In the wake of the Great Recession, world trade and investment have faltered. Responsible officials turned a blind eye to fresh liberalisation, and instead condoned a quiet resurgence of protectionist measures.

- According to Global Trade Alert (2013), over 3,330 new government protectionist measures, such as trade remedies, local content requirements, and discriminatory regulatory practices, have been reported since 2008, with 431 measures imposed during the year May 2012 to June 2013 alone – the highest in a single period to date.

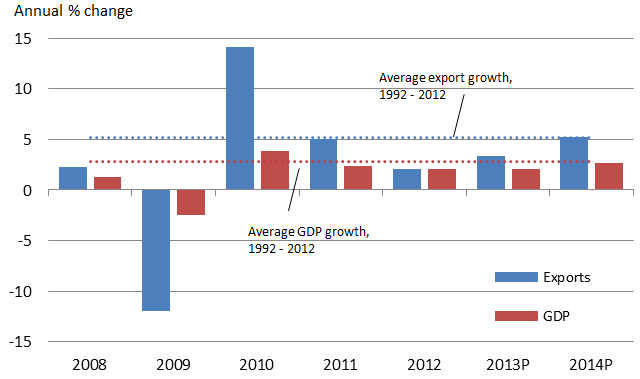

World trade no longer outpaces real global GDP growth by a ratio of two to one. In 2012, global trade grew 2.0% and is projected to slightly rebound to 3.3% in 2013, remaining well below the average growth rate of 5.3% for the last 20 years.1

Figure 1 shows this recent trend. Sluggish economic recovery, compounded with the Doha Round impasse, and rising protectionism are to blame.

Figure 1. Growth in world merchandise trade volume and real GDP, 2008-2014

Note: Figures for 2013 and 2014 are preliminary estimates.

Source: WTO, "Trade to remain subdued in 2013 after sluggish growth in 2012 as European economies continue to struggle," Press Release, 10 April.

Strong medicine needed

The global economy needs strong medicine to rebound, and successful trade talks can be part of the elixir. Yet the past decade has been difficult for the WTO; the Doha Round is on the verge of failure after 12 years of hard negotiations. With the Bali WTO Ministerial fast approaching in December, officials and experts alike agree that 2013 is shaping up as the 'make or break' year for the future credibility of the WTO and the multilateral trading system writ large (Ditchley Foundation 2013).

We do not abandon the Doha Round as a lost cause, but instead take an optimistic view of what can be done in the near-term to revive WTO negotiations. The Payoff from the World Trade Agenda assesses seven feasible agreements that could be endorsed at the Bali Ministerial as multilateral or plurilateral deals, and enter into force as early as 2015. Our objective is to provide a menu of options for what we call a “WTO Recovery Package”; however, we do not suggest that the agreements should be linked as an “all or nothing” package – learning a hard lesson from the Doha Round, a “single undertaking” approach would doom the Recovery Package from the start.

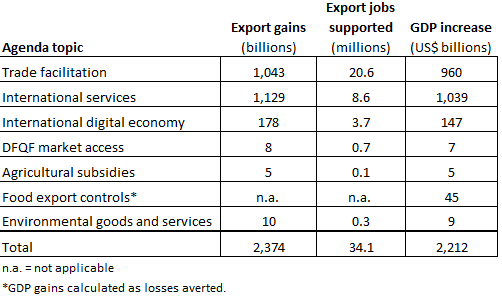

Measuring the potential payoff

We use three metrics to quantify the potential global payoffs from a “WTO Recovery Package”: (1) export gains, (2) jobs supported, and (3) GDP gains (or losses averted). These payoffs are broad estimates and represent permanent annual gains for the world economy. It is worth noting that the concept of 'jobs supported' through larger exports of goods and services is not equivalent to 'jobs added', because two-way trade expansion generally affects the composition of a country’s employment rather than its absolute level. That said, increased trade means more jobs in each country’s export sector, which generally offers better paying jobs than other sectors of the economy.

Table 1 summarises our findings of the potential global payoffs from the world trade agenda. If all seven agreements were ratified, total global export gains over the medium term might exceed $2.3 trillion; total global jobs supported by trade expansion could number 34 million; and global GDP gains (combined with losses averted) might reach $2.2 trillion. Among the agreements, trade facilitation and services would have the largest relative impact, accounting for approximately 90% of total global export gains and total global GDP gains. The trade facilitation agreement is almost ready for signature by all WTO members. A services agreement will not be ripe for conclusion in Bali, but the assembled ministers could endorse the on-going plurilateral TISA talks (Trade in International Services Agreement). Trade facilitation and services should be at the core of a Bali package blessed by ministers in December.

Table 1. Potential long-term payoffs from the world trade agenda

Source: Authors' calculations.

Success at this December’s WTO ministerial meeting in Bali

A successful outcome at Bali will likely preclude tackling new controversial issues that are beginning to take shape as a '21st century' agenda. That said, officials could consider three additional areas for progress in the medium term:

- Enhanced WTO approaches to regional trading arrangements.

- New investment rules.

- Dispute-settlement system reforms.

The potential payoffs from making improvements in these areas are not easily quantified, but each contributes to the 'insurance policy' of international trade obligations – assurance that WTO commitments will be both implemented and enforced, and that market-access guarantees will not be circumvented by regulatory restrictions. Such 'policy predictability' is a proven means of attracting trade and investment.

While the seven agreements assessed here seem ripe for broad acceptance, a successful outcome will depend critically on flexibility from WTO members as negotiations intensify toward a Bali deal (InsideTrade 2013). To reap a decent harvest from progress made in the Doha Round, officials must use the pleasant environs of Bali to focus on the global payoff from a significant deal rather than on mercantalistic self-centered calculations of the 'balance of concessions'.

References

Ditchley Foundation (2013), “International trade and investment policy: where do we go from here?” A Note by the Director, 17-19 January.

Global Trade Alert (2013), "Protectionism's Quiet Return: GTA's Pre-G8 Summit Report," globaltradealert.org, 12 June.

Hufbauer, Gary C, and Jeffrey J Schott (2013), “Payoff from the World Trade Agenda 2013,” Report to the ICC Research Foundation, Peterson Institute for International Economics.

Inside Trade (2013) “Prospects For WTO Deal In Question As Members Pledge To Intensify Work,” Inside US Trade, June 6, 2013 www.insidetrade.com (accessed on June 21, 2013).

World Trade Organization (2013), “Trade to remain subdued in 2013 after sluggish growth in 2012 as European economies continue to struggle”, Press Release, 10 April.

1 It should be noted that sluggish economic growth in Europe has had a disproportionate impact on the slow rate of world trade growth, since trade between EU countries is included in world trade totals. Counting only extra-EU trade in the aggregate figures would revise world trade growth upward from 2.0% to 3.2% in 2012. See WTO (2013), “Trade to remain subdued in 2013 after sluggish growth in 2012 as European economies continue to struggle,” Press Release, 10 April.