Governments often provide loan guarantees to encourage lending by shouldering borrowers’ default risk. These schemes can be especially helpful to sustain bank lending during economic crises, when default waves may propagate across debt chains interconnecting firms, leading also otherwise viable firms to be liquidated. Loan guarantee programmes may provide the required backstop, insofar as transferring default risk to the government encourages banks to increase lending, even to hard-hit firms. They may also be a faster and more efficient way to allocate public support to firms than direct government funding, as typically banks have screening technologies and established relationships that endow them with better information than the government about the quality of each firm (Philippon 2021). This explains why many countries introduced massive loan guarantee schemes to provide emergency lending to firms soon after the onset of the Covid-19 pandemic (Schivardi and Romano 2020, Demmou and Franco 2021).

A crucial question, however, is whether these loan guarantees translate into one-for-one increases in bank lending, or are partially used to repay pre-existing non-guaranteed loans? And, if such credit substitution occurs, for which types of firms and banks does it tend to occur? The media have repeatedly voiced the concern that loan guarantees may end up benefiting banks more than firms hit by the pandemic shock. For instance, on 4 July 2021 the Financial Times drew attention to Greensill Bank AG using state-backed loans from European governments to reduce its exposure to distressed companies owned by metal magnate Sanjeev Gupta.

In a new paper (Altavilla et al. 2021), we use a novel euro area credit register dataset, Anacredit, to investigate precisely whether the public loan guarantee schemes introduced at the onset of the pandemic led to substitution of non-guaranteed with guaranteed credit rather than fully adding to the supply of lending. This behaviour is described by Blanchard et al. (2020) as follows: “The main danger is the transfer of pre-existing exposures. A bank with an exposure to a firm could ask it to use the guaranteed debt to repay its existing loans. This would be a transfer of risk to the state.” Indeed, Figure 1 shows that soon after the period when loan guarantee schemes were launched in the euro area to counter the pandemic, aggregate net lending grew less than one-for-one with the expansion of guaranteed loans. However, such country-level data can hardly be seen as evidence of substitution at the bank-firm level. This is why we investigate the issue of credit substitution by using granular firm-bank-level data.

Figure 1 Guarantee loans and net lending

Note: This figure shows the relationship between the take-up of guaranteed loans and net loan flows at a country level over the period April to August 2020. Each blue dot refers to a country in the euro area.

Credit substitution may originate from banks’ credit supply policies: banks can require firms to (at least partly) use guaranteed debt to repay existing loans, so as to reduce their exposure towards them. Clearly, banks have the greatest incentive to engage in this type of behaviour vis-à-vis their riskiest clients. But substitution may also be triggered by firms wishing to renegotiate pre-existing liabilities at lower interest rates, by replacing them with publicly guaranteed debt. This can be the case for viable and liquid firms, which would not encounter significant challenges to obtain credit without the support of the guarantee programme.

One way to help disentangle whether any credit substitution is taking place due to bank-driven, rather than firm-driven, reasons is to investigate the characteristics of lenders and borrowers observed in the data. For example, substitution is more likely to be bank-driven for risky firms with high liquidity needs, and to be firm-driven in the case of solvent firms with low liquidity needs. In the former case, substitution would reflect the stringency of banks’ credit supply, while in the latter it would reflect firms’ low demand for credit.

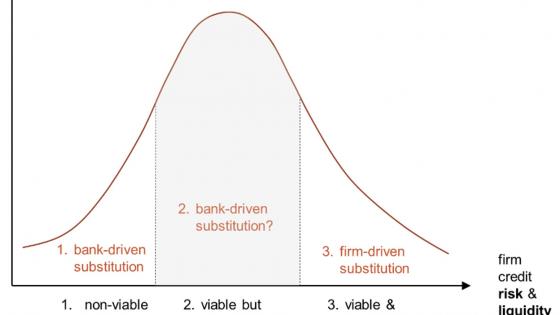

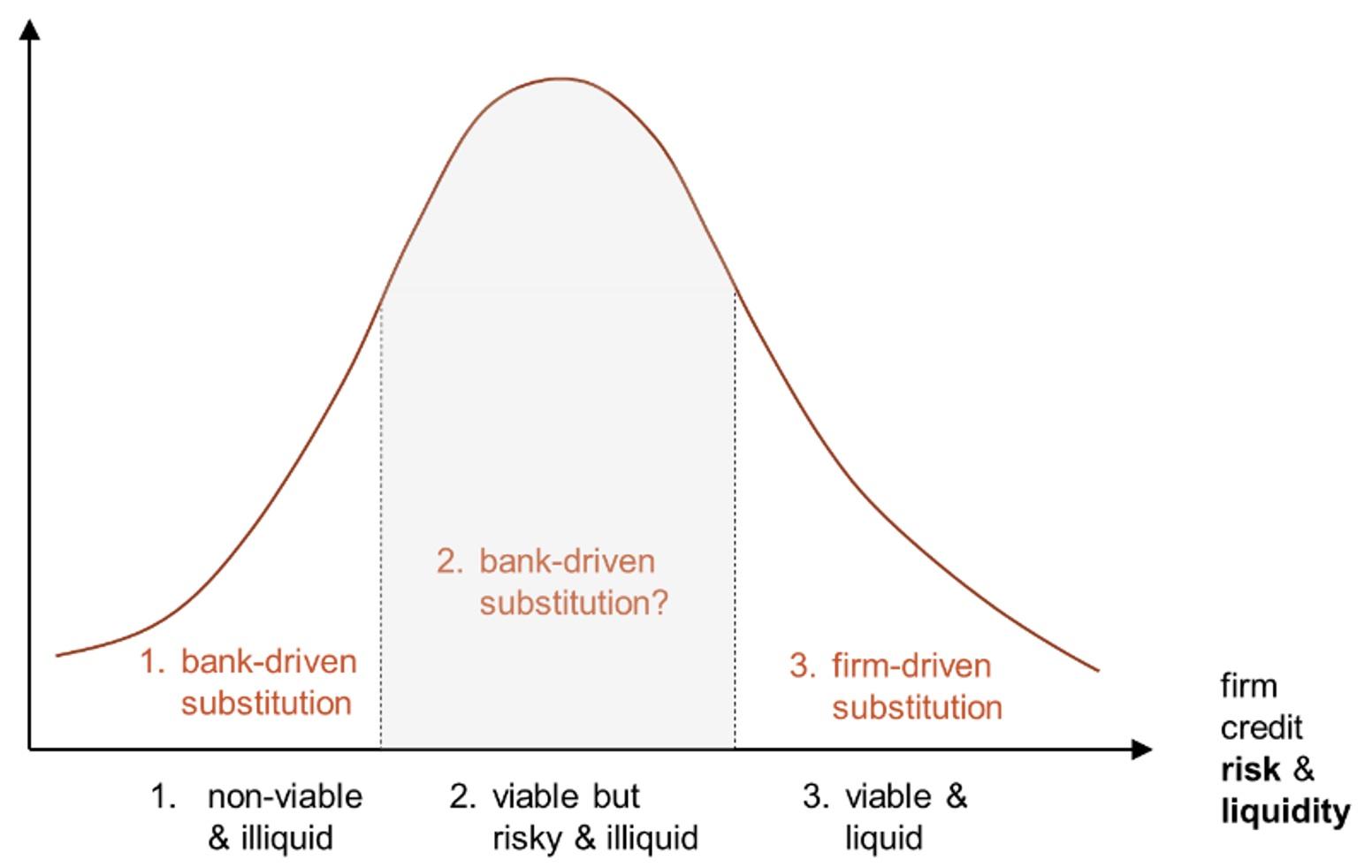

The eligibility rules that determine the allocation of credit guarantees are likely to affect the extent of substitution. To illustrate this point, Figure 2 shows a hypothetical distribution of firms according to their credit quality, that is, an index capturing both solvency and liquidity. Excluding the riskiest firms from the loan guarantee programme amounts to cutting off the left tail of the distribution from the population of beneficiaries, and thus should limit the extent of bank-driven substitution. Conversely, discriminating against firms spared by the pandemic shock and therefore still solvent and liquid should cut off the right tail of the distribution, and thus limit the extent of firm-driven substitution. European policymakers appear to have been aware of this issue in laying out eligibility guidelines for loan guarantee programmes.

Figure 2 Publicly guaranteed loans: Firm eligibility and credit substitution

Note: This figure shows how the selection of firms receiving guaranteed loans may affect the substitution of non-guaranteed credit with guaranteed credit. Firms are ranked by increasing solvency and liquidity.

Empirically, we find that guaranteed loans were overwhelmingly allocated to firms that are small and operating in the most heavily affected industries, but not to firms that were already in or close to distress before the pandemic, in line with the EU Commission guidelines. Seen from this perspective, the guaranteed credit programmes in the euro area were successful in channelling much-needed credit to firms in the most severely hit industries, while leveraging banks’ information to screen out the worst risks. This result also implies that the actual selection of program beneficiaries is likely to have contained the extent of substitution. We also find that firms were more likely to receive guaranteed credit from the largest and most solid banks, confirming the importance of healthy balance sheets as a crucial mechanism in the provision of liquidity at times of stress.

We then investigate whether the guaranteed loans constituted new lending, or instead substitution occurred. We estimate the firm-level substitution of pre-existing credit associated with an increase in guaranteed lending, i.e. how much pre-existing loans to a given firm drop from February 2020 to August 2020 for an extra euro of guaranteed loans. At firm level, we find that guaranteed loans resulted in a moderate degree of substitution. Interestingly, substitution is (a) higher in firms that are smaller, ex ante riskier (credit risk being measured by the magnitude of pre-crisis arrears), and operating in sectors that experienced a larger drop in value-added during the pandemic; and (b) larger for firms borrowing from more solid banks, i.e. larger, more capitalised banks with lower NPLs. Results are broadly consistent across the largest four euro area countries, despite some differences in the design of national guarantee schemes. On the whole, the evidence suggests that, to obtain new guaranteed credit, risky firms were required to renegotiate some of their pre-existing loans.

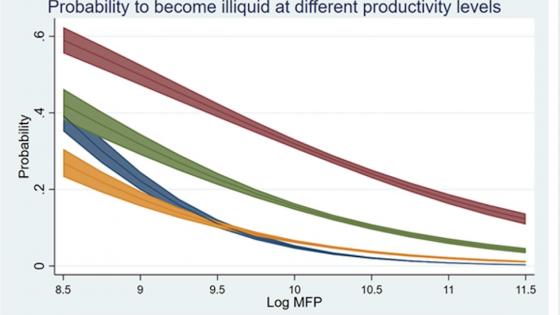

The granularity of our data enables us to compare a firm’s borrowing from the bank that extended a guaranteed loan to it to that from other banks that had a lending relationship with the same firm. This allows us to build a counterfactual for that firm’s bank borrowing in the absence of guarantees and therefore to more accurately pin down substitution. We find that substitution arises from the behaviour of the banks extending guaranteed loans: banks providing guaranteed loans cut pre-existing credit up to 36% more than other banks lending to the same firm. Figure 3 illustrates how credit substitution varies depending on firm, bank and firm-bank characteristics. As the figure shows, within-firm estimates confirm that credit substitution was largest for guaranteed funding granted to riskier and smaller firms operating in more affected sectors, and borrowing from larger and stronger banks, while banking relationships attenuated credit substitution.

Figure 3 Differences in credit substitution across firms and banks

Notes: This figure reports the magnitude of the coefficients associated with interactions between a dummy variable (equal to 1 if the bank is providing the guaranteed loan and 0 otherwise) and several firm, bank and firm-bank characteristics, in percentage points. Each coefficient is multiplied by one standard deviation of the variable in the sample to gauge the economic significance of the estimated effects. The boxes indicate the 90% confidence interval associated with the corresponding coefficient and the whiskers the 95% confidence interval. “Industry value added growth” is used as a proxy for the extent to which the sector was affected by the crisis. “Bank-Firm relationship” is measured by the share of the bank in the firm’s total bank credit exposure. The reduction in pre-existing non-guaranteed exposure by the bank providing the guaranteed loan is larger for: firms operating in sectors that experienced a larger drop in value-added during the pandemic, smaller firms, ex-ante riskier firms, larger banks, banks with a lower percentage of NPLs, weaker firm-bank relationships.

Overall, our results show that in the euro area, government guarantees contributed to the continued extension of credit to relatively creditworthy firms hit by the pandemic, but also benefited the balance sheet of banks to some extent. Although loan guarantee programmes were designed to mitigate it, a moderate amount of credit substitution did occur, and therefore some loan guarantees transferred pre-existing credit risk from banks to taxpayers.

However, this does not necessarily indicate a failure of the public credit schemes, for three reasons. First, absent such schemes, banks could have reduced their pre-existing credit exposures even more, possibly generating default waves that might have crippled even otherwise viable firms. Second, to the extent that banks used such schemes to de-risk their balance sheets, they may have preserved their lending capacity to better face the post-pandemic recovery period: hence, this implicit bank recapitalisation may reduce the risk of a cliff-effect credit crunch when loan guarantee schemes and other support programs are terminated (Laeven et al. 2020, Beck et al. 2021). Third, insofar as substitution moderated lending to the riskiest firms, these should exit the pandemic with lower leverage, hence less debt overhang (Brunnermeier and Krishnamurthy 2020, Gobbi et al. 2020), than in a counterfactual world where no substitution occurred.

References

Altavilla, C, A Ellul, M Pagano, A Polo and T Vlassopoulos (2021), “Loan Guarantees, Bank Lending and Credit Risk Reallocation”, CEPR Discussion Paper No. 16727.

Antill, S, and C Clayton (2021), “Crisis Interventions in Corporate Insolvency,” unpublished, February.

Beck, T, E Carletti, and B Bruno (2021), “Unwinding COVID support measures for banks”, VoxEU.org, 17 March.

Blanchard, O, T Philippon and J Pisani-Ferry (2020), “A New Policy Toolkit Is Needed as Countries Exit COVID-19 Lockdowns,” Bruegel Policy Contribution no. 12.

Brunnermeier, M and A Krishnamurthy (2020) “Corporate Debt Overhang and Credit Policy,” Brookings Papers on Economic Activity, Summer: 447-488.

Demmou, L and G Franco (2021), “From hibernation to reallocation: loan guarantees and their implications for post-COVID-19 productivity”, VoxEU.org, 14 November.

Glode, V, and C C Opp (2021), “Private Renegotiations and Government Interventions in Debt Chains,” SSRN Working Paper No. 3667071.

Gobbi, G, F Palazzo, and A Segura (2020), “Unintended effects of loan guarantees during the Covid-19 crisis”, VoxEU.org, 15 April.

Laeven, L, G Schepens, and I Schnabel (2020), “Zombification in Europe in times of pandemic”, VoxEU.org, 11 October.

Philippon, T (2021), “Efficient Programs to Support Businesses During and After Lockdowns,” The Review of Corporate Finance Studies 10: 188-203.

Schivardi, F, and G Romano (2020), “Liquidity crisis: Keeping firms afloat during Covid-19”, VoxEU.org, 18 July.