Editor’s note: The paper behind this column appears in the second issue of CEPR’s new initiative, Covid Economics: Vetted and Real-Time Papers

To prevent the COVID-19 pandemic, most countries have implemented unprecedentedly stringent restrictions, including lockdowns of cities and regions under which production activities, except for those essential to the survival of citizens, are shut down. In China, Wuhan – the original epicentre of the novel coronavirus – and some other cities were locked down from late January to late March 2020. In Spain, the whole country has been locked down since 28 March.

Lockdowns of cities and regions are apparently associated with substantial economic losses. What often receives little attention is the fact that because economies in the world are now closely connected with each other through global value chains, the negative effect of the economic restrictions can diffuse across economies through the network. When Wuhan, one of China's ‘Detroits’, was locked down, it is reported that some automobile manufacturing plants in Japan shrank their production due to a lack of supplies of parts and components from China. When we consider the economic impact of a lockdown, we therefore need to take this propagation to other economies into account.

A growing strand of literature has shown empirically that the negative economic shock caused by natural disasters diffuses to regions not directly hit by disasters through interfirm supply chains (Barrot and Sauvagnat 2016, Boehm et al. 2019, Carvalho et al. 2016, Inoue and Todo 2019, Kashiwagi et al. 2018). The economic shock of a disaster propagates downstream to customers through lack of supplies, and upstream to suppliers through lack of demand. For example, in Inoue and Todo (2019) we examine production losses from the Great East Japan Earthquake in 2011 using a simulation analysis (summarised on Vox here). We find that the production loss in regions not directly affected by the earthquake because of the propagation effect was 100 times greater than the production loss in the directly affected regions. Therefore, this propagation effect should not be underestimated.

Recently, McKibbin and Fernando (2020) estimate the economic effect of COVID-19 using a macroeconomic model that incorporates international and inter-sectoral linkages in production. In their worst-case scenario, the spread of COVID-19 reduces the GDP of China, Japan, the UK, and the US by 6.2%, 9.9%, 6.0%, and 8.4%, respectively. These figures are substantial, but they could still be underestimates because their model does not incorporate complex interfirm supply chains, which have been found to be a source of quick and substantial propagation in the network science literature.

To quantify the propagation effect through such complex interfirm supply chains, our recent work (Inoue and Todo 2020) estimates the extent to which the economic effect of a lockdown of Tokyo propagates to other regions in Japan, using our framework from Inoue and Todo (2019). Unlike other major cities around the world (including New York, London, and Paris), Tokyo has not been locked down in the sense that people are still free to go out. However, because the number of confirmed cases of COVID-19 in Tokyo has been rising recently, many people are calling for a lockdown and policymakers, including the governor of Tokyo, are considering the possibility.

Specifically, we apply an agent-based model of firms linked through supply chains to the actual supply-chain data from nearly 1.6 million firms in Japan. Parameter values in the model are estimated from the production trajectory of Japan after the Great East Japan Earthquake. We assume that the lockdown prohibits all production activities in the central part of Tokyo (23 wards) except for activities essential to the survival of citizens, such as those in the wholesale, retail, utility, transportation, communication, and healthcare sectors.

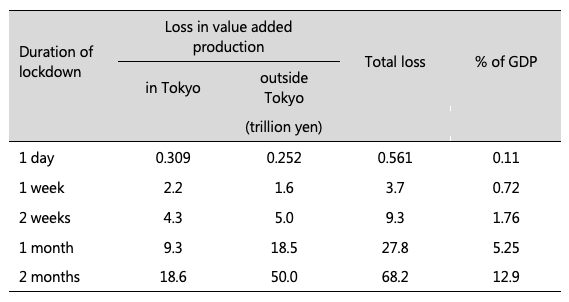

The results shown in Table 1 indicate that when Tokyo is locked down for two weeks, the loss in value added production in the city would be 4.3 trillion yen ($40 billion). In addition, the production loss outside Tokyo due to propagation through supply chains would be 5 trillion yen – 16% more than the loss in Tokyo.

Table 1 Economic effect of a lockdown of Tokyo

The rapid propagation of the lockdown effect over time across Japan is illustrated in Figure 1, in which each red dot indicates a firm whose production is 20% or less of its pre-lockdown level. A YouTube video of the simulation is also available for more demonstrative presentation.

Figure 1 Geographic propagation of the effect of a lockdown of Tokyo

Notes: Each red dot indicates a firm that reduces its production by 80% or more after the lockdown.

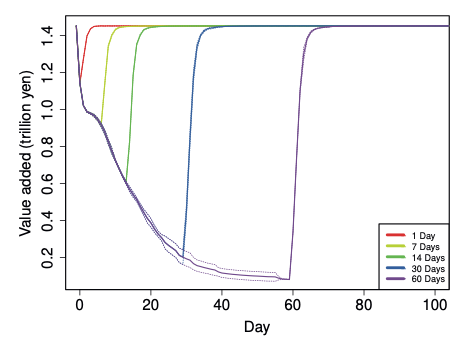

Figure 2 shows the changes in daily value-added production in Japan after the lockdown. After one month, daily production would be a mere one-seventh of its pre-lockdown level even though the production activities shut down in Tokyo account for 21% of total value added in Japan. The total effect of the one-month lockdown would be 5.25% of GDP. Thus, the propagation effect of a lockdown of Tokyo would be quite large.

Figure 2 Changes in daily value added in Japan after a lockdown of Tokyo

In addition, our analysis finds that the effect on other regions becomes progressively larger as the duration of the lockdown becomes longer; when the duration is doubled, the production loss more than doubles. This is because the effect of a longer lockdown can reach firms that are ‘further’ from Tokyo along supply chains, as illustrated in Figure 1.

Our analysis has several policy implications. First, because the overall effect of a lockdown of a major city on the entire economy is extremely large when its propagation effect through supply chains is taken into account, we should consider lockdowns (or complete shutdowns of most production activities) as the last resort. Instead, we should prevent the spread of COVID-19 earlier using other means and avoid any lockdowns of mega-cities. For example, governments should support private investment in online working from home and the reorganisation of production lines to allow ‘social distancing’ between workers so that production activities can continue at minimum. Second, because the total effect of a lockdown progressively increases with its duration, a mega-city lockdown, even if it cannot be avoided, should be as short as possible. Policymakers should be aware that doubling the lockdown duration more than doubles its economic cost.

Finally, we should mention several limitations of our analysis. First, because of data limitations, we cannot distinguish between production in the headquarters of a firm and production in its branches. Second, we assume that non-essential production activities are completely shut down, but in practice, some production activities would continue during the lockdown period through online working. Third, we also assume that firms do not change their suppliers and customers after a lockdown. However, in practice, they could find new partners to alleviate the propagation effect. Because of these factors, our estimate of the effect of a lockdown of Tokyo may be overestimated. Finally, we focus on propagation within the country because our data lack information about supply-chain links with firms outside Japan. Therefore, we have had to ignore international propagation, which is most likely to happen in practice.

References

Barrot, J-N, and J Sauvagnat (2016), "Input Specificity and the Propagation of Idiosyncratic Shocks in Production Networks", The Quarterly Journal of Economics 131(3): 1543-1592.

Boehm, C E, A Flaaen, and N Pandalai-Nayar (2019), "Input Linkages and the Transmission of Shocks: Firm-Level Evidence from the 2011 Tōhoku Earthquake", Review of Economics and Statistics 101(1): 60-75.

Carvalho, V M, M Nirei, Y U Saito, and A Tahbaz-Salehi (2016), "Supply Chain Disruptions: Evidence from the Great East Japan Earthquake", Columbia Business School Research Paper, 17-5.

Inoue, H, and Y Todo (2019), "Firm-Level Propagation of Shocks through Supply-Chain Networks", Nature Sustainability 2: 841-847.

Inoue, H, and Y Todo (2020), "The Propagation of the Economic Impact through Supply Chains: The Case of a Mega-City Lockdown against the Spread of Covid-19", Covid Economics: A Real-Time Journal 2, 8 April.

Kashiwagi, Y, Y Todo, and P Matous (2018), "International Propagation of Economic Shocks through Global Supply Chains", WINPEC Working Paper, No. E1810, Waseda Institute of Political Economy, Waseda University.

McKibbin, W J, and R Fernando (2020), "The Global Macroeconomic Impacts of Covid-19: Seven Scenarios", CAMA Workding Paper, No. 19/2020, Crawford School of Public Policy, Australian National University.