Following private crypto assets such as Bitcoin and Facebook's Libra, central bank digital currencies (CBDCs) are currently being studied among the world's central banks (e.g. Auer et al. 2020). Trial experiments have also begun in some countries, and Asia is no exception. The People's Bank of China has already begun demonstration tests and is leading the way in the world in this area. CBDC is also under consideration in South Korea, Malaysia and Cambodia. The Bank of Japan has been conducting joint research with the ECB, and at the request of the Japanese government a specialized team has been set up and a full-scale study has started. One of the merits of digital currencies is that they can be traded cheaply in real time across national borders. With the progress of digital globalisation in addition to economic globalisation, there should be stronger interest in the realisation of digital regional and global currencies. Although trade in East Asia is currently temporarily stagnant due to Covid-19, economic integration such as building supply chains has progressed for the past half century. Financial integration, on the other hand, has been delayed. The currency used for international transactions is still largely the US dollar. East Asian countries have become more resistant to currency crises, including the enhancement of Chiang Mai Initiatives since the 1997 Asian crisis, but remain vulnerable. In particular, as the US dollar still plays the role of the region's main trade invoicing currency, East Asian economies continue to be heavily affected by US monetary policy. The introduction of a digital common currency could hence be a driving force in promoting integration, although there still remain difficult tasks.

A common currency in Asia

Since the Asian currency crisis in1997, discussions about the international financial architecture have flourished in East Asia. Especially stimulated by the launch of the euro in 1998, the possibility of a common Asian currency was hotly discussed. However, compared to Europe, there was a large divergence in the stage of economic development in East Asian countries at the time. In particular, financial markets were extremely undeveloped in some countries. In addition, the political systems are widely diversified. Overall, East Asia did not meet the conditions of an ‘optimal currency area’ and the opinion that the Asian common currency was premature was dominant. In addition, the 2007 crisis brought to light the negative side of the common currency in Europe, and the debate over the Asian common currency in East Asia died down at that point.

But East Asia has a history of common currencies. One example is the wide circulation of Chinese coins throughout East Asia during the Middle Ages. At that time, trade in the sea flourished around China. Trade links strengthened, and the Chinese currency was used as a currency for trade. While the strength of the trade links at that time are comparable to today's trade links and supply chains in East Asia, the use of Chinese money was much more widespread then. In Japan, the issuance of its own currency had been suspended for a long time, and Chinese money was distributed as a national currency instead. Chinese money used for trade transactions was further also credited as a currency in domestic transactions all over East Asia. The widespread use of Chinese currency at the time was mostly driven by China's economic power, and the establishment of rules by traders rather than state power contributed greatly to the circulation of currencies (Figure 1).

These historical developments are also reflected in today’s currency units. If the current Japanese currency unit is expressed in the old Chinese character, it is yen (圓). The Chinese characters of China's yuan and Korean won are the same (圓).The Hong Kong dollar and the Taiwanese dollar also use the same Chinese characters(圓). Hence, while East Asia is facing a variety of political difficulties today, it shares the historical experience of a common currency.

Figure 1 A Yongle coin from the Ming Dynasty in China (15th century), which was widely circulated in Japan from the 15th to the early 17th century

An Asian digital common currency

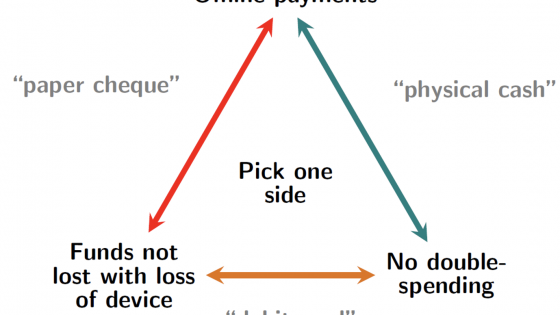

While 20 years have passed since the last common currency debate, conditions fostering the realisation of an Asian common currency have developed since then. One of those conditions is the development of financial markets in Asian countries. In particular, the digital payment system between banks has made significant progress, and the digital settlement of securities has advanced greatly. In addition, online banking and mobile payments have become popular. If the Asian common currency were to be issued digitally now, it would not be necessary to issue paper banknotes. Hence, at least technically, the conditions for the Asian common currency have been developed. The recent issuance of cryptocurrencies also indicates the possibility of the co-existence of multiple currencies, such as existing national currencies and new ones. Considering the lessons learned in Europe, it would be appropriate to issue the Asian common currency in such a way that it co-exists with the existing national currency for the time being.

Issuance of an Asian digital common currency

Using current digital technology, the issuance of an Asian common digital currencies is relatively simple. We need an international organization to supply a common currency. For example, it is possible to use something like AMRO, which was established in the ASEAN+3 as the secretariat of the Chiang Mai Initiatives. One of the main roles of international organisations would be to issue Asian common currency bonds, which are backed by central banks to issue digital currencies denominated in Asian common units. International organisations buy government bonds from central banks and issue Asian common currency bonds. In this way, the issuance of Asian digital common currency would also contribute to the development of the Asian bond market.

Another role of international organisations would be the production of the Asian digital common currency (ADCC) as an electronic medium and its transfer to central banks. This process would hence be similar to how central banks today receive physical banknotes manufactured at the printing bureau. The buying and selling of government bonds and Asian common currency bonds would, of course, be digital, and the distribution of electronic wallets, and so on would be done digitally, not to say that the Asian digital currency itself1 would of course be digital.

The ADCC would then be issued by the central banks of each country. Like the current paper currency, it would be distributed to the economy through banks. We discussing the exact workings and the distribution process in more detail in our paper (Inui et al. 2020b).

Figure 2 Issuing process for an Asian digital common currency

Governance of the Asian digital common currency

Since the conditions for a common currency have been developed in East Asia over the last 20 years, the time is ripe for a new attempt at an Asian common currency. We propose an Asian digital common currency as a multilateral synthetic currency such as the euro. At this stage, we think that the benefits that an Asian common currency would bring – such as deepening cooperation within multilateral frameworks and protecting the rights of small and medium-sized countries – are greater than the disadvantages of inefficiencies in multilateral frameworks.

References

Auer, R, G Cornelli and J Frost (2020), “Rise of the central bank digital currencies: drivers, approaches and technologies”, BIS Working Papers No 880.

Inui, T, W Takahashi, M Ishida (2020), "A Proposal for Asia digital common currency”, RIEB Discussion Paper Series DP2020-19, Research Institute for Economics and Business Administration, Kobe University.

Inui, T, W Takahashi, M Ishida (2020), "On possible measures and processes to issue Digital Common Currency in ASEAN + 3 including challenges and opportunities”, RIEB Discussion Paper Series DP2020-27, Research Institute for Economics and Business Administration, Kobe University.

Endnotes

1 IC chips used in cards, for example, are forced to be transported physically.