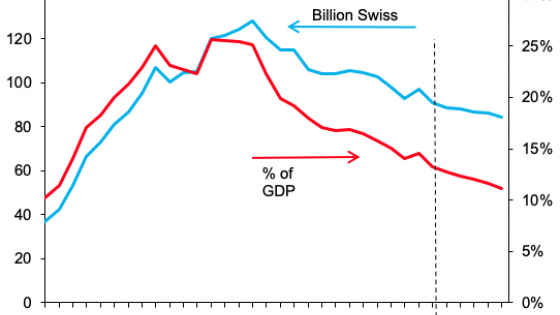

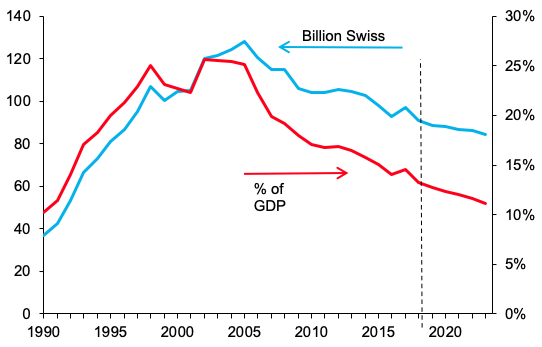

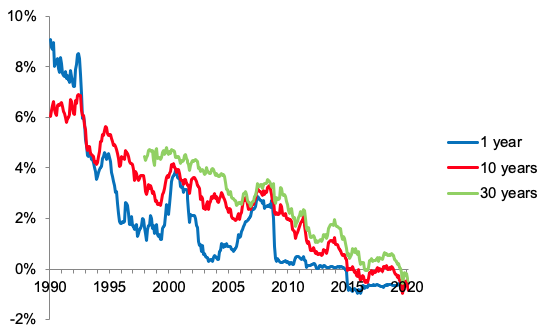

Swiss public finances have been doing very well over the last twenty years. The debt of the Swiss national government amounted to 13% of GDP in 2018, down from a peak of 26% in 2002 (Figure 1), and this looks set to continue. This excellent performance is a direct result of the adoption of a debt brake rule in the late 1990s following a decade where the trend was quite worrisome (Brülhart et al 2017). Aren’t the Swiss – typically – overzealous however? The strict implementation of the rule has led to a reduction of debt, not just relative to GDP but also in absolute terms with nearly a quarter of the debt being paid back since the early 2000s. All this at a time where the cost of the debt has trended down to negative values, even for long maturities (Figure 2). Switzerland seems to have a problem of too little debt (Bacchetta 2017), and is an extreme case of a pattern observed in other countries (Hüther and Südekum 2019).

Figure 1 Swiss federal government's debt

(forecasts since 2019)

Figure 2 Yield on Swiss federal government bonds by maturity

Switzerland can sustain deficits

In a new CEPR Policy Insight (Tille 2020) I consider alternative paths for Swiss fiscal policy. Not only is the yield on Swiss government bonds low, it is below the growth rate of nominal GDP. As Blanchard (2019) points out, we can then run primary fiscal deficits while keeping debt steady relative to GDP. Wyplosz (2019) points that the pattern does not apply to a majority of countries, but Switzerland is one where it clearly does. Figure 3 shows the difference between the 10-year yield and various measures of growth, namely growth over the previous two years (green line) and the IMF WEO forecasts over the next five years (yellow line) and from three to five years in the future (red line). The gap is clearly negative, and taking a longer view shows that this is the usual pattern, with the ‘lost decade’ of low growth in the 1990s being the exception.

Figure 3 10-year interest rate – GDP growth rate

Based on this gap, I estimate that Switzerland could run a primary deficit of CHF 2.8 billion (0.4% of GDP) and keep its debt to GDP ratio at the current low value.

Use fiscal policy to deal with the epidemic

The ongoing epidemic will lead to a sharp economic downturn, and the policy challenge is to ensure that it remains temporary and the economy can quickly fire up again. This requires an aggressive policy action (Baldwi and Weder di Mauro 2020) and the fiscal space should be used to spread the cost (Alós-Ferrer et al. 2020, Danthine 2020).

How much are we talking about? The Swiss government has so far pledged CHF 42 billion for rapid support measures, including benefits for firms keeping workers despite low activity and state-guaranteed loans issued by banks for firms with favourable repayment terms (0% interest and 5 to 7 years maturity). Grünenfelder, Peter, et al. (2020a, 2020b) estimate that the current confinement measures cost CHF 36 billion over 3 months. Stricter measures would raise the cost to CHF 87 billion. Gersbach and Sturm (2020) call for a CHF 100 billion fund to carry the economy through the temporary recession.

Let’s consider that the cost lead one-for-one to an increase in public debt. This is a very pessimistic assumption, as after all firms will be able to repay a substantial share of the state-guaranteed loans. The first column of Table 1 shows that debt would initially increase to 18-27% of GDP, which remains a bearable level. The table shows that the ratio would gradually decrease in the future thanks to the yield-growth differential, and consider several assumptions for the yield. The real yield, currently at -1%, would have to raise to more than 1% for the debt ratio to remain stuck. Even then, the ratio could be brought down to the current low value over twenty years by running moderate primary surpluses.

Table 1 Debt/GDP ratio in 2040

Notes: all scenarios consider a real growth rate of -2% in 2020 and 1.25% thereafter, an inflation of 0% in 2020-21, 0.7% in 2022 and 1% thereafter. In the absence of policy reaction the primary balance is set at 0% of GDP. In the scenarios with a primary surplus (last column) the surplus is set to 0.2% of GDP in the moderate cost scenario, 0.6% of GDP in the high cost scenario, and 0.7% of GDP in the very high cost case.

Of course, the scenarios will need to be re-assessed as the situation is rapidly evolving. Still, Switzerland can fully absorb the cost of the current crisis.

Take advantage of Switzerland’s intangible asset

The downward trend in sovereign yields is a broad phenomenon, and Switzerland is one of the most striking example of the low cost of debt. This special position reflects the trust of global investors in Swiss policymaking and institutions.

Why not then take advantage of it by setting up a sovereign wealth fund? The fund would be funded by long-term sovereign debt and invest in a range of higher-yielding assets. Notice that such a fund is entirely distinct from the central bank, and thus the proposal differs from the recurrent discussion of using some of the SNB assets to invest in such a fund. While Switzerland does not have natural resources, which are usually associated with sovereign funds, it has an intangible asset. Christen and Soguel (2019) consider such a fund for the Swiss cantons (states) and show that it could deliver a source of revenue.

I consider a range of possible portfolio in which Switzerland could invest, and Figure 4 shows the average real returns. I first consider the trust fund of the pay-as-you-go pillar of the Swiss retirement system (AVS), as well as the median return on Swiss pension funds. This points to a real return of 1.5-2.3%. I then consider the return on Swiss external assets from the net international investment position (NIIP) data, focusing on portfolio investment and the reserves of the Swiss National Bank. The real returns on these holdings ranges from 1.3% to 2.0%. Finally, I consider the total return indices of various stock markets. These can provide higher returns, but with a lot of heterogeneity and higher risk.

Figure 4 Average real rate of return since 2000 (AVS: 2006)

Based on the evidence, a real return of 1-2% on the assets is reasonable. I consider a real yield on government bonds between -1 and 0%, in line with recent patterns. With these figures, a fund amounting to 10% of GDP would provide a net return between CHF 0.7 and CHF 2.1 billion (0.1% to 0.3% of GDP). These estimates could of course be refined further.

There is policy space – use it

Instead of reducing its debt level, which in the current configuration amounts to investing at a negative interest rate, Switzerland has several more appealing options. Moderate fiscal deficits, and/or a fund could bring a couple of billions annually to public finances. It won’t be enough to handle the challenges of health costs and ageing for public finances, but it would help. The debt margin can also be put to use to handle the cost of the current recession.

The options are compatible with the debt brake. Moderate deficits keep the debt steady relative to GDP, which is the relevant metric for assessing the burden. A sovereign fund raises the debt, but this is matched by assets leaving the net worth unchanged. Using fiscal policy to counter the epidemic will lead to a debt increase, but this is a clearly identified one-off shock and the debt brake can ensure sound dynamics subsequently.

References

Alós-Ferrer, Carlos, et al. (2020). “Coronavirus. Testen und Einfrieren: Eine Überlebensstrategie für die Schweizer Volkswirtschaft”, mimeo, University of Zürich.

Bacchetta, P (2017). “Is Swiss public debt too small?”, in Monetary Economics Issues Today – Festschrift in honour of Ernst Baltensperger, Orell Füssli, pages 193-202.

Baldwin, R, and B Weder di Mauro (2020). Mitigating the Covid Economic Crisis: Act Fast and Do Whatever It Takes, Vox ebook, CEPR Press.

Blanchard, O (2019a), “Public debt and low interest rates”, American Economic Review 109 (4), pages 1197-1229.

Brülhart, M, P Funk, C Schaltegger, P Siegenthaler, and J E Sturm (2017), “Expertise sur la nécessité de compléter le frein à l’endettement” (Expert report on the need to complete the debt brake).

Christen, R, and N Soguel (2019). “How can states benefit from the equity premium puzzle? Debt as revenue source for Swiss cantons”, Swiss Journal of Economics and Statistics 155(4).

Danthine, J-P (2020). “Switzerland can erase the economic cost of Covid19”, Le Temps, March 23.

Gersbach, H, and J-E Sturm (2020). “Ein Schweizfonds mit 100 Mia. Franken als zweiter Pfeiler”, Oekonomenstimme blog, March 17.

Grünenfelder, P et al. (2020a). “Des réponses de politique économique à la crise du coronavirus”, Avenir Suisse.

Grünenfelder, P et al. (2020b). “Les effets économiques d’un arrêt complet”, Avenir Suisse.

Hüther, M and J Südekum (2019). “The German debt brake needs a reform”, Voxeu column, May 6

Tille, C (2020). “The ‘burden’ of Swiss public debt: Lessons from research and options for the future”, CEPR Policy Insight No. 101.

Wyplosz, W (2019). “Olivier in wonderland”, Voxeu column, June 17.