Economists have argued that the relative price of capital goods, especially machinery and equipment, is a key determinant of investment and growth (Restuccia and Urrutia 2001, Jones 1994, Sarel 1995, Lee 1995, DeLong and Summers 1991, 1993). The price of capital goods – relative to consumption – is much higher in poor countries, and this was considered to be fundamental when explaining the lower investment rates, living standards and growth in these economies.

There is less consensus what causes cross-country heterogeneity in the relative price of capital goods. Some have argued that it reflects differences in countries’ productivity in the making of machinery and equipment, or other tradable goods to exchange for them (Hsieh and Klenow 2007). Others link it to distortionary policy choices, such as trade barriers in the capital goods sector (Eaton and Kortum 2001, Sposi 2015). Research into cross-country differences in relative capital goods prices has blossomed, but those researchers have largely neglected the changes over time in these relative prices within countries.

In our recent research (IMF 2019), we have revisited the debate on what drives the relative price of investment and its macroeconomic implications, using the dramatic changes in prices that have recently taken place across countries and sectors. Using sector-level producer price data, we were able to show that reductions in distortionary trade policies and improvements in productivity both contributed to the decline in the relative prices of capital goods. Analysis of country- and sector-level data shows that lower relative prices of capital goods have boosted real investment across countries, as DeLong and Summers (1991), among others, have hypothesised.

Rising trade tensions and sluggish productivity growth are likely to slow the decline in the relative price of investment goods, which would hold back real investment growth. We think that we should give renewed attention to this relatively unexplored channel, through which the slowing pace of trade integration – or its potential reversal – can affect future economic prospects.

The stylised facts

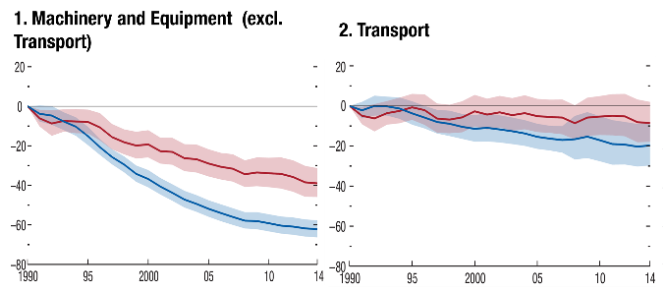

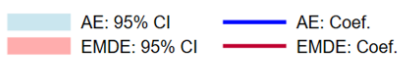

Since 1990, the price of machinery and equipment relative to the price of consumption fell about 60% in advanced economies and about 40% in emerging market and developing economies (Figure 1).

Figure 1 Dynamics of relative prices across types of capital goods and broad country groups

(percent change relative to 1990)

Sources: Penn World Table 9.0 and IMF staff calculations.

Notes: The figure shows the percentage change from the relative investment prices in 1990. The solid lines plot year fixed effects from a regression of low relative prices on year fixed effects and country fixed effects to control for entry and exit during the sample period and level differences in relative prices. AE = advanced economies; EMDE = emerging market and developing economies.

The fall in the relative price of computing equipment, which has declined about 90% since 1990 (based on KLEMS data, primarily from advanced countries), is most striking. Overall these were dramatic declines, especially when compared with the price of housing and commercial structures. These mostly rose in price at the same rate as consumption, or even faster in advanced economies. Other investment (R&D, for example) and transport equipment also declined in relative prices over time, but this decrease was smaller.

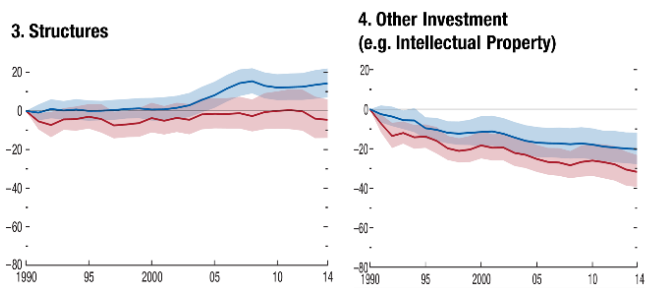

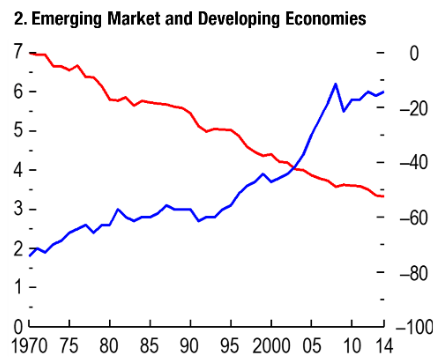

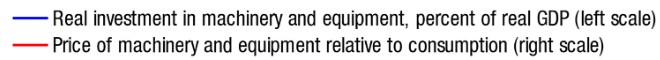

Figure 2 suggests that relative price decreases coincided with significant increases in the real investment rate in machinery and equipment. Over the last 50 years, real investment in machinery and equipment has been steadily rising, especially in emerging market and developing economies. Since 1990, real investment in machinery and equipment as a share of real GDP has risen from 3% to 6%, contributing to much-needed capital deepening in these economies.

Figure 2 Real investment rate, and changes in the relative price, of machinery and equipment (%)

Sources: Penn World Table 9.0; IMF World Economic Outlook and IIMF staff calculations.

Notes: The figure plots the real investment rate in machinery and equipment and changes in the price of machinery and equipment relative to the price of consumption. Changes in relative prices are relative to their levels in 1970.

Drivers of relative prices

Guided by previous research on the sources of differences in the relative price of capital goods across countries, we asked whether large declines in relative prices are reflecting faster productivity growth in the capital goods-producing sector, or whether the removal of potential policy distortions, such as reductions in trade costs, drives relative prices.

Disentangling the role of trade barriers is complicated by the fact that trade integration can affect prices through many channels. Lowering import tariffs may induce domestic producers to cut prices to match those offered by foreign competitors. But trade liberalisation also has an indirect effect on prices through its effect on firm productivity (e.g. Pavcnik 2002, Amiti and Konings 2007, Topalova and Khandelwal 2011, Bustos 2011, Ahn et al. 2019).

To disentangle these effects, we follow a three-step approach:

1. Using sectoral producer price data across 40 advanced and emerging market economies and 33 sectors between 1995 and 2011 from the World Input-Output Database, we estimate the elasticity of producer prices to changes in sectoral labour productivity and exposure to international trade. We use import penetration – the ratio of imports to domestic value added – at the sectoral level, instrumented with sectoral import tariffs to isolate changes in trade exposure triggered by policy choice.

2. We estimate the elasticity of labour productivity at the sectoral level with respect to changes in policy-induced import penetration.1

3. We use these estimated elasticities to decompose the overall decline in the relative prices of capital goods into:

- change due to trade integration

- change due to the indirect effect of trade via productivity

- change due to improvements in relative productivity unrelated to trade, and

- change due to all other factors.

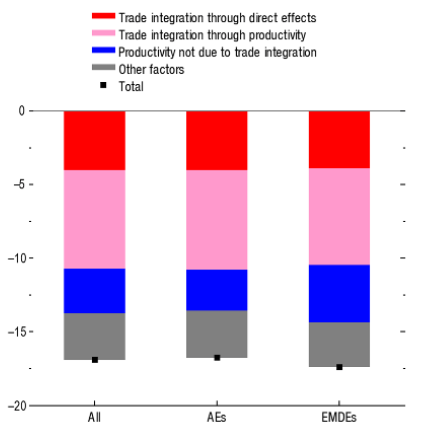

The results (Figure 3) suggest that more than half of the decline in the relative prices of machinery and equipment between 2000 and 2011 can be traced to deepening trade integration, both through its direct effect on producer prices and its effect via improvements in labour productivity.

Figure 3 Contributions to changes in relative producer prices of capital goods: 2000-2011 (%)

Source: IMF staff calculations.

Notes: The figure combines the estimated elasticities of producer prices to trade integration and relative labour productivity, and changes in these factors for the capital goods sector between 2000 and 2011 to compute their contribution to the observed change in the producer price of capital goods relative to the price of consumption.

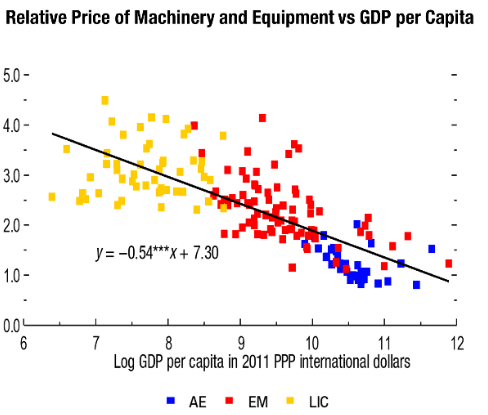

Despite the effects of trade integration and technological progress on the decline in the relative investment prices across income groups, Figure 1 clearly shows that advanced economies experienced larger declines in the relative price of machinery and equipment than emerging market and developing economies. Therefore, it may not be surprising that, in the cross section of countries shown in Figure 4 (top panel), low-income countries continue to face higher relative prices of capital goods, according to the latest available 2011 International Comparison Project data.

Our analysis of the cross-country determinants of relative capital goods prices suggests that both productivity differences in the tradable goods sectors and trade barriers play a role, providing support to both sides of the debate. Interestingly, policy-induced trade costs seem to explain a larger fraction of the variation in relative capital goods prices across countries than natural trade barriers (Figure 4, bottom panel).

Figure 4 Relative price of machinery and equipment in the cross-section of countries in 2011

Sources: International Comparison Program (ICP); CEPII; GeoDist database; Feenstra and Romalis (2014); Fraser Institute; UNCTAD; World Bank Doing Business Indicators, Eora MRIO database; and IMF staff calculations.

Note: The relative price of machinery and equipment is relative to the price of consumption. Policy-related trade costs are: freedom to trade, tariffs on capital goods, cost and time to import.

Macroeconomic implications

Finally, we seek to quantify how much of the increase in machinery and equipment investment over the past 30 years can be attributed to the decline in the relative prices of these goods. We rely on both model-based simulations and empirical evidence from country- and sector-level data.

We use the IMF’s Global Integrated Monetary and Fiscal Model to isolate changes in relative prices of capital goods that are driven by two exogenous shocks:

- a cut in tariffs on capital goods

- a shock to relative productivity of the capital-goods-producing sector.

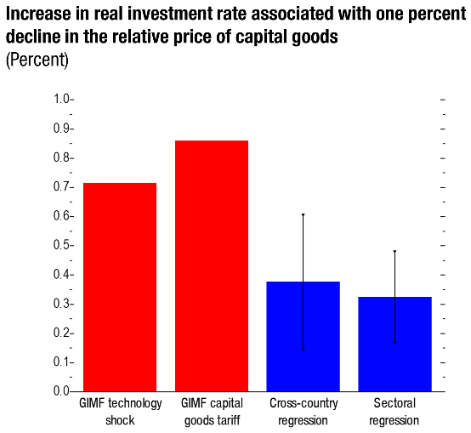

We find that a 1% decline in the relative price of investment, induced by either of these two shocks, leads to approximately 0.8% increase in the ratio of the real investment rate to real GDP in the medium term.

Our empirical estimates using country-level and sectoral data concur with model simulations. Using a reduced-form framework, we relate real investment in machinery and equipment as a share of real output and the price of machinery and equipment relative to the price of consumption across 180 countries, over 60 years, from the Penn World Table 9.0 database.

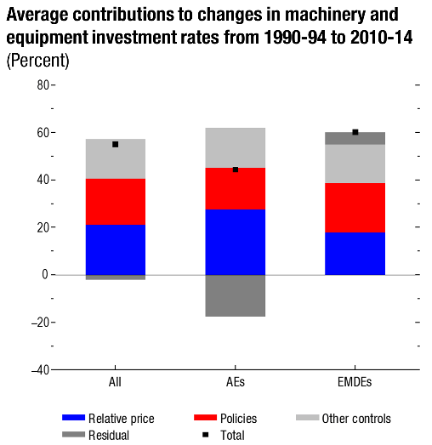

Our sectoral analysis, which allows us to control for all time-varying country factors that may have affected investment rates or prices, relies on data from 15 broad sectors in 18 countries between 1971 and 2015 from the EU and World KLEMS databases. Both country- and sector-level regressions indicate that a 1% decline in the relative prices of tradable capital goods is associated with an increase of between 0.2% and 0.5% in the real investment rate (Figure 5, top panel).2 These estimated elasticities suggest that the decline in the relative price of machinery has been at least as important as a broad set of macroeconomic policies in explaining the increase in real investment in machinery and transport equipment as a share of GDP over the past three decades (Figure 5, bottom panel).

Figure 5 Real investment rate in machinery and equipment

Source: IMF staff calculations.

Note: The bars depict the simulated/estimated elasticity of the real investment-to-GDP to the price of capital goods relative to the price of consumption. Cross-country (sectoral) regression includes country and period (country-sector and country-period) fixed effects. Period refers to 5-year periods.

Source: IMF staff calculations.

Note: The figure presents the contribution to the observed increase in real machinery and transport equipment investment-to-GDP ratios between 1990-94 to 2010-14. Policies include: real interest rates, credit-to-GDP ratio, capital account openness, commodity terms of trade, institutional quality, infrastructure (road quality).

These findings are a cause for concern. With the slowdown in trade and sluggish productivity growth in recent years, the decades-long downward trend in relative prices of capital goods may be coming to an end. Preliminary evidence from advanced countries, including the US (Byrne and Pinto 2015), suggests that the decline in relative prices of capital goods has already slowed or stopped. This could be ominous for future investment.

Our goal is to bring attention to the relative price of capital goods as an important, but overlooked, driver of investment, especially now that future price declines seem to be under theat.

References

Ahn, J, E Dabla-Norris, R Duval, B Hu, and L Njie (forthcoming), "Reassessing the Productivity Gains from Trade Liberalization", Review of International Economics.

Amiti, M, and J Konings (2007), "Trade Liberalization, Intermediate Inputs, and Productivity: Evidence from Indonesia", American Economic Review 97(5): 1611–38.

Bustos, P (2011), "Trade liberalization, exports, and technology upgrading: Evidence on the impact of MERCOSUR on Argentinian firms", American Economic Review 101(1): 304-40.

Byrne, D and E Pinto (2015), "The Recent Slowdown in High-tech Equipment Price Declines and Some Implications for Business Investment and Labor Productivity", FEDS Notes, 26 March.

DeLong, J B, and L H Summers (1991), "Equipment Investment and Economic Growth", Quarterly Journal of Economics 106: 445–502.

DeLong, J B, and L H Summers (1993), "How Strongly Do Developing Economies Benefit from Equipment Investment?" Journal of Monetary Economics 32: 395–415.

Eaton, J, and S Kortum (2001), "Trade in Capital Goods", European Economic Review 45: 1195–235.

Hsieh, C-T, and P J Klenow (2007), "Relative Prices and Relative Prosperity", American Economic Review 97: 562–85.

International Monetary Fund (2019), "The Price of Capital Goods: A Driver of Investment Under Threat?" Chapter 3 in World Economic Outlook April 2019, IMF.

Jones, C (1994), "Economic Growth and the Relative Price of Capital", Journal of Monetary Economics 34: 359–82.

Lee, J-W (1995), "Capital Goods Imports and Long-Run Growth", Journal of Development Economics 48(1): 91–110.

Pavcnik, N (2002), "Trade liberalization, exit, and productivity improvements: Evidence from Chilean plants", The Review of Economic Studies 69(1): 245-276.

Restuccia, D, and C Urrutia (2001), "Relative Prices and Investment Rates", Journal of Monetary Economics 47(1): 93–121.

Sarel, M (1995), "Relative Prices, Economic growth and Tax Policy", IMF working paper WP/95/113.

Sposi, M (2015), "Trade barriers and the relative price of tradables", Journal of International Economics 96(2): 398-411.

Topalova, P, and A Khandelwal (2011), "Trade Liberalization and Firm Productivity: The Case of India", The Review of Economics and Statistics 93 (3): 995–1009.

Endnotes

[1] To identify these elasticities, we assume that reduction in tariffs, especially their differences across sectors, is not driven by domestic economic conditions. While it is difficult to test this assumption directly, we may exaggerate the contribution of trade to price decline if it does not hold.

[2] More details on the range of empirical estimates obtained at the country- and sector-level are available in IMF (2019).