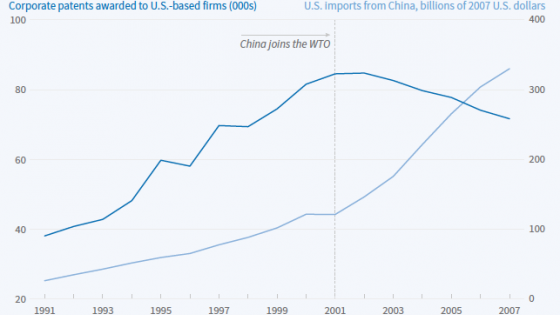

The widely accepted relationship between competition and growth sits somewhat uncomfortably with the inconclusive literature on the relationship between competition and innovation (for reviews, see Cohen 2010 or Gilbert 2006), and this is becoming increasingly relevant to the debate over trade openness and growth. Despite an extensive literature suggesting that trade liberalisation increases productivity, recent evidence from the US, Canada, and Europe generally finds negative or unclear impacts of rising import exposure on innovation (e.g. Autor et al. 2017, 2020, Bloom et al. 2016, Campbell and Mau 2021, Kueng et al. 2016).

There are conceptual reasons to think that, in practice, the effects could vary greatly with country context. Aghion et al. (2005) offer a synthesis of the view that competition is necessary to get entrepreneurs out of bed in the morning, and Schumpeter’s argument that higher rents are needed to increase innovation. They accept that firms that are far from the frontier may behave à la Schumpeter and retrench with greater competition, but they argue that firms that are closer to it may see innovation precisely as a way to escape from competition (Akcigit et al. 2018). They find supportive evidence for an inverted U-shaped relationship between industry-level innovation and competition in the UK (Hashmi and Van Biesebroeck 2016), although other evidence (e.g. Hashmi 2013, Gorodnichenko et al. 2010) has been more ambiguous. This raises the question of whether the net impact of competition on innovation might be more detrimental in emerging countries which have fewer globally competitive firms than developed economies.

To shed light on the debate, in a recent paper (Cusolito et al. 2021), we revisit this question exploiting the China shock to study the impact of increased competition on innovation in a prominent upper middle-income country, Chile, which is, perhaps, uniquely suited as a case for two important reasons. First, we are able to draw on a matched firm production-innovation panel dataset that contains information on input and product prices at the firm level and therefore allows us to generate measures of markups and efficiency (physical total factor productivity) that correspond more closely to the concepts of rents and technological leadership envisaged in the Schumpeterian literature. Second, the Chilean data permit us to study the effect of foreign competition not just on patenting, as has been the traditional focus, but on a broader range of plant performance and innovation outcomes than has been possible previously, including quality.

Chile offers a clean experiment to explore the effects mentioned above. It is the iconic ‘textbook’ well-run open economy with few micro distortions that, as elsewhere, saw levels of competition shocked by a major increase in import penetration from China. But, distinct from many trade liberalisation episodes, this shock was not accompanied by other sector-specific reforms. Hence, the effects we see are likely to be purely due to differential exposure to increased foreign competition across sectors.

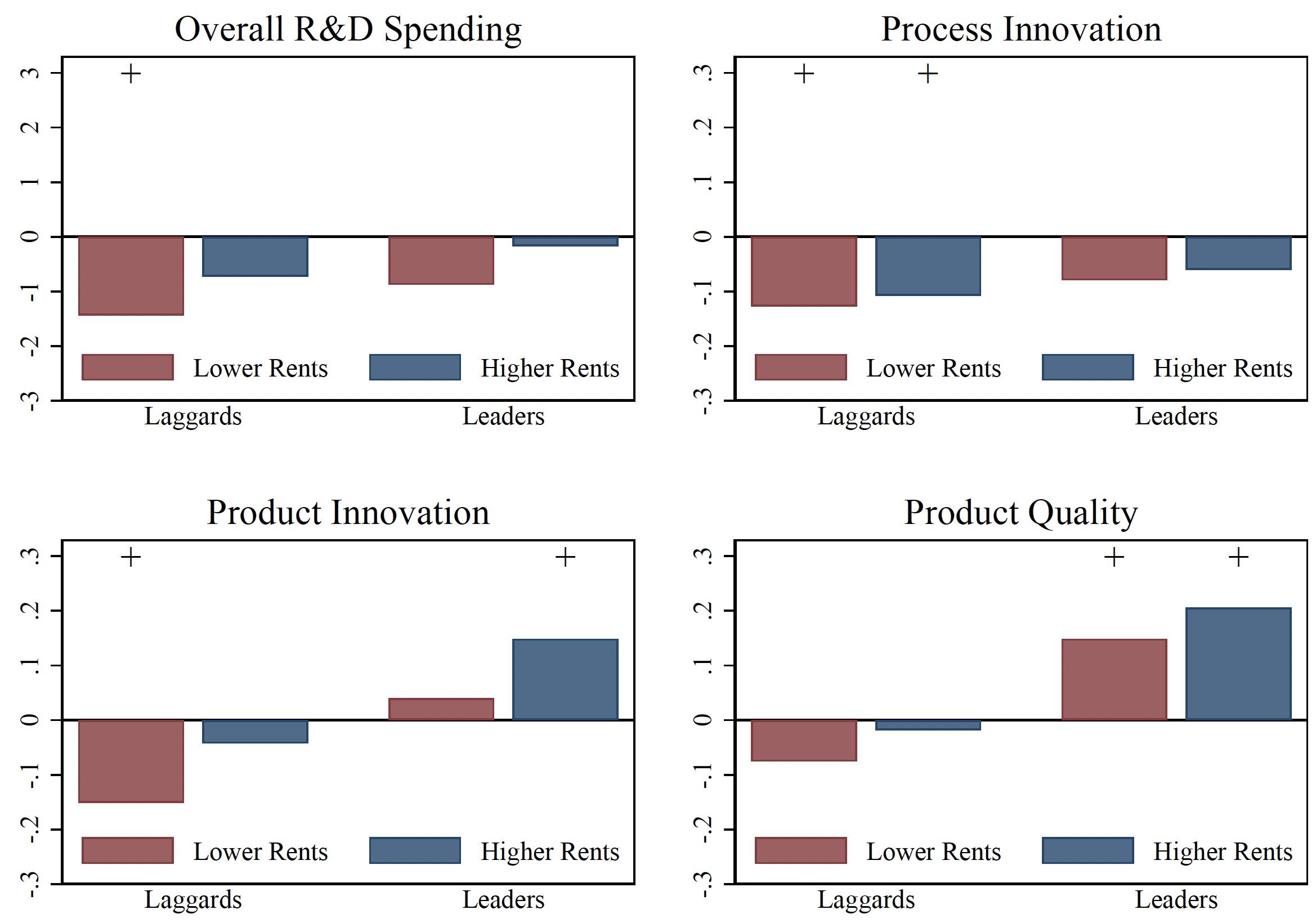

Overall, we find a negative impact of competition on innovation across all measures. But we also find important heterogeneity along the lines of Aghion et al. (2005). We illustrate this in Figure 1, where we report the competition-innovation elasticity dividing the sample by leaders and laggards, and then by whether markups rose or declined with the increase in Chinese imports for four of the innovation variables. Research and development (R&D), process innovation, product innovation, and quality all fall for laggards, and the effect is exacerbated when markups are falling. Product innovation and quality rise for leaders, and more so if markups are increasing. Thus, Aghion et al.’s (2005) view of the importance of proximity to the frontier, as well as the classical Schumpeterian view of the importance of rents, both receive support.

Figure 1 Effect of Chinese import competition on innovation variables

Notes: The figure shows the response of different innovation outcomes to changes in Chinese import competition. Industry leaders correspond to the top 10% of plants with the highest average TFPQ before 2001. Plants with higher/lower rents due to their exposure to Chinese import competition are identified running an auxiliary regression of plant-level markups against instrumented lagged imports from China, industry-year, and plant fixed-effects. Thus, the indicator variable only considers the fraction of markups that varies due to increased Chinese competition. All regressions are run at the plant-year level, control for the logarithm of employment, and include industry-year (at the two-digit level) and plant fixed-effects. The cross on top of each column indicates if the corresponding coefficient is statistically significance at the 90% level.

These results are consistent with other recent findings. In contemporaneous work, also exploiting the canonical China shock, Aghion et al. (2021) find a detrimental effect on French firms’ sales and patenting from Chinese competition in output markets – with the negative impact being concentrated in low-productivity firms, defined as being below the median level of revenue total factor productivity (TFP). In a somewhat different experiment, Aghion et al. (2009) find the entry of greenfield foreign firms raises patenting for sectors close to the technology frontier but has a weak or even negative effect in laggard industries, again, where leaders are defined as the top 50%.

What is striking in the Chilean case is that when leaders are defined similarly, there is no positive impact on innovation. Sequentially running our specification with different cut-offs across the physical total factor productivity distribution (TFPQ), we find positive effects only when leaders are defined as the top 10% of the distribution, which accounts for 25% of industrial value added. Intuitively, this is consistent with countries further from the frontier having few firms near the frontier. But it also means that the impact of competition on incumbent innovation will be lower than in advanced countries and, potentially, net negative, as appears to be the case in Chile.

Our findings return us to our original paradox – how to reconcile that plant productivity often appears to increase with trade liberalisation, even in developing countries, but innovation does not. We propose two possible explanations. The first one may arise from the fact that the revenue TFP (TFPR) measure commonly used in the literature to define leaders and laggards combines efficiency, quality, and rents. Thus, if greater trade exposure actually leads to higher margins, as shown by De Loecker and Goldberg (2014), then this will show up as increased ‘productivity’. Our ability to exploit product price data to work with a cleaner measure of proximity to the efficiency frontier, TFPQ, allows us to abstract from mark-ups. The second explanation may arise from the fact that it is possible that increased competition leads to one-off adjustments – shedding excess workers, for example – but does not lead to dynamic increases arising from innovation.

Clearly, a finding of limited incumbent rises in innovation and perhaps lesser confidence in previous findings of increased productivity with trade liberalisation does not dictate reducing competition. Competition works through other margins, such as the reallocation of resources from low-productivity plants to high-productivity plants and through the entry of more productive plants and the exit of less productive ones (Melitz and Redding 2021). For the same period covered in the present study, Cusolito and Maloney (2018) show that over 60% of the gains in TFPQ in Chile arose precisely from entry and exit. Liu (1993) finds that in the early phases of the Chilean reforms, much productivity growth precisely occurred along the extensive margin, which rings true given the extraordinary levels of protection and distortions being unwound at the time.

But the evidence does suggest that the positive impact of competition is likely to be greater, the larger the share of frontier-proximate firms. Hence, raising the capabilities of firms and their access to resources may be an important complement to pro-competition policies. This might include extending managerial consulting programs, strengthening local innovation systems, supporting standards compliance, fostering technology adoption, and ensuring access to longer term finance, among other firm-level initiatives.

References

Akcigit, U, S T Ates and G Impullitti (2018), “Innovation, trade policy, and globalization”, VoxEU.org, 02 July.

Aghion, P, A Bergeaud, M Lequien, M Melitz and T Zuber (2021), “Opposing firm-level responses to the China shock: horizontal competition versus vertical relationships?”, Unpublished manuscript, Harvard University.

Aghion, P, N Bloom, R Blundell, R Griffith and P Howitt (2005), “Competition and Innovation: An Inverted-U Relationship”, The Quarterly Journal of Economics 120(2): 701–728.

Aghion, P, R Blundell, R Griffith, P Howitt and S Prantl (2009), “The effects of entry on incumbent innovation and productivity”, The Review of Economics and Statistics 91(1): 20–32.

Autor, D, D Dorn, G H Hanson, G Pisano and P Shu (2017), “Competition from China reduced innovation in the US”, VoxEU.org, 20 March.

Autor, D, D Dorn, G H Hanson, G Pisano and P Shu (2020), “Foreign Competition and Domestic Innovation: Evidence from U.S. Patents”, American Economic Review: Insights 2(3): 357–374.

Bloom, N, M Draca and J Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity”, Review of Economic Studies 83(1): 87–117.

Campbell, D and K Mau (2021), “On ‘Trade Induced Technical Change: The Impact of Chinese Imports on Innovation, IT and Productivity’”, The Review of Economic Studies, forthcoming.

Cohen, W M (2010), “Fifty years of empirical studies of innovative activity and performance”, Handbook of the Economics of Innovation 1: 129–213.

Cusolito, A P, A Garcia-Marin and W F Maloney (2021), “Proximity to the Frontier, Markups, and the Response of Innovation to Foreign Competition: Evidence from Matched Production-Innovation Surveys in Chile”, Policy Research Working Paper Series 9757, The World Bank.

Cusolito, A P and W F Maloney (2018), Productivity revisited: Shifting paradigms in analysis and policy, Washington, DC: World Bank Publications.

De Loecker, J and P K Goldberg (2014), “Firm Performance in a Global Market”, The Annual Review of Economics 6: 201–227.

Gilbert, R (2006), “Looking for Mr. Schumpeter: Where are we in the competition–innovation debate?”, Innovation policy and the economy 6: 159–215.

Gorodnichenko, Y, J Svejnar and K Terrell (2010), “Globalization and innovation in emerging markets”, American Economic Journal: Macroeconomics 2(2): 194–226.

Hashmi, A R (2013), “Competition and Innovation: The Inverted-U Relationship Revisited”, The Review of Economics and Statistics 95(5): 1653–1668.

Hashmi, A R and J Van Biesebroeck (2016), “The Relationship between Market Structure and Innovation in Industry Equilibrium: A Case Study of the Global Automobile Industry”, The Review of Economics and Statistics 98(1): 192–208.

Kueng, L, N Li and M-J Yang (2016), “The Impact of Emerging Market Competition on Innovation and Business Strategy”, NBER Working Papers 22840.

Liu, L (1993), “Entry-Exit, Learning, and Productivity Change Evidence from Chile”, Journal of Development Economics 42(2): 217–242.

Melitz, M J and S J Redding (2021), “Trade and Innovation”, VoxEU.org, 28 July.