Amid the 2008 financial crisis, political uncertainty around the world reached record levels and has remained elevated ever since (Baker et al. 2013). While uncertainty is a natural feature of even the healthiest political processes, its recent surges have been in large part self-inflicted, for example, by the stubbornly dysfunctional discourse in the US Congress. What is the price we pay for cultivating an uncertain political climate?

Equity markets are an informative gauge of the price of political uncertainty. They reveal investors' assessments of how political risks impact economic activity into the indefinite future, conveniently summarised in present value terms. Day after day, stock prices react to news about what governments around the world have done or might do. For example, on 3 March 2014, European stocks lost about 3% of their value after the Russian parliament approved President Putin's request to use Russian military forces in Ukraine. Russian stocks fell by more than 10%. These price drops were partially reversed on the following day when President Putin broke his silence and fears of a large-scale military confrontation eased.

For a more peaceful example, when European politicians announced a deal cutting Greece’s debt in half on 27 October 2011, US stocks gained 3%, while French and German stocks soared by more than 5%, presumably in response to the increased likelihood of the preservation of the Eurozone. Early in the following week, stocks gave back all of those gains when Greece’s prime minister announced his intention to hold a referendum on the deal. When other Greek politicians voiced their opposition to that initiative, stocks rose sharply again. It is stunning that the pronouncements of politicians can instantly create or destroy hundreds of billions of dollars of market value around the world. Despite the obvious ties between political uncertainty and global financial markets, little work has carefully studied the nature of this connection.

A new theoretical framework

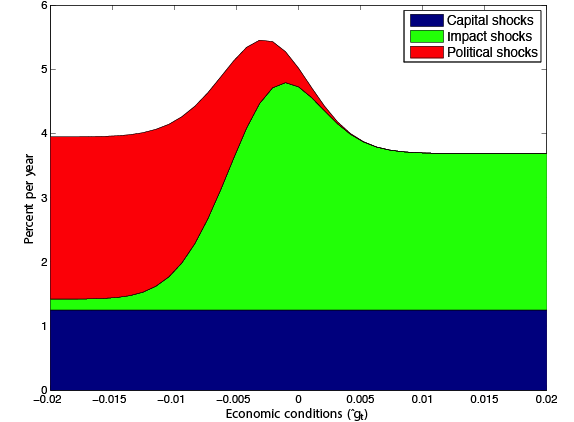

In Pastor and Veronesi (2012, 2013) and Kelly et al. (2014), we offer a theoretical framework for evaluating the influence that political uncertainty exerts on financial markets. In our model, the equity premium, which summarises the extent to which investors discount future economic activity to reach current market values, depends crucially on political uncertainty. The predicted association is intuitive — the political risk premium is larger when the prevailing degree of political uncertainty is high, and it is also larger in weak economic conditions. When the economy is weak, government-related changes are more likely. For example, governments are more likely to change their policies, and voters are more likely to replace governments. Since government-related changes affect all firms, they cannot be diversified away. Therefore, news about what might happen – which we label ‘political shocks’ – can have a large impact on stock prices. This theoretical prediction is illustrated in Figure 1. The figure shows the equity risk premium as a function of economic conditions, and decomposes it into the premia associated with political risks (red) and non-political risks (blue and green). In poor conditions, the odds of a governmental shake-up soar and the political risk premium dominates the equity premium.

Figure 1

The empirical challenge

Assessing the market impact of political uncertainty in the data is a challenge. This uncertainty may depress prices and economic activity but, as the model shows, an economic decline can also precipitate political uncertainty. It is difficult to distinguish the cause from the effect. How can we measure the impact of political risk on financial markets? In Kelly et al. (2014), we offer an answer. Our approach tracks equity index option prices from 20 countries around national elections and global summits.

Elections and summits are well suited for our analysis because they can result in major policy shifts and, since their dates are usually determined far in advance, they are a source of exogenous variation in political uncertainty.

Options are ideally suited for this analysis for two reasons.

- First, they have relatively short maturities, which we can choose to cover the dates of political events. An option whose life spans a political event provides protection against the risk associated with that event. Since the political event is often the main event that occurs during the option’s short life, the option’s price is informative about the value of protection against political risk.

- Second, options come with different strike prices, which allow us to examine various types of risk associated with political events, such as tail risk.

We calculate three option-market variables: the implied volatility of an at-the-money option, the slope of the function relating implied volatility to moneyness, and the variance risk premium. These variables capture the value of option protection against three aspects of risk associated with political events: price risk, tail risk, and variance risk, respectively. To take out non-political effects, we normalise each variable with respect to nearby options that do not span the political event.

Political uncertainty is priced

We find that at-the-money options whose lives span political events are on average 5% more expensive than neighbouring options that don't span the event. Furthermore, the well-known implied volatility smirk dramatically steepens around such events as investor demand for insurance against tail events soars. For example, among put options that are 10% out-of-the-money (and thus provide better protection against tail risk than at-the-money options), options whose lives span political events are more expensive by 16% compared to neighbouring options. We also find that political events are associated with abnormally high variance risk premia, so that insurance against variance risk is also more expensive ahead of such events.

All three option-market variables take larger values in weaker economic conditions. For example, at-the-money options providing protection against political events are 8% more expensive when the economy is weak but only 1% more expensive when the economy is strong.

The European sovereign debt crisis is once again highly illustrative. Leading up to the Greek elections in 2012, those elections were widely viewed as a de facto referendum on Greece’s continuation as a member of the Eurozone. With one of the leading political parties proposing renegotiating Greece’s treaty with Europe, a plausible election outcome would have involved a Greek exit from the Eurozone, with uncertain consequences for other vulnerable Eurozone members such as Italy and Spain.

Shortly before the Greek elections, the average ‘excess’ implied volatility across all European countries was five times larger than its full-sample mean, indicating an unusually high price of political uncertainty. The countries whose options were the most affected by these elections were Spain and Italy, which were arguably ‘next in line’ to exit the Eurozone after Greece. The effects on Germany and France, the key Eurozone players, were also large. In contrast, the least affected European countries were Sweden and Switzerland, neither of which is a Eurozone member.

Another prominent example is the US presidential election on 4 November 4, 2008 (Obama vs. McCain), and the nearby G20 summit on 14-15 November 2008. The US excess implied volatility in November 2008 exceeded the full-sample mean by a factor of eight! It makes sense for such a ‘double-whammy’ event to experience large pricing effects: options expiring after two political events should be more valuable as they provide protection against the political risks associated with both events.

These two anecdotes reflect the price implications that we identify throughout our sample of political events. Figure 2 shows our measure of excess implied volatility, labelled IVD, for each observation in our sample as a function of prevailing economic conditions.

Figure 2

Economic conditions are measured by either recent stock market return (left panel) or GDP growth (right panel). Black dots are global summits and yellow squares are national elections.

Conclusions

These plots highlight two conclusions from our analysis.

- First, insurance against political uncertainty is expensive, on average.

- Second, this insurance tends to be more expensive when the economy is weaker.

We obtain similar results for the prices of the variance and tail risks associated with political events.

Despite the salience of political uncertainty, our understanding of its effects on financial markets is only beginning to emerge. We show that political uncertainty commands a risk premium, especially when the economy is weak. By raising the firms’ cost of capital, political uncertainty depresses investment and real activity. Furthermore, by raising risk premia, political uncertainty destroys market value. Perhaps we should ask reckless politicians to chip in.

References

Baker, Scott R., Nicholas Bloom, and Steven J. Davis (2013) “Measuring economic policy uncertainty,” NBER working paper.

Kelly, Bryan, Lubos Pastor, and Pietro Veronesi (2014) “The price of political uncertainty: Theory and evidence from the option market,” NBER working paper.

Pastor, Lubos, and Pietro Veronesi (2012) “Uncertainty about government policy and stock prices,” Journal of Finance 67, 1219-1264.

Pastor, Lubos, and Pietro Veronesi (2013) “Political uncertainty and risk premia,” Journal of Financial Economics 110, 520-545.