, and may be impossible politically. Rapid reductions in debt ratios through post-crisis growth is unrealistic for countries with low growth potential. In this scenario, some member states may be constantly in danger of losing access to financial markets, which would inevitably undermine their growth prospects further. Resolution may come through a restructuring of one or several member states’ public debt, or countries might need constant support by the ECB. This scenario is also unviable for Europe.

Scenario 3: Burden sharing

Scenarios 1 and 2 are likely to break the political fabric of the EU. The only viable scenario involves burden sharing among all EU member states. Countries need to be able to spend what is needed without ending up on the cusp of an unsustainable debt burden. Europe needs political agreement on the principle that a large part of the costs of the pandemic have to be shared in a way that all countries can take the necessary measures without being financially overwhelmed. Then member states can agree on an economically and legally sound instrument that is capable of delivering this kind of burden-sharing.

In what follows, we outline what such an instrument could look like.

The Pandemic Solidarity Instrument

We propose a one-off common EU crisis response that is tailored to this specific crisis. Burden-sharing in this crisis should not permanently alter the financial architecture of the EU or of the euro area. Nor do we need to create new institutions. The aim is to ensure that the old institutional setup has a reasonable chance of surviving this crisis. It also aims to give all countries the certainty they need to spend as the crisis requires. Otherwise, we may end up in scenario 2, with highly indebted countries doing too little, causing long-term economic damage. To provide this certainty, burden-sharing has to be agreed now, not in a few months.

Through our Pandemic Solidarity Instrument, the EU would raise the necessary funds in markets on its own account. It would spend those funds in four ways: to cover costs directly related to fighting the virus; to strengthen the EIB; to subsidise short-time work schemes; and to co-finance national stimulus packages once economies are opening up again. The Instrument would be set up under Article 122 of the Treaty on the Functioning of the European Union. The appendix below explains in detail the legal implications.

This is how the Instrument would work in practice.

Expenditure

- All countries should have the necessary means to finance the health-related costs of this crisis. €20 billion of the funds raised by the Instrument should be made available to member states to cover COVID-related healthcare costs, such as the purchase of additional ventilators, protective gear and the set-up of new intensive-care units. The Instrument would cover 80% of eligible expenditures while member states cover the remaining 20%.

- Companies should receive the necessary liquidity throughout the Union to survive the lockdown. The EIB has proposed an EU-wide scheme to this end and has asked for €25 billion in guarantees to fund liquidity support of about €200 billion. This is a good start, but too small to have a sizable effect throughout Europe. Initially, Germany’s liquidity programme, via its public investment bank KfW, had a volume of about €465 billion, but it is now unlimited. Since Germany makes up 25% of EU27 GDP, an EU-wide scheme should aim for liquidity support of at least €1.8 trillion. The EIB should provide half of this support, with the other half provided by national governments and public investment banks. To this end, the EIB should receive about €120 billion of the Instrument’s funds in the form of direct guarantees from the EU.

- The EU should support efforts that help Europeans keep their jobs during the containment phase, such as the French ‘chômage partiel’ or Germany’s ‘Kurzarbeit’ (short-work) scheme. Such schemes already exist in many member states and could be introduced in more.4 For every worker that is furloughed under such a scheme, the EU should contribute up to 40% of the net salary as long as member states match this one-to-one. In addition, all member states should receive a subsidy of short-term unemployment benefits of up to 25% of the net salary as long as the subsidy is matched by the member state for the first six months of unemployment. Payouts here would depend on labour market developments in member states. It is impossible to estimate ex ante the cost of this scheme, given the uncertainty about the size and duration of the impact of COVID-19. The German ‘Kurzarbeit’ scheme cost about €4.6 billion in 2009, with 1.1 million beneficiaries.5 A ballpark estimate is that uptake in the German Kurzarbeit scheme could well end up three times higher than in 2009. In 2009, Germany also paid out €17 billion euros in unemployment benefits in a situation where job losses were comparatively limited. Taken together, these figures lead us to estimate a minimum EU-wide need of about €30 billion for short-term work schemes and about €70 billion for short-term unemployment benefits, thus bringing funding needs to €100 billion.

- All countries will need to deploy substantial fiscal stimulus once containment measures can be gradually lifted (Odendahl and Springford 2020). Some countries will need more than others. The more an economy relies on sectors in which pent-up demand is unlikely (in particular services such as tourism), the more the state will have to stimulate spending. The EU should support such measures: our Instrument should fund 50-75% of eligible fiscal stimulus measures. Measures should be eligible if they have a clear stimulating effect; are not undermining EU goals such as the fight against climate change; and have tangible spill-overs to the rest of the Union. The overall envelope per country should be calculated based on the GDP shortfall in the first half of this year. The more dependent the economy is on sectors that are unlikely to see catch-up effects, the larger co-financing should be. If we assume that the necessary stimulus will be 2% of EU GDP and an average co-financing of 65%, this brings us to an envelope of about €200 billion.

Altogether, this means that the EU would need additional funds of about €440 billion to be spent over the coming 12 months.

Funding

The EU should borrow the funds in the market. It would issue a one-off Pandemic Solidarity Bond backed by the EU budget with long maturities of 20-50 years. To raise €440 billion, the EU would need to receive irrevocable and unconditional guarantees from member states.6

These guarantees could, in principle, follow the model of the European Financial Stability Facility (EFSF), which was set up as a temporary lending facility during the euro crisis. The guarantee structure of the EFSF proved financially solid and has the advantage that it has already been tested during adverse market conditions.7 However, the EU would remain the bond issuer and would be liable to repay it. It could draw on the guarantees if need be, but it could potentially make good on its liability by other means. This is important. The EU is an institution with its own capacity to act, and therefore, the guarantees would not count as member states’ individual debt by Eurostat.8 This is a major advantage compared to all variants that rely on extra-institutional setups such as special purpose vehicles (SPVs), as guarantees to SPVs are counted as national debt. The legal act setting up the asset and establishing the guarantees would need to be ratified by some parliaments, such as the German Bundestag.

The bonds could be perpetually refinanced in the market when they come due, leaving the guarantees in place. But the legal act should contain a provision that regulates how the bonds are repaid, should member states decide to do so when the bonds come due. We propose a simple solution here: member states should be liable for repayment not according to their share of the guarantees, but according to their share in EU GDP at the time of repayment. A 30-year bond would thus be repaid by member states according to their economic strength in 2050. So the Instrument would have a guarantee structure to give the EU the solid legal basis for cases of default – and a repayment structure that ensures that the strong end up supporting the weak, whichever countries those will be in the distant future.

The Pandemic Solidarity Bonds would not only finance the measures above. They would also substantially enlarge the volume of supranational safe assets that the ECB could buy in its purchase programmes and that banks could pledge as collateral. At the same time, markets would be able to absorb such a large sum of new, safe assets and fund the Instrument at similar rates to those of the ESM.

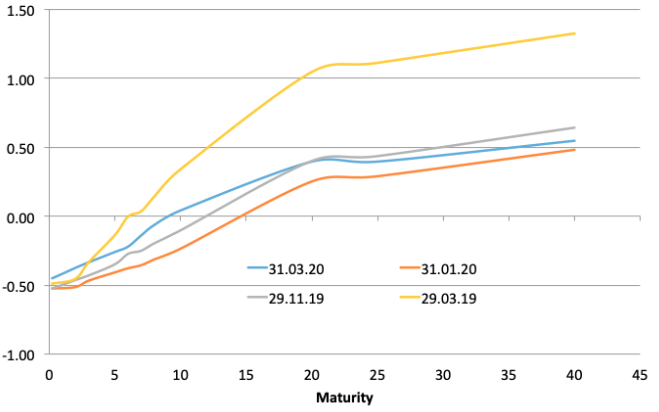

Figure 2 ESM yield curve (%)

Source: ESM

Necessary measures beyond the Pandemic Solidarity Instrument

Our proposal would not fully mutualise the costs of this crisis. Doing so may seem justified, but would not be politically feasible. All member states will thus have to finance a portion of their additional fiscal expenditure on markets. They will face different funding costs when doing so.

With the PEPP, the ECB has intervened forcefully in government bond markets and will continue to do so until the European economy has recovered. But the ECB should not be the only backstop for member states’ access to markets. There are political and legal limits to ECB bond purchases. On 5 May, the German constitutional court will deliver its judgment on the ECB’s QE programme and this could lead to doubts about the legality of PEPP if the Court puts severe limits on the Bundesbank’s participation in QE. What is more, the ECB will face questions about whether mass purchases of government bonds are still legitimate when they mostly serve the purpose of keeping member states afloat. The ECB has no legal or political mandate to fully mutualise or even monetise European public debt.

This is why additional lines of defence for member states’ financing are necessary. Given the severity of the crisis, such transfers are justified, above and beyond the risk sharing in the Instrument outlined above. The Commission’s SURE proposal is a good start – a credit line of up to €100 billion to support countries’ fight against unemployment. A special COVID credit line in the ESM (Bénassy-Quéré et al. 2020) would further help countries finance their increased debt burdens. A credit line of €100 billion credit would reduce Spain’s interest costs by €100 billion over a 10-year period, for example (Erce et al 2020). Both the SURE proposal and a special ESM line would entail some transfers, as lending rates and funding conditions in both are subsidised by the fiscally strong countries in the EU. But given the severity of the crisis, such transfers are justified, above and beyond the risk sharing in the Instrument outlined above.

Conclusion

The Pandemic Solidarity Instrument would provide more vulnerable member states with enough fiscal relief to act as forcefully as the strong. Action cannot be left to a “second phase” of crisis-fighting – member states need that certainty today that they will have the necessary fiscal space in a few months’ time. The proposal does not create a ‘transfer union’ feared by some in Germany, the Netherlands and elsewhere, nor open-ended debt mutualisation. It is sizeable but proportionate, since COVID-19 could result in an existential crisis for the European project.

References

Bénassy-Quéré et al. (2020), “A proposal for a Covid Credit Line”, VoxEU.org, 21 March.

Erce, A, A Garcia Pascual and T Roldán Monés (2020), “The ESM must help against the pandemic: The case of Spain”, VoxEU.org, 25 March.

Gostyńska-Jakubowska, A and L Scazzieri (2020), "The EU needs to step up its response to the COVID-19 outbreak", Centre for European Reform Insight

Grund, S (2020), “Legal, compliant and suitable: The ECB‘s Pandemic Emergency Purchase Programme (PEPP)”, Hertie School Policy Brief, 25 March.

Guttenberg, L and J Hemker (2020), “Corona: A European safety net for the fiscal net”, Jacques Delors Centre Policy Brief.

Köster, G and C Priesmeier (2017), “Revenue elasticities in euro area countries: an analysis of long-run and short-run dynamics”, ECB Working paper No. 1989.

Odendahl, C and J Springford (2020), “The two economic stages of coronavirus”, Centre for European Reform.

Redeker and Hainbach (forthcoming), ‘Flattening the recession curve: Early fiscal responses to the corona crisis in the EU’, Jacques Delors Centre.

Schulten, T and T Müller (2020), ‘Kurzarbeitergeld in der Corona-Krise’, WSI Policy Paper.

Appendix: The opportunities and limits of Article 122 TFEU

Article 122 TFEU provides the EU with a legal basis to enact extraordinary measures under “exceptional occurrences”. Article 122 TFEU has two prongs: while Article 122(1) allows the EU to take measures appropriate to the economic situation “in the spirit of solidarity”, Article 122(2) provides a legal basis for ad-hoc financial assistance to one or more Member States. There is no doubt that the current COVID-19 pandemic and the ensuing economic crisis constitutes the type of exceptional occurrence that Article 122 TFEU sought to address One may even go as far as arguing that there has never been a more urgent need to make real the overarching principle of solidarity enshrined in the EU Treaties.

Since Article 122 TFEU provides an exception from other primary law provisions, such as the no-bailout clause, it is not limitless: it must be narrowly framed and follow the subsidiarity principle.9 Given that the COVID-19 pandemic affects the Union as a whole and causes severe economic disturbances in all Member States, there should be little doubt that collective action is necessary. With respect to the type of measures that may be taken on the basis of Article 122 TFEU, the Council has a wide margin of discretion. The main requirement is that the measures need to be “appropriate to the economic situation.”10 Given the unprecedented disruptions that the pandemic has already caused, even highly extraordinary common economic measures are likely to be deemed appropriate.

With respect to the law-making process, the Council decides with qualified majority on Article 122 TFEU measures following a proposal by the Commission, which can take the form of either a directive or a regulation.11 The European Parliament has no formal role in the legislative process stipulated by Article 122 TFEU. However, national parliaments will have to play a strong role according to national constitutional requirements if the legal act under Article 122 involves guarantees provided by member states, as we propose here. This means that although theoretically legal acts under this article can be adopted by a qualified majority in the Council, some parliaments, such as the German Bundestag, will have to ratify the act to comply with domestic constitutional law.

In the case of our proposal, Article 122 TFEU provides an exception with regard to two relevant primary law provisions: The no-bailout clause (Article 125 TFEU) and the prohibition for the EU budget to go into deficit (Articles 310 and 311 TFEU).

Article 125 TFEU - no bailout clause

Article 122 TFEU can be understood as an exception to the no-bailout clause.12 More specifically, Article 122 TFEU epitomizes the principle of solidarity among Member States in cases where the economic situation in one or more member states warrant exceptional measures by the EU. The solidarity clause would thus counterbalance the strict no-bailout clause with a view at allowing collective action in certain exceptional circumstances.13 In this re, we must also differentiate between Article 122(1) and Article 122(2). While Article 122(1) focuses on measures taken in the spirit of solidarity, Article 122(2) talks specifically about “financial assistance.”14 For the purpose of a Pandemic Solidarity Instrument, the former provision seems more suitable, since the measures we propose go beyond “financial assistance” in the strict sense of the word, i.e. beyond the mere granting of loans. Relying on Article 122(1) TFEU also seems more appropriate in light of the new instrument’s objective, not least since (only) Article 122(1) explicitly refers to measures taken “in the spirit of solidarity.” Finally, Article 122(1) TFEU also provides more flexibility against the backdrop of the European Court of Justice’s Pringle judgement.15 Pringle raises some questions as to the precise meaning of “financial assistance” under EU law and leaves some uncertainty whether Article 122(2) requires conditionality.16 This is not to say that Article 122(2) TFEU is unsuitable, but rather that Article 122(1) TFEU provides a superior legal basis for the instrument we propose.

Article 310 and 311 TFEU

The other relevant provision is Article 310 TFEU which stipulates that all revenue and expenditure of the Union have to be shown in the EU budget and that the EU budget has to be balanced. As our proposal entails grants, i.e. direct expenditure, one could argue that these have to be financed by actual contributions and cannot be financed by bonds issued by the EU. However, this argument is not convincing. As explained above, Article 122 TFEU gives the Union wide discretion to act “in the spirit of solidarity” and Article 311 TFEU stipulates that “the Union shall provide itself with the means necessary to attain its objectives and carry through its policies.” In the current situation, it would be very hard to argue that any meaningful act of solidarity can be taken by the Union without fresh money and it would be equally hard to say that this fresh money can come from member states’ direct contributions at a time when all member states have to turn to markets to finance their own expenditures. In this context, raising funds from bond sales by the Union that are backed by member states’ guarantees to finance emergency expenditure should qualify as“means necessary” for the Union to be able to reach the solidarity objectives pursuant to Article 122 TFEU. All revenues from the bond sales would then count as normal revenues of the EU budget and potential interest payments on bonds issued to finance the new instrument would count as normal expenditures. To be sure, just like measures based on Article 122(1) TFEU, any financing by EU member states outside the ordinary budgetary process must be limited in time and in scope to fighting the extraordinary threat that the COVID-19 outbreak poses to the Union and its members.

Endnotes

1 For a comprehensive proposal on a safety net for market access see Guttenberg and Hemker (2020).

2 This assumes the same growth rate of EU27 GDP, absent the corona crisis, for 2020 as 2018 and 2019 (roughly 3.2% nominally).

3 We use the long-run elasticity of 1 based on Köster and Priesmeier (2017). Total government revenues of the EU27 stood at €6.3 trillion in 2018, after growing roughly 4% in nominal terms in the previous two years. Assuming a similar growth rate for 2019 and 2020, total general government revenues in the EU27, absent the corona crisis, should have been around €6.7 trillion in 2020.

4 For an overview see Schulten and Müller (2020).

5 This covers both replacement of 60% of the salary and the payment of social security contributions by the state.

6 The EU can issue debt without guarantees but is limited to the margin between the expenditure ceilings in the Multiannual Financial Framework and the revenue ceiling in the Own-Resources Decision. This margin is about 0.2% of GDP per year and thus too small. Increasing that margin is possible, but politically more challenging in our view, which is why we prefer one-time guarantees.

7 See ESM, "Top credit rating for EFSF’s debut debt issuance", Press Release, 19 January 2011, https://www.esm.europa.eu/press-releases/top-credit-rating-efsf%C2%80%C2%99s-debut-debt-issuance.

8 Eurostat counts EFSF debt to the Maastricht debt of member states based on the guarantees given to the facility, because it is not an “institutional unit” but an “an accounting and treasury tool”. It does not do so for the ESM as it is considered an “institutional unit” even though the callable capital of the ESM has very similar characteristics to the EFSF guarantees. As the EU is definitely an “institutional unit” in the Eurostat sense, debt incurred under our proposal would not be counted as public debt of member states by Eurostat.

9 In other words, the objectives of the measures taken must be of such nature that they could not be achieved at the national level. Bernardus Smulders/Jean-Paul Keppenne in von der Groeben/Schwarze/Hatje, Europäisches Unionsrecht, AEUV Art. 122 (ex-Artikel 100 EGV), para 7.

10 ibid.

11 Kempen in Streinz, EUV/AEUV, AEUV Art. 122, para 5.

12 See for this reading of the provision in Bernardus Smulders/Jean-Paul Keppenne in von der Groeben/Schwarze/Hatje, Europäisches Unionsrecht, AEUV Art. 122 (ex-Artikel 100 EGV), para 11.

13 Ibid.

14 To recall, Article 122(2) provided the legal basis for the European Financial Stability Mechanism (EFSM).

15 C-370/12, Thomas Pringle v. Government of Ireland and Others, 27 November 2012.

16 See for a recent discussion of the meaning of “financial assistance assistance” in M. van der Sluis, “A Euro area budget: another seedling?”, Maastricht Faculty of Law Working Paper Series, 2019/04.