The current US administration has been openly implementing protectionist trade policies ever since Donald Trump became president. Amiti et al. (2019) and Fajgelbaum et al. (2019a,b) evaluate the consequences of this stark policy reversal on consumer welfare and firm profits. These authors report that the US raised tariffs on targeted imports from an average of 2.6% to 17% and that their trade partners raised tariffs from an average of 6.6% to 23% on targeted US exports. Both papers find complete pass-through of tariffs on domestic prices of imported goods. They also estimate large impacts on trade flows but moderate losses to US consumers and importing firms (the losses are estimated to amount to less than $70 billion, according to Fajgelbaum et al.), even though these small aggregate effects hide heterogeneous impacts across regions.

Parroting Perot

In 2017, echoing the late Ross Perot, who is remembered above all for worrying about a “giant sucking sound [of jobs] going south” when running for president as an independent in 1992, then candidate Trump labeled NAFTA the “worst trade deal ever signed (…) in this country”. Among the public at large, concerns related to trade deals are also primarily about jobs.

The empirical economics literature has been busy documenting such effects for quite a while now (e.g. Autor et al. 2013, Caliendo et al. 2019, Pessoa 2018). A parallel literature is developing quantitative trade models to estimate the trade and welfare effects of various extant trade agreements, such as NAFTA (Caliendo and Parro 2015), and to provide plausible estimates of the effects of policies to come, such as Brexit (Dhingra et al. 2016, Dhingra et al. 2017). With the – to the best of our knowledge – unique exception of Heid and Larch (2016), these two types of work are evolving in parallel. A recent paper of ours (Carrère et al. 2019) contributes to filling this gap by accounting for equilibrium unemployment in a quantitative trade model.

Specifically, we complement the aforementioned works by designing a multi-sector, multi-country general equilibrium trade model (following Costinot et al. 2012) featuring labour market frictions (following Helpman and Itskhoki 2012), risk-averse workers, and equilibrium unemployment as in the works of 2010 Nobel laureates Mortensen, Diamond, and Pissarides. The mechanism in our model is consistent with the empirical evidence put forth in the companion paper by Carrère et al. (2016). Accordingly, our welfare criterion is a certainty-equivalent real wage that accounts for the probability of losing one's job. We structurally estimate the parameters of the model using world trade data for over 60 importing and 207 exporting countries, as well as sectoral employment and production data for 31 OECD countries, 34 sectors, and for the years from 2001 to 2008.

MaCaGA: Make Canada great again

We then run several counterfactual exercises. Our first counterfactual scenario involves the repeal of NAFTA and the imposition of 20% bilateral tariffs between the US and Mexico in all sectors, as well as the reintroduction of some of the non-tariff barriers that were eliminated by NAFTA. We follow Head and Mayer (2016, 2019) and take the former Secretary of Economy Ildefonso Guajardo's threat “to retaliate right away” seriously by assuming that Mexico would match the 20% tariff rate. We find that this trade regime would raise the unemployment rate from 3.9% to 5.8% in Mexico and from 5.8% to more than 5.9% in the US. Welfare is expected to fall by 0.31% in the US and by 6.6% in Mexico. Changes in real GDP per capita are similar but their magnitude is smaller – accounting for unemployment matters. Unlike their Mexican and US counterparts, trade diversion makes Canadian workers slightly better off – not an obvious Trump constituency! – by any metric (lower unemployment, higher wages).

The welfare and real GDP per capita losses in Mexico and the US are larger than Caliendo and Parro’s (2015) mirror-image estimates of welfare gains from NAFTA. Part of the reason for these larger effects is that such a bold policy reform would go beyond undoing NAFTA (average bilateral tariff rates were lower than 20% prior to 1993) and inter-sectoral linkages are more important nowadays than back then. We also account for non-tariff barriers and our welfare criterion accounts for risk aversion – workers care about the risk of being in unemployment over and above the earnings loss that it entails.

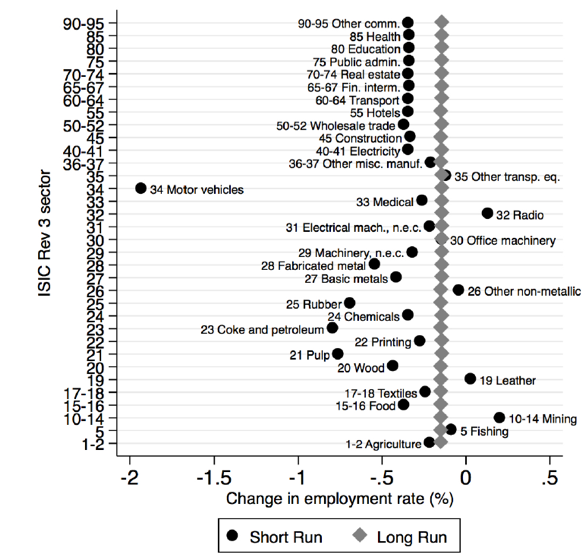

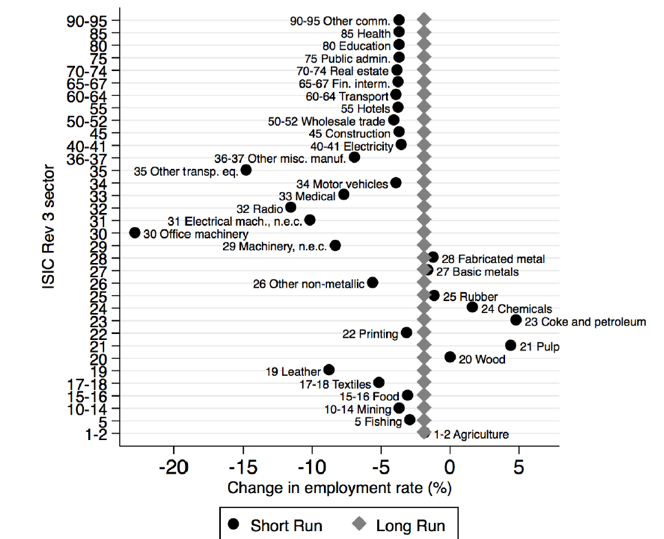

Figure 1 Short-run and long-run changes under the repeal of NAFTA

(a) Changes in employment rates for the US

(b) Changes in employment rates for Mexico

Note: The figure reports short-run (black dots) and long-run (gray diamonds) changes in sectoral employment rates for the US (upper panel) and Mexico (lower panel) under the scenario of repealing NAFTA. The vertical axis reports the International Standard Industrial Classification of All Economic Activities Revision 3 (ISIC Rev 3) sector classification and short sector descriptions are also shown as labels on short-run markers. The horizontal axis reports the percentage change in the sectoral employment rate.

We define employment rates at the sector level as one minus the unemployment rate in this sector. In the long run, workers may freely reallocate their labour supply to any sector and occupation (and pay the corresponding skill acquisition costs). In our static model, this situation corresponds to a novel equilibrium. We also compute a counterfactual analysis using a short-run version of our model, in which the sector choices of workers at the moment of the policy change are frozen at the initial (long-run) equilibrium but all other equilibrium conditions hold. In our model, long-run changes in the employment rates of sectors are almost proportional to one another, as is illustrated by grey diamonds in Figure 1 (panels a and b report results for the US and Mexico, respectively). By contrast, we find heterogeneous employment responses across sectors in the short run, as illustrated by the black dots in Figure 1. Differences between the short-run and long-run outcomes of our model capture some transitory dynamics that are absent from our static model.

Disrupting the value chain in the car industry

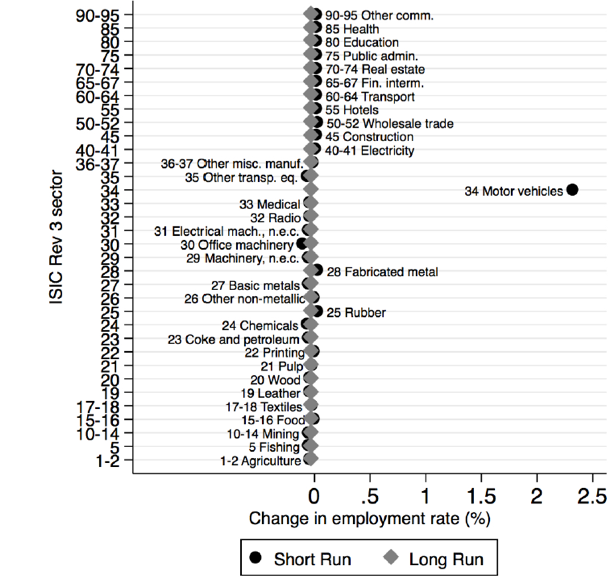

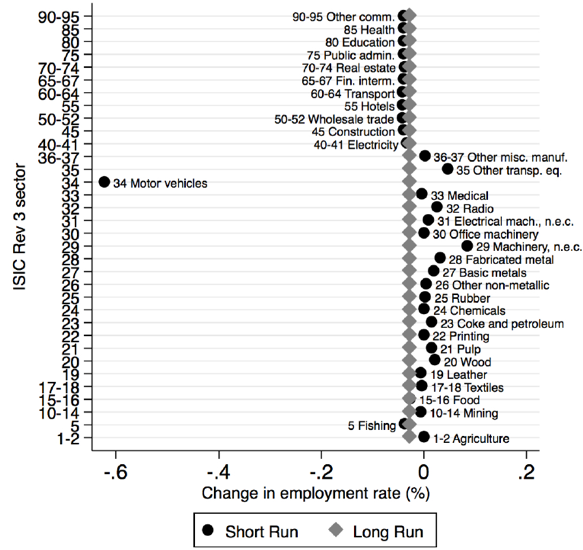

Whereas in our first scenario the US is raising trade barriers in all sectors against two countries, in our second scenario the US is raising trade barriers in one sector (motor vehicles) against imports from all countries bar Mexico and Canada. We also raise non-tariff barriers from Mexico to the US to account for changes in the rules of origin that increase Mexican production costs. The main provisions of the US–Mexico–Canada agreement, signed on 30 November 2018, include changes in the rules of origin for automakers and other regulations. These provisions are likely to lead to a surge in the production costs and prices of motor vehicles imported from Mexico (e.g. Head and Mayer 2019) and, in turn, of imports from Asia and Europe. We assume that the White House would then react by raising tariffs on motor vehicle imports from third countries to 20%. Figure 2 illustrates the short-run and long-run results in grey diamonds and black dots, respectively, for the US and Mexico. In a rare vindication of the protectionist instincts of President Trump, US employment would rise in the sector of interest in the short run. By contrast, we find that long-run welfare and employment would fall in both Mexico and the US as well as in major car producing countries.

Figure 2 Short-run and long-run changes under US protectionism in the car industry

(a) Changes in employment rates for the US

(b) Changes in employment rates for Mexico

Note: The figure reports short-run (black dots) and long-run (grey diamonds) changes in sectoral employment rates for the US (upper panel) and Mexico (lower panel) under the scenario of US car protectionism. The vertical axis reports the ISIC Rev 3 sector classification and short sector descriptions are also shown as labels on short-run markers. The horizontal axis reports the percentage change in the sectoral employment rate.

Summary and conclusion

The public and the general press tend to assess the merits of trade agreements and of other trade policy changes on the basis of jobs created and lost. The academic literature has been busy responding to this concern in various ways. Yet, almost all quantitative trade models that are used by economists to quantify the trade and welfare effects of such trade policy changes do not include unemployment as an important margin of adjustment. Our paper aims to fill this gap. We have applied our model to two contemporaneous trade policy experiments – other applications are possible (Carrère et al. 2015).

References

Autor, D, D Dorn and G Hanson (2013), “The China syndrome: Local labor market effects of import competition in the United States”, American Economic Review 103(6): 2121-2168.

Amiti, M, S Redding and D Weinstein (2019), “The impact of the 2018 trade war on US prices and welfare”, CEPR discussion paper 13564.

Caliendo, L and F Parro (2015), “Estimates of the trade and welfare effects of NAFTA”, Review of Economic Studies 82(1): 1-44.

Caliendo, L, M Dvorkin and F Parro (2019), “Trade and labor market dynamics”, Econometrica 87(3): 741-835.

Carrère, C, M Fugazza, M Olarreaga and F Robert-Nicoud (2016), “On the heterogeneous effect of trade and unemployment”, CEPR discussion paper 11540.

Carrère, C, A Grujovic and F Robert-Nicoud (2019), “Trade and frictional unemployment in the global economy”, CEPR discussion paper 13564, Journal of the European Economic Association (forthcoming).

Carrère, C, A Grujovic and F Robert-Nicoud (2015), “Trade agreements, trade deficits and jobs”, VoxEU.org, 3 September.

Costinot, A, D Donaldson and A Komunjer (2012), “What goods do countries trade? A quantitative exploration of Ricardo’s ideas”, Review of Economic Studies 79: 581-608.

Dhingra, S, H Huang, G Ottaviano, J P Pessoa, T Sampson and J Van Reenen (2017), “The costs and benefits of leaving the EU: Trade effects”, Economic Policy 32(92): 651-705.

Dhingra, S, H Huang, G Ottaviano, T Sampson and J Van Reenen (2016), “The consequences of Brexit for UK trade and living standards”, VoxEU.org, 4 April.

Fajgelbaum, P, P Goldberg, P Kennedy and A Khandelwal (2019a), “The return to protectionism”, NBER working paper 25638.

Fajgelbaum, P, P Goldberg, P Kennedy and A Khandelwal (2019b), “The return to protectionism”, VoxEU.org, 12 April.

Head, K and T Mayer (2019), “Brands in motion: How frictions shape multinational production”, American Economic Review (forthcoming).

Heid, B and M Larch (2016), “Gravity with unemployment,” Journal of International Economics 101: 70-85.

Head, K and T Mayer (2016), “Reversal of regional trade agreements: Consequences of Brexit and Trumpit for the multinational car industry,” VoxEU.org, 12 November.

Helpman, E and O Itskhoki (2010), “Labor market rigidities, trade and unemployment”, Review of Economic Studies 77: 1100-1137.

Pessoa, J (2018), “International competition and labor market adjustment”, FGV-Sao Paulo School of Economics working paper.