The intervention of public development banks (PDBs) in the provision of credit to businesses is a pervasive feature of all types of economies. PDBs are not only numerous, but also widely different in terms of the missions they fulfil and the models under which they operate (Figures 1 and 2).

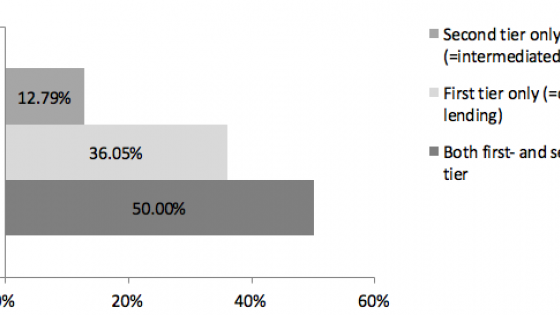

Figure 1 Fraction of public development banks that lend to…

Source: World Bank's Global Survey of Development Banks, 2012; own calculations.

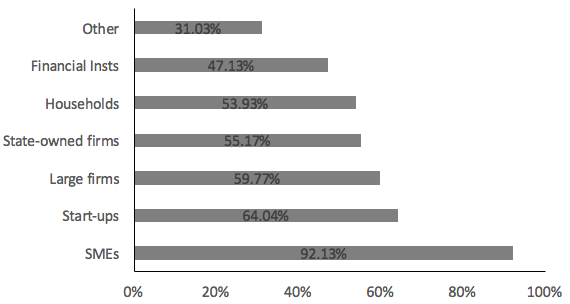

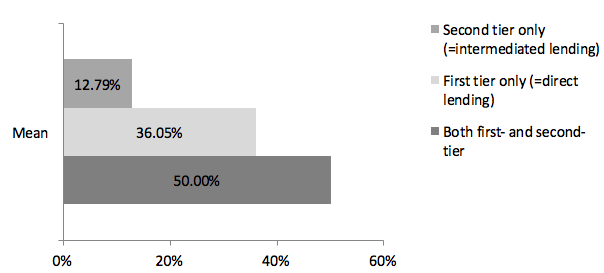

Figure 2 Fraction of public development banks that report that they lend...

Source: World Bank's Global Survey of Development Banks, 2012; own calculations.

Why should PDBs operate, what types of firms should be targeted and under what model?

Questions about the operation of PDBs remain unanswered. As mentioned in a recent IDB report, “The existence of market failures and other factors that restrict credit is a necessary but insufficient condition for justifying public intervention… Governments and Public Development Banks need to analyze the origin and nature of the restrictions, quantify the market gap, and conduct a cost-benefit analysis of intervening via a PDB” (De Olloqui 2013). Moreover, there is the concern that lending by these institutions may end up being inefficiently allocated due to political or institutional constraints. An abundant body of empirical evidence points to cases where this allocation seems to follow political considerations rather than seeking to maximise efficiency (Carvalho 2014, Cole 2009, Dinc 2005, Khwaje and Mian 2005, Lazzarini et al. 2014 Sapienza 2004).

Two possible roles for PDBs have been formalised by Hainz and Hakenes (2012) and Arping et al. (2010). The former explain how a PDB can use banks’ screening technology to channel public funds to activities that, despite having negative net present value, generate positive externalities. They also show that a model in which the PDB’s funds are intermediated by other banks can optimally avoid the duplication of screening efforts. Arping et al. (2010), in turn, direct the spotlight towards credit market imperfections as the main justification of PDB activities. They focus on moral hazard at the firm level as the origin of some firms with positive net present value projects being denied credit.

Bank screening for fund allocation

In Eslava and Freixas (2016), we set out to explore a different dimension of credit market imperfections – the need for costly screening to decide on the allocation of funds. In our setup, the source of imperfect credit provision lies on the banks’ side. The origin for the resulting inefficient resource allocation resides in the banks' inability to fully internalise the benefits of the projects they might finance.

The intuition of our approach is simple. From a societal point of view, it is optimal to provide credit to all projects with expected benefits that exceed the banks' screening costs. Yet, a bank's choice of screening level takes into account only the loan repayment, while the benefits of the project are not internalised. This implies that costly screening produces an inefficient equilibrium, as some firms with a positive net present value project will be credit rationed, which justifies public intervention.

In the context of our model, the PDB's role consists of increasing the probability for firms with positive net present value to access credit. This could be done directly, by the PDB investing in the screening technology and granting credit to firms, or indirectly, with the PDB channelling funds to banks and using conditionality to incentivise banks to screen more. In both cases, the objective is to subsidise the screening activity, either of the PDB if direct lending is chosen, or of financial intermediaries, and both imply a cost due to the distortion associated with taxes.

Our results show that, absent political interference, direct lending would be preferred to intermediated (tier two) lending because PDB profits will reduce the cost of subsidies to tax payers. Still, as suggested by extant empirical evidence, if the direct influence of political interests is not compensated by sufficiently strong corporate governance, intermediated lending will be preferred. This is the case because, under intermediated lending, beneficiaries are selected by banks, not by the PDB itself, and the lending or credit guarantees programmes do not target specific firms but whole industries. The risk of political targeting is thus mitigated.

Under intermediated lending, the PDB provision of incentives to banks so as to increase the quality (or precision) of their screening implies subsidising that activity, (even if it is complemented by some additional tax) and because of the social cost of taxation, the efficient subsidies should be directed to industries characterised by:

- The existence of credit rationing that reflects under-provision of credit screening;

- Sufficiently high expected profits for firms, as this reflects the benefits of screening that are not internalised by the bank;

- Industries where the subsidy has a marginal impact, which implies a high proportion of good firms and a low convexity of the screening cost.

These results partially challenge the usual view that credit support should target risky small businesses that lack sufficient collateral – those with a limited credit history or those with low present value, but which could generate externalities on other firms or sectors.

Implementation of subsidies

Subsidising industries where the market screening level is insufficient requires that subsidies are conditional to banks' lending, a difference with Hainz and Hakenes (2012). This can be implemented through two different channels – either by giving the bank access to funding at a lower rate, or to provide (under-priced) credit guarantees that reduces the banks' credit risk. (Notice, though, that an excessively large credit guarantee may lead banks to stop screening, as even bad firms will become sufficiently profitable). In the basic set up, these two channels are equivalent. Nevertheless, the actual implementation of subsidies should take into account the existence of collateral, banks' competition and the business cycle.

First, while the creation of legal certainty on collateral provides better access to the credit market, if collateralised lending is also profitable and implies no screening cost, this may have a negative impact as it reduces banks’ incentives to screen. Still, the social cost of credit rationing is then also reduced because of the existence of collateralised lending as a ‘spare tyre’, and consequently, the optimal credit subsidy will be lower than in the absence of collateral.

Second, competition has two effects on the level of screening. On the one hand, it reduces the probability of a firm being rationed, as it is able to apply to a larger number of banks. On the other hand, it reduces the incentives to screen, as banks know that firms will shop around for the best rate and may end up borrowing from a competing bank. In our framework, the first effect overtakes the second, so that overall, competition has a positive impact. Still, enough competition may force banks to pass down to the firms the benefits of subsidies, reducing its effectiveness. While the qualitative policy implications of our framework are not modified by bank competition, the optimal subsidy is smaller in size.

Third, the optimal role of the PDB is likely to switch over the business cycle. While in normal times the under-provision of screening and moral hazard are likely to dominate, downturns may be times of especially stark liquidity or solvency constraints. It is well known that during a downturn banks’ credit standards may become much stricter, and this may combine with the reduction in lending that arises from a bank’s liquidity and solvency restrictions. PDBs may alleviate both restrictions by providing credit (in case of illiquidity) or credit guarantees (in case of solvency). Of course, in this case the equivalence of subsidised credit lines or subsidised guarantees vanishes, so the optimal strategy is to provide both instruments and let banks choose one or the other depending on their most severe constraint. Also in this case, public lending may improve credit access even if it is not subsidised.

Conclusions

To sum up, while the practice of PDBs are pervasive, the theory hinges on exploring the possible justifications for an inefficient market allocation. Our contribution highlights the role of a PDB when the market inefficiency stems from banks’ costly screening, which we view as a key focus in view of the empirical evidence on credit rationing and changing credit standards.

References

Arping, S, G Lóránth, and A D Morrison (2010), “Public initiatives to support entrepreneurs: Credit guarantees versus co-funding”, Journal of Financial Stability 6 (1): 26-35

Cole, S (2009), “Fixing Market Failures or Fixing Elections? Agricultural Credit in India”, American Economic Journal: Applied Economics 1: 219-50

De Olloqui, F (ed.) (2013), Public Development Banks: Toward a New Paradigm?, Interamerican Development Bank

Dinç, S (2005), "Politicians and Banks: Political Influences in Government-Owned Banks in Emerging Countries," Journal of Financial Economics 77: 453-470

Eslava, M, and X Freixas. (2016), "Public Development Banks and Credit Market Imperfections," Documento CEDE no. 2016-06.

Hainz, C, and H Hakenes (2012), “The politician and his banker - How to efficiently grant state aid”, Journal of Public Economics, 96(1-2), 218-225

Khwaja, A I, and A Mian (2005), “Do Lenders Favor Politically Connected Firms? Rent Provision in an Emerging Financial Market”, Quarterly Journal of Economics 120 (4): 1371-411

Lazzarini, S G, A Musacchio, R Bandeira-de-Mello, and R Marcon (2015), “What Do State-Owned Development Banks Do? Evidence from BNDES, 2002-09”, World Development 66(C), 237-253

Ruckes, M (2004), “Bank Competition and Credit Standards”, Review of Financial Studies, 17(4), 1073-1102

Sapienza, P (2004), “The Effects of Government Ownership on Bank Lending”, Journal of Financial Economics 72: 357-384.