Recently the euro as a common currency has been the subject of strong criticism by economists from both sides of the Atlantic (e.g. Stiglitz 2016, Sinn 2014). This criticism has been inspired by the financial and economic crisis in some Eurozone countries and by the slow recovery in the region after the Global Crisis of 2008. Scholars claim that a majority of citizens have turned against the euro in large member states of the Eurozone, such as Germany (Stiglitz 2016: 314) and Italy (Guiso et al. 2016: 292, Sinn in Kaiser 2016a).

In the wake of the vote for Brexit in the UK referendum in June this year, it is argued that knock-on effects in the form of potential upcoming referenda on the euro in the Eurozone (e.g. in Italy) might lead to its break-up (Feldstein 2016, Stiglitz in Martin 2016, Stiglitz in Kaiser 2016b). In addition, it has been postulated that animosity amongst EU member states is at a high (Alesina 2015: 78). This suggests a rising threat to the European project, including the common currency.

These claims concerning the standing of the euro raise the question: How does the public in EU member states actually look upon the common currency at this stage? We are able to provide an answer based on survey data on the popularity of the single currency, which are available from its creation, as polled by TNS-opinion (European Commission 2016). These data are provided through the Eurobarometer (EB). The euro is a unique currency in the sense that similar time series evidence does not exist for any other currency.

Our answer draws upon our previous contribution to this site (Roth et al. 2012), where we explored Eurobarometer survey data on public support for the common currency from 1990 to 2012. There we concluded that in the first four years of the crisis (2008-2012), public support for the euro declined only marginally. Now the question is: What has happened in the most recent years regarding public support for the euro?

Support for the common currency within the original Eurozone

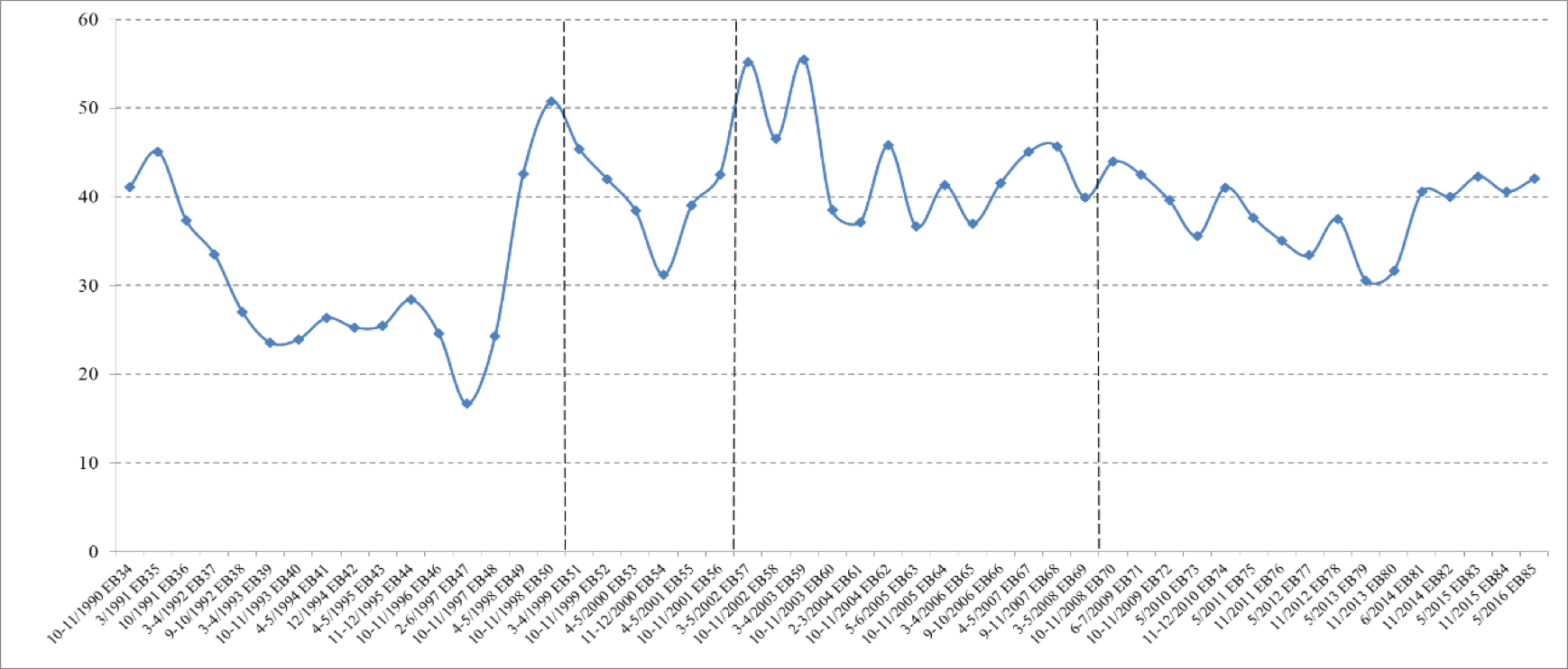

We present an up-to-date picture of the evolution of public support for the euro until May 2016, adopting our approach in Roth et al. (2016). First, we focus on the original 12 Eurozone member states (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain – the EZ12) that adopted the euro as a physical entity in January 2002. Figure 1 shows average net support (in per cent) for the single currency in the EZ12 countries over a 27-year period from 1990 to 2016.

Figure 1 Average net support (in %) for the single currency in the EZ12 countries, 1990-2016

Note: The y-axis displays net support in percent. Since the figure depicts net-support, all values above 0 indicate that a majority of the respondents support the single currency. The dashed lines distinguish the introduction of the euro as a book keeping entity in January 1999, the actual circulation of the euro in January 2002 and the start of the financial crisis in September 2008. Data for EB45 were not available. Population-weights are applied. Net-support is measured as the number of ‘For’ responses minus ‘Against’ responses and is constructed according to the equation: Net-support = (For – Against)/(For + Against + Don’t Know).

Source: Figure 1 is an updated version of Figure 1 until 5/2016 (by EB’s 82-85) in Roth et al. (2016; 948).

Figure 1 leads us to the following conclusions:

- Over the 27-year time period, a majority of citizens within the EZ12 has supported the single currency (with average net support exceeding 15% at all times).

- Since the introduction of the euro in 1999, a large majority of EZ12 citizens has supported the euro (with average net support exceeding 30%).

- In the 8th year (in May 2016) since the start of the financial crisis, average net support of 42% has surpassed the pre-crisis level of 40% in March-May 2008.

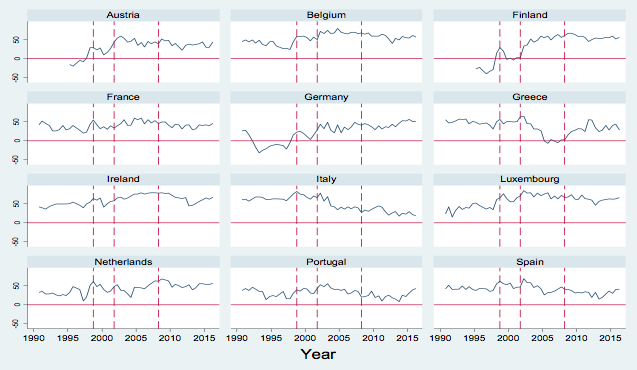

Figure 1 gives the aggregate picture. How has support for the euro evolved in the individual members of the EZ12? Figure 2 provides an answer.

Figure 2 Net support for the single currency in EZ12 countries, 1990-2016 (%)

Source: Figure 2 is an updated version of Figure A1 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 957).

Figure 2 suggests that:

- Since the introduction of the euro in 1999, aside from short periods in Finland and Greece before the crisis, a majority of citizens in each member state of the EZ12 supported the euro, even in times of crisis.

- From 2008 to 2016, significant increases in support in Greece, Portugal and Germany (26, 23 and 10 percentage points, respectively) have levelled out the fall in net support in other EZ12 countries, ranging from 11 percentage points in Ireland to 5 percentage points in Finland.

- Over the 27-year time period (1990-2016), Italy has always had a pro-euro majority, with the minimum net level of 17% in November 2013, clearly above the majority threshold of 0%.

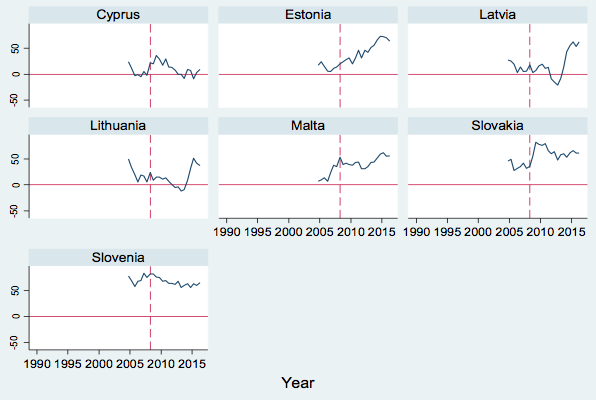

Support for the euro among the new members of the Eurozone

How has support for the euro evolved in the new member states that joined the euro after its physical introduction in January 2002, that is, in Cyprus, Estonia, Latvia, Lithuania, Malta, Slovakia and Slovenia? After adopting the euro, aside from short periods in Cyprus, a majority of citizens in each country has supported the euro.

Figure 3 Net support for the euro across seven EZ countries that joined the euro in the period 2004-16 (%)

Source: Figure 3 is an updated version of Figure A3 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 958).

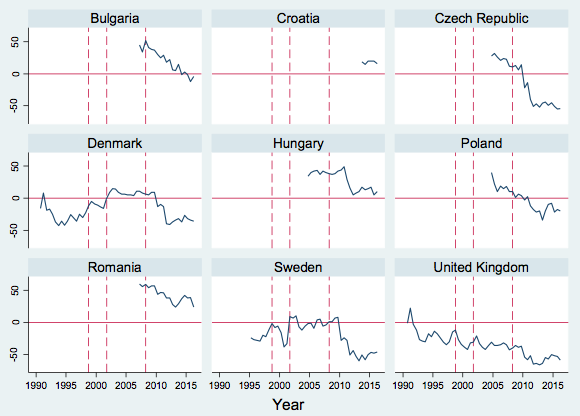

Support for the euro outside the Eurozone

In our 2012 column, we highlighted the distinct fall in public support for the euro in EU member states outside the Eurozone (Roth et al. 2012). What has happened since then? Figure 4, displaying the evolution of net support for the euro outside the Eurozone from 1990-2016, gives an answer.

Figure 4 Net support for the single currency in non-EZ countries, 1990-2016 (%)

Source: Figure 4 is an updated version of Figure A2 until 5/2016 (by EB’s 82-85) in Roth et al. (2016: 958).

Figure 4 suggests:

- Outside the Eurozone, net support for the euro has declined in a pronounced manner. Whereas in Bulgaria, Czech Republic and Poland a majority of citizens supported the euro in the years preceding the crisis, a majority in those countries has turned against the euro after the crisis. The decline in support, ranging from 65 to 30 percentage points, is strong. In contrast, in Romania and Hungary, in spite of a fall of 35 and 28 percentage points, respectively, a majority of euro support still exists.

- In Denmark and Sweden, the majority has turned away from euro support after the crisis. Just before the crisis, there was for brief periods a majority for the euro.

- The UK is an exceptional case. For the 26 years from 1991 to 2016, a majority of citizens was always against the single currency. During the crisis, net support for the euro reached levels as low as -66% (in November 2012). Given the persistent rejection of the euro, the Brexit vote should not come as a surprise but rather as reflecting a long-running critical view towards the European project. Therefore, any knock-on effects of the Brexit vote in the form of a break-up of the Eurozone via potential upcoming referenda in the Eurozone are not likely to emerge. On the contrary, recent survey data from July 2016 by the French polling institute, Ifop, suggest an enduring majority support for the euro in the Eurozone (Fourquet et al. 2016: 52).

Conclusions

Our updated analysis of public support for the common currency over a quarter of a century, from 1990-2016, brings out four major conclusions.

First, in contrast to recent claims, a majority of citizens support the euro in each member state of the original Eurozone, including in Germany and Italy. This was the case even during the peak of the recent crisis.

Second, in contrast to some critical euro voices, we do not believe, on basis of Eurobarometer data, that any knock-on effects of the Brexit vote in any potential upcoming referenda on EU issues would pose an imminent threat to the euro.

Third, taking into account our earlier findings, which identify the unemployment rate as a key driver of public support for the euro in times of crisis (Roth et al. 2016), a strong job recovery in the Eurozone is likely to increase public support for the euro.

Fourth, popular support for the common currency has fallen sharply after the recent crisis in EU member states that have not adopted the euro. Here the negative sentiment is strongest in the UK.

We suggest the following bottom line: with the exception of short periods in Finland and Greece before the crisis, the evidence points towards majority support for the euro in each original Eurozone member state (including Italy and Germany) before, during and after the crisis. So far, the euro has clear backing from the public. It has adopted the common currency as its own currency.

References

Alesina, A (2015), Rules, Cooperation and Trust in the Euro Area. In: The search for Europe – Contrasting Approaches, BBVA and OpenMind Book, pp. 68-79,

European Commission (2016), Standard Eurobarometer Nos. 34-85.

Feldstein, M (2016), “How EU Overreach Pushed Britain out”, Project Syndicate, 28 June.

Guiso, L, P Sapienza, and L Zingales (2016), “Monnet’s Error”, Economic Policy 31, pp. 247-297,

Fourquet, J, E Pratviel and J-P Dubrulle (2016), Les Europeéns et le Brexit, Ifop pour la Fondation Jean Jaurès et la FEPS.

Kaiser, T (2016a), “Hans-Werner Sinn rechnet mit Euro-Austritt Italiens”, interview with Hans-Wwerner Sinn, Die Welt, 17 October.

Kaiser, T (2016b), “Star-Ökonom erwartet den Euro-Austritt Italiens”, interview with Joseph Stiglitz, Die Welt, 5 October.

Martin, W (2016), “STIGLITZ: Italy could be the “cataclysmic event” that leads to the fall of the Eurozone”, interview with J. Stiglitz, Business Insider, 22 August,

Roth, F, L Jonung and F Nowak-Lehmann (2012), “Crisis and Public Support for the Euro”, VoxEU.org, 5 November.

Roth, F, L Jonung and F Nowak-Lehmann (2016), “Crisis and Public Support for the Euro, 1990-2014”, Journal of Common Market Studies 54, pp. 944-960,

Sinn, H-W (2014), The Euro Trap—On Bursting Bubbles, Budgets, and Beliefs, Oxford University Press.

Stiglitz, J (2016), The Euro – How a Common Currency threatens the Future of Europe, Norton & Company.