Local currency asset purchases by central banks in emerging market economies (EMEs) were deployed for the first time in these countries to respond to the Covid-19 shock. With a multifaceted pandemic shock, leading to a sharp reversal in global risk appetite, collapsing economic activity and global trade and declining commodity prices, quantitative easing (QE) policies in EMEs primarily aimed to (i) compensate for the bond sell-off by foreign investors; (ii) prevent surges in local benchmark bond yields; and (iii) communicate that central banks were ready to purchase their respective sovereign’s assets should the anticipation of a large fiscal expansion undermine investor confidence (Arslan et al. 2020, Hartley and Rebucci 2020, and IMF 2020). A major scepticism among observers towards this policy implementation in EMEs concerns de-anchoring of inflation expectations and increases in exchange rate volatility.

A small open economy model with financial sector and sovereign borrowing

In order to quantitatively investigate the efficacy of QE policies in EMEs, we extend the medium-scale New Keynesian small open economy model with financial sector by Mimir and Sunel (2018) to an environment with local currency and long-term government debt and asset purchase policies (Mimir and Sunel 2021). The model is standard in the demand and production side with a single tradable consumption good, aggregating home and foreign goods. Intermediate goods producers use capital and labour and determine the nominal price of their good in a monopolistically competitive market subject to menu costs.

As shown by Ehlers and Víllar (2015), the domestic banking sector facing currency mismatches is central in the analysis. Banks borrow local currency deposits from households and foreign currency funds from foreigners. Using these funds and their bank capital, they purchase (i) private securities issued by non-financial producers to finance physical capital, which is not readily available due to financial frictions; and (ii) long-term, local currency government bonds. The endogenous supply of private securities by non-financial firms meets asset purchases by commercial banks and by the central bank. A fixed supply of government bonds (as a debt rule) on the other hand, meets the demand from foreign investors, domestic banks, and the central bank. Foreign holdings of sovereign bonds are subject to investor sell-off shocks and they negatively respond to rising country spreads. Country spreads in turn increase with the total external indebtedness of the economy.

An agency cost problem limits bank borrowing. At any point in time, banks may default and divert a fraction of risky assets, whose value should be less than the present discounted value of banks, which would be lost upon a run-off should depositors learn the diversion. This incentive compatibility constraint eliminates defaults but leads to endogenous leverage limits that tie risky assets to bank capital. Finally, we assume government bonds are harder to divert (since they are considered to be less risky or even safe) and domestic depositors have comparative advantage in monitoring banks so that a fraction of their deposits are also not diverted.1

Government bond and private security purchase policies of the central bank are designed to compensate for the market dislocation from bond sell-offs and mitigate loan-deposit spreads, respectively.2 Both asset purchases are financed by issuing short-term government bonds to banks (or interest bearing reserves) which are perfect substitutes to household deposits.3

Model parameters are chosen by taking as reference the historical episode of 2002Q1-2019Q4 for the average of 13 EMEs that are identified in Arslan et al. (2020) to have implemented QE during the Covid-19 crisis. A first subset of model parameters is chosen to match deterministic long-term macroeconomic ratios, various interest rate spreads, the local currency government bonds-to-GDP ratio and foreign investors’ share in outstanding local currency sovereign bonds. Bond maturity is calibrated to ten years, using the geometrically decaying coupon modelling in Sims and Wu (2021). A second set of model parameters (that affect model dynamics) is estimated by using Bayesian techniques based on the evolution of key macroeconomic and financial variables across the countries in our sample.

QE eases financial conditions with no currency depreciation or inflation risks

We first notice that QE policies ease financial conditions with no currency depreciation and hence inflation risks (Figure 1). In this experiment, we study discretionary public (solid lines) and private (dashed lines) asset purchases of 1.5% of GDP, which is representative of the average EME central bank sovereign bond purchase through August 2020 (IMF 2020). Note that assets intermediated by the central bank are not subject to any leverage constraints and hence, increase the level of total credit in the economy. This boosts asset prices for private securities and bonds, thereby reducing loan-deposit spreads and the excess bond premia.4 The rise in asset prices feeds back into bank capital and enhances banks’ loan making capacity via the so-called financial accelerator mechanism (Gertler and Karadi 2011). With stronger balance sheets, banks can borrow more from both depositors and foreign lenders, which drives capital inflows, appreciating the real exchange rate and thus reducing inflation. In this sense, we provide analytical foundations to the estimated subdued exchange rate response to asset purchase announcements in EMEs (Arslan et al. 2020 and IMF 2020).5 The appreciation of the currency further boosts bank balance sheets via reducing the average cost of funds as banks face currency risk while funding their assets. The decline in inflation facilitates an interest policy easing and results in higher investment as well as output.

Figure 1 Quantitative easing policies ease financial conditions with no currency depreciation risks

Impulse-response functions of selected model variables to discretionary quantitative easing policy shocks

Note: Deviations from the steady state. Asset purchase-to-GDP ratio is representative of EME central bank sovereign bond purchases during the Covid-19 crisis. Increases in the real exchange rate denote depreciations. Excess yield is over the US short-term rate.

We also find private security purchases to be more effective than sovereign bond purchases (Figure 1). This is because private asset purchases act as a direct financial multiplier on private credit, whereas government bond purchases expand the loan-making capacity of banks only indirectly via increased asset prices and appreciated currency. In addition, the sharp portfolio shift from government bonds to private securities under public asset purchases causes the agency cost constraints to bind more tightly since bonds are less risky than private securities.

Rules-based asset purchases mitigate the effects of bond sell-off shocks

Next, we explore the effectiveness of the rules-based public (solid line) and private (dashed line) asset purchases compared with a no-QE case (dotted line) in response to a local currency government bond sell-off shock of 1.5% of GDP (Figure 2). We find that public asset purchases that replace foreign investors one-to-one reduce the rise in excess bond yields over the US benchmark rates by half, and substantially mitigate the decline in private credit, the depreciation of currency, the rise in domestic credit spreads, and the surge in inflation. We also notice that private asset purchases bring a similar degree of stabilisation even with purchases of only 0.5% of GDP.6

Figure 2 Rules-based quantitative easing policies mitigate the effects of bond sell-off shocks

Impulse-response functions of selected model variables to an orthogonal bond sell-off shock of 1.5% of GDP

Note: Deviations from the steady state. Public asset purchase policy rule is calibrated to ensure that the central bank entirely makes up for bonds sold by foreign investors (1.5% of GDP at the peak). Private asset purchase policy rule positively responds to domestic credit spreads and is calibrated to imply asset purchases that are one-third of that under public asset purchase policy. Increases in the real exchange rate denote depreciations. Excess yield is over the US short-term rate.

Bond purchases are less effective under de-anchored inflation expectations

A major scepticism toward QE programmes announced by EMEs precluded that should bond purchases derail inflation expectations, they would have perceived as monetisation of debt and cause higher inflation, let alone easing financial conditions. We consider this possibility in an extension by assuming that intermediate goods producers attach a higher weight to past inflation rates rather than the inflation target as their reference in computing their menu costs, which captures imperfect central bank credibility (dashed lines in Figure 3). In this case, excess yield reduction of bond purchases is hampered and inflation emerges as higher and more persistent relative to the case of anchored inflation expectations (solid lines in Figure 3).

Figure 3 Bond purchases are less effective when inflation expectations are de-anchored

Note: Deviations from the steady state. The solid lines are the case of a public asset purchases policy programme that reaches 4.5% of GDP at the peak. The dashed lines differ from this case by assuming that intermediate good producers partially take previous period’s rate of inflation rather than the target inflation as their reference in computing their menu cost. Ten-year spreads are the difference between the real yield-to-maturity of government bonds and the real short-term deposit rate. Excess yield is over the US short-term rate.

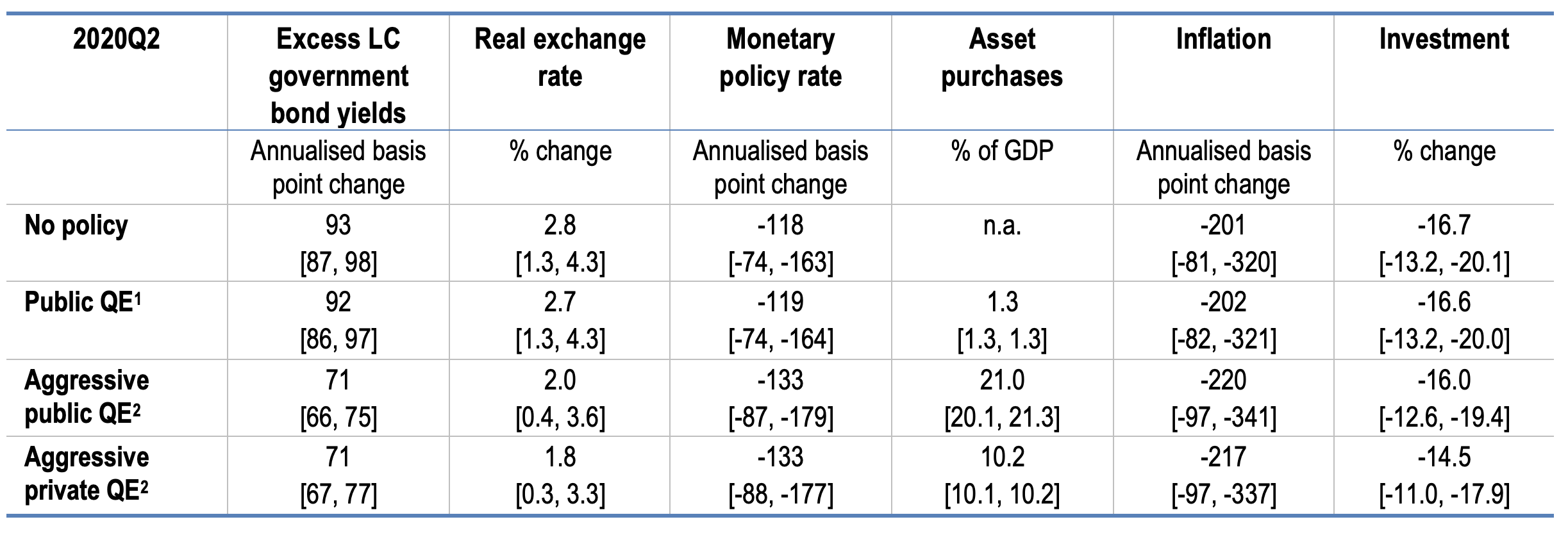

High frequency estimates of bond yield reductions from QE could have persisted only under large-sized programmes

Finally, we conduct a counterfactual analysis that focuses on the Covid-19 shock. We take the estimated model without QE policies at 2019Q4 as our initial condition. We then filter the structural shocks to replicate data realisations of key variables for 2020Q1-2020Q3 in the model with the baseline public asset purchases policy that peaks at 1.3% of GDP. We then present three counterfactual economies with (i) no QE policy, (ii) an aggressive public asset purchase policy, and (iii) an aggressive private asset purchase policy (Table 1). We find that bond yield reductions under public asset purchases that reflect the EME central bank experience during the pandemic do not survive a full quarter. On the other hand, the estimated initial bond yield compression of around 20 basis points from QE announcements in EMEs (Hartley and Rebucci 2020, IMF 2020, World Bank 2021) can only be sustained under large-scale asset purchase programmes that are representative of advanced economies into the second quarter of the pandemic (the last two rows of Table 1). Finally, although their benefits are limited, we show that asset purchases in EMEs with credible monetary policy frameworks are not inflationary (column 6 in Table 1) and would not have been so had they been larger.

Table 1 The small size of EME central bank asset purchases resulted in short-lived easing in financial conditions

Effects of adopting counterfactual quantitative easing policies during the Covid-19 crisis

Note: Changes relative to the HP-filtered trend at quarterly frequency. Increases in the real exchange rate denote depreciations. Asset purchases are as a share of steady state GDP. Ranges in square brackets are 90% confidence intervals. 1. This row presents 2020Q2 cross-country averages of the actual data. The remaining rows represent the outcome of counterfactual exercises. 2. Asset purchase sizes in these rows are calibrated to match the six-day average bond yield compression of 22 basis points in EMEs as estimated by the IMF-GFSR (2020) report.

Discussion and policy implications

Our analysis lends support to the argument that by mitigating financial shocks, QE would not derail the currency and inflation outlook in countries with inflation expectations that are in check and currencies that float freely (Benigno et al. 2020). Nonetheless, QE is mostly useful in guiding price discovery rather than mitigating real economic repercussions of multifaceted shocks such as the Covid-19 pandemic. These findings are specific to our framework and some key assumptions may play out differently under real world complexities. Firstly, we tackle de-anchoring of inflation expectations and efficiency costs of asset purchases in a tractable way and thus abstract from a total loss of confidence to the central bank. Introducing confidence effects might reduce the effectiveness of asset purchases. Secondly, purchases of private securities directly boost the use of productive capital by firms in our model. Central bank purchases of private assets in practice might have more indirect spillovers to the use of physical capital. Finally, banks are not monopolistically competitive in our setup, barring them from raising intermediation margins to create rents from increased credits facilitated by central bank’s asset purchases. Designing QE policies while considering these caveats would increase their efficacy.

Authors’ note: This note should not be reported as representing the views of Norges Bank and the OECD or of its member countries. The views expressed are those of the authors and do not necessarily reflect those of Norges Bank and the OECD.

References

Arslan, Y, M Drehmann and B Hofmann (2020), “Central bank bond purchases in emerging market economies”, BIS Bulletin, No. 20, June, Basel.

Benigno, G, J Hartley, A García-Herrero, A Rebucci and E Ribakova (2020), “Credible emerging market central banks could embrace quantitative easing to fight COVID-19”, VoxEU.org, 29 June.

Dedola, L, G Georgiadis, J Gräb and A Mehl (2020), “Quantitative easing policies and exchange rates”, VoxEU.org, 21 October.

Ehlers, T and A Víllar (2015), “The Role of Banks”, BIS Papers 83 (November): 9–39.

Gertler, M and P Karadi (2011), “A model of unconventional monetary policy”, Journal of Monetary Economics 58(1): 17-34.

Gertler, M and P Karadi (2013), “QE1 vs. 2 vs. 3: A Framework to Analyze Large Scale Asset Purchases as a Monetary Policy Tool”, International Journal of Central Banking 9(S1): 5–53.

Hartley, J S and A Rebucci (2020), “An Event Study of COVID-19 Central Bank Quantitative Easing in Advanced and Emerging Economies”, CEPR Discussion Paper Series 14841.

IMF (2020), “Global Financial Stability Report: Bridge to Recovery”, October, International Monetary Fund.

Jakab, Z and M Kumhof (2019), “Banks are not intermediaries of loanable funds — facts, theory and evidence”, Bank of England, Staff Working Paper No. 761, June.

Mimir, Y and E Sunel (2019), “External Shocks, Banks, and Optimal Monetary Policy: A Recipe for Emerging Market Central Banks”, International Journal of Central Banking 15(2): 235–299.

Mimir, Y and E Sunel (2018), “A recipe for monetary policy in emerging market economies”, VoxEU.org, 3 April.

Mimir, Y and E Sunel (2021), “Quantitative easing in emerging market economies”, mimeo.

Sims, E and J C Wu (2021), “Evaluating Central Banks’ tool kit: Past, present, and future”, Journal of Monetary Economics 118: 135-160.

WB (2021), “Global Economic Prospects”, January, World Bank.

Endnotes

1 This feature also provides a foundation to deviations from the uncovered interest parity; i.e. a positive spread between local and foreign interest rates beyond that explained by country risk premia and expected exchange rate depreciations (Mimir and Sunel 2019).

2 The latter arises due to financial frictions and increases in bad times.

3 These short-term bonds endogenously adjust in equilibrium to meet the increase in asset purchases due to Walras’ Law, essentially making quantitative easing costless. In an extension, we consider efficiency costs to asset purchases, which would be necessary for welfare analysis but do not change the direction of our positive findings (Mimir and Sunel 2021).

4 The decline in local currency government bond yields from long-term bond purchases is around 70% of that found for advanced economies (Gertler and Karadi 2013).

5 Large scaled QE programmes in advanced economies are found to depreciate the currency in these countries mainly explained by deviations from the uncovered interest parity and the reduction in the short-term interest rate differentials between the QE implementing jurisdiction and the rest of the world (Dedola et al. 2020).

6 In an extension, we consider the impact of a country risk premium shock that is representative of the JP Morgan-EMBIG spread hikes during the pandemic. Simulations are also calibrated to ensure that the sell-off by foreigners negatively responds to rises in the country risk spread and is representative of the sell-off in the first quarter following the onset of the Covid-19 crisis (IMF 2020). We find that a rule-based public asset purchase policy that exactly replaces dislocation by foreigners can only provide limited stabilisation in response to this orthogonal shock. The rule-based private asset purchase policy on the other hand (again at a moderate size of 0.5% of GDP), boosts bank capital, reduces loan-deposit spreads, and mitigates the collapse in private credit and investment (Mimir and Sunel 2021).