Any economic evaluation of the public finances must rely on some notion of potential output. However, potential output must be estimated, and the way these estimates are produced and then used in policy, including in EU fiscal surveillance, is frequently criticised. One such vocal criticism is the “Campaign against ‘nonsense’ output gaps”,1 or CANOO (Tooze 2019).

In this column, we firstly recall the role of potential output and structural (cyclically adjusted) balances in the EU’s fiscal surveillance processes, and re-state why their introduction in the EU’s rules constituted progress, compared with the cruder, much more pro-cyclical, nominal rules. We then acknowledge the issues and challenges from the use of the ‘unobservable’ potential output variable in isolating the cyclical component of actual GDP and why, in order to avoid having too many estimates of potential, the EU agreed, 20 years ago, to have a commonly agreed methodology (CAM) for calculating it. Despite acknowledging the ongoing challenges, we dispute some of the criticisms, including from the CANOO, by showing the plausibility of the EU’s output gap estimates compared to other business cycle indicators. Finally, we put the role of potential output in EU fiscal surveillance into its appropriate context: far from being mechanical, the practice of surveillance has given space to the use of constrained judgment in specific situations, while simultaneously trying to increase predictability in fiscal assessments.

1 The structural focus of the SGP’s ‘second generation’ fiscal rules has improved the economic effectiveness of EU fiscal surveillance instruments

To appreciate the role of potential output and structural balances in EU fiscal rules today, one has to remember that the fiscal surveillance apparatus has come a long way from its original design. The Maastricht Treaty refers to ‘headline’ nominal reference values for deficits and debt-to-GDP ratios (3% and 60%, respectively). EU surveillance and the original Stability and Growth Pact (SGP) largely focused on headline deficits. It was the difficulties that the SGP.2 ran into in its first economic cycle, culminating in the controversy over Germany’s and France’s deficits in the early 2000s, which led to a stronger emphasis on cyclically adjusted measures, with the first evolution of the Pact in the mid-2000s.

From there on, the EU’s fiscal framework evolved as a perfect illustration of what has been dubbed ‘second generation fiscal rules’ (Debrun et al. 2018). The role of structural balances was confirmed in the ‘Six-Pack’ and ‘Two-Pack’ reforms of the early 2010s (together with other innovations such as the introduction of a net expenditure rule). In the SGP, the medium-term objective (MTO) now serves as the target of reference in the preventive arm. It is conceived to allow the automatic stabilisers to play out, both in upturns and downturns, without breaching the 3% value for the deficit (European Commission 2019). Also in the corrective arm of the Pact (i.e. the Excessive deficit procedure, or EDP, arm), structural balances play an important role in setting the pace of fiscal adjustments.

From an economic perspective, the more ‘intelligent’ fiscal rules of the second generation, which rely heavily on notions of potential output and cyclically adjusted fiscal balances, represent clear progress compared with the simpler, but overly crude, rules which relied on headline nominal numbers. The difficulty, however, has now shifted from one of nominal naivety to one where the significant consequences from having to accept the ‘unobservability’ of potential output have to be sensibly dealt with.

2 The issue of potential output unobservability and recent criticisms of the EU’s output gap estimates

Potential output is, and always will be, an unobservable variable and consequently has to be estimated. In order to ensure equal treatment and to obtain transparent and unbiased estimates for all of the EU’s member states, a commonly agreed methodology (CAM) has been employed over the last 20 years in order to calculate the potential growth and output gap estimates which are used in the EU’s policy surveillance processes. Given the importance of the CAM – in particular, its estimate of the amount of economic slack in the EU’s economy at a given point in time – to the conduct of the EU’s fiscal policy, it is understandable, and indeed welcome, that it is the subject of sustained interest and criticism from the economics profession and the wider public.

Currently, criticisms of the economic plausibility of the output gaps produced by the EU’s CAM focus on the following three broad themes:

- First how is it possible that the EU’s CAM is suggesting that we have a closed output gap and yet the EU has still almost no inflation?

- Second, what is the link between the output gap and external imbalances?

- And finally, how is it plausible that Germany and Italy have the same level of the output gap in spite of their very different growth dynamics?

Below we sequentially address these three criticisms, first at a conceptual level and second by providing empirical evidence. We will show that a lot of these criticisms draw heavily on specific inflation indicators (such as headline or core inflation) or on indicators of external imbalances,3 which do not perform well as indicators of the cycle and consequently should be used with extreme caution by policy makers.

a) Is a closed output gap consistent with almost no inflation?

The inflation rate is often used as a plausibility check for output gap estimates. There is a significant correlation between the output gap and inflation, and limited inflation acceleration in the euro area has been a reason for questioning the speed in which the output gap is closing (Couere 2018). However, one should be aware that a one-to-one relationship between inflation and the output gap should not be expected and that there are a number of plausible explanations for the so-called missing inflation puzzle. The first explanation is that inflation is not only driven by demand pressure but also by supply shocks. In recent years, there has been little wage pressure in the euro area. In Germany, real unit labour costs have remained stable despite a continuous decline of the unemployment rate, which suggests that the NAWRU (trend unemployment rate) has been falling. Restrained domestic cost pressures to some extent reflect the fact that Germany’s labour market problems are more skewed to supply-side or skill mismatch issues rather than to cyclical and labour demand issues. Other reasons for a divergence between the closure of the euro area’s output gap and weak inflation developments are low raw material and oil price inflation; and low import price inflation in general, which reflects globalisation induced deflationary mechanisms, with knock on implications in terms of pricing power throughout the euro area (Forbes 2019).

In overall terms, therefore, there are lots of reasons why the output gap and inflation do not co-move, with the present combination in the euro area of having an output gap which is closed and with inflation staying low providing a strong reminder as to why a one-to-one relationship should not be expected. In fact, many aspects of recent euro area trends are consistent with the central elements of the secular stagnation debate, especially the evidence regarding increasing savings, higher risk aversion and falls in the natural rate of interest. The downward shift in actual GDP growth rates in the euro area between the pre-crisis and post crisis periods is perhaps heralding an era of both permanently lower potential growth and core inflation rates, similar to what has been experienced in Japan for some time now.

b) What is the link between the output gap and external imbalances?

Whilst measures of external imbalances such as the current account balance are, like inflation, linked to output gap developments; they are also similar to inflation in that they are not unequivocal cyclical indicators. The current account balance can incorporate a strong trend component, because it can reflect changes in household savings driven by shifts in demographic trends (e.g. Cheung et al. 2013). Moreover, the link to the cycle is not straightforward: the current account balance can be positive because of low domestic demand (small or negative output gap) or because of buoyant external demand conditions (which tend to push up the output gap).

c) How plausible is it that Germany and Italy have the same level of output gap despite their very different growth patterns?

The level of the output gap is simply the difference between the level of actual and potential output at a given point in time. Differences between countries therefore depend on their actual and potential growth rates and the location of a country in their own respective economic cycle. Transitory country specific shocks, which the individual countries have been exposed to, determine cross-country differences. If one focuses in on the longer term evolution of economies, rather than on their shorter business cycles, one can see clearly that over the last 20 years Germany’s actual and potential growth rates have both grown at around three times those of Italy, with the unsurprising, mechanical, result that average output gaps over this 20 year period have been broadly the same. Consequently, commentators should not really focus in on the fact that Germany’s and Italy’s output gap in 2019 are, in both cases, forecast by the CAM to be around -0.25% (and therefore that the fiscal policy response should be broadly the same). The real issue is why are German and Italian potential growth rates so different (a structural, not a fiscal, policy question).

In relation to the question of weak Italian potential growth (which ultimately determines the sustainable, non-inflationary, pace of Italy’s actual GDP growth), the CAM is consistent with the central thrust of the academic literature which pinpoints the set of structural factors which can explain Italy’s relatively disappointing growth performance. First, there is Italy’s negative trend productivity growth (with this negative trend already firmly established before the crisis), which has been highlighted in various studies (e.g. Calligaris et al. 2016, Gopinath et al. 2017, OECD 2017) and is often attributed to capital misallocation (with one indication of this misallocation being the high share of non-performing loans). Associated with capital misallocation, the investment rate in Italy has been very low (leading to a negative contribution from capital growth to potential growth). In addition, the population of working age is only growing at a very low pace (and growth has been negative in recent years). Though real unit labour costs have been declining, the decline was smaller than in other countries struck by the Great Recession in 2008/2009, such that Italy did not manage a turnaround of unemployment of the same order of magnitude as other EU countries.

3 Are recent criticisms of the EU’s CAM based on solid empirical evidence? New research by Commission staff suggests caution using specific business cycle indicators for estimating output gaps and confirms the plausibility of the EU’s output gap estimates

Recent research by Commission staff (Roeger et al 2019) shows that a lot of the criticisms on the EU’s CAM are not only flawed conceptually but also empirically. It shows how most of the critiques use indicators of the economic cycle which have a poor track record in terms of explaining changes in the amount of cyclical slack in the EU’s economy.

Roeger et al.’s (2019) analysis explains that if one was to use only specific business cycle indicators, such as price inflation and the current account balance, then one would have expected to see a significant negative output gap in the euro area as a whole (and in specific euro area Member States) in 2018, as claimed by the CANOO. Instead, the EU’s CAM shows a small positive output gap for the euro area in that year. The authors explain this discrepancy by demonstrating that specific business cycle indicators may only be capturing partial dimensions of the business cycle (i.e. they only provide a cyclical signal for either the product or labour market dimension but not both dimensions). Moreover, they may not be unambiguous cyclical indicators since they contain strong non-cyclical and trend components.

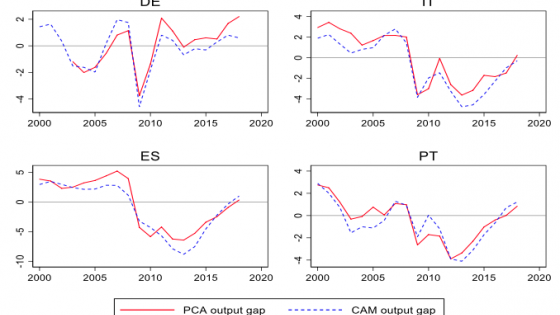

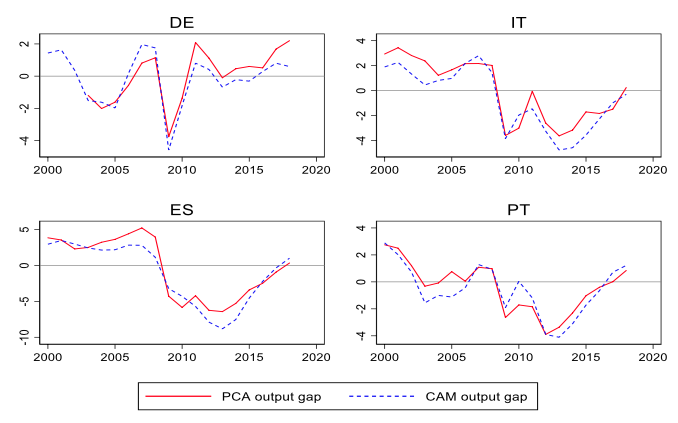

Roeger et al. select seven of the most widely used business cycle indicators – price inflation, wage inflation, current account balance, GDP growth, short-term unemployment rate, sentiment indicator for economic slack, and capacity utilisation – and try to find a common cyclical signal amongst them by performing a principal component analysis (PCA). The analysis confirms the cyclical ambiguity of the inflation and CAB indicators. The paper derives a PCA output gap shown in Figure 1. The PCA and CAM output gap for four euro area countries are highly correlated, with the two output gaps following a similar pattern over the period 2000-2018.

The most important conclusion to be derived from Roeger et al.’s analysis is that one needs to be very careful in selecting business cycle indicators, since an excessive reliance on individual indicators might lead to wrong conclusions about the business cycle position of a country. Some indicators might be ambiguous and might contain trend as well as cyclical variations, with the price inflation and CAB variables being classic examples of this. This is why one should always look at a broad range of indicators in order to get a balanced and plausible view of the current cyclical position. Preferably, one should combine indicators that exploit the cyclical signal from both the labour and product market sides of the economy, which is exactly what the CAM does.

Figure 1 ‘PCA output gap’ and the EU’s ‘CAM output gap’ for Germany, Italy, Spain and Portugal, 2000-2018

4 Dealing with potential output unobservability in EU fiscal surveillance must involve an element of constrained judgement

Whilst the EU’s fiscal surveillance system is an essentially rules-based system, the fact that it is based on an unobservable variable – and could, in extreme circumstances, lead to the imposition of legally binding sanctions on a specific country – makes it clear that the EU never intended it to be used for the taking of automatic decisions. This essential need to include a judgemental component in the EU’s fiscal surveillance system was underlined in the 2002 ECOFIN Council decision which introduced the CAM, with the Council stating clearly that they welcomed “the Commission’s intention to apply this method in a non-mechanistic, transparent and consistent way”. This clear signal from the Council has placed the role of potential output in EU fiscal surveillance in its proper context, with a joint focus on ensuring non-mechanistic, yet broadly predictable, fiscal assessments.

In practical terms, beyond the ongoing research efforts of the OGWG to produce more robust estimates, quite a few steps have been taken in the EU’s fiscal surveillance framework itself in order to mitigate the implications of potential output unobservability. In particular, efforts have been made both to reduce the amount of dependence being placed on the potential output estimates in order to increase predictability; as well as retaining an element of judgement in the implementation of the SGP.

The emphasis is on the change in the output gap rather than on the level of the output gap

Within the assessment of the Stability and Convergence Programmes, it is not so much the output gap as such which is important, but the change in the output gap. As long as a Member State is not at it’s MTO, it must be on an appropriate adjustment path towards the MTO. This adjustment is measured as an improvement in the structural balance, and is thus influenced by the change in the output gap.

The SGP’s overall dependence on potential output estimates has been reduced

More emphasis is given to the so-called expenditure benchmark in the preventive arm of the SGP. It compares the growth of primary expenditure to a smooth notion (10-year centred average) of potential growth (the indicator also corrects for revenue measures, hence it is a ‘net’ expenditure rule that doesn’t take ‘sides’ with respect to the size of government). The expenditure benchmark still relies on an evaluation of potential growth, but not on the level of potential output, as the MTO does. This makes a considerable difference in practice, as uncertainty on potential growth is almost an order of magnitude smaller than level uncertainty. Finally, any assessment of the correction of excessive deficits in future EDPs should also focus on policy delivery in terms of tax and expenditure measures.

An element of judgement has also been introduced into the fiscal surveillance process

The Commission, with the backing of the Council of Ministers, has introduced elements of flexibility and judgement in the implementation of the rules to deal with specific circumstances. In particular, where the potential output estimates depart from plausible estimates based on other cyclical indicators (Hristov et al. 2017), constrained judgement is used when setting the pace of adjustment to the MTO. In addition, a range of country-specific changes have been approved to the CAM over recent years, with specific attention also being paid to countries where the need to consolidate has had to be weighed up against a fragile recovery. Due to the existence of these provisions, reduced fiscal requirements, compared with the standard rules, were approved for countries including Spain and Slovenia.

The overall outcome from the above considerations is that the reality of the implementation of fiscal surveillance in recent years is a long way from a rigid, mechanical approach based solely on an evaluation of output gaps. In fact, some commentators actually consider that the Commission has gone too far in taking an overly flexible approach.

In conclusion, what emerges from the analysis in this column regarding potential output and EU fiscal surveillance is a small number of deeper and more subtle challenges. First, while the EU’s fiscal framework has become more sophisticated, it is now widely seen as too complex – and the above considerations suffice to make this clear. Second, there is some tension between the need for predictability (and consistency across countries and over time) and the need to retain discretion in particular circumstances. This is not to say that further improvements might not be conceivable, possibly building on a ‘third generation rule’ such as the so-called single expenditure rule with a debt anchor. It will in any event remain a tall order to find an economically sensible and politically viable compromise given the complex trade-offs involved between the principles of simplicity, predictability and flexibility.

Authors’ note: The authors are writing in their personal capacity and their opinions should not be attributed to the European Commission.

References

Calligaris S, M Del Gatto, F Hassan, G I P Ottaviano and P Schivardi (2016), “Italy’s Productivity Conundrum: A Study on Resource Misallocation in Italy”, ECFIN Discussion Papers, 2016.

Cheung, C, D Furceri, and E Rusticelli (2013), “Structural and Cyclical Factors behind Current Account Balances”, Review of International Economics 21(5): 923-944.

Coeure, B (2018), “Scars that never were? Potential output and slack after the crisis”, Speech at the CEPII 40th Anniversary Conference, Paris, 12 April.

European Commission (2018), “Staff working document on the review of the flexibility under the Stability and Growth Pact”, COM(2018) 335.

Debrun X, L Eyraud, A Hodge, V Ledo and C Patillo (2018), “Second-generation fiscal rules: From stupid to too smart”, VoxEU.org, 22 May.

European Commission (2019), “Vade Mecum on the Stability and Growth Pact”, European Economy Institutional Paper N°101.

Fatas, A (2018), “Self-fulfilling pessimism: The fiscal policy doom loop”, VoxEU.org, 28 September.

Forbes, K J (2019), “Inflation Dynamics: Dead, Dormant, or Determined Abroad?” Brookings Papers on Economic Activity.

Gopinath, G, S Kalemli-Özcan, L Karabarbounis and C Villegas-Sanchez (2017), “Capital allocation and productivity in southern Europe”, Quarterly Journal of Economics 132(4): 1915–1967.

Hristov A, V Vandermeulen and R Raciborski (2017), “Assessment of the plausibility of the output gap estimates”, European Economy Economic Brief 023, April.

Kiel Institute (2019), Estimating Potential Output and the Output Gap – An Analysis of Revisions and Cyclicality, February.

OECD (2017), “Economic Survey of Italy 2017”.

Orphanides A and S Van Norden (2002), “The unreliability of output gap estimates in real time”, Review of Economics and Statistics 84(4): 569-583.

Roeger W, K Mc Morrow, A Hristov and V Vandermeulen (2019), “The current debate on output gaps and cyclical indicators”, European Economy Discussion Papers, July.

Tooze, A (2019), “Output gap nonsense”, Social Europe, 30 April.

Endnotes

[1] See https://twitter.com/RobinBrooksIIF

[2] The Commission does not apply its own methodology. It applies the rules and methods that have been commonly agreed, in the Output Gap Working Group (OGWG), by technical and academic experts from all of the EU’s 28 Member States, as well as from the OECD and the IMF; with the OGWG also periodically drawing on assessments of the method which have been carried out by independent academic experts and institutions.

[3] See https://twitter.com/RobinBrooksIIF and Tooze (2019).