The repeal of the Corn Laws in 1846 by Britain’s parliament was the signature trade policy event of the 19th century. The repeal led the mid-Victorian move to freer trade by Britain and helped usher in the great expansion of the country’s overseas commerce in the late 19th century.

In 1815, at the end of the Napoleonic Wars when normal European commerce was set to resume, parliament passed a very restrictive set of duties – the Corn Laws – to keep out imports of grain, particularly wheat (Figure 1). This action sparked an outcry and was viewed as class legislation that promoted the interests of Britain’s land-owning aristocracy against the interests of the working-class labourers and capital owners in manufacturing (an export sector). The classical economists, including David Ricardo and Thomas Malthus, participated in the robust public debate about the economic effects of the duties. In 1843, Richard Cobden formed the Anti-Corn Law League to mobilise public opinion in favour of abolishing the tariffs.

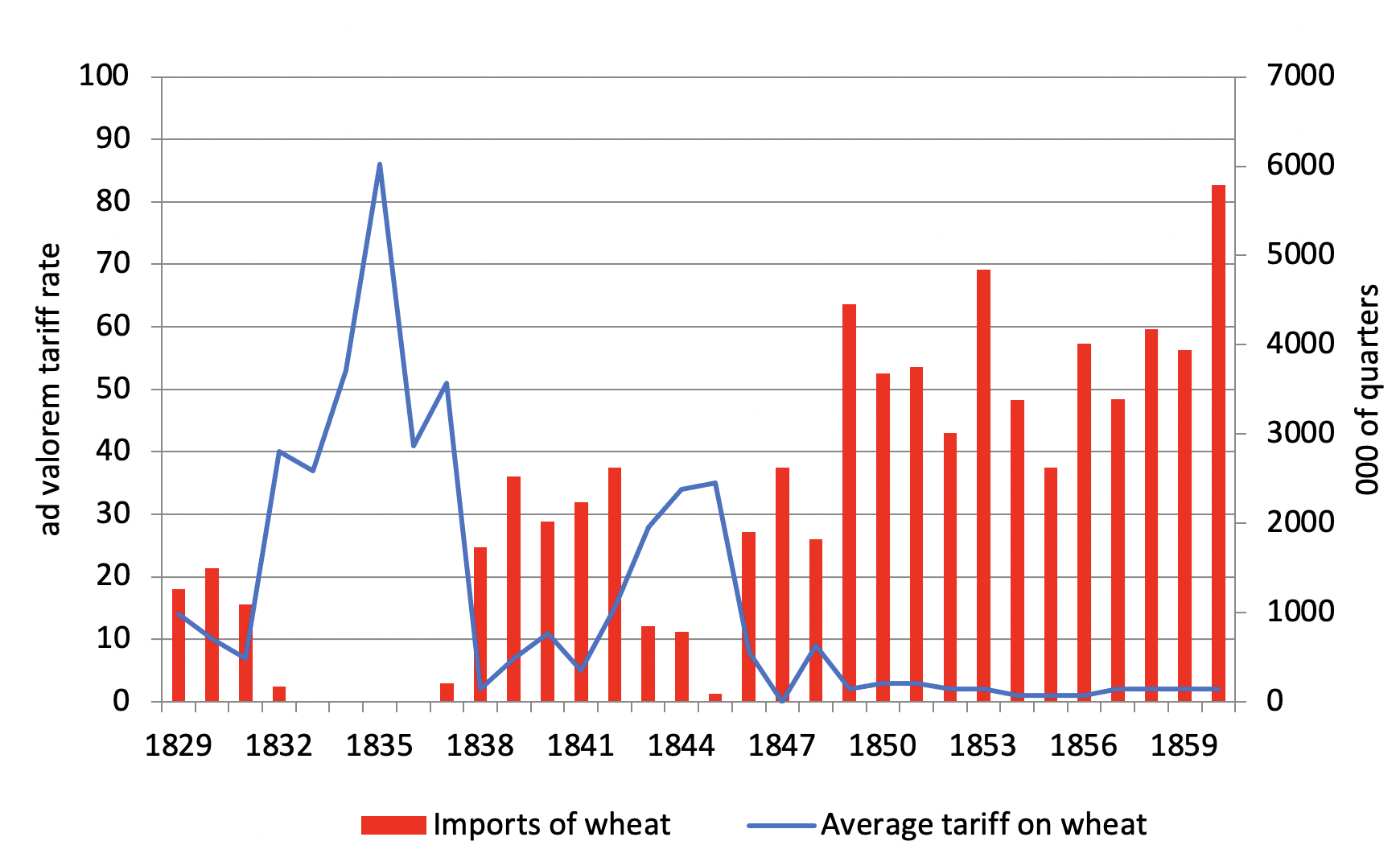

Figure 1 Average import tariff on wheat and Britain’s wheat imports, 1829-1860

Source: Sharp (2010)

In 1846, with the Irish potato famine looming in the background, the Conservative Prime Minister, Robert Peel, proposed that the Corn Laws be abolished. This decision split the Conservative Party and cost Peel his leadership position, but the repeal managed to pass in Parliament.1

What were the economic implications of the repeal of the Corn Laws? Who were the winners and losers? How was British welfare affected? Previous work by Williamson (1990), O’Rourke (1997), Ward (2004), and others have lent partial insight into the economic impact, using simple partial or general equilibrium models that focused on different aspects of these questions.2

In our recent paper (Irwin and Chepeliev 2020), we undertake a new quantitative general equilibrium assessment of the Corn Law repeal that provides a unified framework for evaluating its impact on various sectors of the British economy, on the domestic income distribution, and on overall economic welfare. The general equilibrium model is based on the input-output table for the British economy in 1841 constructed by Horrell et al. (1994). The availability of a consistent accounting of Britain’s commodity production, inter-sectoral flows of goods and services, international trade, and final consumption during this period is an enormous aid to evaluating the impact of the Corn Law repeal and the broader move to freer trade.

We incorporate two important features into our analysis of the Corn Law repeal. First, we account for the fact that Britain was a ‘large’ country in the world economy. Specifically, Britain could influence the price of its cotton textiles exports and the prices of cotton and wheat imports. Second, in terms of distributional impacts, we not only examine the impact of the repeal on the incomes of land holders, labourers, and capital owners, but we combine these income effects with differential consumption patterns. We divide the population into two groups, the top 10% of income earners and the bottom 90%. The top 10% earn most of their income from land rents and capital profits. The bottom 90% earn most of their income from wage labour and spend a disproportionate amount of their income on food.

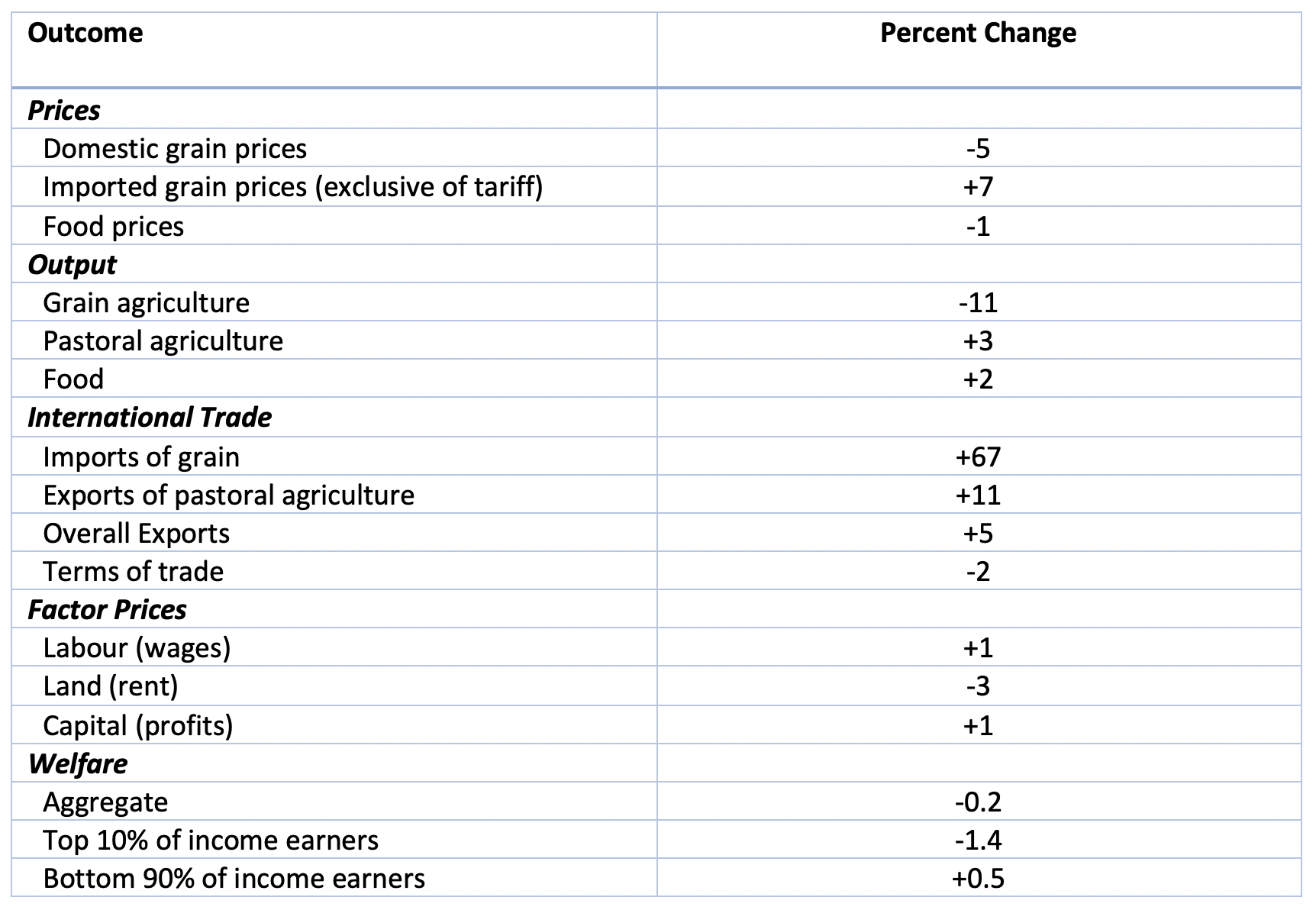

We take the repeal of the Corn Laws to be the elimination of a 28% tariff on imported grain. Our principal results are summarised in Table 1. Domestic grain prices fall about 5% (a composite of the price of domestic and imported grain), which allows food prices to fall 1%. The price of imported grain (excluding the tariff) rises about 8% as British demand puts pressure on world grain markets. Domestic grain output falls 11%, but other sectors (including pastoral agriculture) expand production. In terms of traded quantities, grain imports rise nearly 70%, but they comprise just a fraction of overall imports. Total exports grow about 5%.

Table 1 Key simulation results from the repeal of the Corn Laws

Note: The repeal eliminates a 28% tariff on imported grain. Results are rounded averages from high and low elasticity scenarios. See Irwin and Chepeliev (2020) for full details.

The repeal contributed to a slight deterioration in Britain’s terms of trade (about 1-2%). In terms of aggregate welfare, this deterioration in the terms of trade offsets the static efficiency gains of the tariff abolition. Overall, Britain’s welfare was essentially unchanged, declining a slight 0.1-0.3%.

While the overall welfare impact was negligible, the income distributional consequences of the Corn Law repeal were pronounced: landowners lost roughly 3% of their income while workers and capital owners saw their incomes rise about 1%. When this is combined with data on consumer expenditures, we find that repeal reduced the welfare of the top 10% of income earners by about 1%-2% and increased the welfare of the bottom 90% by about 0.5%. Thus, freer trade was a progressive ‘pro-poor’ policy, in line with more contemporary findings.3

Finally, we also compare our model findings with ex-post data on outcomes (prices, quantity responses, etc.). In general, the magnitudes of the impact of the Corn Law repeal that emerge from our model are reasonably close to the actual observed outcomes.

References

Fajgelbaum, P D and A K Khandelwal (2016), “Measuring the Unequal Gains from Trade”, Quarterly Journal of Economics 131: 1113–1180.

Heblich, S, S J Redding and Y Zylberberg (2020), “The Distributional Consequences of Trade: Evidence from the Repeal of the Corn Laws”, Working paper, Princeton University.

Horrell, S, J Humphries and M Weale (1994), “An Input-Output Table for 1841”, Economic History Review 47: 545-566.

Irwin, D A and M G Chepeliev (2020), “The Economic Consequences of Sir Robert Peel: A Quantitative Assessment of the Repeal of the Corn Laws”, NBER Working Paper, November 2020.

O'Rourke, K H (1997), “The European Grain Invasion, 1870-1913”, Journal of Economic History 57: 775-801.

Schonhardt-Bailey, C (2006), From the Corn Laws to Free Trade: Interests, Ideas, and Institutions in Historical Perspective, Cambridge: MIT Press.

Sharp, P (2010), “1846 and All That: The Rise and Fall of British Wheat Protection in the Nineteenth Century”, Agricultural History Review 58: 76-94.

Ward, T (2004), “The Corn Laws and English Wheat Prices, 1815-1846”, Atlantic Economic Journal 32: 245-55.

Williamson, J G (1990), “The Impact of the Corn Laws Just Prior to Repeal”, Explorations in Economic History 27: 123-156.

Endnotes

1 For a fascinating discussion of the political economy of repeal, see Schonhardt-Bailey 2006

2 A recent paper by Heblich et al. (2020) uses a new economic geography model to show that the repeal of the Corn Laws led to significant out migration of people from wheat growing areas of Britain.

3 Fejgelbaum and Khandelwal (2016) find that lower-income consumers tend to benefit from trade liberalisation in terms of their expenditures, but unlike here they do not simultaneously investigate the impact of that liberalisation on household incomes.