The COVID-19 crisis has been tackled with unprecedented economic policies all around the world (Baldwin and Weder di Mauro 2020). In July 2020, the EU leaders agreed upon an economic recovery fund amounting to €750 billion in loan and grants. Affected countries will use part of these resources in a large scheme of government spending programmes with the goal of stimulating households’ and firms’ demand. The effects of these packages on the economy will be assessed through the fiscal multiplier, which measures the dollar change in output following an exogenous increase in government consumption spending. However, fiscal multipliers are not constant structural parameters, but rather depend on the characteristics of the economy.

In Basso and Rachedi (2020), we show that output fiscal multipliers are larger in economies with relatively higher shares of young people in total population. We build a parsimonious life-cycle open economy New Keynesian model and discipline it with empirical evidence on the effects of military build-ups across US states, finding that the ageing of the US population between 1980 and 2015 has decreased the output spending multiplier by 38%. Our analysis underscores the relevance of the high marginal propensity to consume and high volatility of labour market outcomes of young households for the transmission of fiscal policy.

Our first contribution is to uncover the causal effect of demographics on fiscal multipliers across US states. The identification comes from the cross-state variation in the share of young people in total population. As states’ age structure can respond to government spending shocks through migration flows, we exploit the heterogeneity in fertility across US states and instrument the share of young people with lagged birth rates. Then, we identify the government spending shocks by leveraging the heterogeneity in the geographical distribution of military spending, as in Nakamura and Steinsson (2014).

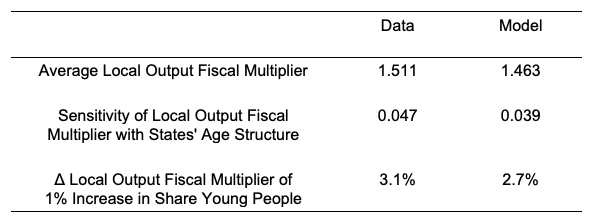

In our benchmark regression, whose results are reported in the first column of Table 1, the size of the local fiscal multiplier depends positively on the share of young people (aged 20 - 29) in total population: increasing the share of young people by 1% above the average share across US states raises the local output fiscal multiplier by 3.1%, from 1.51 up to 1.56. These estimates imply that local multipliers vary from 1.1 to 1.9 within the inter-quartile range over all the state-year observations of the share of young people in our sample. We run a comprehensive battery of robustness checks and find that the age sensitivity of local fiscal multipliers is always highly economically and statistically significant.

Table 1 Local output fiscal multiplier: Data vs model

To rationalise the link between demographics and government spending multipliers, we extend a standard two-country New Keynesian economy with a rich lifecycle structure, whereby households face three stages of life: young, mature, and old. The model features age-specific differences in both labour supply and labour demand. On the one hand, the labour supply elasticity varies exogenously across the three age groups. In the empirically relevant case, young and old workers have a higher elasticity than mature workers. On the other hand, we posit that the production function is characterized by capital-experience complementarity, as in Jaimovich et al. (2013). The demand of experience labour is relatively more persistent over the cycle, since it is tied to the stock of capital. Instead, young labour is less complementary to capital, and thus its demand is relatively more volatile. These two mechanisms allow the model to be consistent with the high volatility of hours worked and hourly wages of young workers observed in the data.

The model also features credit frictions that limit households’ borrowing capacity. These frictions disproportionately hit younger households, which face a hump-shaped labour income over the lifecycle, and would like to borrow for smoothing lifetime consumption. As a result, the credit frictions boost the marginal propensity to consume of young households well above the one of mature households, as it is in the data.

In the model, young households are then characterised by very elastic employment outcomes and a relatively high marginal propensity to consume. Consequently, as the proportion of young workers increases, a government consumption spending shock triggers a larger response of both labour and consumption, implying a larger output fiscal multiplier.1

The second column of Table 1 reports the results of the quantitative analysis, and shows the model matches almost entirely the size of the local fiscal multiplier and explains 87% of the link between fiscal multipliers and demographics: increasing the share of young people by 1% above the average share across US states raises the local output fiscal multiplier by 2.7%, from 1.463 up to 1.502. In the paper, we show that half of the age-sensitivity is due to the credit market frictions, whereas the remaining half is attributed to the age differences in labour demand and, to a minor extent, labour supply.

Focusing on regional data allows us to leverage local heterogeneity to identify fiscal multipliers and their sensitivity to demographics. Yet, the effectiveness of fiscal policy should also be evaluated at the national level, taking account of all general equilibrium mechanisms. Since our theoretical model is consistent with the empirical evidence on local multipliers, it represents an ideal laboratory to study whether the link between demographics and fiscal multipliers also exists at the national level. We evaluate in the model the effects of government spending on national output and find that demographics still matter: increasing the share of young people by 1% raises the national output fiscal multiplier by 1.1%.

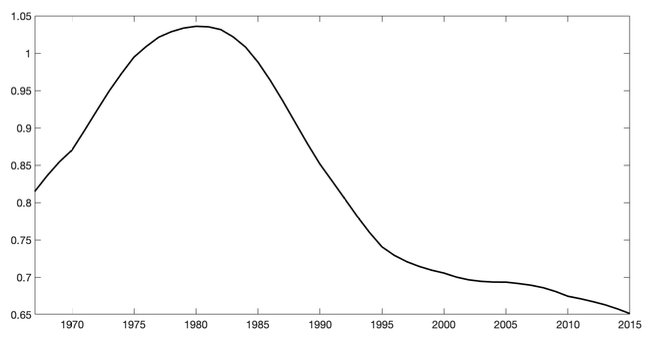

We then evaluate how the effectiveness of government spending has been shaped by the dramatic changes in the demographic structure of the US population over the recent decades: the share of young people in total population plummeted by 30% from 1980 to 2015. We feed this shift in population shares into our model and find substantial low-frequency variation in the size of the national fiscal multiplier over the recent decades, as reported in Figure 1. In particular, we find that the population ageing between 1980 and 2015 has reduced the national output fiscal multiplier by 38%.

Figure 1 Fiscal multipliers from 1967 to 2015

Since most advanced economies are experiencing a gradual population ageing, our analysis suggests that over time fiscal stimulus through government consumption spending could become a relatively less effective tool to spur economy activity. This result has to be interpreted with one important caveat. Although fiscal policy - intended in the classical form of purchasing goods from the private sector - becomes less effective in spurring economic activity due to population ageing, fiscal interventions targeted at specific age groups could still be highly expansionary. This caveat is particularly relevant when thinking about the design of fiscal stimulus packages amidst the COVID-19 crisis, whose negative economic outcomes are disproportionately borne by the young (Heathcote et al. 2020).

References

Aksoy, Y, H S Basso, R Smith and T Grasl (2015), “Demographic structure and macroeconomic trends”, VoxEU.org, 8 April.

Baldwin, R and B Weder di Mauro (2020), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, a VoxEU.org eBook, CEPR Press.

Basso, H S and O Rachedi (2020), “The young, the old, and the government: Demographics and fiscal multipliers”, American Economic Journal: Macroeconomics, forthcoming.

Bloom, D (2019), Live long and prosper? The economics of ageing populations, VoxEU.org Book, London: CEPR Press.

Heathcote, J, A Glover, D Krueger and V Rios-Rull (2020), “Health versus wealth: On the distributional effects of controlling a pandemic”, VoxEU.org, 26 April.

Jaimovich, N and H Siu (2009), “The young, the old, and the restless: Demographics and business cycle volatility”, American Economic Review 99: 804-826.

Jaimovich, N, S Pruitt and H Siu (2013), “The demand for youth: Explaining age differences in the volatility of hours”, American Economic Review 103: 3022-3044.

Nakamura and Steinsson (2014), “Fiscal stimulus in a monetary union: Evidence from US regions”, American Economic Review 104: 753-792.

Endnotes

1 Although in the model also old individuals have a high marginal propensity to consume, their consumption does not increase substantially following a government spending shock. This is due to the fact that they barely experience a rise in labour earnings given their low contribution to the labour force.