With the onset of the global financial crisis (GFC), quantitative easing (QE) started to be used on a large scale. This trend intensified dramatically during the first half of 2020 as central banks reacted to the COVID-19 crisis, leading to the further expansion in their already bloated balance sheets. The huge fiscal deficits created in response to the pandemic prompted a number of economists to recommend a temporary lifting of the taboo on monetary financing of deficits (more colourfully known as helicopter money) (Gali 2020 and forthcoming, Yashiv 2020, Blanchard Pisany-Ferri 2020).1 In this column, the similarities and differences between QE and helicopter money are discussed alongside the relative advantages (and disadvantages) of each method of monetary expansion.

Under current monetary institutions, there is an important technical similarity between QE and helicopter money. Both are implemented by creating new base money to buy government securities.2 The main difference between them is that under QE, the central bank is allowed to buy only ‘seasoned’ (and possibly other public and private) bonds. In comparison, under helicopter money, the central bank is allowed to buy new public securities at source, providing direct seignorage finance to government. Thus, QE is a device that enables central banks to ease government finance, subject to the so called ‘no printing’ component of central bank autonomy. Although it does not involve direct financing of the deficit, QE supports government finances by assuring a smooth market for seasoned government bonds and the associated reductions in the cost of new issues.

In this sense, QE is a weaker form of helicopter money for two reasons. First, QE is not necessarily associated with additional government expenditures, while helicopter money is (by definition) new money spent by government for goods and services. Second, even if QE is associated with larger government expenditures at the margin, they are most likely lower than the expenditures financed by a similar amount of helicopter money. As is the case with helicopter money, the stimulatory impact of QE is larger the longer the assets purchased to implement it are held by the central bank. By extending QE operations to long term maturities during the GFC, the Federal Reserve and other central banks managed to influence the level (and slope) of the yield curve. Similarly, by relieving some of the pressure on the supply of bonds by government, helicopter money could lower the yield curve and extend the range of maturities available to the government. Hence, it is also likely to flatten the governmental yield curve and ease the access to credit for both corporations and households.

In general, both QE and helicopter money may have permanent or temporary effects on the monetary base depending on whether the central bank decides to maintain the monetary base that was created by those operations in the future. Reichleen et al. (2013) emphasise that to effectively stimulate aggregate demand, the public must believe that monetary financing is permanent. In other words, they must think that the increase in the monetary base that supported the creation of helicopter money will not be reversed in the future through open market sales. It is worth noting that this argument applies equally well (and even more forcefully) to QE. This perspective implies that full effectiveness of both QE and helicopter money is achieved when there is a credible commitment that those operations will not be reversed.

The public’s perception of permanence about the operation of helicopter money is likely to depend on whether those operations are financed by an expansion of the base or by a reduction in the capital held by the central bank. The second mode of financing may send a signal that the operation is more permanent. But, by the same token, it increases the dependence of the central bank on the fiscal authority. To date, the Federal Reserve and other central banks largely maintain the bloated balance sheets they created through QE operations performed during the GFC. However, there was no clear-cut commitment to follow this course of action at the time that the balance sheets were expanded. Subsequent policies concerning this issue was discretionary and did not follow a preset rule. Similarly, central banks may, or may not, decide to do the same in the future, with the additions to the monetary base resulting from helicopter money operations (in case such operations are implemented during the COVID-19 crisis).

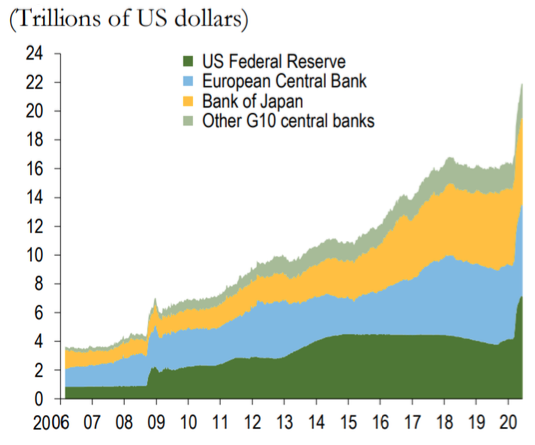

QE operations deployed in reaction to the pandemic during the first half of 2020 came on top of the large balance sheets inherited from the GFC and were even larger than those deployed during the GFC (Figure 1). In addition to this, central bank purchases were extended to stocks and corporate bonds. The objectives of those operations were to supply liquidity to financial markets, stimulate aggregate demand, and to facilitate the financing of fiscal deficits created through huge fiscal expansions.

Figure 1 G10 central bank assets

Source: Global Financial Stability Update, June 2020.

Note: G10 = Group of Ten; other G10 central banks = central banks of Canada, Sweden, Switzerland, and the United Kingdom.

A byproduct of these extraordinary QE operations is the creation of a disconnect between stock markets and the real economy. While practically all forecasts for the world economy growth are negative, stock markets valuations are consistent with substantially higher rates of growth, sending wrong signals to investors. Large QE operations ease budgetary finances in periods of fiscal stress (as is currently the case). However, this comes at the cost of artificially maintaining stock markets at exaggerated levels. In addition to distorting signals, the artificially high stock markets also increase inequality in the distribution of wealth, without economic justification given the depressed state of the real economy. By contrast, helicopter money measures are unlikely to create such distortions for two reasons. First, it involves an exchange of assets and liabilities only within the public sector. Second, a single dollar of helicopter money finances a full dollar of the deficit, while QE finances less than a dollar. It is therefore possible to achieve a given contribution to deficit financing with smaller helicopter money than with QE operations.

In summary, an important advantage of QE over helicopter money is that it can be deployed within the existing framework of CBI and IT. On the other hand, the stimulatory impact (per dollar), and its contribution to deficit financing, are lower than that of seignorage. Furthermore, when used in huge quantities (as is currently the case), QE artificially ‘blows up’ the value of stock markets. For advanced economies with negative inflation rates, helicopter money has the additional advantage of moving inflation toward the target more quickly (Cukierman 2020).

References

Blanchard, O and J Pisany-Ferri (2020), “Monetization: Do not panic”, VoxEU.org, 10 April.

Cukierman, A (2020), “COVID-19, helicopter money and the fiscal-monetary nexus”, CEPR Discussion Paper 14734.

Galí, J (2020), “Helicopter money: The time is now”, VoxEU.org, 17 March.

Galí, J (Forthcoming), “The effects of a money-financed fiscal stimulus”, Journal of Monetary Economics.

Masciandaro, D (2020), “Covid-19 helicopter money: Economics and politics”, Covid Economics 7.

Reichlin, L, A Turner and M Woodford (2013), “Helicopter money as a policy option”, VoxEU.org, 23 September.

Yashiv, E (2020), “Breaking the taboo: The political economy of COVID-motivated helicopter drops”, VoxEU.org, 26 March.

Endnotes

1 In coordination with the fiscal authority, the Bank of England even implemented a limited period of monetary financing of the deficit.

2 In some proposals for the implementation of HM the CB finances the government by erasing part of its capital (Gali (2020), Masciandaro (2020). I return to this