Recently, economists and policymakers have offered a steady flow of insights into, and evaluations of, the first two decades of the euro.1 But in our view these assessments overlook a critical factor: the extent to which citizens in the 19 member states in the euro area have supported the single currency, and what that support means for policy.

Support for the euro among citizens (and thus among voters) is a key – perhaps the key – determinant of its long-term survival. Public support is the political glue that holds a monetary union together (Bordo and Jonung 2003). As long as this glue is present, citizens give policymakers the freedom to respond to political and economic shocks that would threaten the sustainability of the union.

This column builds on our previous studies on public support for the single currency during the euro crisis (Roth et al. 2016) and during the economic recovery (Roth et al. 2019). Here, we summarise and update our analysis as reported in Roth and Jonung (2019), covering the whole period from 1999 to 2019. We examine both public support for the euro and the ways in which public trust in the ECB and in national governments in the euro area have evolved since 1999.

Public support for the euro and trust in the ECB

The euro is the only currency for which we have long, consistent time series data that capture levels of popular support for the currency as well as public trust in the central bank that supplies and manages the currency. The series are derived from bi-annual opinion polls conducted with representative samples of respondents in every euro area member country, and are reported in the Eurobarometer.

Our analysis is based on two questions from the Eurobarometer survey. The first, concerning popular support for the euro, reads:

"Please tell me for each statement, whether you are for it or against it. A European economic and monetary union with one single currency, the euro."

Respondents can choose "For", "Against", "Don’t know", or (since Eurobarometer 90) "Spontaneous refusal".

Our measure for trust in the ECB uses responses to:

"Please tell me if you tend to trust or not to trust these European institutions. The European Central Bank."

Respondents have three choices: "Tend to trust", "Tend not to trust", and "Don’t know". There is a similar question on trust in the national government.2

Figure 1 shows aggregate responses from citizens in all member countries of the euro area.

Figure 1 Net support for the euro, net trust in the ECB and the national government and the unemployment rate, average for the euro area, 1999-2019.

Notes: As the figure depicts net support/trust, all values above 0 indicate that a majority of the respondents support the euro and trust the ECB. The vertical dashed lines represent three milestones in the history of the single currency: the physical introduction of the euro in January 2002, the start of the global crisis in September 2008, and the start of the recovery at the end of 2013.

Source: Roth and Jonung (2019).

Three results stand out:

- Support for the euro. The euro has had the support of a large majority of euro area citizens throughout its first two decades, reaching its highest level on its 20th birthday.

- Citizens like the euro more than they do their governments. Support for the euro is consistently higher than both trust in the ECB and trust in national governments. This is true before, during and after the euro crisis. (Note that the ECB enjoys higher trust than the national governments.)

- Divergent effect of the crisis. Before 2008, public support for the euro and trust in the ECB were stable and strongly correlated at a high level. They diverged in the crisis years between 2008 and 2013, which were characterised by rapidly rising unemployment. Trust in the ECB fell sharply, while support for the euro declined only slightly.

During the recovery that began in 2013, the unemployment rate started to fall and support for the euro began to rise. So too did trust in the ECB, but in this case the rise in trust is far more modest. In 2019, the gap between the two series remains much larger than before the crisis, suggesting that there have been long-lasting negative effects upon trust in the ECB.

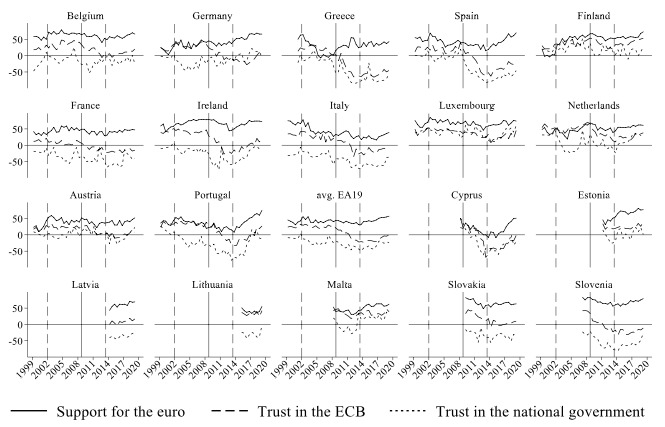

Turning to the data for each of the 19 member states of the euro area (EA19), displayed in Figure 2, we report four striking findings:

- A majority of citizens in almost every country have supported the euro throughout. The exceptions are Greece and Finland in the pre-crisis period, and Cyprus during the crisis.

- Pronounced losses in trust in the ECB and in national governments. This occurs particularly in some peripheral countries that were hit hardest by the crisis, such as Spain, Greece, Ireland, Portugal and Cyprus. Note there is only a slight decline in support for the euro during the crisis.

- A recovery of support for the euro. During the economic recovery we detect a pronounced increase in public support for the euro in almost all euro area countries. The euro now enjoys its highest level of public support in nine of the 19 members, including Germany and Spain. A strong recovery in trust in both the ECB and the national government has taken place in some peripheral countries too. The loss of trust in the national government has been more than restored in Portugal and Ireland – but not in Spain and Greece.

- A recovery of trust in the ECB. This has taken place in all EA19 countries except Slovakia. The increase in trust in the ECB in Germany – the largest euro area economy – from 2016 onwards implies that the ECB enjoys positive net trust among Germans in 2019.3 This is in contrast with the second, third and fourth largest economies in the EU – in France, Italy and Spain, the ECB still has negative net trust.

Figure 2 Net support for the euro and net trust in the ECB and in the national government, euro area member states, 1999-2019

Source: Roth and Jonung (2019).

The rate of unemployment drives public support and trust

As we report in Roth and Jonung (2019), our econometric work demonstrates that the rate of unemployment is key to explaining changes in support for the euro and trust in the ECB during both the crisis from 2008 to 2013, and the economic recovery from 2013 to 2018.

During the crisis, unemployment slightly dented public support for the euro and had a greater higher impact on trust in the ECB and national government. During the recovery period, a 1 percentage point of decline in unemployment led to an increase of 3.6 percentage points of public support for the euro. The decline in unemployment during the recovery more than made up for the losses in public support for the single currency during the crisis.

Trust in the ECB shows a different pattern. The loss in trust during the crisis was only partially restored by the decline in unemployment, suggesting that the loss of trust in the ECB will take time to recover.

Why is support for the euro more stable than trust in the ECB?

The divergence in the time series for the euro and ECB (Figure 1), both during and after the crisis years, is striking. One explanation is that citizens were distinguishing between the euro, the money they were using in day-to-day transactions, and the ECB, the institution responsible for framing and implementing monetary policy in the euro area.

The public most likely thinks about the euro as performing the standard micro-functions of money (medium of exchange, store of value, unit of account). Judging from the responses, the currency has done all three well, particularly acting as a source of stable purchasing power. This argument is in line with our econometric findings, which show a strong negative impact from inflation on public support in times of crisis (Roth and Jonung 2019).

But when asked about their trust in the ECB, respondents are more likely to focus their attention on the macro-problems associated with monetary policy (unemployment, stagnation, austerity, financial crises and crisis management). They may hold the ECB responsible for macroeconomic conditions – or at least jointly responsible with actors such as the national government. Hence the parallel decline in trust in the ECB and national governments during the crisis period.

In short, the ECB is judged as a policymaker. At times of rising unemployment and falling growth, respondents find economic policies to be inadequate, and public trust in the institutions framing economic policies declines.

The crucial role of public support for the euro

Popular support for the euro is crucial for its long-term sustainability. Two recent cases illustrate why.

- Populism in Italy. The euro has been the object of criticism and blame by populist politicians in several euro area countries, but most notably in Italy. After more than a decade of economic distress, unemployment above the euro area average, and below average levels of trust in the national government, a coalition of populist parties governed Italy from June 2018 until September 2019. The coalition government wanted to nominate a finance minister who was highly critical of the euro, but the president ultimately prevented the nomination. Perhaps this was because Eurobarometer records that a majority of Italian citizens have supported the euro for more than three decades. The coalition also dropped its proposed plan to hold a referendum on the euro – in our view because of the lasting popularity of the single currency.

- ECB bond purchases. The popularity of the euro made it possible for the ECB to become a major buyer in the euro area government bond market in 2012. It took the ECB four years from the onset of the crisis to assume this role, but the announcement by the ECB president in July 2012 that it would do “whatever it takes” swiftly resolved the euro area's sovereign debt crisis. But a majority of citizens of euro area member countries lost trust in the ECB during the crisis, so we suggest that public support for the euro created political legitimacy for the ECB's expansionary policy, and shielded it from criticism of this exceptional action.

Conclusions

A majority of citizens in the euro area have supported the single currency throughout its first two decades, but the crisis of 2008-2013 led to a sharp fall in public trust in the ECB. And while the economic recovery since 2013 has triggered an upturn in trust in the central bank, it is still lower than it was before the crisis.

The high esteem in which the public holds the euro will make it easier for policymakers to cope with the challenges that the currency is likely to face in its third decade. But our results demonstrate that it will be crucial for policymakers to keep inflation and (particularly) unemployment low if they wish to sustain public support for the single currency, and public trust in the ECB. Citizens in the euro area ultimately assess their currency based on their daily experiences of using it, and judge the ECB on the euro area's macroeconomic development.

References

Bordo, M D and L Jonung (2003), “The Future of EMU—What Does the History of Monetary Unions Tell Us?”, in F Capie and G Wood (eds), Monetary Unions, Theory, History, Public Choice, Routledge.

Buti, M, M Jollès and M Salto (2019), “The euro – a tale of 20 years: The priorities going forward”, VoxEU.org, 19 February.

Hartman, P and G Schepens (2019), “20 Years of European Economic and Monetary Union: Selected takeaways from the ECB’s Sintra Forum”, VoxEU.org, 2 September.

Pisani-Ferry, J and J Zettelmeyer (2019), “Risk sharing plus market discipline: A new paradigm for euro area reform? A debate”, VoxEU.org, 18 June.

Roth, F, L Jonung and F Nowak-Lehmann D. (2016), “Public support for the euro”, VoxEU.org, 11 November.

Roth, F., E. Baake, L. Jonung and F. Nowak-Lehmann (2019), “Revisiting Public Support for the Euro, 1999-2017: Accounting for the Crisis and the Recovery”, Journal of Common Market Studies 57: 1262-1273.

Roth, F and L Jonung (2019), “Public Support for the Euro and Trust in the ECB: The first two decades of the common currency”, Lund University department of Economics working paper 2019:10, forthcoming in J Casteñada, A Roselli and G Wood (eds), The Economics of Monetary Unions. Past Experiences and the Eurozone, Routledge.

Endnotes

[1] See for example Hartman and Schepens (2019), Buti, Jollès and Salto (2019) and Pisani-Ferry and Zettelmeyer (2019).

[2] We focus on net values, that is the number of respondents that are for/tend to trust minus the number of respondents that are against/tend not to trust. For a detailed description of our methodology, see Roth and Jonung (2019).

[3] A majority of citizens also trust the ECB in the other core economies of the EA19 such as Finland, Austria, the Netherlands and Luxembourg.