The sovereign debt crisis continues to cast shadows on the timid economic recovery of Europe. The issue has regained salience since Syriza's victory in the snap election of January 2015. The current Greek government advocates a radical renegotiation of the assistance programme, including more flexible terms of repayment and the end of fiscal austerity. A related, salient issue is that of structural reforms to restore sustainable growth. The ultimate way out of the crisis requires Greece to improve its state capacity (e.g., in tax collection) and the efficiency of its labour market. However, the political process has so far failed to deliver major reforms. Is the debt crisis a stimulus or an obstacle to reforms?

Hawks, doves, and pragmatists

Two apparently irreconcilable positions confront each other in the policy debate. The hawks maintain that the terms of the initial agreement must be enforced and no further concession should be granted. Beyond its direct costs, appeasing Greece would undermine the credibility of markets and institutions, creating a huge moral hazard problem. In particular, it would destroy incentives for troubled countries to carry through the necessary structural reforms. According to this view, forcing Greece to exit from the Eurozone would be the lesser evil (Sinn 2015).

In the doves' opinion, fiscal austerity is as painful as fruitless to end recession (Wypolsz 2012), and is the problem rather than the solution.1 In Greece, output has fallen by 38% relative to the pre-crisis trend, and the unemployment rate today is over 25%. Structural reforms would entail further social costs in the short run. These are unthinkable – argue the doves – unless they are eased by some debt relief. Additionally, the debt burden is already so high that restructuring is in any case unavoidable (Philippon 2015).

Since the start of the crisis endless negotiations have led to repeated revisions of previously agreed terms. This approach is ridiculed by many observers who portray it as the ultimate evidence of the inability of European institutions to address the problem.

A fresh perspective on sovereign debt and structural reforms

In a recent study (Müller et al. 2015), we challenge this popular view, and show that sound economic theory predicts that the best response is precisely pragmatism and sequential compromise.

Our research aims to identify the efficient approach to help a sovereign country struggling with a recession and a debt crisis. We construct a macroeconomic model embedding three salient features of the European debt crisis.

- The first is that sovereign debt is subject to limited enforcement, and can be defaulted on at some costs.2

Such costs are stochastic, reflecting domestic and international political shifts (e.g., the election of Syriza) which affect the perceived penalty associated with defaulting.

- The second is that whenever creditors face a credible default threat, they can offer the indebted country a haircut to prevent a disorderly default as it happened in Greece in 2011.

In equilibrium, outright default is never observed. Instead, the debt is repeatedly renegotiated with diverse outcomes in terms of haircuts and debt recoveries, in line with the evidence documented by Tomz and Wright (2007) and Sturzenegger and Zettelmeyer (2008).

- Third, the indebted country can make structural reforms that induce growth and reduce the expected duration of recession.

Examples include policies making it easier to start new firms, reforms enhancing state capacity in tax collection, rationalisation and downsizing of the public administration, labour market reforms, etc. These policies yield efficiency gains, but hurt in the short run some groups of citizens, and may trigger street protests, loss of popularity for governments, and social costs such as temporary increases in the unemployment rate.

To establish a normative benchmark, we characterise the optimal dynamic contract between a lender and a sovereign country struggling with a recession. The key friction is that the debtor can, subject to a default cost, walk away from the contract and revert to the market for future financing needs. The efficient contract features non-decreasing consumption and a non-increasing reform effort during the recession. More precisely, consumption and reform effort remain constant as long as the debtor has no incentive to walk away from the existing contract (i.e., the default cost is too large to make such event credible). However, whenever the country faces a low realisation of the default cost, and threatens to quit, the lender increases the country's consumption, and reduces the required reform effort, promising altogether more favourable future terms.

In this environment, the laissez-faire market outcome, where the country finances its needs by issuing government bonds and decides independently over its structural reforms, is inefficient. First, despite rising renegotiation premia, indebted countries keep accumulating debt during recessions. Whenever debt is honoured, consumption falls, while consumption rises whenever debt is renegotiated. This stop-and-go dynamics result in excessive consumption volatility. Second, there is too little structural reform, especially if the debt is large. The reason is that the value of debt increases when the recession ends, due to a lower probability that the outstanding debt be renegotiated. Therefore, part of the gain from reforms accrues to the creditors. The sovereign does not internalise these gains and engages in too little reform. This effect, which is related to the debt overhang argument in Krugman (1988), leads to an inefficiently long duration of the recession.

Assistance programme – yes, Grexit – no

Efficiency can be attained by the intervention of an external institution such as the IMF. The optimal intervention is an assistance programme providing the country with debt relief and a transfer flow until the end of the recession, when the country is settled with a large interest payment. The assistance programme has two features. First, the country is not allowed to increase its consumption unilaterally, i.e., it is subject to an austerity programme. Second, the agency can monitor the structural reforms. While these are standard features of stand-by programmes, our theory also delivers a surprising normative prediction: Whenever the debtor threatens credibly to abandon the programme (for instance, because of a political shock such as the Syriza's victory), the terms of the agreement must be renegotiated in its favour. In particular, the country must be offered a more lenient repayment structure (e.g., deferred interest payments, or even a reduction of the face value debt), and softer demands on structural reforms. A contract in which the agency commits to ‘Grexit’ rather than consider a renegotiation request is less efficient than a pragmatic approach involving sequential renegotiations.

Pragmatism as a matter of economic principles

The model can reproduce realistic debt-to-GDP ratios, and we find that a well-designed assistance programme can deliver large welfare gains. In the absence of policy intervention, the market fails because the government of the borrowing country cannot commit to future reforms and can renegotiate its debt.

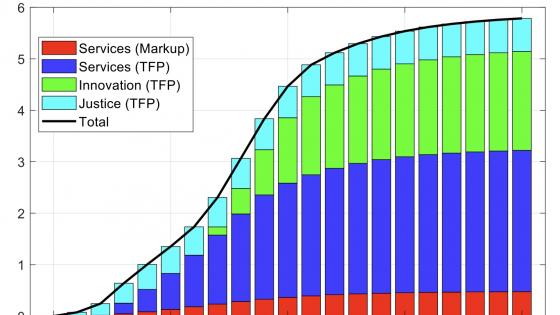

Figure 1.

Notes: The two upper panels contrast consumption and reform effort in the troubled country under two alternative simulated scenarios. The red line represent the outcome of the efficient contract, while the blue line captures the market outcome. The market outcome yields more volatile consumption and reform effort. The crisis ends after eight periods in the market equilibrium, and already after six periods under the optimal contract. The lower panels show the dynamics of debt and the associated risk premium that result from the repeated renegotiations in the market equilibrium.

The prescription of our theory stands in sharp contrast with the view that a tough approach is the best way to solve the European debt problem. Our research highlights the risk that misconceived economic principles bring about large welfare losses for Greece and renewed financial instability in the Eurozone.

References

Aguiar, M, and G Gopinath (2006), "Defaultable Debt, Interest Rates, and the Current Account", Journal of International Economics 69 (1), 64--83.

Arellano, C (2008), "Default risk and income fluctuations in emerging economies", The American Economic Review 98(3), 690--712.

Collard, F, M Habib, and J-C Rochet (2015), "Sovereign Debt Sustainability in Advanced Economies", Journal of the European Economic Association 13(3).

Corsetti, G (ed) (2012), "Austerity: Too Much of a Good Thing?", VoxEU.org ebook.

Krugman, P (1988), "Financing vs. forgiving a debt overhang", Journal of Development Economics 29(3), 253--268.

Müller, A, K Storesletten, and F Zilibotti (2015), "Sovereign Debt and Structural Reforms", CEPR Discussion Paper 10588.

Philippon, T (2015), "Fair debt relief for Greece: New calculations", VoxEU.org, 10 February.

Sinn, H-W (2015), "Der Grexit ist die beste Lösung für alle," interview from Bystron von Petr published in Format 17/2015.

Sturzenegger, F, and J Zettelmeyer (2008), "Haircuts: estimating investor losses in sovereign debt restructurings, 1998--2005", Journal of International Money and Finance 27(5), 780--805.

Thomas, J, and T Worrall (1988), "Self-enforcing wage contracts", The Review of Economic Studies 55(4), 541--554.

Tomz, M, and M L J Wright (2007), "Do countries default in bad times?", Journal of the European Economic Association 5(2-3), 352--360.

Wyplosz, C (2012), "The coming revolt against austerity", VoxEU.org, 2 May.

Footnotes

1 See Corsetti (2012) for a collection of diverse views about the wisdom of austerity measures.

2 See Aguiar and Gopinath (2006), and Arellano (2008).