The Bank of Japan's quantitative and qualitative easing (QQE) programme (Kuroda 2013, 2017) stands out for its size and scope even among post-Crisis G7 central banks. The most qualitative of the easing measures put in place – the purchase of Japanese equities through exchange-traded funds (ETFs) – has attracted little scrutiny, perhaps because it has been dwarfed by the size and novelty of the other QQE components. We examine what the Bank of Japan is trying to do with this programme, and whether it is working. We then look at whether there are lessons for other central banks.

Despite its novelty, the Comprehensive Assessment of QQE released by the Bank of Japan contained no reference to the ETF purchase programme (Bank of Japan 2016d), and of the first 28 speeches made by board members of the Bank in 2017, ETF purchases were mentioned in just one – and that was in passing (Masai 2017). However, the cumulative purchases by the Bank of Japanese equities are becoming substantial. We estimate the market value to have been just below ¥20 trillion at the end of July 2017, or around 3.2% of the total Japanese stock market, making the central bank the second largest owner of Japanese stocks after the Government Pension Investment Fund.

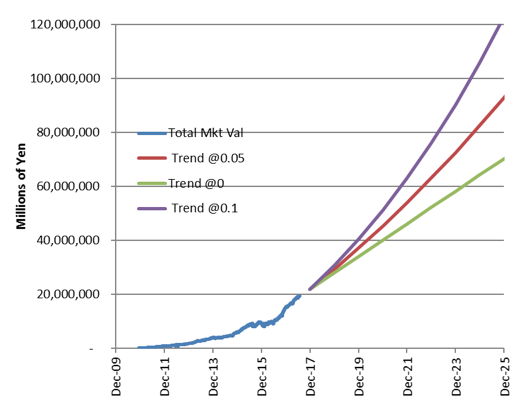

Without further adjusting the pace of ETF purchases, we project that the central bank will own 10% of the market sometime between 2022-2026, depending on the interim market performance (see Figure 1).

Figure 1. Estimated Bank of Japan holdings of Japanese equity ETFs

Note: expressed as market value and share of Japanese stock market, contingent on different paces of stock market appreciation

Such levels of equity ownership are extremely unusual among developed market central banks. Only the Hong Kong Monetary Authority’s 1998 market intervention (Goodhart and Dai 2003) stands out as a candidate to match the Bank of Japan's cumulative intervention in the modern era, albeit in a far smaller stock market, and in quite different circumstances (Caballero 1999, Chan 2015).

Aims of the programme

The self-declared aim of the Bank of Japan is to conduct a programme of asset purchases “with a view to lowering risk premia of asset prices" (Bank of Japan 2013). There are a number of mechanisms by which lower risk premia could lead to stronger economic growth and a greater chance of reaching the Bank’s inflation objective. These include, but are not limited to, higher volumes of public issuance as the cost of equity capital fell; a ‘portfolio balance’ channel in which capital seeking higher rates of return is squeezed into new investment projects (in the form of private or public equity capital); and perhaps a ‘confidence channel’ in which ‘animal spirits’ are set alight. We focus on the narrower question of whether the programme succeeded in raising equity prices, which should follow from a fall in risk premia.

Operationally, the Bank of Japan conducts the programme by creating reserves, and passes them to a trust bank that buys underlying equities in the proportions in which they make up the value of Japanese stock indices. Three stock indices have been used since the inception of the programme (Bank of Japan 2016, 2016c).

Measuring impact

If the self-declared aim of the programme is to lower the risk premia of asset prices, have they succeeded?

QQE announcements, as commitments to execute large-scale price-insensitive purchases in the future, might reasonably be deemed likely to raise the marginal price of targeted assets at the point of announcement. But for open-ended purchase programmes with no well-defined target purchase quantities, the assessment of market impact is challenging. In assessing their own open-ended commitment to purchase assets, the ECB finds that analysing the announcement effect and the execution effect separately is fruitful (Andrade et al. 2016). We take this approach when assessing the market impact of the Bank of Japan's ETF programme.

Announcement effects

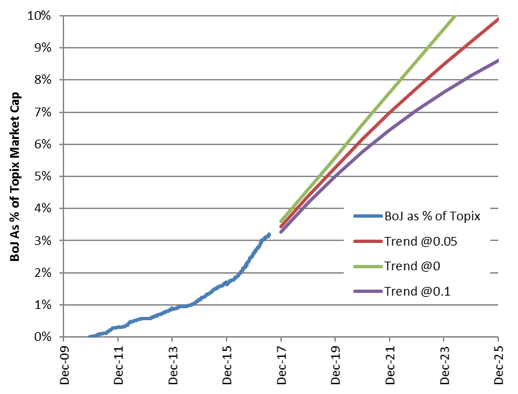

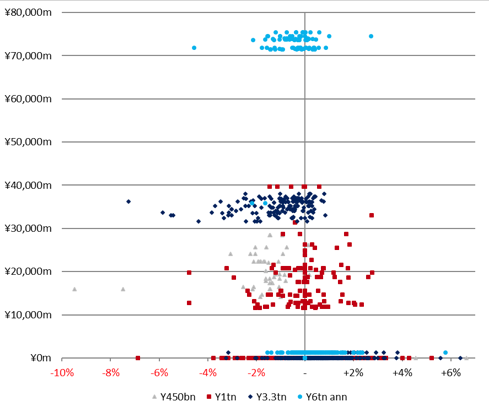

There have been four notable announcements, initiating and expanding the ETF programme. In two announcements (Bank of Japan 2013, 2014) the Bank simultaneously delivered a positive surprise with regards to the quantity of bond purchases, leading to a drop in 10-year Japanese government bond yields and a sharp fall in the value of the yen. By contrast, the 2016 announcement (Bank of Japan 2016b) delivered a negative surprise on bond purchases, leading to higher Japanese government bond yields and a sharply stronger yen. Given the global orientation of their earnings, Japanese stock price returns have a significantly negative correlation with the value of the yen; like other developed market equities, changes to Japanese stock prices are cointegrated with changes to global stock prices. We control for this by examining the excess returns of Japanese stocks versus global stocks two business days post-announcement in common currency (last column in Table 1). The relationship between the scale of purchases and the price change is positive in each episode, although the confidence we have in the relationship is not strong given such few data points.

Table 1. Announcements of ETF programmes, market context, and market impact

One problem with measuring announcement effects is that the policy may already be ‘priced in’ to some extent. As such, we capture in Table 1 only the surprise effect, and this should be a lower bound on the true impact.

Execution effects

Unlike many other central bank purchase programmes, the Bank of Japan does not announce in advance the days on which it will be making asset purchases as part of its QE programme. Tokyo trading is split into two distinct morning and afternoon sessions, and interventions occur in the afternoon sessions. We are thus able to compare the characteristics of mornings prior to Bank interventions to mornings after which no decision to purchase is made. We can then compare the characteristics of afternoon sessions of intervention and non-intervention days.

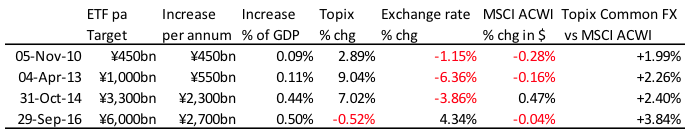

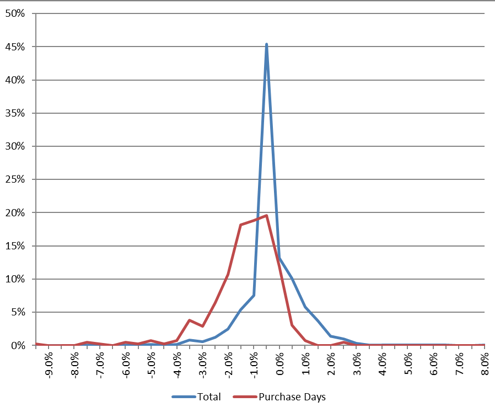

In examining the four phases since 2010 of the Bank’s ETF buying programme, operating with different annualised purchase target speeds, we find compelling evidence of intent, but no conclusive evidence of market impact. Figure 2a below shows the market move on the day of the purchase (horizontal axis) and size of purchase in yen (vertical axis). Figure 2b shows the distribution of market moves over the period (blue) compared to the distribution of daily market moves on intervention days (red). The mean, skewness, and kurtosis attached to intervention days is clearly negative, compared to non-intervention days.

We find that price changes in morning sessions that were followed by Bank purchases saw an average daily price change of 1.55% in yen terms or 1.04% in US dollar terms (to control for inverse price movements associated with intraday currency changes) below the price changes of those morning sessions after which no intervention took place. Afternoon sessions saw similar levels of price returns with and without intervention (in local and US dollar terms). It is of course not possible to know what the counterfactual performance of these afternoon sessions would have been without intervention, but there appears to be no compelling execution impact that can be discerned from the data. Somewhat surprisingly – given that the goal behind the timing of interventions was to reduce market volatility – we find that the distribution of price returns in afternoon sessions during which intervention took place had higher levels of volatility and kurtosis, and more negative skew, than afternoons during which no intervention took place (although again, we cannot with confidence model a counterfactual against which to compare these afternoon interventions).

Figure 2. Estimated Bank of Japan holdings of Japanese equity ETFs expressed as...

a) Market value

b) Share of Japanese stock market

In summary, while there is no reliable counterfactual against which we can compare the market impact of execution, we find that the Bank of Japan has timed the execution of its ETF purchase programme to coincide with episodes of market weakness, potentially with the aim of dampening price volatility.

Perhaps counter-intuitively, we further find that cumulatively, over the course of the ETF purchase programmes, Japanese stocks de-rated against global stocks. That is to say, the price-multiple for anticipated future earnings of Japanese stocks fell relative to the price-multiple for non-Japanese stocks over the period. This would seem to point to a failure in the Bank’s stated policy of reducing the risk premia of assets, although again, perhaps not against an unknowable counterfactual.

Programme limits

There are few mechanical limits to the ownership of equities by central banks in general. But from a domestic legal perspective, Article 18-2 of the Bank of Japan’s accounting rules (Bank of Japan 2016e) require that provisions for unrealised losses on stockholdings are registered on a semi-annual basis. With a political preference for avoiding a negative capital position on the BOJ balance sheet, limits on the purchase programme from a 'solvency' perspective are placed on the accumulation of equity. Goldman Sachs calculate that the limits of this might already be being tested (Baba et al. 2016). They estimate that a 99% value-at-risk estimate for the Bank’s total equity holdings is already more than the Bank’s capital, and point to the removal of the provision that allows for loss compensation from the Ministry of Finance in the 1998 revision of the Bank of Japan Law. The degree to which the programme is contingent upon political support that could be threatened either by a transition away from Governor Kuroda at the end of his term in 2018, or a change in political leadership following the recent call of a snap election, is also not to be underestimated.

Lessons for other central banks

Many central banks that have navigated the question of monetary policy accommodation at the lower policy rate bound have done so in similar ways – the execution of straight quantitative expansions, adjustments to increase the interest rate duration of asset purchases, extension of asset purchases into private non-financial assets. Japan has been alone in purchasing equities as part of its monetary easing programme, and the question of whether the purchase of equity securities is the next step along this path is of wider interest. Even if central banks in the US/Eurozone/UK achieve a lasting lift-off from the zero bound, and are able to shed asset purchases from their balance sheet, low central bank rates are discounted by markets to be a fact of life for the next decade or two, and the chance of needing to have recourse to unconventional measures appears very large.

We have shown that the announcement effect has been important for price changes experienced by equities, just as it has been for bonds. However, the execution effect is not straightforward to estimate with confidence. Further, the limits of equity purchase programmes will be governed by institutional arrangements in place for individual central banks.

References

Andrade, P, J Breckenfelder, F De Fiore, P Karadi and O Tristani (2016), “The ECB's asset purchase programme: An early assessment”, ECB, Working Paper 1956.

Bank of Japan (2013), “Introduction of the "Quantitative and Qualitative Monetary Easing”, 4 April.

Bank of Japan (2014), "Expansion of the Quantitative and Qualitative Monetary Easing", 31 October.

Bank of Japan (2016), "Special rules for purchases of ETFs to support firms proactively investing in physical and human capital", 15 March.

Bank of Japan (2016b), "Enhancement of Monetary Easing", 29 July.

Bank of Japan (2016c), "Change in the maximum amount of each ETF to be purchased", 21 September.

Bank of Japan (2016d), "Comprehensive assessment: Developments in economic activity and prices as well as policy effects since the introduction of Quantitative and Qualitative Monetary Easing (QQE)", 21 September.

Bank of Japan, 2016e, “Accounting Rules of the Bank of Japan”, 7 October.

Caballero, R (1999), Stock market interventions: "an update", 7 July.

Chan, N (2015), 'When markets fail', Speech at the 6th Caixin Summit 2015, Hong Kong Monetary Authority, November.

Baba, N, T Ota and Y Tanaka (2016), “BOJ’s ETF purchase programme could significantly improve stock supply/demand, but purchasing closer to limits”, Japan Economics Analyst, Goldman Sachs Economics Research, 3 August.

Goodhart, C and L Dai (2003), Intervention to Save Hong Kong, OUP.

Kuroda, H (2013), “Quantitative and Qualitative Monetary Easing”.

Kuroda, H (2017), "Quantitative and Qualitative Monetary Easing with yield curve control: After Half a Year since Its Introduction”.

Masai (2017), “Economic and Financial Developments and Monetary Policy in Japan”, 6 March.