After the 2008 global crisis, emerging market corporations substantially increased their issuance of US dollar-denominated bonds. Focusing on the boom in foreign currency bond issuances and overall corporate debt, several authors discuss the drivers and the implications of high dollar debt for financial stability (Acharya et al. 2015, Acharya and Vij 2021, Forni and Turner 2021).

The historic lows of US interest rates and the ‘search for yield’ by institutional investors in developed economies are perceived to be major drivers of the post-2008 boom in emerging market dollar-denominated debt (Becker and Ivashina 2013). In that respect, this latest episode can be seen as a replay of the booms that occurred in the 1970s (when petrodollars were recycled through bank loans to developing country sovereigns and corporations) and in the early 1990s (when falling dollar interest rates produced a sizeable expansion in developing country sovereign and corporate bonds).

The preponderance of large bonds

This time, there is an added wrinkle, which has created an incentive for emerging market borrowers to focus on one particular segment of the market. As we show in this column and document in detail in a recent study (Calomiris et al. 2022), the growth in US dollar-denominated issuances after 2008 by emerging market corporations was driven by large bonds.

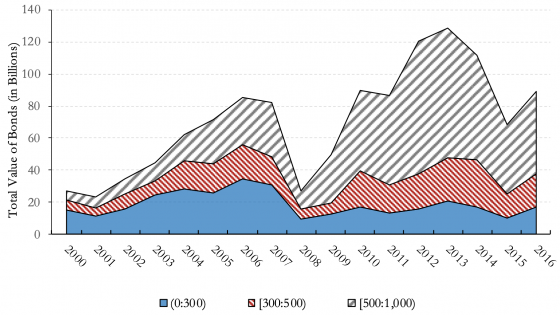

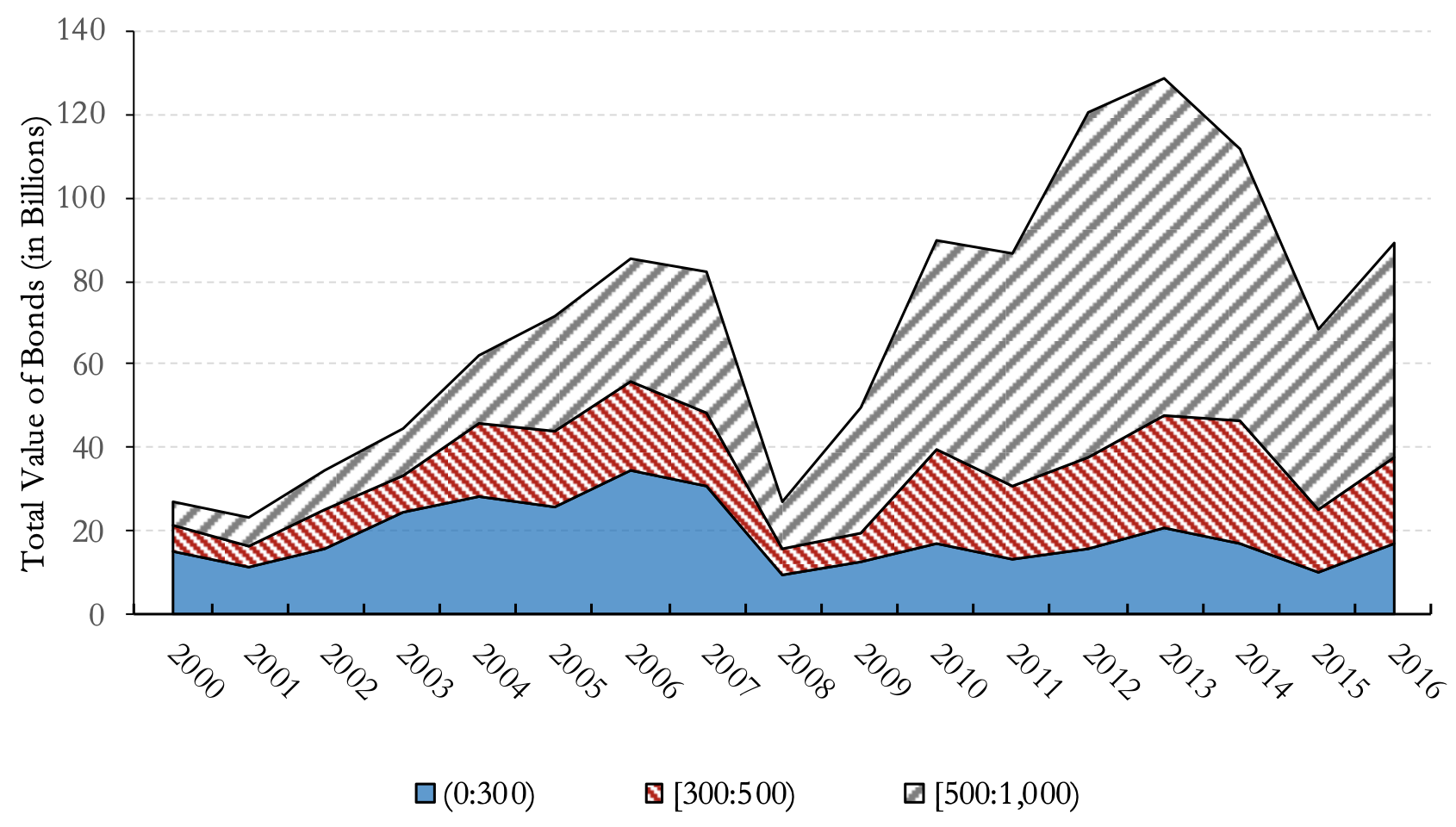

In particular, the market has concentrated since 2008 in bonds with principal greater than or equal to $500 million (Figure 1). These bonds had lower yields than lower face value bonds issued by otherwise identical issuers (Figure 2).

Figure 1 Total value of emerging market corporate bond issuance

Notes: This figure shows the total value of international US dollar-denominated bonds issued by emerging market firms during 2000-2016. The figure shows the total value of bonds in billions of 2011 US dollars, dividing bonds with face value below $300 million (0:300), between $300 and $500 million [300:500), and equal to or above $500 million [500:1,000), respectively.

Figure 2 Yield to maturity of corporate bond issuance, pre and post 2008

Notes: This figure shows the average yield to maturity of international US dollar-denominated bonds of different sizes issued by firms in emerging markets during the pre-2008 (2000-2008) and post-2008 (2009-2016) periods. Issuance size is in millions of US dollars.

The role of institutional investors

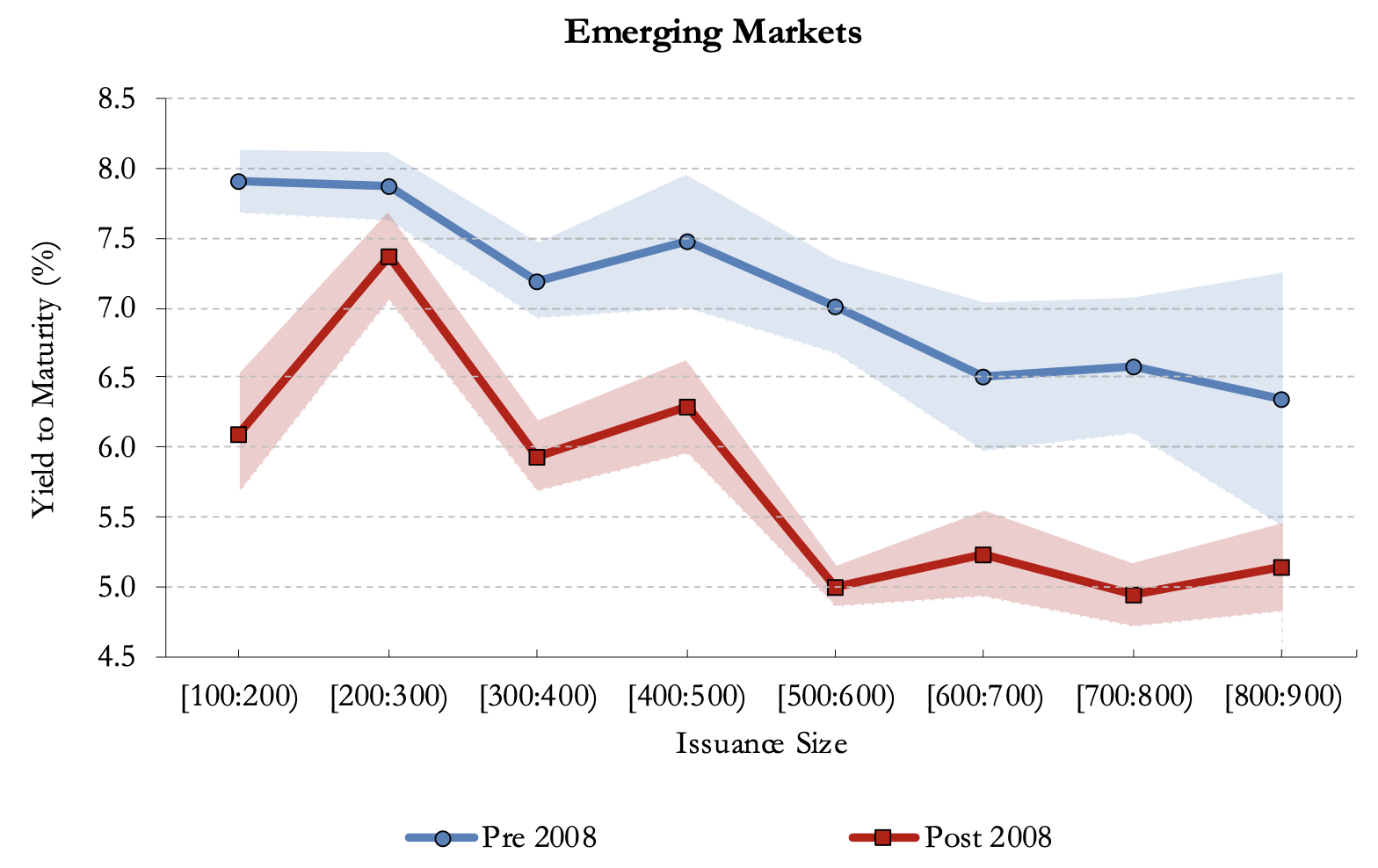

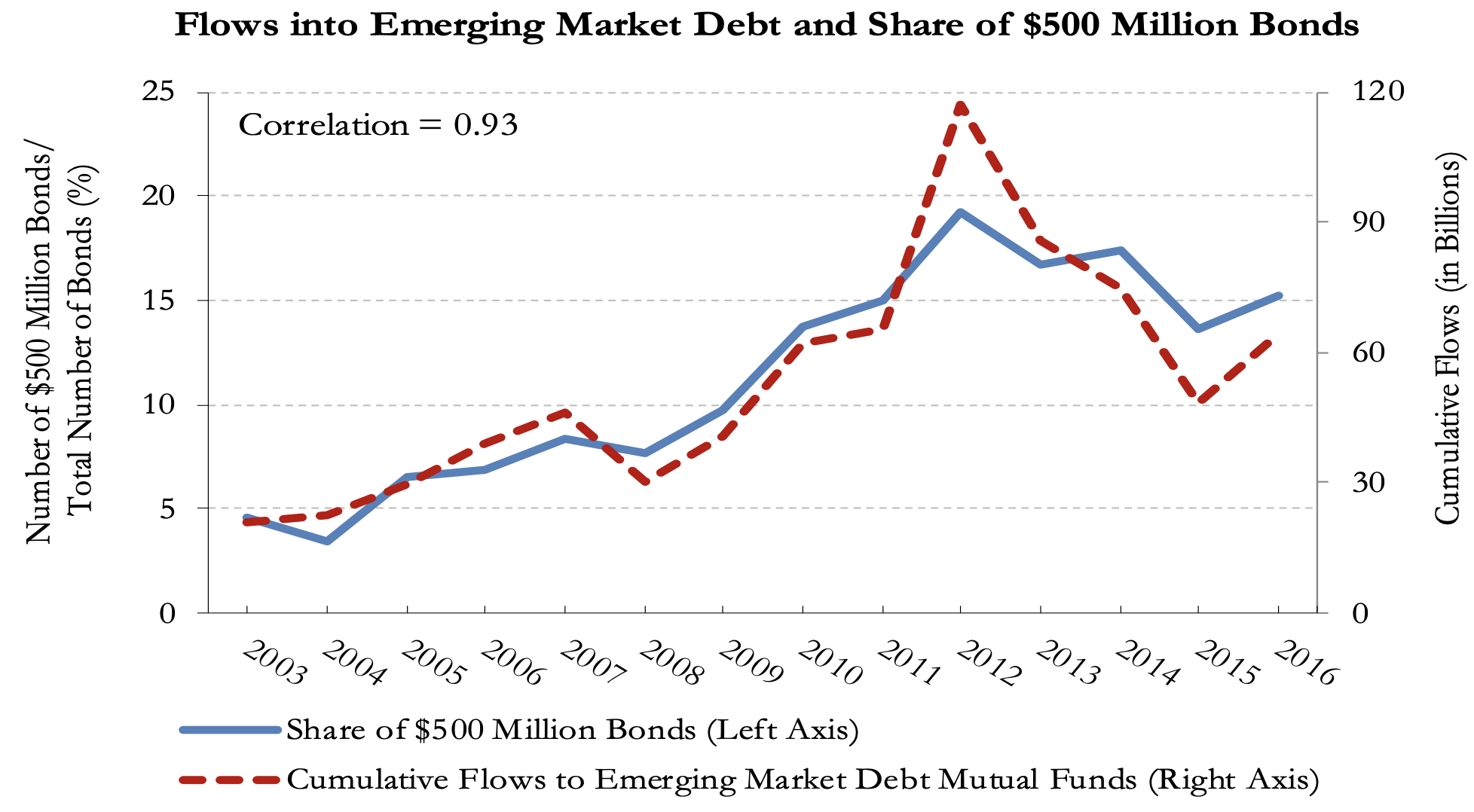

The boom in large bonds and their lower yields since 2008 reflect a change in the demand for bonds by institutional investors. Newly created emerging market corporate debt benchmark indexes, such as the JP Morgan CEMBI narrow index, along with the greater interest of institutional investors from developed economies in expanding into emerging markets since 2008, are the key aspects driving market rewards for the issuance of large bonds. Issuers are automatically included in the CEMBI narrow if they issue a standard type of bond with a principal of $500 million or more. Many corporations that previously would have issued smaller bonds started issuing bonds with a principal amount of $500 million because those bonds became eligible for inclusion in the index (Figure 3).

Figure 3 Cumulative distribution of corporate bond issuance size, pre and post 2008

Notes: This figure shows the cumulative distribution of international US dollar-denominated bonds of different sizes issued by firms in emerging markets during the pre-2008 (2000-2008) and post-2008 (2009-2016) periods. Issuance size is in millions of US dollars.

There is a clear connection between institutional investors’ involvement in emerging market debts and the premium on large bonds. As international investors generated increased capital inflows to emerging economies, firms responded by issuing proportionally more bonds of exactly $500 million (Figure 4).

Figure 4 Mutual fund investments in emerging markets

Notes: This figure shows the cumulative flows into emerging market sovereign and corporate debt mutual funds in billions of US dollars and the fraction of international US dollar-denominated bonds with face value equal to $500 million during 2003-2016. The fraction is calculated as the number of US international dollar-denominated bonds issued with face value equal to $500 million relative to all international US dollar-denominated bonds issued by firms in emerging markets.

What is driving institutional investors’ preference for large, index-eligible bonds? We show that it is mainly non-specialist funds (those not tracking the CEMBI index) that have a preference for large bonds. We argue that this reflects the liquidity advantages of index-eligible bonds, which are especially valuable to non-specialists who are relatively inexperienced in the asset class. From the standpoint of firms, the greater liquidity premium attached to large bonds affords them a significant cost advantage (Kashyap et al. 2019).

Firms’ responses

Borrowers – including those that might not have a need for a large amount of funding – have faced strong incentives to borrow large-denomination bonds because the yields on those bonds have become particularly low. This means that some firms have undertaken historically unprecedented large debts.

Firms that issued more than they needed to fund their investments held the unused proceeds in the form of increased cash. These additional cash holdings (if held in riskless dollar-denominated form, such as in Treasury bills) might have a buffer effect for future crises for these dollar-borrowing firms (Joseph et al. 2020a, 2020b), or alternatively, the cash might be an additional source of risk if firms invest it in local currency denominated assets, creating a currency mismatch (Bruno and Shin 2017). We find that the latter is a distinct possibility. In fact, firms are more likely, ceteris paribus, to engage in large bond issuance in countries where the carry trade is advantageous (where local interest rates are high relative to dollar interest rates).

Booms in dollar-denominated borrowing during prior periods of low US interest rates have been a source of instability for emerging markets when monetary policy tightens, leading to appreciations of the US dollar. Rising inflation in the US, and the prospect of monetary policy tightening by the Fed today, should therefore be a source of current concern.

References

Acharya, V, S Cecchetti, J De Gregorio, S Kalemli-Ozcan, P Lane and U Panizza (2015), “Emerging Economy Corporate Debt: The Threat to Financial Stability”, VoxEU.org, 5 October.

Acharya, V and S Vij (2021), “Foreign Currency Corporate Borrowing: Risks and Policy Responses”, VoxEU.org, 29 April.

Becker, B and V Ivashina (2013), “Reaching for Yield in Hot Credit Markets”, VoxEU.org, 3 May.

Bruno, V and H S Shin (2017), “Global Dollar Credit and Carry Trades: A Firm-level Analysis”, Review of Financial Studies 30(3): 703-749.

Calomiris, C, M Larrain, S Schmukler and T Williams (2022), “Large International Corporate Bonds: Investor Behavior and Firm Responses”, Journal of International Economics, forthcoming Also available as NBER Working Paper 25979).

Forni, L and P Turner (2021), “Global Liquidity and Dollar Debts of Emerging Market Corporates”, VoxEU.org, 15 January.

Joseph, A, C Kneer, N Van Horen and J Saleheen (2020a), “All you need is cash: Corporate cash holdings and investment after the financial crisis”, CEPR Discussion Paper 14199.

Joseph, A, C Kneer, N van Horen and J Saleheen (2020b), “Cash in the time of corona”, VoxEU.org, 26 April.

Kashyap, A, N Kovrijnykh, J Li and A Pavlova (2019), “Why Asset Managers Create Subsidies for Certain Firms”, VoxEU.org, 18 February.