Big Techs are large companies whose primary activity is digital services (FSB 2019, BIS 2019). The range of services can be very wide, and includes e-commerce, social media, internet search, mobile phone hardware and software, ride hailing, and telecommunications.

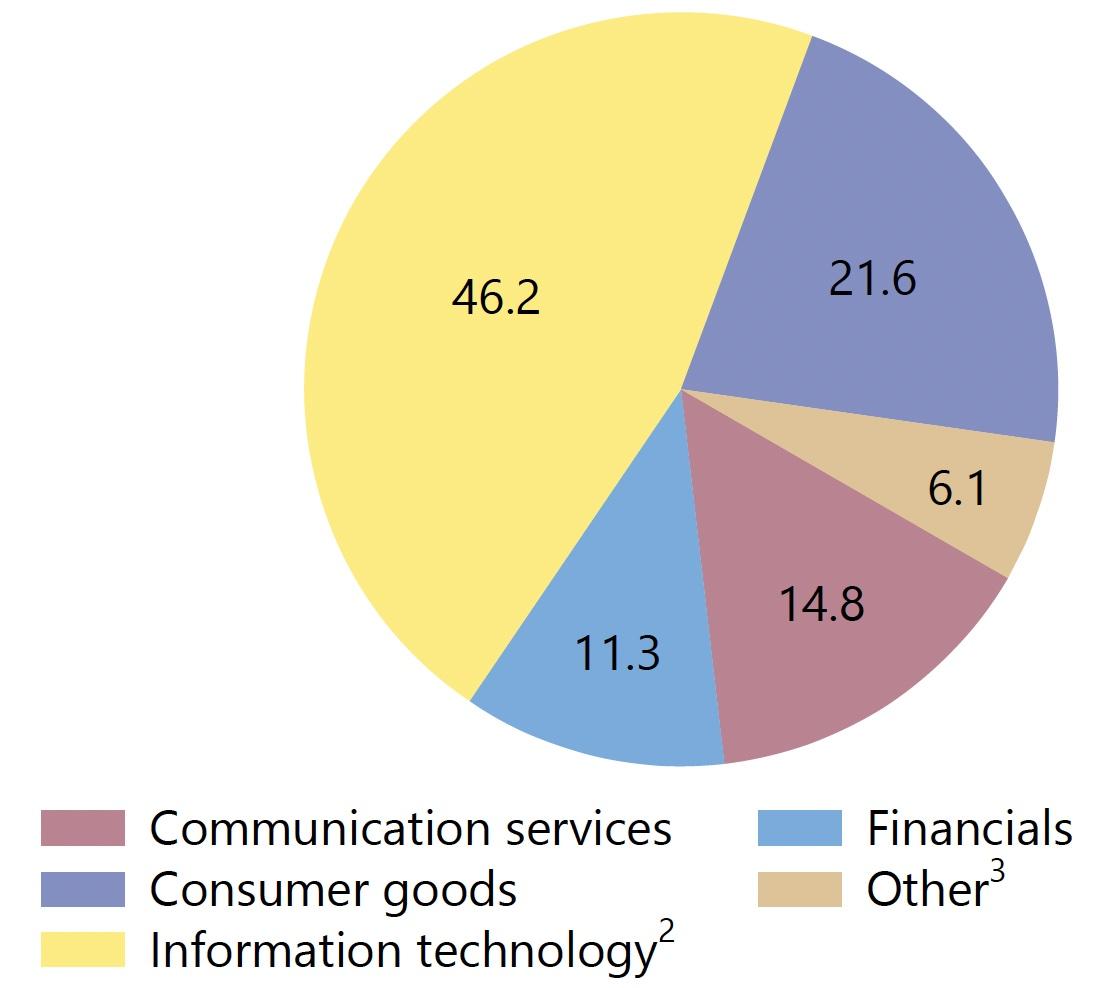

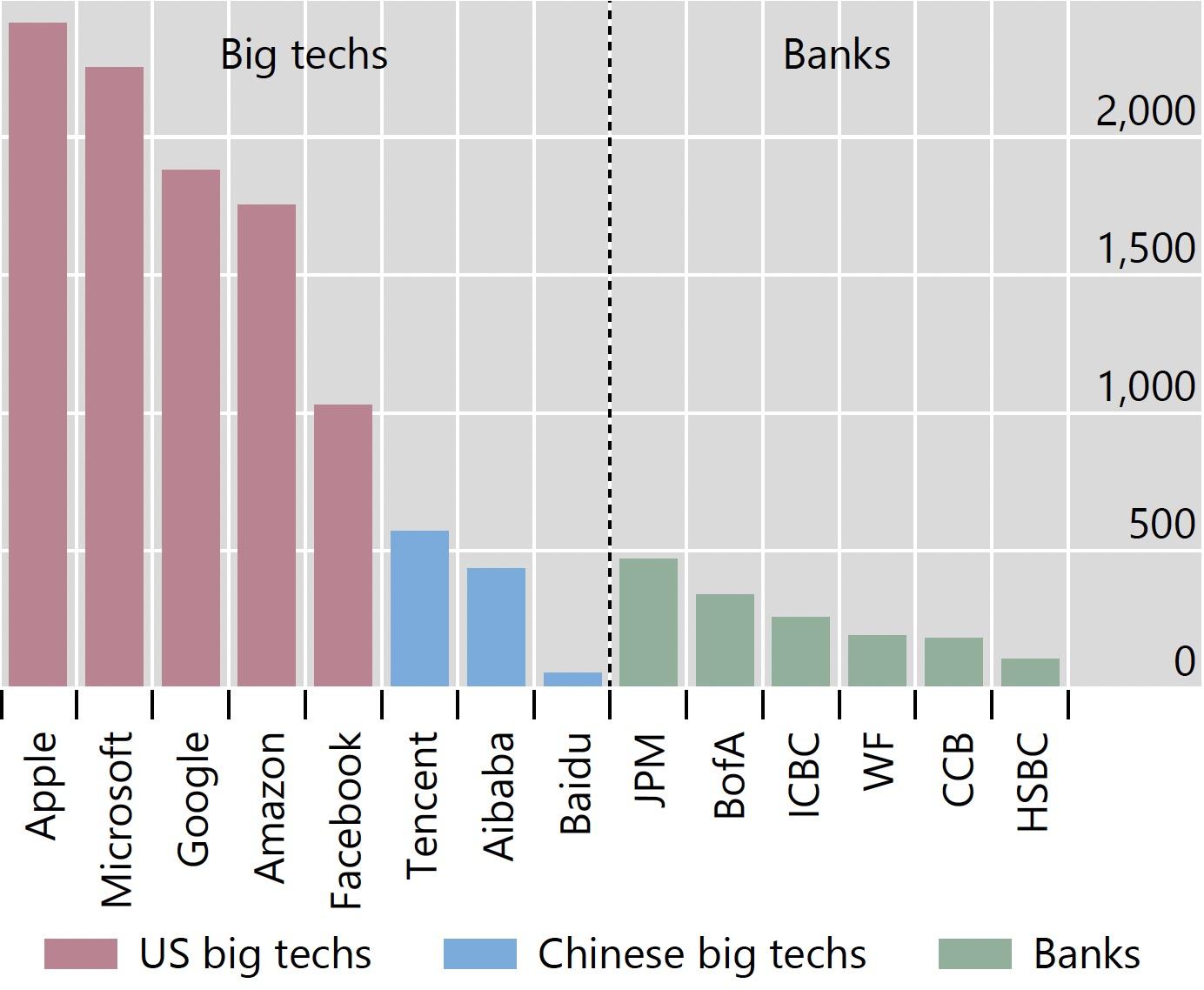

Big Techs have recently entered financial services and have rapidly gained prominence (Frost et al. 2019). In Figure 1, Panel A shows that financial services make up more than 10% of Big Techs’ revenues on average. They have a substantial footprint in the payment systems of several advanced economies and across a wider spectrum of financial services in emerging market and developing economies. In China, two Big Techs jointly account for 94% of the mobile payments market and play a significant role in other financial services such as digital credit. At the global level, Big Techs extended or facilitated more than $500 billion of credit in 2019 (Cornelli et al. 2020), and there are early indications that such credit grew further during the Covid-19 pandemic in 2020. By developing their activities, Big Techs like Google, Apple, Facebook, Amazon in the US and Alibaba and Tencent in China have market capitalisations that far surpass those of the largest banks (Figure 1, Panel B).

Why have they got so large? Big Tech business models rest on enabling direct interactions among a large number of users. This may be in (1) e-commerce, such as Alibaba, Amazon, or Mercado Libre; (2) social media, such as Facebook, Tencent, or Kakao; (3) telecommunications, such as Safaricom or MTN; or (4) search, such as Google or Baidu. An essential by-product of their business is the massive user data they generate and collect on their platforms. They exploit natural network effects, generating further user activity and data which can be leveraged to improve their product offering. As an example, payment services generate transaction data, network externalities facilitate the interaction among users, and all this helps serve the Big Techs in their other activities (such as credit or wealth management), generating more engagement with existing users and attracting new ones.

Figure 1 Big Techs operate a broad range of business lines and have grown very large

A) Big Techs’ revenues by sector of activity (percent)

B) Market capitalisation of big techs and banks4 (in billion US dollars)

Notes: 1 Shares based on 2018 total revenues, where available, as provided by S&P Capital IQ; where not available, data for 2017. The sample includes Alibaba, Alphabet, Amazon, Apple, Baidu, Facebook, Grab, Kakao, Mercado Libre, Rakuten, Samsung and Tencent. 2 Information technology can include some financial-related business. 3 Includes health care, real estate, utilities and industrials. 4 Data for 17 Sep 2021.

Sources: BIS (2019); Refinitiv.

But these activities generate further data and fuel a data–network–activities feedback loop. This has been called the DNA of big techs (BIS 2019). This DNA loop is a source of significant benefits to users and the financial system. For example, Big Techs’ business model can be very powerful at enhancing efficiency and financial inclusion, particularly in weakly contestable markets with dominant financial incumbents. Moreover, the use of detailed user data from other business lines may reduce the need for costly collateral for loans (Gambacorta et al. 2020). At the same time, if left unchecked, the DNA loop can engender new risks for privacy and consumer protection, market contestability and, eventually, financial stability.

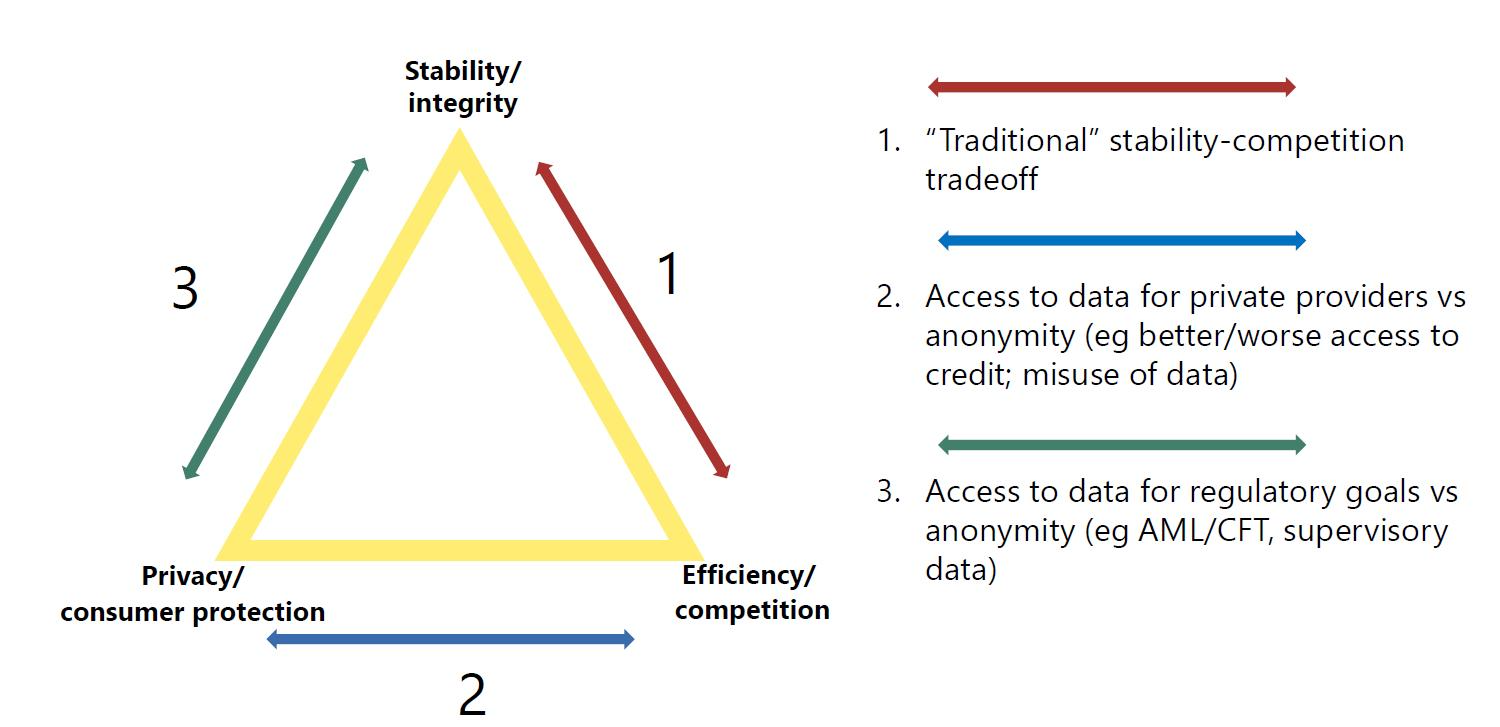

In a recent paper (Feyen et al. 2021), we analyse the entry of Big Tech firms into financial services and how this impacts the existing trade-offs among public policy objectives across: (1) financial stability and market integrity, (2) efficiency and competition, and (3) data privacy and consumer protection. We can elaborate such trade-offs around a policy triangle, adapted from Petralia et al. (2019) and Carletti et al. (2020).

Let’s start with the ‘traditional’ stability–competition trade-off (red arrow in Figure 2). Regulators have long debated the relationship between competition and financial stability. There are broadly two schools of thought. One emphasised that greater competition was not always optimal or conducive to financial stability because more competition reduces banks’ profits and overall franchise value (Keeley 1990). A second school of thought argues that greater market entry in the financial sector is desirable. Greater contestability fosters beneficial competition (by increasing innovation and efficiency) and reduces incumbents’ market power (Claessens 2009). The relationship may depend on other features, including regulation (Beck et al. 2013).

Figure 2 Policy trade-offs from digital transformation in finance

Source: Feyen et al. (2021). Adapted from Petralia et al. (2019) and Carletti et al. (2020).

The entry of Big Tech into finance may change these paradigms, due to the DNA feedback loop. Companies with market dominance in their core business could translate that dominance into complementary financial services, making entry a source of increased concentration and market power. Such control may also generate conflicts of interest and potential market abuse when big tech platforms become the main distribution channel for their competitors (e.g. banks).

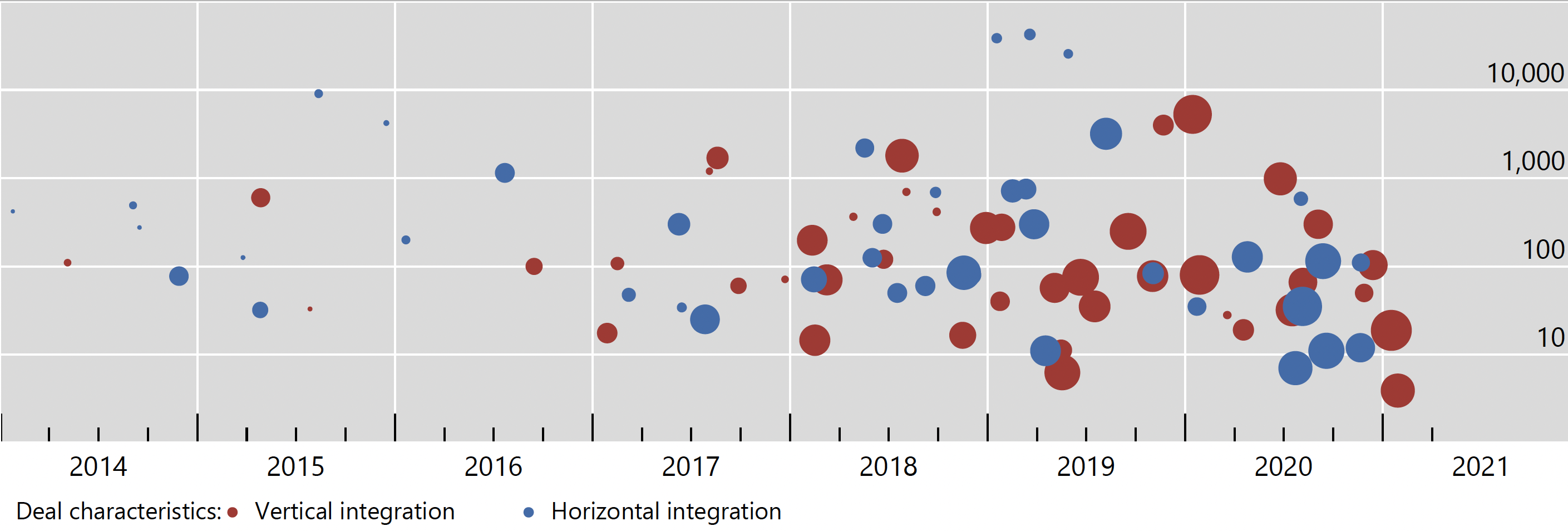

An example of how competition in payments may evolve is given by merger and acquisition activity by digital platforms (Big Techs and card networks). Figure 3 shows how vertical and horizontal integration trends have developed in recent years. Some of the largest deals have been horizontal acquisitions, such as the acquiring of direct competitors (blue dots). In other cases, vertical acquisitions have taken place (red dots). These deals allow payment firms to increase their efficiency and perform ‘in-house’ activities for which they previously used partners or vendors. The trend towards larger dots lower on the graph shows that smaller companies may be acquired before reaching a critical mass of users (Kamepalli et al. 2020).

Figure 3 Merger and acquisition activity by global payment platforms has increased1

Purchase price in millions of US dollars, logarithmic scale

Notes: 1 For 2020, data up to 31 January 2021. The figure divides forms of vertical integration in red and horizontal forms of integration in blue. The size of the bubble represents the market capitalisation of the acquiring company, while the height in the graph represents the deal size. Each dot represents a merger and acquisition (M&A) deal by Ant Financial, Fidelity National Information Services (FIS), FISERV, Global Payments, Mastercard, PayPal, Square, or Visa as collected by PitchBook and Refinitiv Eikon. This excludes divestitures and intra-company operations. M&A deals are classified as ‘vertical’ when the acquiring and the target firm operate at different stages along the same payment chain, as determined by company reports. In ‘horizontal’ deals, the acquiring and target firm are direct competitors in at least one key business line. The size of each dot is proportional to the acquiring company market capitalisation on the day of the deal or, in the case of Ant Financial, the valuation of Ant Financial as of end-2018, multiplied by changes in the market capitalisation of Alibaba Holdings relative to end-2018.

Sources: Croxson et al. (2021).

While competition and more efficient solutions may often benefit consumers, trade-offs between efficiency/competition and privacy/consumer protection arise. This is represented by the blue arrow in Figure 2. In many jurisdictions, Big Tech providers may not be subject to regulatory oversight that protects financial services consumers. Big Tech mobile money competes with bank payments services on price and availability dimensions, but more personal data might be exposed to mobile money providers than to banks.

As data become an even more important source of market power there are tensions around the ownership and use of data. Data can, in principle, be used many times and by any number of firms simultaneously, without being depleted – this is the so-called ‘non-rivalry’ characteristic of data (Carrière-Swallow and Haksar 2020, Haksar et al. 2021, World Bank 2021). Credit bureaus operate on this principle. However, unrestricted sharing of data can also harm individuals. For example, open access to personal data represents a loss of privacy, and can allow for identity theft, reputational damage, and the manipulation of behavioural biases to sell consumers products that are not in their own interests. On the other hand, allowing data producers to maintain a monopoly over the data presents challenges as well. It could impede consumers from switching providers or enable price discrimination or algorithmic exclusion.

Big Tech companies are also very efficient in pricing given big data. They can divide a customer population into very fine subcategories – each charged a different price, representing the maximum price each individual is willing to pay. By extracting more of the consumer surplus from those willing to pay more, prices can also be reduced for those able to pay less, potentially creating a more inclusive offering. Yet such fine price discrimination may overlap with protected categories such as gender or race. Regulators need to balance innovation and efficiency with consumer protection that might dampen certain innovations.

Data sharing can alleviate problems of asymmetric information, and adequate data are crucial for monitoring financial stability and integrity. This potentially introduces a new trade-off between privacy (and consumer protection more generally) on the one hand and financial stability and market integrity on the other. This trade-off is represented by the green arrow in Figure 2.

For example, in the credit market, there is ample evidence that more data can improve stability. Credit reporting systems allow safe lending to borrowers who had previously been priced out of the market, resulting in higher aggregate lending (Pagano and Jappelli 1993) and furthering financial inclusion. In the case of credit reporting, the data can only be accessed by licensed entities and only upon customer consent and only for authorised purposes. In the case of Big Techs, the data they capture are far more granular and touch several aspects of personal life, so it is important to have safeguards for privacy. At the same time, detailed information on all parties in a transaction could be helpful to reduce illicit activity and preserving market integrity. Anti-money laundering (AML) and combating the financing of terrorism (CFT) practices could benefit from machine learning applications on big data. Balancing privacy and integrity goals will require societal dialogue and likely legislation.

Conclusions

The rise of Big Techs underscores how rapidly digital innovation can disrupt markets and put competitive pressure on incumbents. This brings efficiency and financial inclusion, particularly in emerging market and developing economies, but also new concerns for policy. This column highlights new trade-offs between public policy objectives: (1) financial stability and market integrity, (2) efficiency and competition, and (3) data privacy and consumer protection.

The current framework for regulating financial services follows an activities-based approach where providers must hold licences for specific business lines. There is scope to address the new policy challenges by developing specific entity-based rules, as proposed in several key jurisdictions – notably the EU, China, and the US (Carstens et al. 2021).

But the new trade-offs between the policy objectives in the triangle also call for more coordination. At the domestic level there is need for more coordination between national authorities overseeing competition, financial regulation, data, and consumer protection. Finally, as the digital economy expands across borders, there is a need for international coordination of rules and standards in the public interest.

Authors’ note: The views expressed here are those of the authors and not necessarily the Bank for International Settlements or the World Bank Group.

References

Bank for International Settlements (BIS) (2019), “Big techs in finance: opportunities and risks”, Annual Economic Report 2019, Chapter III.

Beck, T, O De Jonghe and G Schepens (2013), “Bank competition and stability: Cross-country heterogeneity”, Journal of Financial Intermediation 22(2): 218–44.

Carletti, E, S Claessens, A Fatás and X Vives (2020), The Bank Business Model in the Post-Covid-19 World, CEPR Press.

Carrière-Swallow, Y and V Haksar (2019), “The economics and implications of data: an integrated perspective”, IMF Departmental Papers 19(16).

Carstens, A, S Claessens, F Restoy and H S Shin (2021), “Regulating big techs in finance”, BIS Bulletin 45.

Claessens, S (2009), “Competition in the Financial Sector: Overview of Competition Policies”, The World Bank Research Observer 24(1), 83–118.

Cornelli, G, J Frost, L Gambacorta, R Rau, R Wardrop and T Ziegler (2020), “Fintech and big tech credit markets around the world”, VoxEU.org, 20 November.

Croxson, K, J Frost, L Gambacorta and T Valletti (2021), “Platform-based business models and financial inclusion”, BIS Papers, forthcoming.

Feyen, E, J Frost, L Gambacorta, H Natarajan and M Saal (2021), “Fintech and the digital transformation of financial services: implications for market structure and public policy”, BIS Papers 117 and the WBG Fintech and the Future of Finance flagship report.

Financial Stability Board (FSB) (2019), “BigTech in finance: Market developments and potential financial stability implications”, December.

Frost, J, L Gambacorta, Y Huang and H S Shin (2019), “The emergence of Big Tech in financial intermediation”, VoxEU.org, 4 October.

Gambacorta, L, Y Huang, Z Li, H Qiu and S Chen (2020), “Data vs collateral”, BIS Working Paper 881, September.

Haksar, V, Y Carrière-Swallow, A Giddings, E Islam, K Kao, E Kopp and G Quirós-Romero (2021), “Toward a Global Approach to Data in the Digital Age”, IMF Staff Discussion Note SDN/2021/005.

Kamepalli, S K, R Rajan and L Zingales (2020), "Kill zone", NBER Working Paper, no 27146.

Keeley, M (1990), “Deposit insurance, risk and market power in banking”, American Economic Review 80(5): 1183–1200.

Pagano, M and T Jappelli (1993), “Information Sharing in Credit Markets”, Journal of Finance 48(5): 1693–18.

Petralia, K, T Philippon, T Rice and N Veron (2019), Banking Disrupted? Financial Intermediation in an Era of Transformational Technology, Geneva Reports on the World Economy 22, ICMB and CEPR.

World Bank (2021), World Development Report 2021: Data for Better Lives, Washington, DC: World Bank.