If capital-to-labour ratios are low in poor countries and returns high, as the standard one-sector growth model predicts, why doesn’t more capital flow from rich to poor countries? By making two reasonable adjustments to a naïve measure of the marginal product of capital (MPK), Caselli and Feyrer (2007) find that the cross-country MPK is roughly flat. Yet this finding is obtained using total capital, instead of private capital, which is the appropriate variable when we want to calculate the return to private investment.

In a recent paper (Lowe et al. 2018), we attempt to tackle this issue by distinguishing between the public and private MPK. The private and public distinction is important for at least two reasons. First, the public sector plays a disproportionately large role in investment in developing countries compared to advanced economies. Second, the theory behind MPK determination is likely to differ significantly between the two sectors. For example, the public sector tends to invest where markets fail, i.e. where social returns exceed private returns. In short, public and private capital should be considered imperfectly substitutable in a country’s production function. In this sense, the overall MPK is misleading, whilst the private and public MPKs are more informative.

The analysis is carried out on a broad sample, composed of 26 advanced economies and 42 developing countries, taken from Monge-Naranjo et al. (2016) for the year 2015. The reason for adopting this sample is that they construct estimates of the income share of reproducible capital by directly employing natural-resource rents that represent an improvement of the measure of the income share of natural resources used by Caselli and Feyrer (2007).

Aggregate marginal product of capital

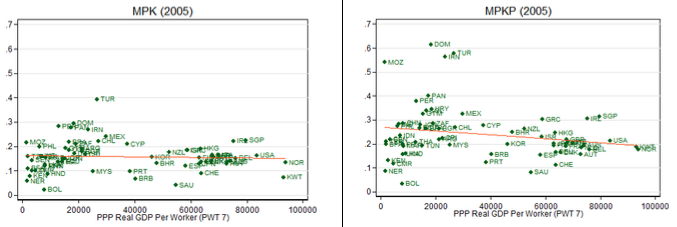

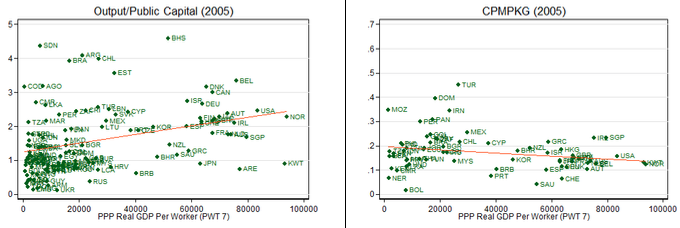

First, we attempt to reproduce Caselli and Feyrer’s main result on the overall MPK using our baseline dataset. In Figure 1, MPK incorporates several adjustments made by Caselli and Feyrer, notably correcting for natural capital and the relative output to capital price. The top-left panel in Figure 1 shows this MPK measure. We can see that the fitted line is basically flat. Then, Caselli and Feyrer’s main result suggesting that international capital markets do a good job of allocating capital efficiently across countries is confirmed.

Figure 1 Aggregate, public, and private marginal product of capital

Sources: PWT 7.0 and authors calculations.

Yet, Caselli and Feyrer’s measure is based on a capital stock that includes both public and private components, whereas the relevant MPK for investors is only the return to private capital. Consequently, the remainder of the analysis goes beyond this by stripping out public capital from total capital to achieve a more accurate estimate of the marginal productivity of private capital. In addition, we want to shed light on the allocation of public capital across countries (although our estimates of the marginal productivity of public capital are more tentative and based on ad hoc and harder-to-verify assumptions).

Unpacking the marginal product of capital into its public and private components

The top-right panel of Figure 1 shows the private MPK (MPKP). The main finding here is that MPKP is slightly downward-sloping but the associated misallocation is low. In particular, we calculate the overall percentage increase in global income from private capital reallocation across countries, and find that the increase would be 1.90%, higher than the 0.40% found by Caselli and Feyrer but still relatively small.

Results for the public MPK are calculated following different approaches. For example, the bottom-right panel shows the estimates obtained for the public MPK (CPMPKG) when the Cooley-Precott (2005) approach to computing the shares of public capital is followed. Nevertheless, all of them suggest that the misallocation from public capital is much larger than the one from private capital. The former is at least 4.8 times larger, reaching 9.09% in our most conservative scenario. The bottom-left panel in Figure 1 illustrates that this result is mainly a consequence of the large variance of the ratio of output to public capital.

Messages

Our results imply that, in terms of the Lucas Paradox, private capital is allocated remarkably efficiently across countries, and that the most significant loss in world GDP may be due to the misallocation of public capital, not private capital. Searching for the roots of the differences in the MPK across countries, we split the sample into open and closed economies, and find that the cost of public capital misallocation can be substantially larger for closed than for open economies. Another important result from this exercise is that for closed economies the case for upward frictions in the international flow of private capital is supported.

Our approach suggests a refinement of the sceptical outlook on aid presented in Caselli and Feyrer, which concludes that greater flows of aid would be displaced only by capital outflows. Our disaggregation implies that, given imperfect substitutability between private and public capital in the production function, investment in public capital may lead not to capital outflows, but to inflows of private capital, since the greater stock of public capital raises the returns to private capital.

Still, our public MPK results should be considered tentative due to the strong assumptions made. There is still much work to be done to improve measurement of the return to public capital investment. We have just started to scratch the surface to understand public capital allocations across countries.

References

Caselli, F and J Feyrer (2007) "The Marginal Product of Capital", Quarterly Journal of Economics 122(2): 535-568.

Cooley, T F and E C Prescott (1995) “Economic Growth and Business Cycles,” in T F Cooley (ed.), Frontiers of Business Cycle Research, Princeton University Press, pp. 1-38.

Lowe, M, C Papageorgiou and F Perez-Sebastian (2012), "The Public and Private Marginal Product of Capital," Economica, forthcoming.

Monge-Naranjo, A, J N Sanchez and R Santaeulalia-Llopis (2016) “Natural Resources and Global Misallocation”, American Economic Journal: Macroeconomics, forthcoming.