Recent evidence suggests a large increase in polarisation across political parties in the US (e.g. Iyengar et al. 2012, Mason 2013, Mason 2015, Gentzkow 2016, Boxell et al. 2017). There is an increasing tendency of voters to view the economy through a ‘partisan perceptual screen’, in other words, their assessment and interpretation of economic conditions and policies depends on whether the White House is occupied by the party they support (e.g. Gerber and Huber 2009, Mian et al. 2017). Given the documented rise in partisanship, it is important to understand the implications of this phenomenon for the US economy. In this column, we investigate whether partisan ideology affects the actions of an important set of finance professionals – namely, credit rating analysts – whose decisions have implications for firms’ cost of capital as well as their financing and investment decisions.

To study this question, we compile a novel, hand-collected dataset that links credit rating analysts to the corporate bond ratings they issue, as well as to information on party affiliation from voter registration records. Our sample consists of 449 corporate credit analysts, working at Fitch, Moody's, and Standard and Poor's between 2000 and 2015. These analysts cover a total of 1,778 US firms. Our goal is to test whether the rating behaviour of credit rating analysts depends on their political alignment with the US president.

Evidence of partisan bias affecting credit ratings

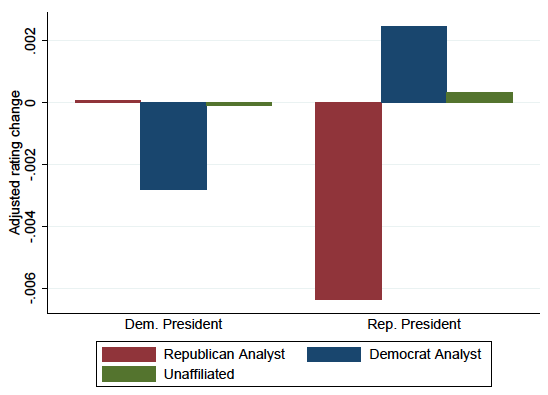

Figure 1 shows the average adjusted rating change for Democratic, Republican, and unaffiliated analysts under Democratic and Republican presidents, respectively. Adjusted rating changes are computed by taking the quarterly rating change and subtracting the average rating change within the same firm and quarter, averaged across all agencies rating the firm. This allows us to control for the possibility that the party affiliation of the analysts covering a given firm may correlate with the firm's fundamentals under different administrations. Rating changes are measured in notches, so a positive change is a downgrade. The figure shows that during a Democratic presidency, Democratic analysts upward-adjust ratings more relative to Republican analysts. Under a Republican president, the sign of this difference reverses – Democratic analysts downward-adjust more relative to Republican analysts.

Figure 1 Average adjusted rating change by analyst party affiliation

Our analysis shows that analysts who are not affiliated with the president's party are more likely to adjust ratings downward, relative to other analysts covering the same firm at the same point in time. Specifically, analysts who are not affiliated with the president's party downward-adjust ratings by 0.015 notches more per quarter. This effect corresponds to 9.38% relative to the average absolute quarterly rating adjustment, and is therefore economically sizable. Our identification strategy ensures that this result cannot be explained by several potential confounding factors, such as the possibility that Democratic analysts rate firms which tend to do well under the policies of Democratic presidents. Moreover, our empirical analysis allows us to control for differences in rating methodologies across rating agencies, as well as for unobserved time-invariant differences across analysts.

The role of partisan conflict

To further support our conclusion that the above finding reflects partisan bias, we investigate whether the effect is more pronounced in periods with high partisan conflict. We use the Partisan Conflict Index provided by the Federal Reserve Bank of Philadelphia, which tracks the degree of political disagreement among US politicians at the federal level by measuring the frequency of newspaper articles reporting disagreement in a given month. The effect of partisan bias is substantially larger when partisan conflict is high. We also find larger effects for analysts who are more politically active, proxied by how frequently an analyst participates in political elections.

Analysts of different political parties have different views of the economy

We interpret the above evidence as showing that analysts with opposing political views differ in their beliefs about how the economic policies of the US president affect firm fundamentals. To support this interpretation, we show that analysts' alignment with the president's party has no effect on their ratings of foreign firms, or of domestic firms with low political risk. Hence, their disagreement appears to be focused precisely on the set of firms whose fundamentals should be most affected by the economic policies of the US president, i.e. domestic firms that face high political risk. This result suggests that the heterogeneous behaviour of analysts with different party affiliations is likely driven by their ideologically different views of economic policies. Moreover, we estimate the effect of partisan bias on ratings accuracy, and we find that analysts who do not support the president's party are less accurate.

Potential real effects of partisanship

We further show that rating actions by partisan analysts have non-negligible price and potential real effects. We find cumulative abnormal stock returns of around -1.8% in the three days around a rating downgrade. For upgrades, we only find very small abnormal returns. More importantly, we find little evidence that the stock price response to a downgrade differs significantly when the downgrade is announced by an analyst who is ideologically misaligned with the president. In other words, the stock market does not seem to correct analysts' ideological bias. We also perform a back-of-the-envelope calculation to gauge the potential real effects of analysts' partisan bias on firm investment. The results suggest that replacing an analyst who is aligned with the president with an analyst who is misaligned leads to a difference in firm investment of around 2.8%.

Combined, our results suggest that partisanship distorts the rating decisions of credit rating analysts. Since credit ratings have been shown to significantly affect firms' cost of capital and investment decisions, distortions in credit rating decisions may have non-negligible real effects.

References

Boxell, L, M Gentzkow, and J M Shapiro (2017), “Is the internet causing political polarization? Evidence from demographics”, NBER Working Paper 23258.

Gentzkow, M (2016), “Polarization in 2016”, Toulouse Network of Information Technology White Paper.

Gerber, A S and G A Huber (2009), “Partisanship and economic behavior: Do partisan differences in economic forecasts predict real economic behavior?”, American Political Science Review 103: 407–426.

Iyengar, S, G Sood, and Y Lelkes (2012), “Affect, not ideology”, Public Opinion Quarterly 76: 405–431.

Kempf, E, and M Tsoutsoura (2018), “Partisan Professionals: Evidence from Credit Rating Analysts”, NBER Working Paper 25292.

Mason, L (2013), “The rise of uncivil agreement: Issue versus behavioral polarization in the American electorate”, American Behavioral Scientist 57: 140–159.

Mason, L (2015), “’I disrespectfully agree’: The differential effects of partisan sorting on social and issue polarization”, American Journal of Political Science 59: 128–145.

Mian, A R, A Sufi, and N Khoshkhou (2017), “Partisan bias, economic expectations, and household spending”, Fama-Miller Working Paper.